🏆 Barron’s Top 10 Stocks for 2026

Opportunity… or a Deep Value Trap? 🧭

2025 has been another incredible year for markets.

The S&P 500 is up around 18%, capping off what has been an extraordinary two-decade run for U.S. equities.

Every December, the financial publishing firm Barron’s releases it’s Top 10 Stocks to buy for the coming year.

And this year, they actually had many high yielding positions on their list.

Let’s review.

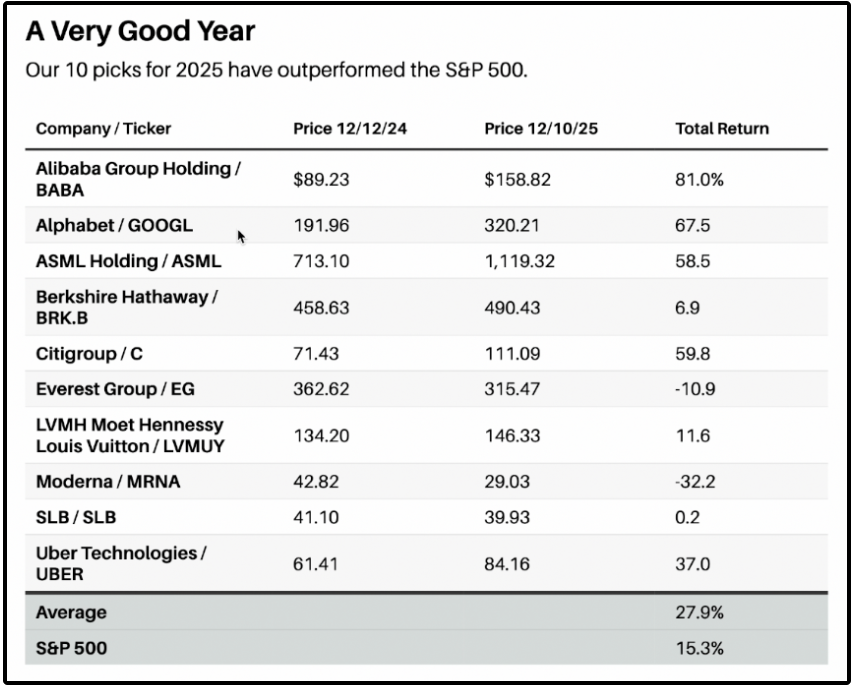

📊 Barron’s 2025 List

Barron’s list has been criticized for underperformance in the past-

But that certainly wasn’t the case over the past year.

Barron’s list (as of 12/10/25) has outperformed by a wide margin.

Barron’s average return: 27.9%

S&P 500 15.3%

Just a few great investments can more than make up for the laggards in your portfolio.

As we build out our Dividend Growth Portfolio and High Yield Portfolio, this is something we must keep in mind.

This is why we abide by the Rule of Three from François Rochon:

One year out of three, the stock market will go down at least 10%

One stock out of three that we buy will underperform

One year out of three, we will underperform the market

Despite this, we still expect to deliver exceptional returns.

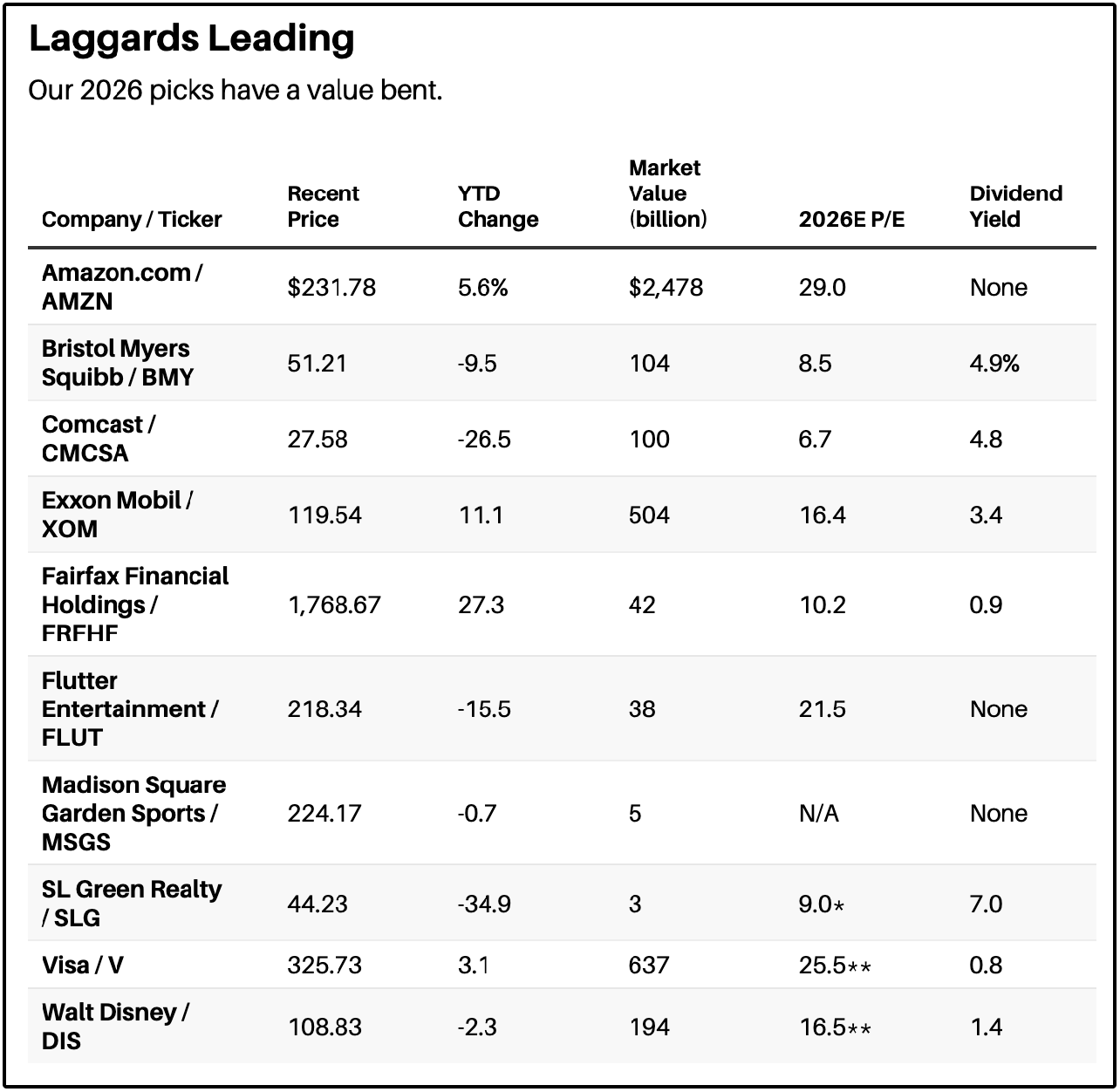

🔍 Barron’s 2026 Picks

Barron’s 2026 picks are interesting for a multitude of reasons.

For example:

9 out of the 10 picks underperformed in 2025

4 positions yield over 3%

Several names trade at just single-digit forward P/E multiples

This is one of Barron’s most “value-leaning” lists in years.

The argument they made for many of the companies on this list were grounded in classic value theses such as:

Deep value

Turnarounds

Spin-off potential

Asset-based valuations

Let’s look at just a few of the arguments they made, particularly for the higher yielding positions.

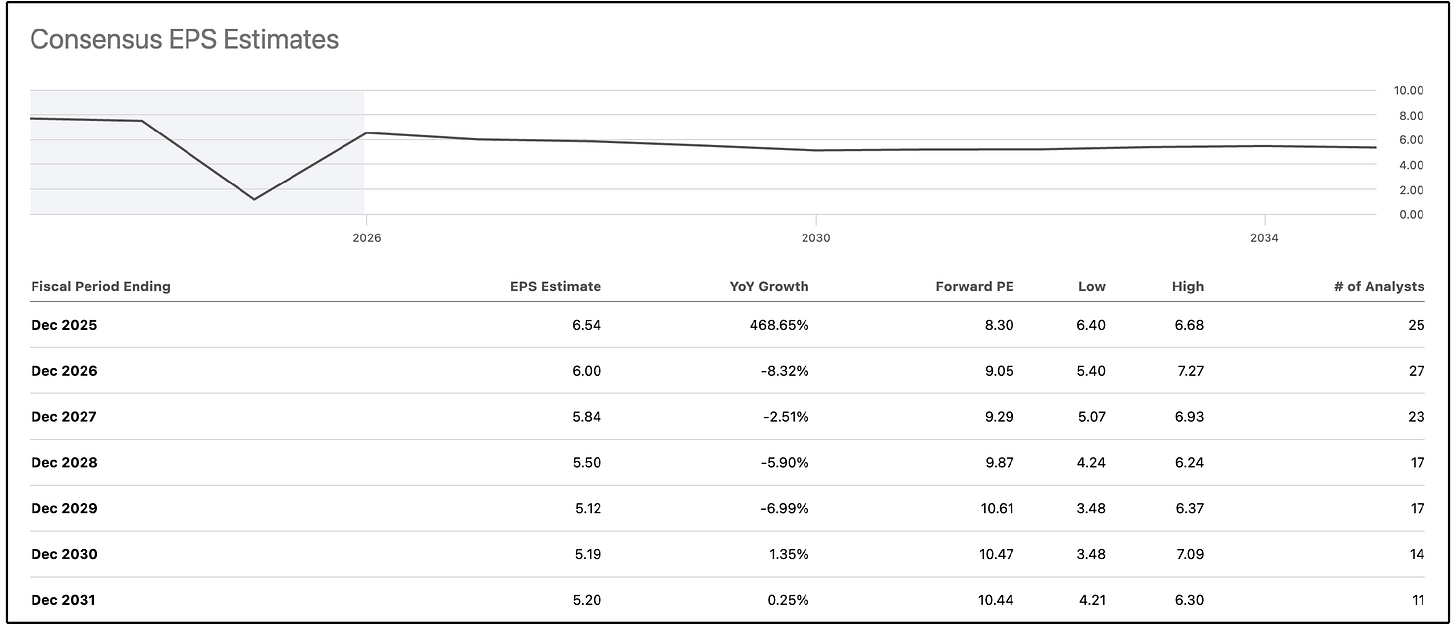

💊 Bristol-Myers Squibb - (BMY)

BMY trades near 8x projected 2026 earnings and offers a ~4.9% dividend yield.

Barron’s also notes BMY could emerge as a potential buyout candidate if the turnaround fails to materialize organically.

Here’s my issue:

This is a pharmaceutical stock, and pharmaceutical stocks are valued based on the strength of their patents.

A significant portion of Bristol-Myers Squibb’s earnings power is tied to Keytruda-related royalty income, and that revenue stream faces patent expiration risk beginning in 2028.

Wall Street is incredibly pessimistic about their product pipeline, and is projecting negative earnings growth over the next 5 years.

Ideally, investors do not want to have to rely on a ‘buyout’ in order for their investment to be profitable.

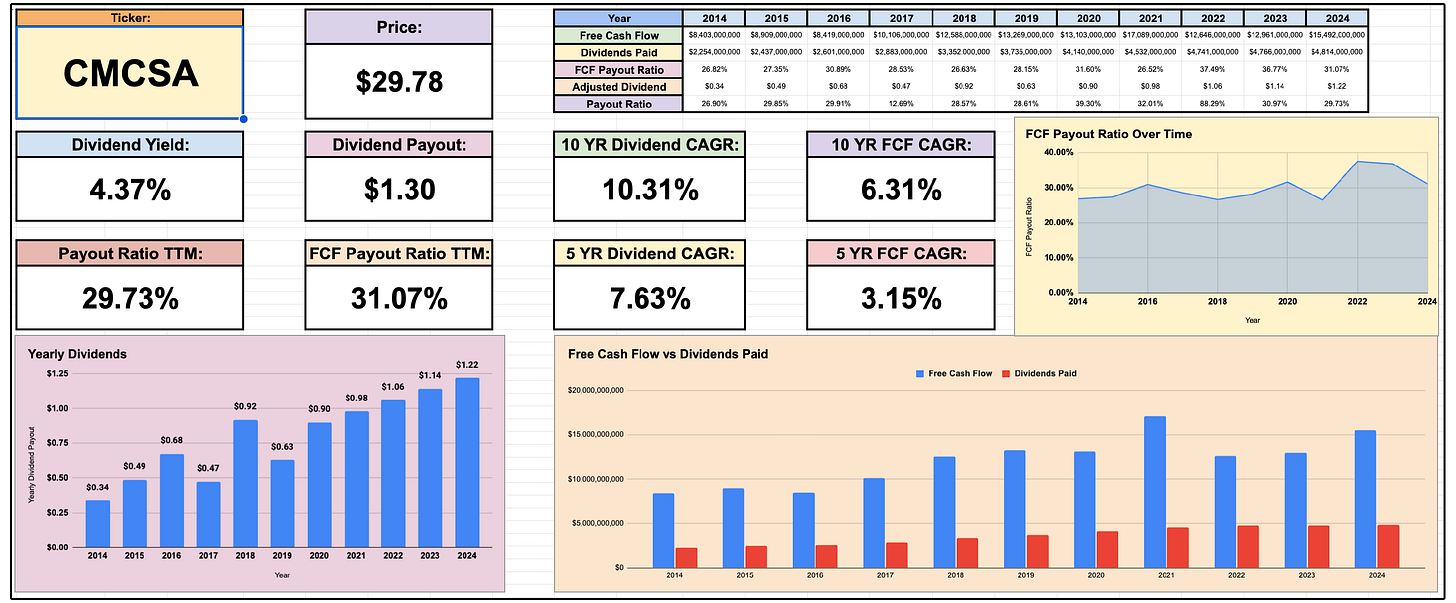

📡 Comcast - (CMCSA)

Comcast is one of the most deeply discounted stocks in the S&P 500, trading at roughly 6x projected 2026 earnings while yielding close to 5%.

Barron’s argues the market has become overly pessimistic about broadband competition and secular decline.

The real upside according to Barron’s lies in the potential for asset separations involving media, parks, or cable properties that could unlock significant hidden value.

My take:

Comcast is trading at an incredibly low P/E multiple and actually has quite attractive dividend metrics.

But future earnings growth is virtually non-existent, and this is an incredibly capital intensive business.

The stock could potentially benefit from a valuation multiple rerating, but the company is simply not growing its intrinsic value.

Like BMY, I don’t want to rely on a company where shareholder returns depend on corporate restructuring, and that is the primary argument that Barron’s makes.

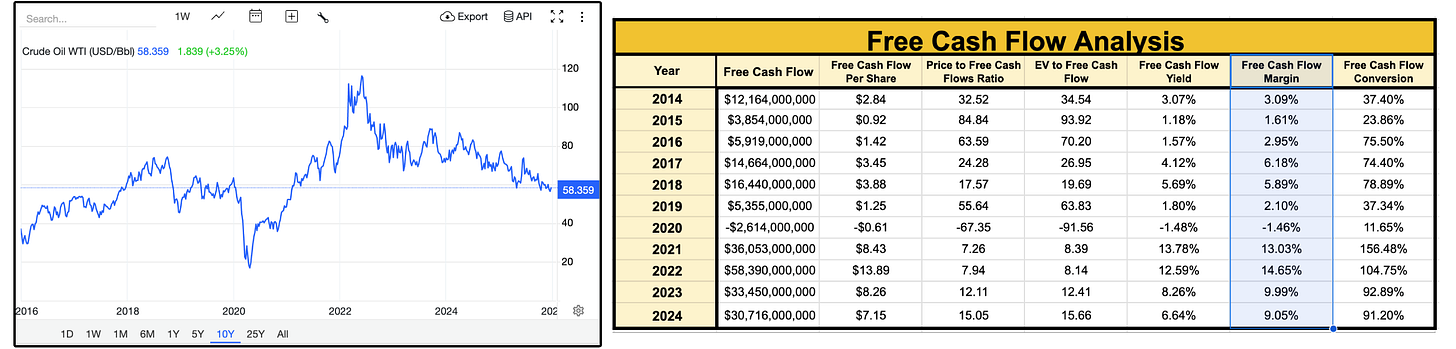

🛢️ Exxon Mobil - (XOM)

Barron’s views Exxon Mobil as the gold standard in global energy, emphasizing its updated corporate plan targeting 13%+ EPS CAGR through 2030, assuming Brent crude averages around $65.

Investors are also compensated with a 3%+ dividend yield and a 43-year streak of dividend increases, underscoring payout resilience even in weaker commodity environments.

My take:

This argument from Barron’s is much more appealing.

The starting yield is attractive, intrinsic value is growing, and they have a history of dividend growth.

However, XOM is incredibly reliant on crude oil prices, and their free cash flow margin varies by a wide amount year after year as a result.

Not only am I looking to buy companies at a healthy valuation that are growing intrinsic value, I’m looking to buy companies with incredibly predictable cash flows.

Growth of cash flows + Predictability of cash flows = high quality.

With that being said, there are also better opportunities in the oil space.

For example, last month we added a stock yielding over 8% to our high yield portfolio, and management has guided towards double digit dividend growth in the coming years.

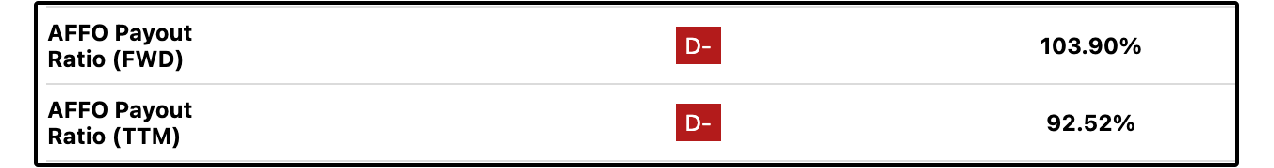

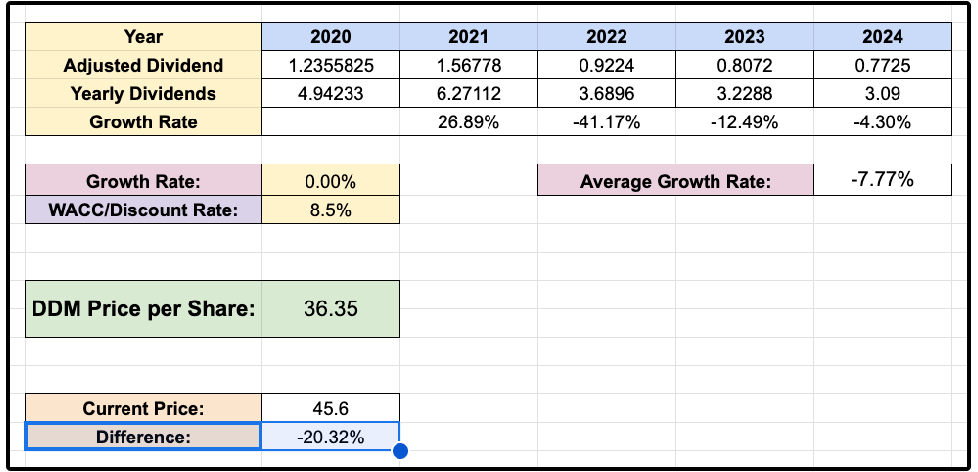

🏢 SL Green Realty (SLG)

Barron’s characterizes SL Green as one of the most extreme valuation disconnects in New York real estate.

The stock has been heavily punished, but management argues current pricing implies the company is worth little more than the land beneath its buildings, with asset value estimates exceeding $70 per share.

The thesis rests on asset value rather than near-term cash flow growth.

My take:

SL Green stands out as one of the riskiest picks on this list.

Leverage is quite high for this REIT, and near term guidance is not attractive.

It has a high starting yield of around 7%, but despite this, they’ve endured multiple dividend cuts in the last 5 years and currently have a forward AFFO payout ratio of 103.9%.

Office exposure, leverage, and political uncertainty in the increasingly unfriendly business environment of New York add additional layers of risk.

This is not a stock I would own for income stability.

It’s a speculative deep value bet.

Ironically, assuming 0% dividend growth, this stock could still have 20% more downside.

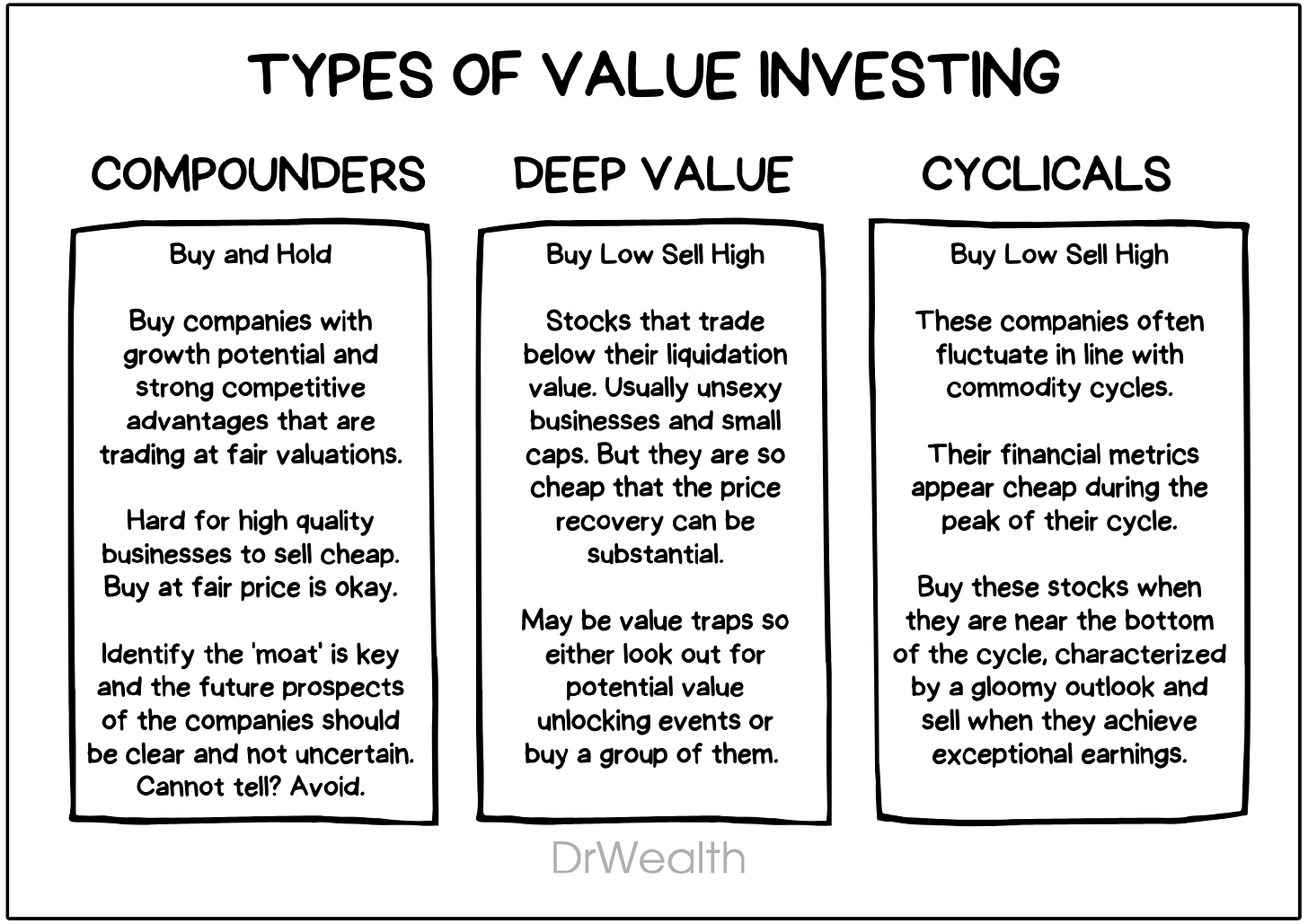

⚠️ Deep Value

When you step back and look at Barron’s 2026 list as a whole, a clear pattern begins to emerge.

Many are businesses in ‘deep value’ territory where the path to shareholder returns is far less predictable.

The core issue is this:

Most of Barron’s theses rely on things going right, rather than things continuing as they are.

In other words, returns are expected to come from:

Multiple expansion

Asset sales or spin-offs

Turnarounds

Commodity price assumptions

Pipeline or restructuring success

That’s the definition of deep value investing:

Buying assets that look statistically cheap and hoping sentiment or structure changes unlock value.

There’s nothing inherently wrong with this approach.

But it comes with trade-offs.

Deep value stocks tend to have:

More volatile cash flows

Higher business or balance sheet risk

Less visibility into long-term earnings power

Outcomes that hinge on management execution or external factors

Contrast that with the type of businesses we prioritize in our Dividend Growth and High Yield Portfolios.

We want returns to come from things like organic cash flow growth, durable competitive advantages, strong balance sheets, predictable earnings streams, and dividends that grow because the business is growing.

That doesn’t mean Barron’s picks can’t perform.

But returns relative to the risk you take on matter.

Predictability matters.

💼 Our Portfolios

2025 has been a great start for our High Yield and Dividend Growth Portfolios.

Next week, we will be reviewing each of them as we head into 2026.

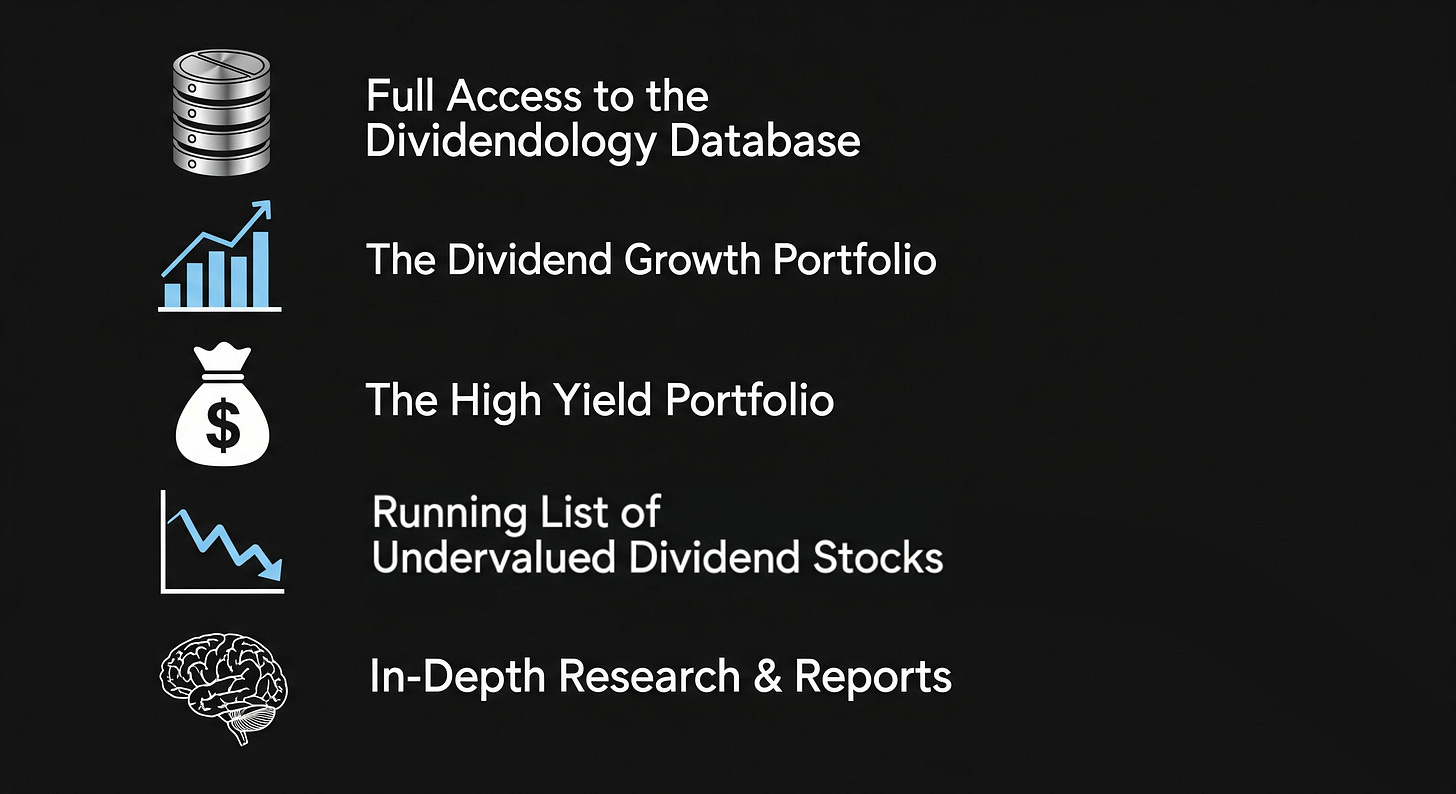

If you want to be a part of the process of building these portfolios and also get access to everything mentioned below, you can join here:

Here’s everything you’ll get as a paid Dividendology member 👇

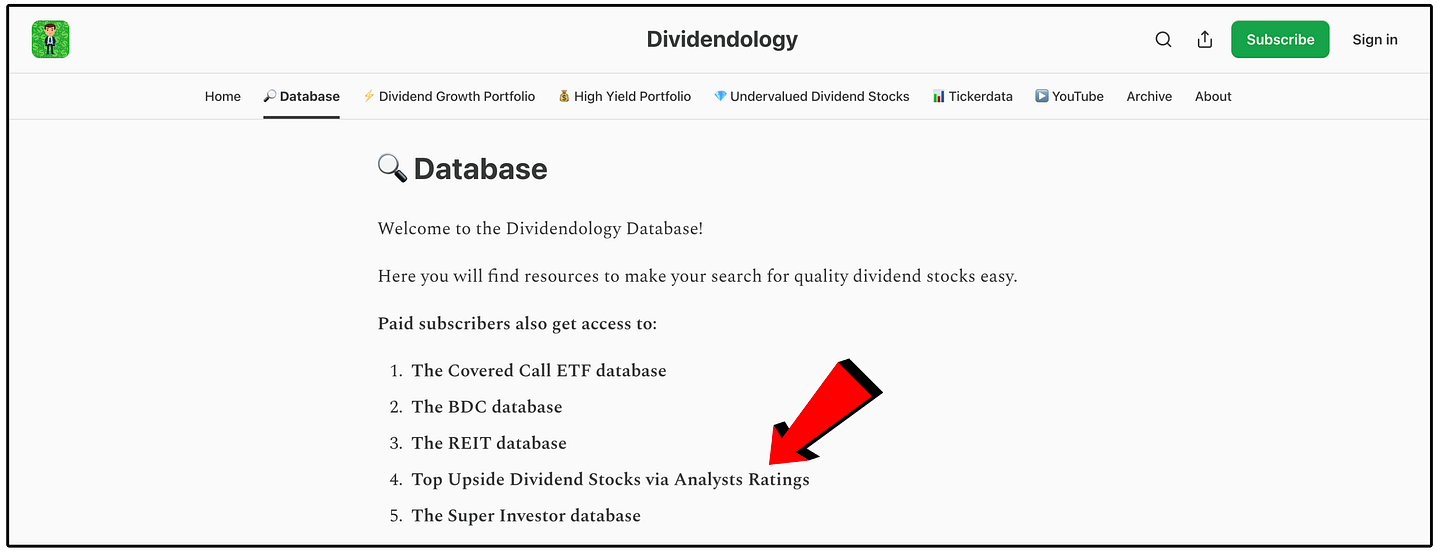

Last month, we added a new feature to the Dividendology Database as well!

Every month, I compile a data on Wall Street price targets and compile it to bring you the ‘Most Upside Dividend Stocks via Analyst Ratings’.

Dividendology is continuing to grow.

The best is yet to come!

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets! (Code: ‘2026’) for 30% Off!))

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($30 off! + 7 day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

We may see AI multiple compression in 2026, so I completely agree with your picks…

What about AMZN?