🥇 Adding an 8%+ Yield to the High Yield Portfolio

The BEST High Yield and Dividend Growth Combo? 💰

In late September, we started the process of building out our High Yield Portfolio.

The goal of the High Yield Portfolio is simple:

Deliver a sustainable dividend yield of around 8%

Preserve capital (no long-term value erosion)

Provide predictable cash flow

Why 8% yield?

Because the amount of capital we would need to retire is cut in half. (based on the 4% rule).

Members of Dividendology will be able to view all the holdings of the High Yield Portfolio on Dividendology.com.

🏆 Our First Two Purchases

Before today, we had added 2 position to the High Yield Portfolio:

We added a fund with an over 9%+ yield, paying out monthly, that grows dividends over time WITHOUT selling options

We added an 8%+ yielding REIT with the potential for significant upside

The first position is one I believe our High Yield Portfolio will likely be able to hold forever.

The second one is in ‘deep value’ territory and carries a bit more risk, but has recently gone through a significant shift in structure that has allowed them to pay a much more sustainable dividend.

But the position we’re adding today, is the position I’m most excited about yet.

This position is yielding well over 8%, and management has recently stated that they are aiming to grow the dividend at a double digit rate moving forward.

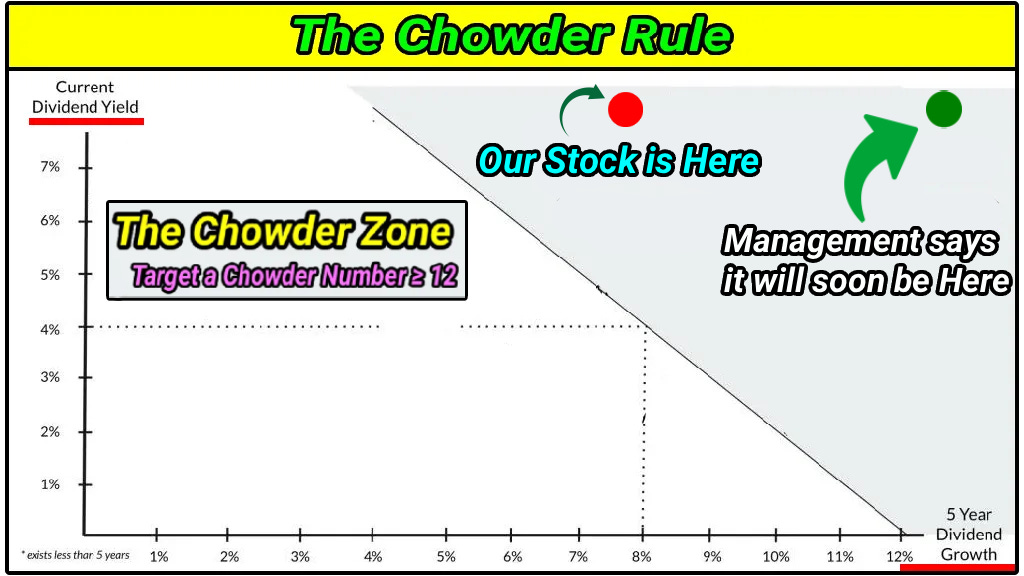

This combination of yield and dividend growth gives them one of the best ‘Chowder Scores’ that I’ve seen.

💰 The High Yield Advantage

As I’ve ramped up my analysis on high yield assets over the last year, I’ve come to understand even more how little coverage these assets get.

This is a major advantage for us.

First off, most softwares don’t provide the data necessary to analyze high yield assets, meaning retail investors have to do an immense amount of research to properly analyze them.

However, when we shift away from traditional investments into these alternative income plays, it creates two interesting dynamics:

📝 Limited analyst coverage & market inefficiencies

Unlike the mega-cap S&P 500 names that have Wall Street analysts dissecting every detail, many high-yield alternatives trade with less attention. This lack of coverage often results in pricing inefficiencies and misvaluations, both on the upside and downside.🔍 Greater opportunity for diligent investors

For those willing to roll up their sleeves and learn the nuances of these asset classes (things like AFFO for REITs, NAV growth for BDCs, or option coverage ratios for Covered Call ETFs), there are chances to capture both yield and capital appreciation where the broader market overlooks it.

This is what makes me so excited about High Yield investing.

💎 Today’s High Yielder

Stocks can typically trade at a premium for two reasons:

They are growing earnings/cash flows at a high rate

Their future cash flows have a high level of predictability

Most people know and understand the first reasons.

A large portion of people undervalue the second.

It’s important as we build out the High Yield Portfolio, we remember our ultimate goal-

We want to build a portfolio we can live off of and still sleep well at night.

I have no interest in buying a company where I can’t project a range of what their cash flows will look like 3 years from now.

The company we are adding today is not only growing their cash flows, but is doing so with a high degree of predictability.

Below, we will be taking a deep dive into this stock.

If you’d like to get access to the High Yield Portfolio, as well as everything mentioned below, you can do so here:

Now, let’s dive in.