5 Investing Truths to Live By 🚀

This will change the way you invest 💭

No matter what type of investor you, there are certain investing truths that we must all understand and abide by to be successful investors.

These are concepts that have stood the test of time, and when properly understood, undoubtedly give you an edge up as an investor.

Today, we will review 5 investing truths to live by.

1. Stocks Outperform 📈

Since the year 1800, a $1 investment would’ve grown to over 2.3 million.

The next closest asset would be bonds, but they would’ve only grown to $2,163, followed by bills and gold.

That is a staggering difference.

And the value of the dollar would’ve deteriorated all the way down to around $0.04.

2. Not Investing is Risky 😬

What's risky short term, is safe long term.

What's risky long term, is safe short term.

EX: Holding cash is safe short term, but holding it long term is risky!!

Why is this?

Because the longer you invest for, the more likely you are to beat simply holding cash.

3. Invest for the Long Term ⏳

When you invest for the long term, making money becomes incredibly easy.

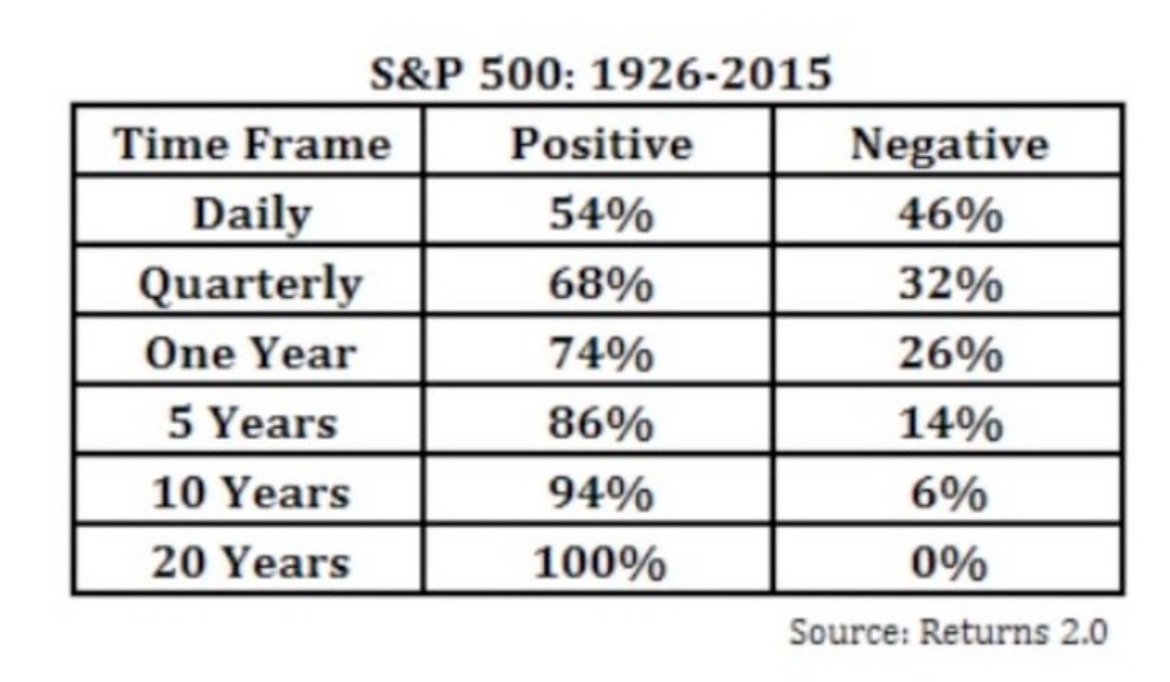

If you simply stay invested in the S&P 500 for 1 quarter (3 months), history tells us you have a 68% chance of making money.

Bump that up to 1 year invested, and you have a 74% chance of making money.

At 5 years, you have an 86% chance of making money.

And at 20 years, a 100% chance.

4. Don’t lose Money 💵

Warren Buffett once said, “The first rule of an investment is don't lose money. And the second rule of an investment is don't forget the first rule. And that's all the rules there are.”

Why is this?

Because it can be difficult to make that money back.

5. Don’t Stop the Compounding Effect ❄️

When people start investing, they often get discouraged by the lack of results they feel they are seeing.

To be fair, the beginning is the hardest part, because you don’t have the compounding effect taking place yet.

This is why Charlie Munger always said it is so important to get to that first 100k.

Once you hit that mark, the snowball effect REALLY starts kicking in.

People think the first 100k puts you at 10% of the way to 1 million.

But if you look at it from a time perspective, 100k is 25% of the way to 1 million (thanks to the compounding effect). 👇

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

Other News…

At the end of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

This sheet was received by nearly 200 dividend investors last month. (Wow!)

If you’d like to receive this sheet at the end of this month, you can sign up here:

That’s all for now!

See you next week!

Dividendology