📊 10 Buy & Hold FOREVER Dividend Stocks

Grow Your Dividends Forever 🚀

One of my favorite quotes?

“Our favorite holding period is forever” - Warren Buffett

Buying with the intention of holding forever forces you to assess the quality of the underlying business.

As their free cash flow grows, the amount they pay you in dividends grows.

Let’s look at 10 companies that you can buy with the intention of holding forever.

The ‘Buy Forever’ Secret

There have been many companies that were once ‘great’, but have fallen to irrelevance.

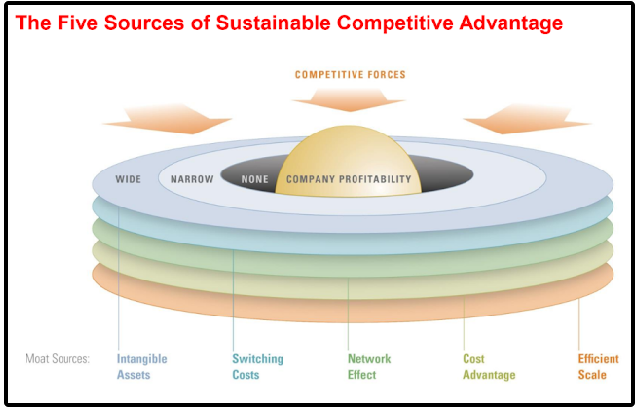

So what makes a company a ‘forever’ stock?

A sustainable competitive advantage.

There are typically 5 ways a competitive advantage can be described:

Network effects

Switching costs

Cost advantages

Intangible assets & patents

Efficient scale

But here’s the secret about a sustainable competitive advantage-

These moats show up in the fundamentals in 2 ways:

Return on Invested Capital (ROIC): High-quality companies reinvest in projects that generate strong returns (10%+ baseline, 20%+ elite).

Gross Profit Ratio: Companies that sustain or expand gross margins over time are often demonstrating competitive advantage.

A sustainable competitive advantage protects a company’s ability to generate high returns on invested capital, and protects their profitability margins.

10) 🏦 JPMorgan Chase ($JPM)

Dividend Yield: 1.69%

5-Year Dividend CAGR: 6.87%

ROIC: (Bank stock, not applicable)

Gross Profit Ratio: (Bank stock, not applicable)

Company Profile

JPMorgan is the largest U.S. bank, spanning consumer banking, credit cards, asset management, and investment banking. Its size, capital strength, and brand trust make it the backbone of the financial system.

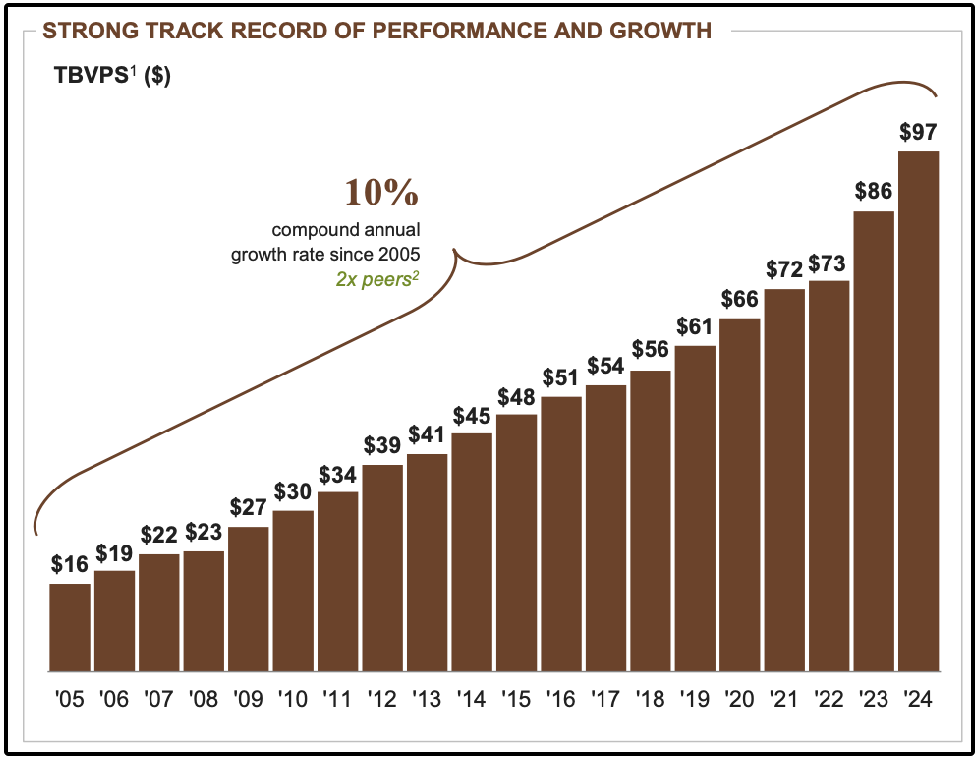

Why will the company still be relevant in 50 years from now?

Banking is a core utility and JPM is too entrenched to be displaced.

Compounds tangible book value at a faster pace than peers.

Switching costs and brand reputation keep customers locked in.

Buying JP Morgan is like buying a slice of the growth of the American economy.

(Tom Lee also seems to think bank stocks like JPM could soon be valued like tech stocks?)

9) 🛢️ MPLX ($MPLX)

Dividend Yield: 7.54%

5-Year Dividend CAGR: 5.76%

ROIC: 14.63%

Gross Profit Ratio: 44.18%

Company Profile

MPLX is a master limited partnership operating pipelines, terminals, and processing facilities for crude oil and natural gas. It earns fee-based revenue from long-term contracts, supporting its high payout.

Why will the company still be relevant in 50 years from now?

Critical midstream infrastructure with high replacement barriers.

Fee-based model reduces exposure to commodity volatility.

Strong cash flow coverage for its generous distributions.

Holding MPLX is like owning the toll roads for America’s energy system.

8) 🗑️ Waste Management ($WM)

Dividend Yield: 1.49%

5-Year Dividend CAGR: 7.91%

ROIC: 8.30%

Gross Profit Ratio: 29.07%

Company Profile

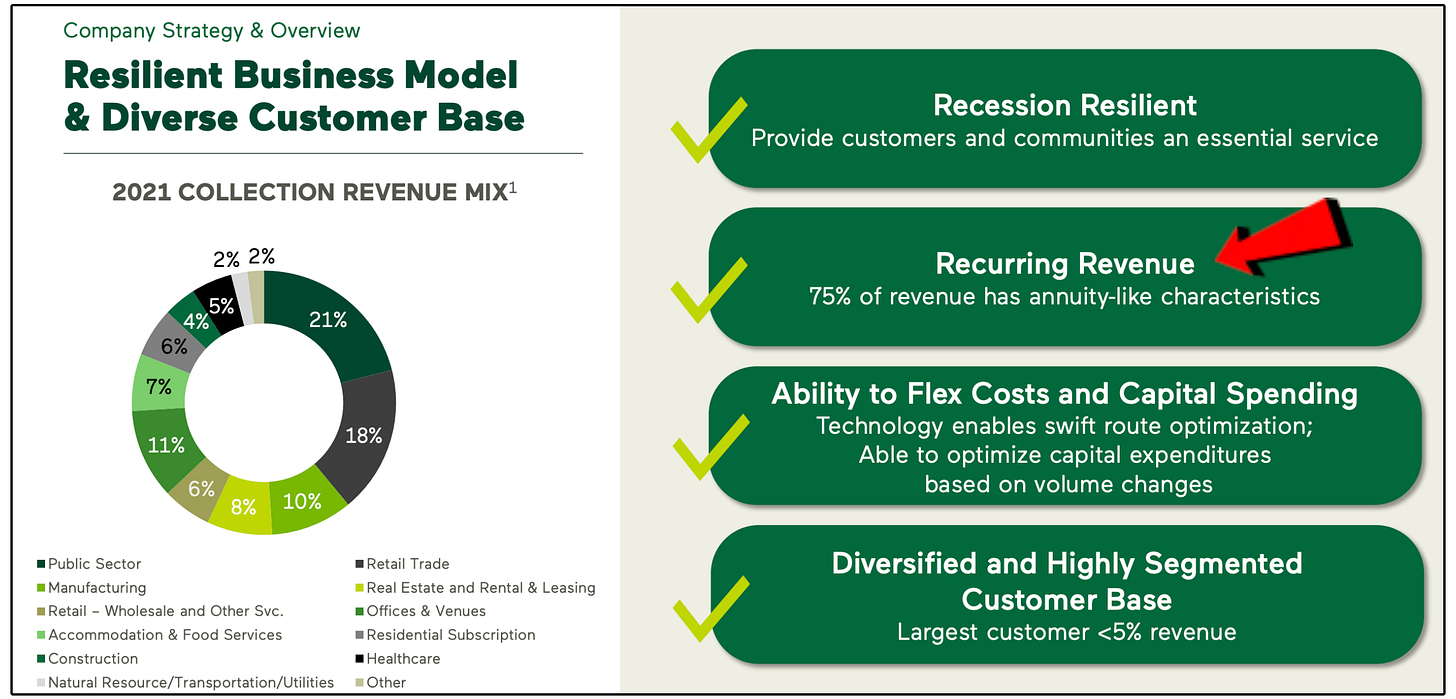

Waste Management is the largest waste services company in North America. It collects, recycles, and disposes of waste, with owned landfills and recycling plants providing recurring revenue.

Why will the company still be relevant in 50 years from now?

Trash collection is essential, non-discretionary, and recurring.

Landfill ownership creates regulatory and geographic moats.

Population growth ensures rising demand for waste services.

75% of the company’s revenue has annuity like characteristics!

7) 🚂 Canadian National Railway ($CNI)

Dividend Yield: 2.67%

5-Year Dividend CAGR: 8.76%

ROIC: 8.73%

Gross Profit Ratio: 40.87%

Company Profile

CNI runs a transcontinental rail network spanning Canada and the U.S., connecting three coasts. It hauls industrial goods, intermodal freight, and agricultural products.

Why will the company still be relevant in 50 years from now?

Rail infrastructure is irreplaceable and extremely capital-intensive.

Lowest-cost and most fuel-efficient long-haul freight option.

Efficient scale and limited competition create pricing power.

CNI has essentially no new threats of entrants into their industry.

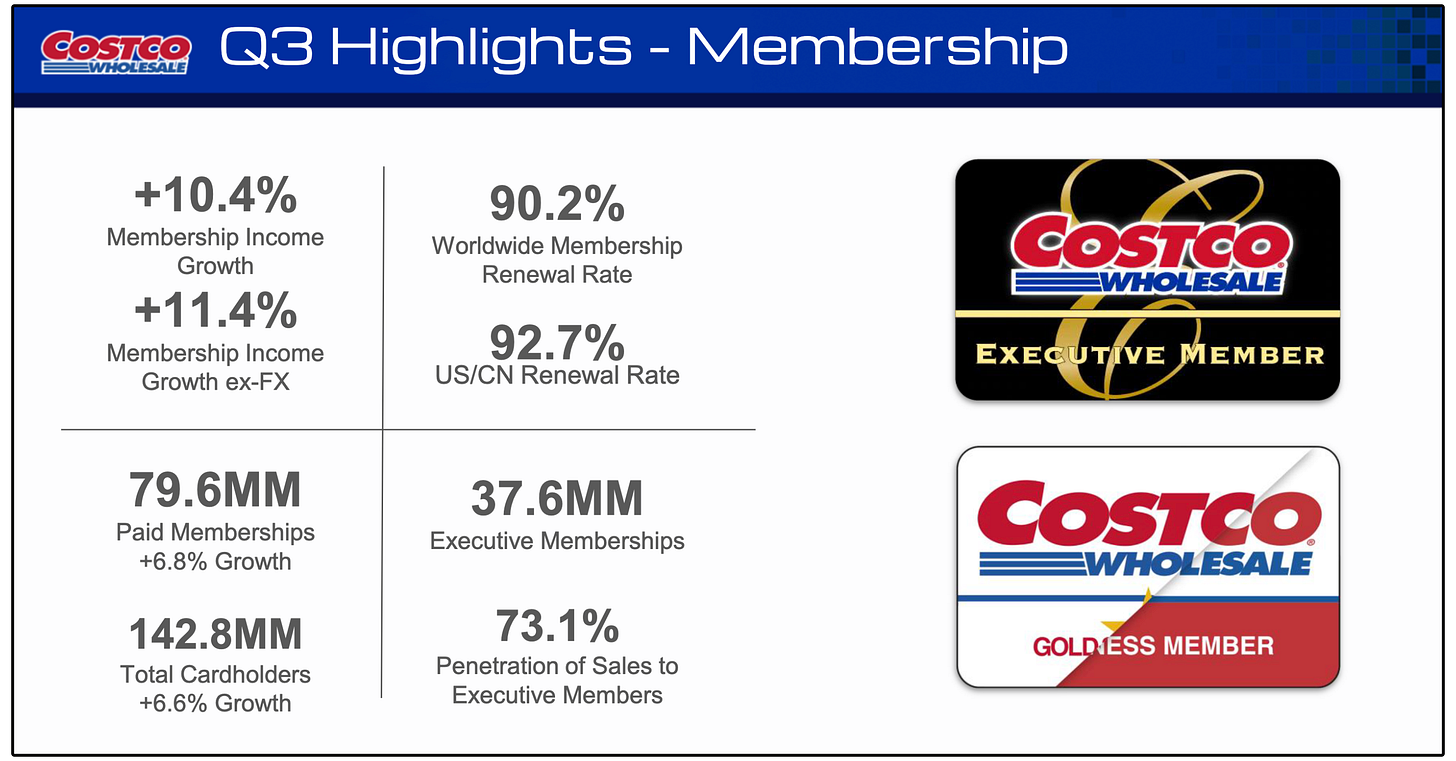

6) 🛒 Costco ($COST)

Dividend Yield: 0.52%

5-Year Dividend CAGR: 12.30%

ROIC: 20.37%

Gross Profit Ratio: 12.61%

Company Profile

Costco is a membership-based retail giant offering bulk goods at low margins. Membership fees drive predictable, high-quality earnings.

Why will the company still be relevant in 50 years from now?

90%+ membership renewal rates show customer stickiness.

Scale advantages and private label power (Kirkland).

Predictable, recurring revenue streams investors prize.

5) 📡 Broadcom ($AVGO)

Dividend Yield: 0.67%

5-Year Dividend CAGR: 14.14%

ROIC: –

Gross Profit Ratio: 63.03%

Company Profile

Broadcom designs semiconductors powering networking, storage, and wireless systems, alongside infrastructure software. Its products are deeply embedded across the tech ecosystem.

Why will the company still be relevant in 50 years from now?

Semiconductors are the “digital plumbing” of modern life.

Switching costs from deep hardware integration.

Expanding role in AI, cloud, and connectivity.

AVGO is projected to grow earnings at a 30% CAGR over the next 5 years!

4) 🔬ASML Holding ($ASML)

Dividend Yield: 0.73%

5-Year Dividend CAGR: 13.60%

ROIC: 24.99%

Gross Profit Ratio: 51.28%

Company Profile

ASML is the only company in the world that makes EUV lithography machines, critical for advanced semiconductor manufacturing.

Why will the company still be relevant in 50 years from now?

Monopoly position in EUV technology.

Semiconductors are the backbone of every digital platform.

Decades of R&D make new entrants very difficult.

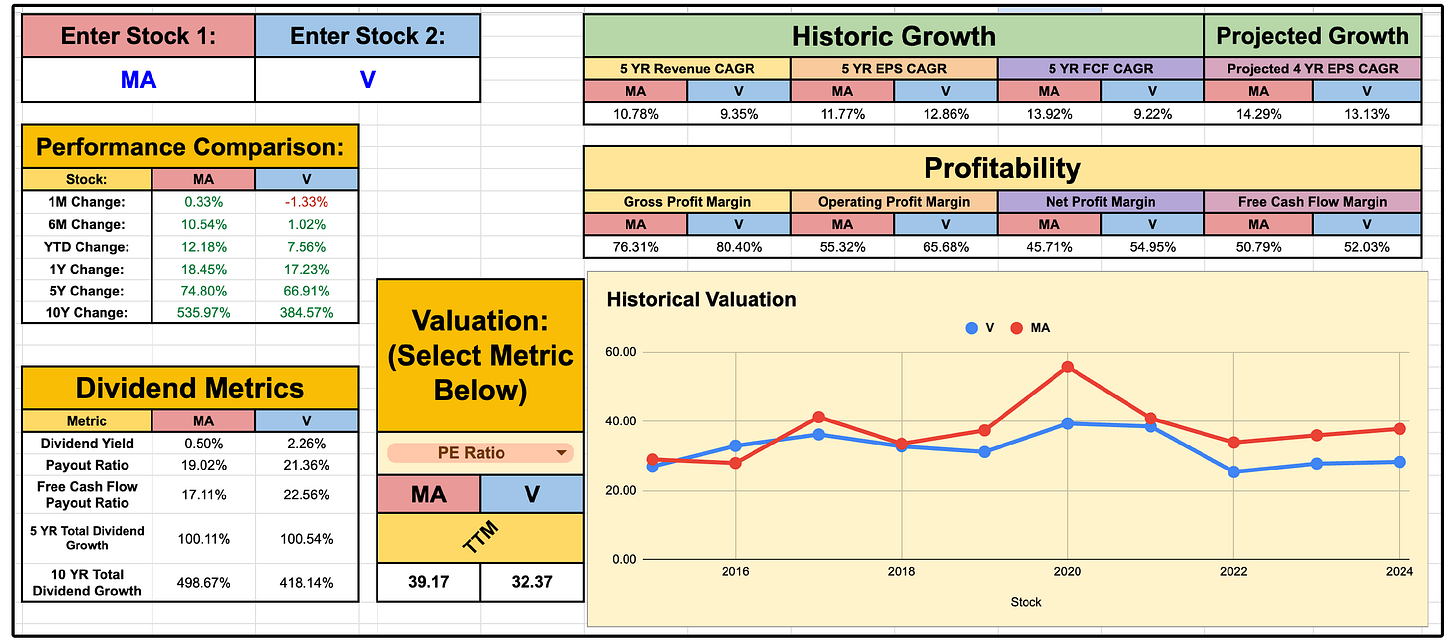

3. 💳 Mastercard ($MA) & 2. 💳 Visa ($V)

Dividend Yield: Visa 0.70% | Mastercard 0.50%

5-Year Dividend CAGR: Visa 15.41% | Mastercard 14.87%

ROIC: Visa 28.65% | Mastercard 44.41%

Gross Profit Ratio: Visa 80.40% | Mastercard 76.31%

Company Profile

Visa and Mastercard are the two dominant global payment networks, processing trillions in annual transaction volume across more than 200 countries. Both companies earn fees from merchants and financial institutions, while also monetizing fraud prevention, data, and value-added services. Their business model is asset-light, highly scalable, and benefits from powerful network effects. The more consumers use their cards, the more attractive they become to merchants, and vice versa.

Why will the companies still be relevant in 50 years from now?

The shift from cash to digital payments is still in its early stages in many parts of the world.

Network effects create a nearly unbreakable moat, making it hard for competitors to replicate their global acceptance.

Both brands are household names with unmatched trust and reliability in payments.

Owning Visa and Mastercard is like collecting a royalty on every swipe, tap, and online payment across the globe, and they are well positioned to benefit from the rise of stablecoins.

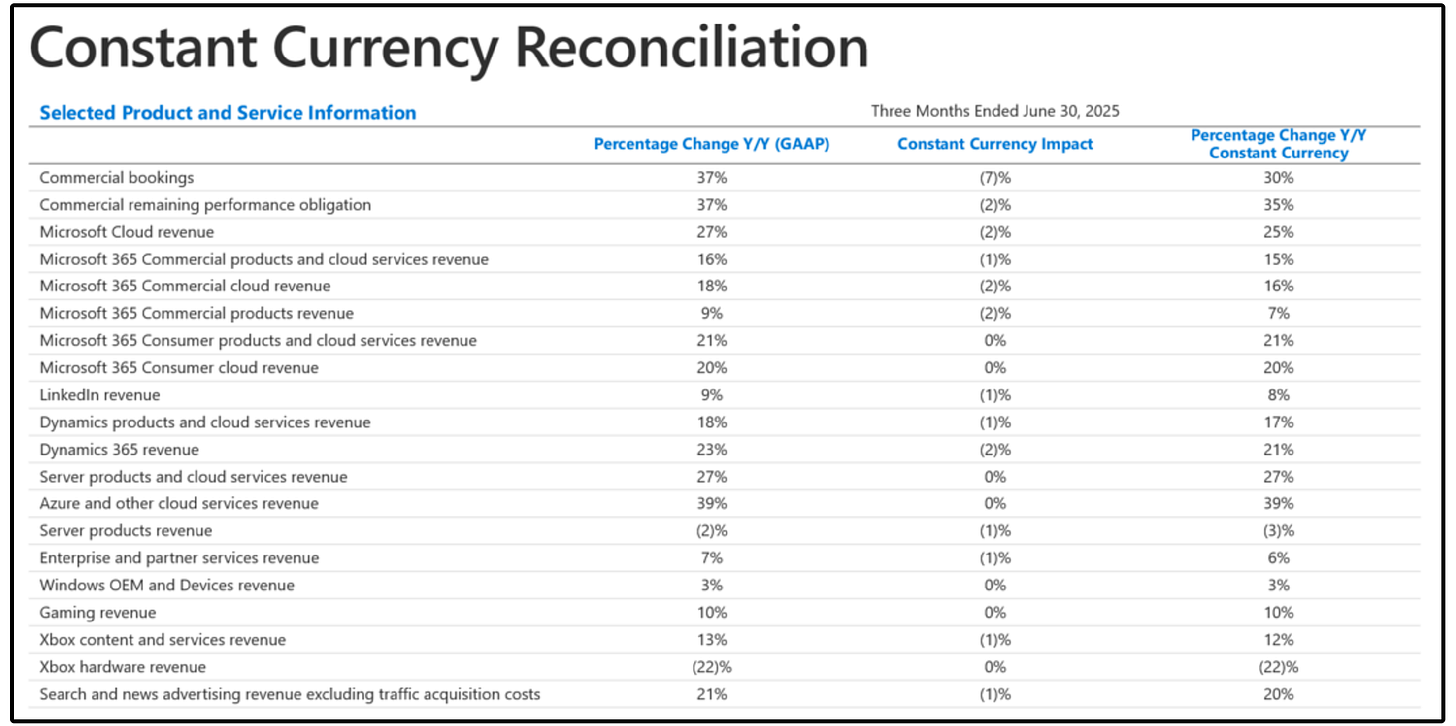

1) 🖥️ Microsoft ($MSFT)

Dividend Yield: 0.65%

5-Year Dividend CAGR: 10.26%

ROIC: 22.61%

Gross Profit Ratio: 69.76%

Company Profile

Microsoft provides enterprise and consumer software, cloud infrastructure, developer tools, and gaming. Its products are mission-critical for businesses and consumers alike.

Why will the company still be relevant in 50 years from now?

Ecosystem lock-in via Office, Teams, Azure, and Windows.

Azure cloud and AI workloads drive massive long-term growth.

A diversified “tech ETF” of enduring business lines.

Owning Microsoft is owning the backbone of global business and cloud computing.

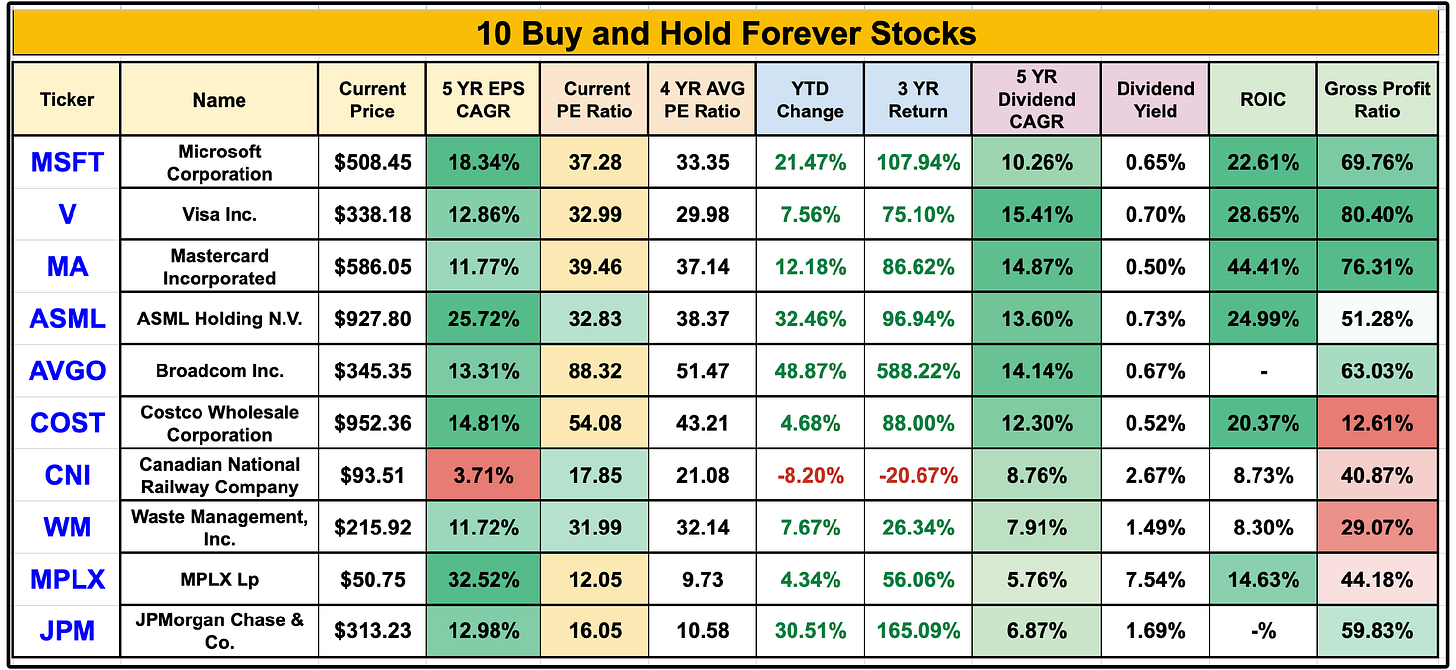

📊 The Top 10

Let’s review our top 10 list.

Out of the 10, only 3 are trading below their 4 year average PE ratios:

ASML

Canadian National Railway

Waste Management

Every stock on this list could fall under the category of ‘dividend growth’.

They grow earnings at a high rate, allowing them to grow dividends at a high rate.

They will be paying and growing dividend payments for decades to come.

🏆 Buying Our First Stock

Last week, we officially started the journey of building our real money model portfolios:

The Dividend Growth Portfolio

The High Yield Portfolio

On Tuesday, we will be buying our first stock for the high yield portfolio.

If you aren’t yet a member of Dividendology and want to be a part of the full experience, you can join here: 👇

See you on Tuesday!

Dividendology 🚀

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($30 off! + 7day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Want More?

Consider becoming a Dividendology member.

Here’s everything you’ll get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with now over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

Disclaimer: As a reader of Dividendology, you agree to our disclaimer. You can read the full disclaimer here.

Solid list

Good job. Great value.