April Dividend Portfolio Update 2025 🔥 🚀

Buying 4 Stocks 📊

Portfolio Update 📊

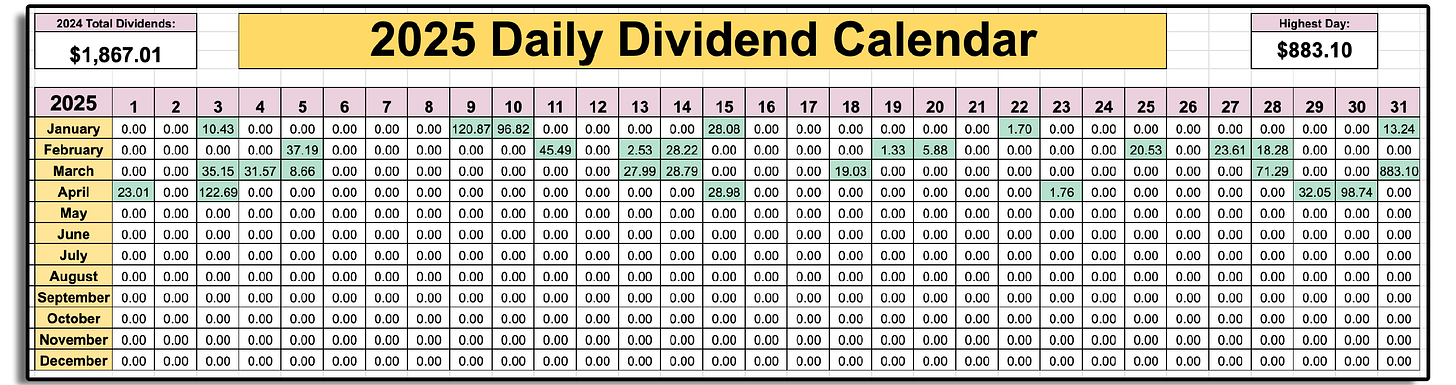

Through the first 4 months of 2025, I’ve made $1,867.01 in dividend income.

One of the big mistakes investors make (especially dividend investors) is judging how much a stock is making them by how much they pay in dividends.

This is completely the wrong way to think about stocks.

Here’s what I mean:

How Much A Stock Actually Earns You 📈

I currently own 42 shares of Visa stock.

Visa’s dividend payout for the trailing 12 months is $2.29.

By this logic Visa has paid me $96.18.

(42 X $2.29 = $96.18)

But that isn’t how much Visa has ‘earned for me.’

In the last 12 months, Visa has generated $11.86 in free cash flow per share.

That’s $498.12 that Visa has generated in free cash flow for me.

(42 X $11.86 = $498.12)

This is the true measure of how much Visa ‘earned for me.’

Because all $498.12 is being used to reward me as a shareholder.

Whether it’s paying dividends, buying back shares, or reinvesting back into the business, management is using that capital in a way that they see fit to best reward me as a shareholder.

(With that being said, I always want to see a growing stream of income coming into my pockets via dividends).

Why do I bring this up?

Because I bought 4 stocks this past month, and while 3 of them don’t currently pay a lot in dividends, they generate MASSIVE free cash flow, and are growing free cash flow at a high rate (and will grow their dividends at a high rate as a result).

My April Buys 💸

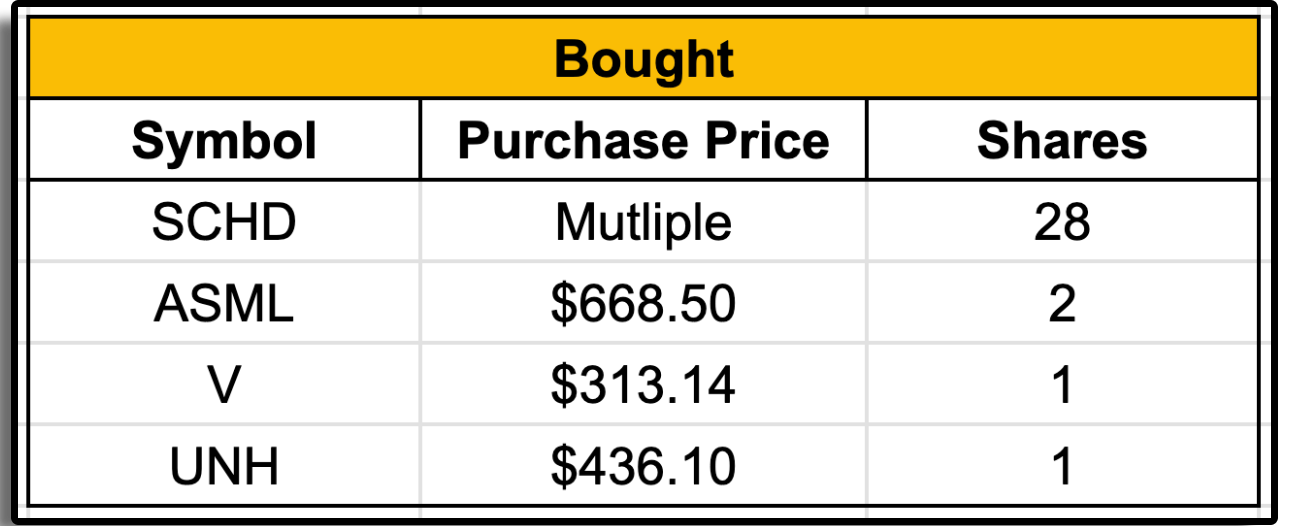

Here are the 4 stocks I bought in April:

🏦 Schwab U.S. Dividend Equity ETF (SCHD)

💳 Visa (V)

🖥️ ASML (ASML)

🏥 UnitedHealth Group (UNH)

These were all existing positions in my portfolio.

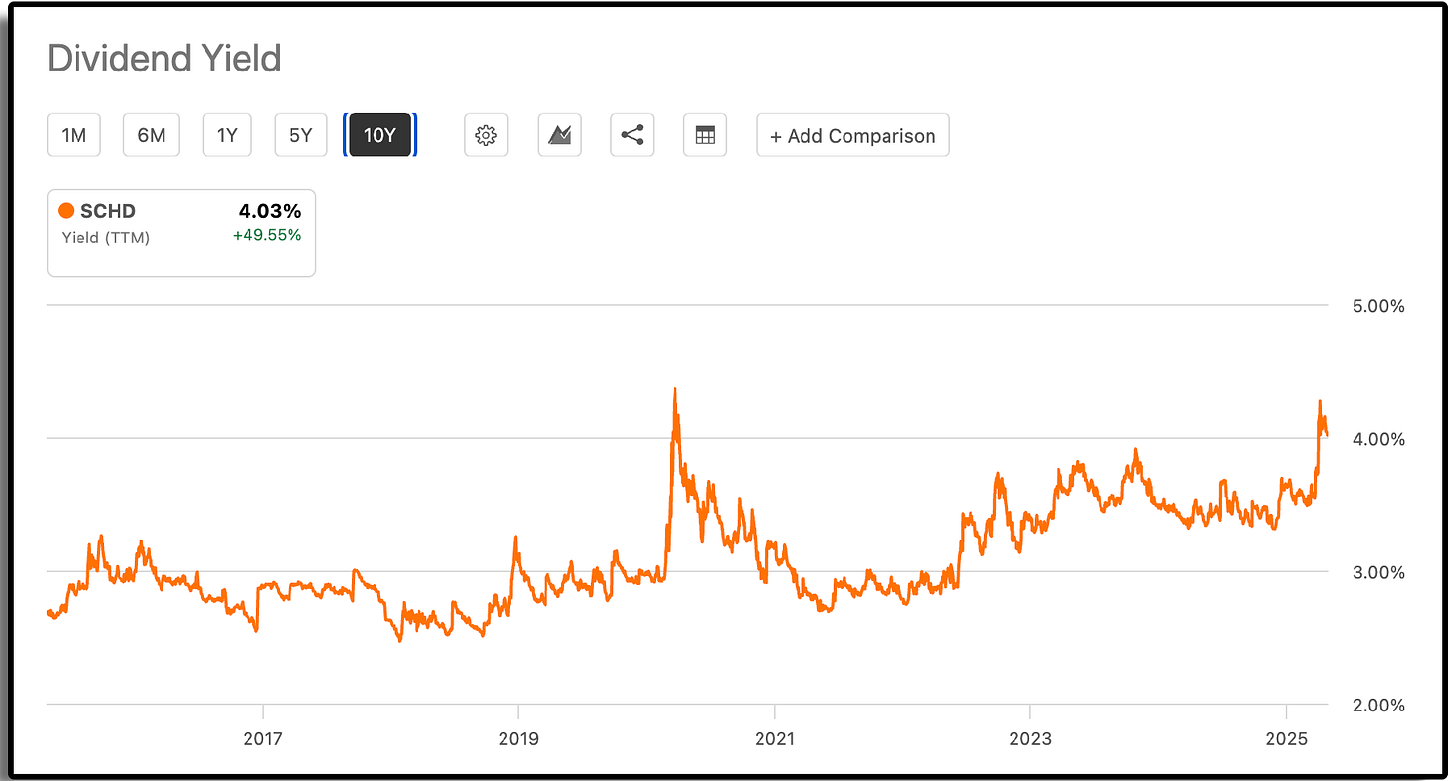

SCHD is currently presenting a rare opportunity, as the yield is now sitting above 4%. The only other time this has ever happened was during the 2020 market crash.

As for Visa, ASML, and UNH, all 3 of these are companies I suspect will be growing free cash flow and their dividend payments at a double-digit rate for the foreseeable future.

My Dividends 💰

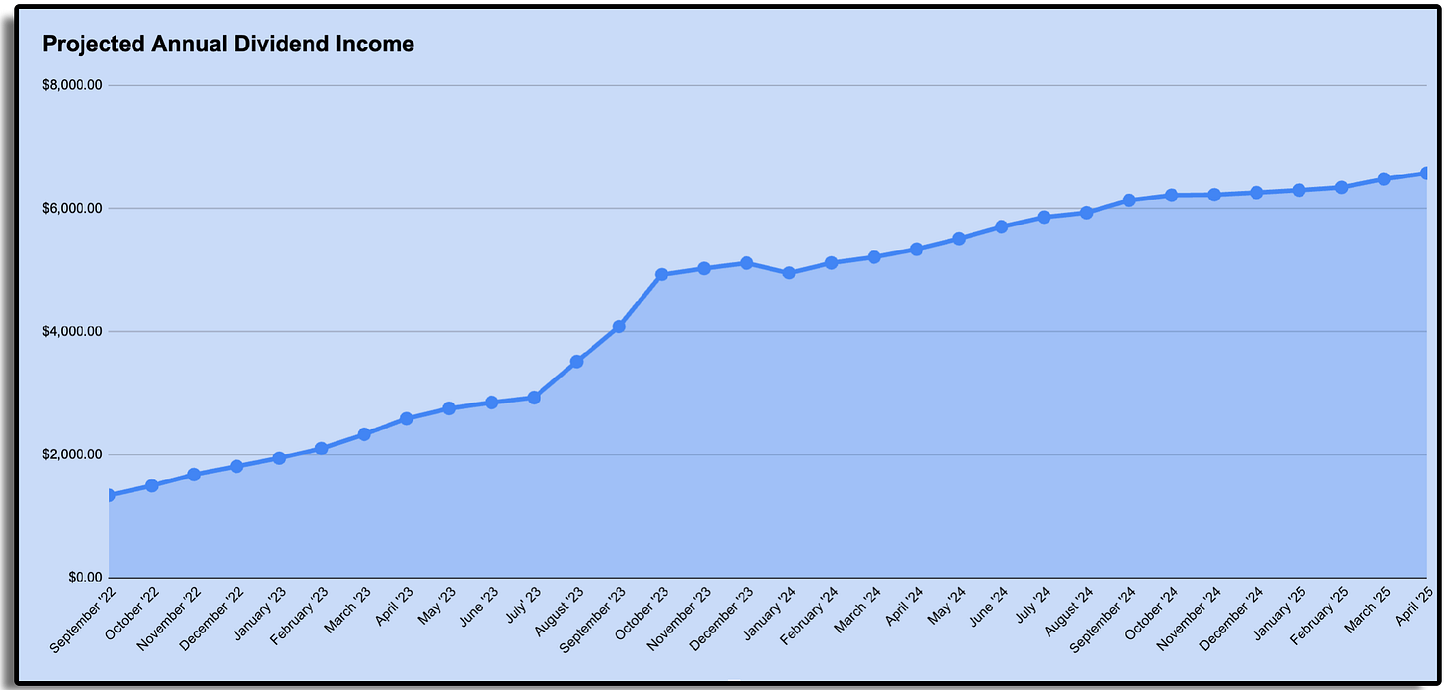

My portfolio value dropped $8,000 this month, going from $210,000 down to $202,000. But my dividend income continued to climb higher.

My dividend income always climbs higher.

My projected annual dividend income is now sitting at $6,576.

That averages out to $548.05 per month.

It’s a pretty amazing feeling knowing that if I decided I wanted to stop reinvesting dividends for a bit, I would have an extra $548 at my disposal every month.

2 notable dividend payments this month:

🏨 VICI Properties: $122.69

🚬 Altria: $98.74

Even with the market remaining uncertain due to a multitude of reasons, I feel confident that the stocks I own can continue to pay and grow their dividend payments over time at a healthy rate.

This is one of the major benefits of dividend investing. The peace of mind that when you buy quality stocks, those dividend payments are going to continue rolling in, regardless of market conditions.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform + Spring Sale!!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Just signed up for the free program but I'm really excited about joining the community and building a formidable dividend portfolio.

Any thoughts on $DE $CAT?