🧱 Building the Dividend Growth Portfolio

Creating Growing Income Streams 💰

What an exciting week it’s been!

The full launch of Dividendology has been a huge success.

We’ve launched the Dividendology Database, and are now in the beginning stages of building out our 2 real money portfolios:

The Dividend Growth Portfolio

The High Yield Portfolio

Today, we need to address the goals and expectations for our Dividend Growth Portfolio.

📊 Why Dividend Growth

A Dividend Growth strategy is a beautiful thing for multiple reasons.

Let’s start with the basics.

Hartford Funds recently conducted one of the most in-depth research studies on dividend stocks over the last 94 years.

What they found revealed some fundamental truths about dividend stocks.

The first was that dividend growers outperform.

Why is this the case?

Think about what a stock growing its dividend often means:

Cash flow can cover the dividend

Management is confident earnings will continue to grow in the future

It forces management to focus on the highest ROI projects

Management is focused on long term objectives

Remember: Dividend growth and share price appreciation are byproducts of free cash flow growth.

Not only did dividend growth provide better historical returns-

They have also been less volatile. (Lower beta and lower standard deviation)

From 1940–2024, dividend’s contribution to the total return of the S&P 500 Index averaged 34%.

In the 1940s and 1970s, dividends accounted for over 60% of the total returns.

And in the 2000s… The S&P 500 had negative returns.

Dividends were the only source of positive return that decade.

This is incredibly important to make note of, because it reveals the greatest danger to most investors:

Sequence Risk.

🚨 The Danger of Sequence Risk

For decades now, investors have been preached ‘The 4% rule’.

What a mistake that has been.

Sequence risk refers to the danger of experiencing poor investment returns early in retirement, when an investor is making withdrawals.

Look at the example pictured below.

In the above example, both investors started with $100,000, and had an average annual return of 4% over a 15 year time period.

But here is what each finished with:

Investor 1: $105,944

Investor 2: $35,889

Why such a difference?

Because the sequence of returns you get plays a major role in the potential longevity of your portfolio.

Dividend growth solves this problem.

With dividend growth, your payments grow larger every year, despite the fluctuations in the market.

The 4% rule killed many investors ability to retire in 2020, 2022, and essentially for the entire decade of the 2000s.

But those with a dividend growth strategy continued to collect their growing payments.

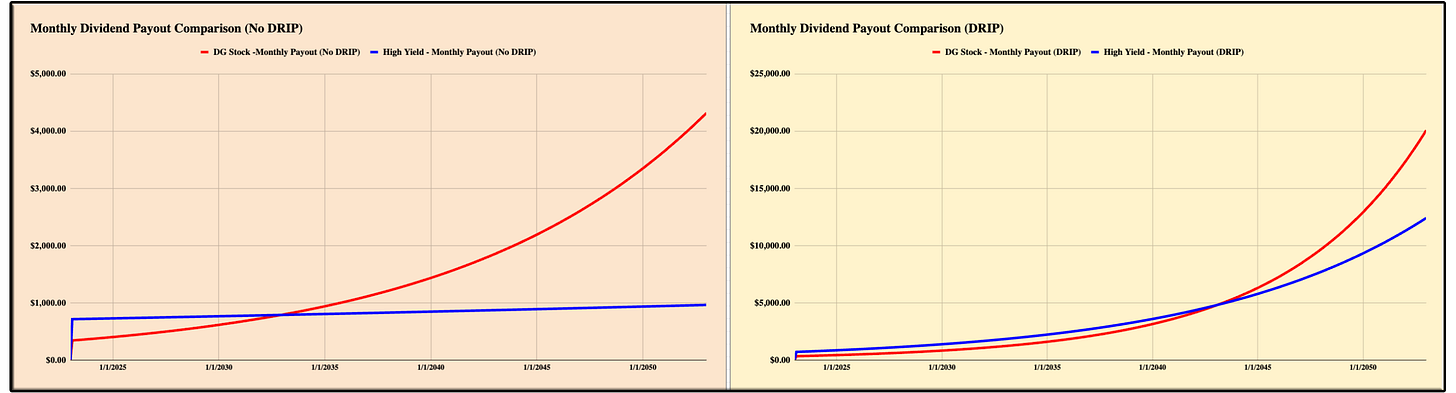

📈 Maximizing Income

I love the idea of maximizing my income (who wouldn’t?)-

And the most common mistake I see is investors assuming the best way to achieve this is with a high yield strategy.

If your goal is to maximize income in the short term, this would make sense.

However, regardless of whether you reinvest dividends or not, dividend growth actually pays out more in the long term.

The reason boils down to one concept, and that concept is the single most important task of management…

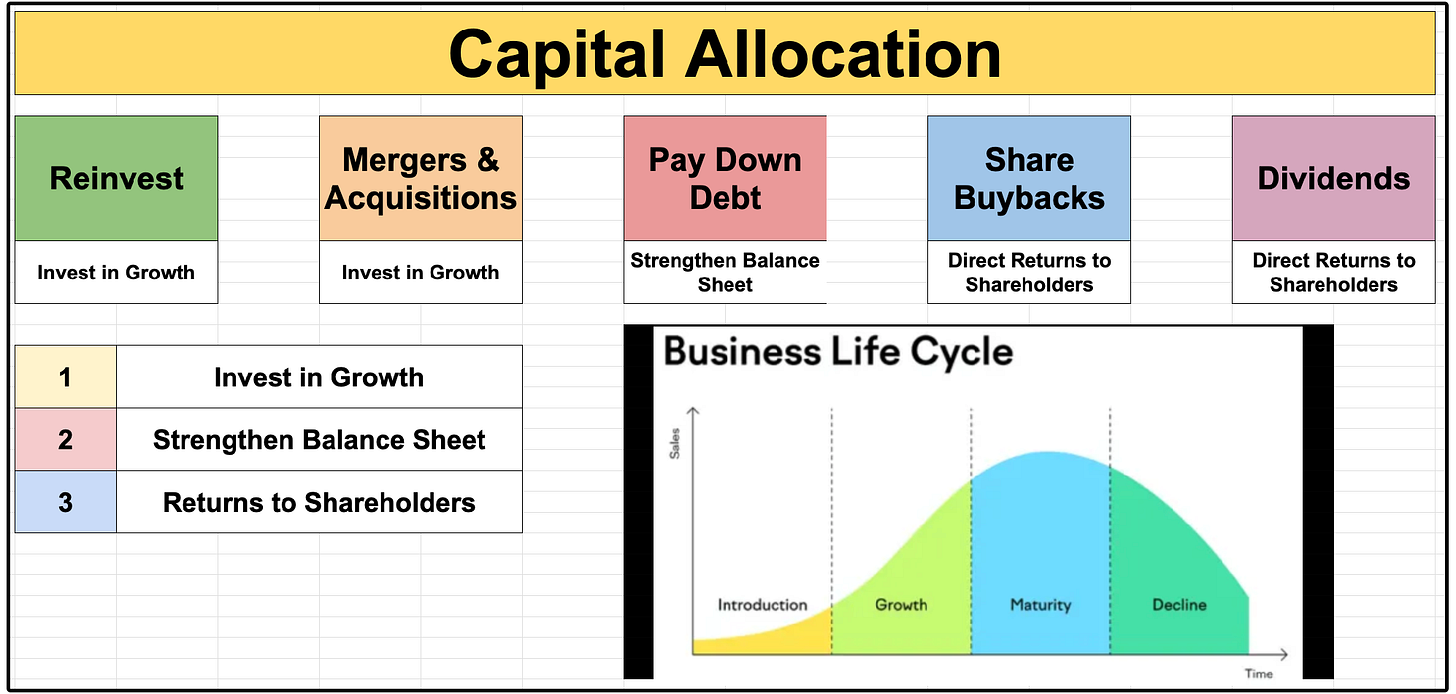

💼 Capital Allocation

Do you know what makes stocks go up?

It’s growing free cash flow.

The reason is that there are 5 ways to use free cash flow:

Reinvest into the business

Mergers & Acquisitions

Pay Down Debt

Share Buybacks

Dividends

The goal of management is to decide the best way to allocate that capital.

If a company uses all of their capital to pay out dividends, they cannot reinvest back into the business, making it more difficult to grow free cash flow in subsequent years-

Which actually makes it more difficult to grow dividends in the future.

This is why we commonly see dividend growth stocks with payout ratios of around 20% grow dividends at a high rate, and even outperform the market.

…But wait a second…

Doesn’t this mean if a stock stopped paying a dividend and reinvested all of its capital, then free cash flow would grow faster leading to more share price appreciation?

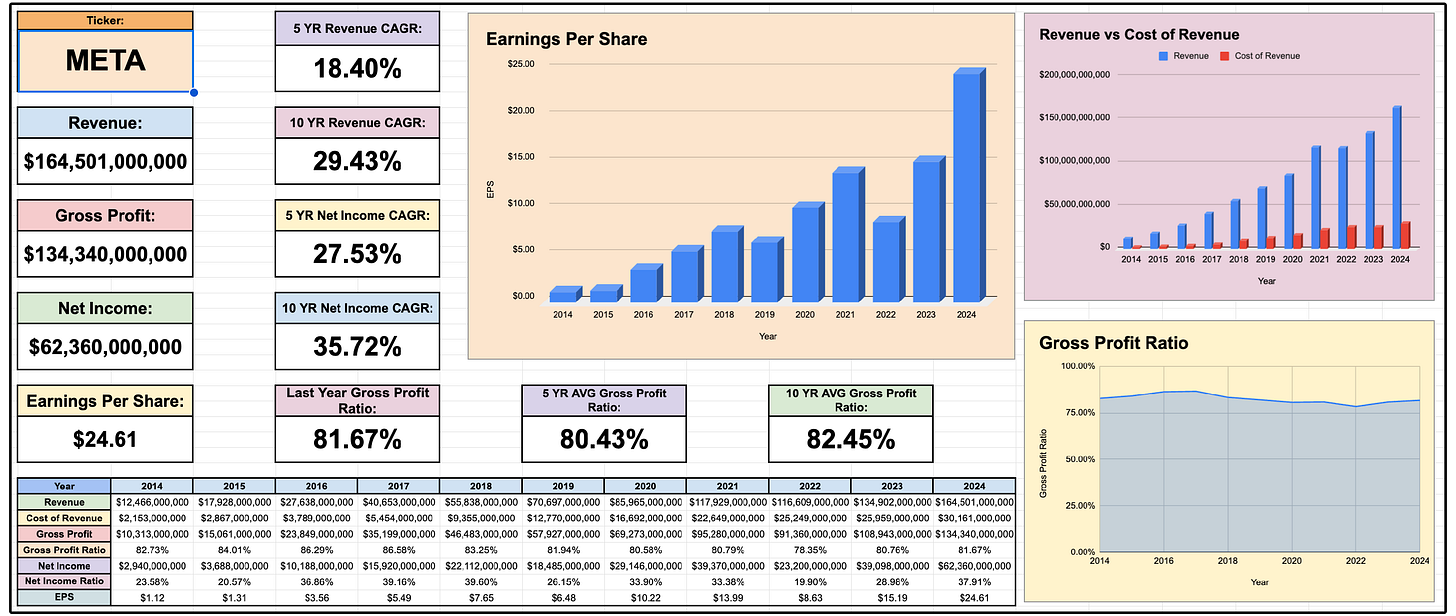

🔍 META Case Study

1.5 years ago, Meta announced plans to start paying dividends.

If we examine their financials, we see a company with exceptional profitability.

Over the past decade, Meta has grown its revenue at an impressive rate, with a five-year compound annual growth rate (CAGR) of 18.4%.

Their balance sheet is just as strong, with over $91 billion in current assets and minimal debt.

Yet, despite their financial strength, Meta faced a unique problem-

They had too much cash.

Over the past four to five years, Meta burned through $45 billion trying to build Reality Labs, their metaverse division, which turned out to be unprofitable.

This illustrates a critical point: even the best companies can misallocate capital if they reinvest too much without getting proper returns.

By choosing to pay dividends now, Meta acknowledges they’ve reached a stage where it’s better to return cash to shareholders than continue over investing in low-return projects.

🏛️ High-Quality Companies Pay Dividends

The decision to pay dividends often comes down to efficiency.

Companies like Microsoft, Apple, and Google generate so much cash that, after funding high-return projects, there’s still excess.

At this point, paying dividends becomes the most efficient use of capital.

But here’s what makes these companies unique: they can pay dividends without sacrificing growth.

For example, Microsoft has been paying dividends since 2003. In 2013, they paid out $7.5 billion in dividends while generating $24.5 billion in free cash flow.

A decade later, their free cash flow nearly tripled to $60 billion, and their dividend payments grew to $18 billion annually.

Despite paying out dividends, Microsoft continued to grow at an exceptional rate.

In theory, not paying out dividends would help Meta grow faster.

But in practice, it’s a much different story.

🗂️ The Goal

The goal of the Dividend Growth Portfolio is simple:

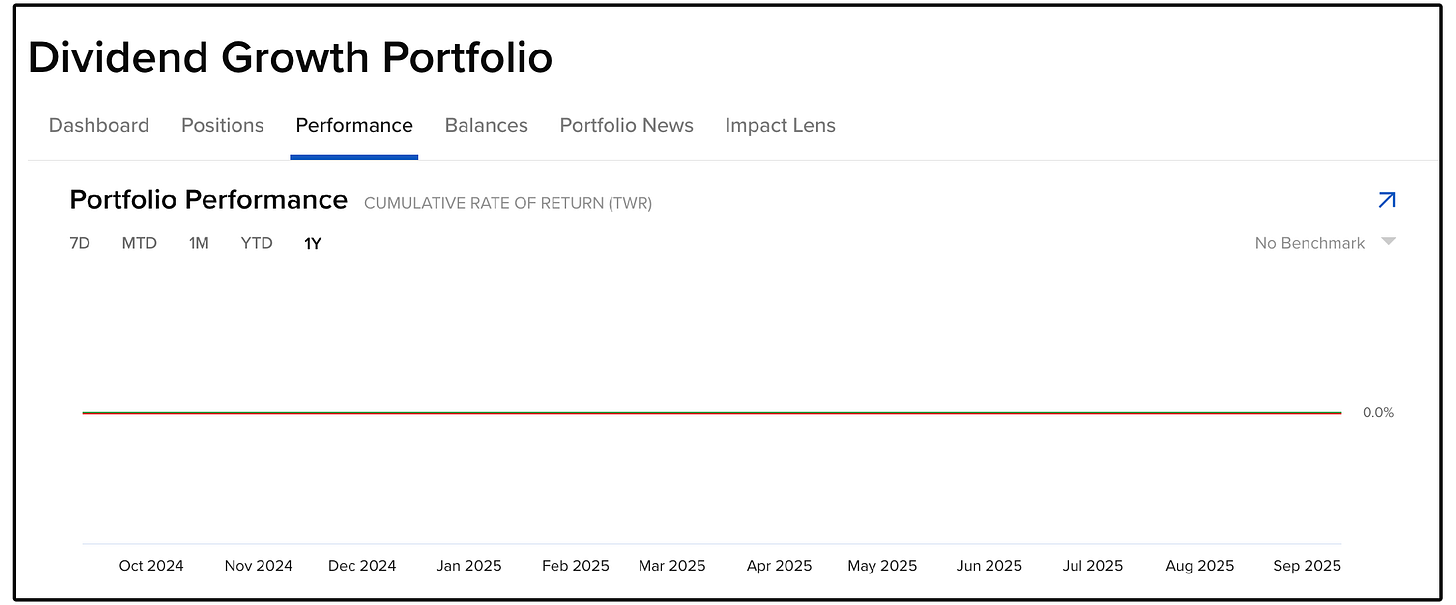

To achieve dividend income growth of 7–10%+ annually, while maintaining capital appreciation in line with or better than the S&P 500 over a full market cycle.

Achieving the above goal would allow us to take full advantage of all of the above mentioned benefits of dividend growth investing.

The success of this portfolio will only be able to be measured over the long term.

Keep in mind, I am a believer in the Rule of Three from François Rochon:

One year out of three, the stock market will go down at least 10%

One stock out of three that we buy will underperform

One year out of three, we will underperform the market

I believe this will be the case for our dividend growth portfolio.

But declining share prices can be a huge advantage to the dividend growth investor.

Declining stock prices mean the following:

You can buy stocks at better valuations

Stocks will have higher dividend yields

Your reinvested dividends will buy you more shares, buying you even more income

📋 Execution

We will not limit our scope of research to the U.S. only.

We will search worldwide for the best opportunities.

Because of this, I’ve opened an account with Interactive Brokers to start building out our portfolio.

If you’d like the checkout Interactive Brokers, you can do so here:

Keep in mind, members of Dividendology will be able to view all the holdings in the portfolio with complete transparency in real time, by going to https://www.Dividendology.com/.

If you aren’t yet a member of Dividendology and want to be a part of the full experience, you can join here: 👇

On Tuesday, we will be laying out the goals for our High Yield Portfolio.

After that, it’s time to start adding positions.

I just got off a Zoom call with a highly esteemed fund manager, who has a fund that I’ve identified as a huge opportunity for the High Yield Portfolio.

These are exciting times!

See you on Tuesday.

Dividendology 🚀

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($30 off! + 7day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Disclaimer: As a reader of Dividendology, you agree to our disclaimer. You can read the full disclaimer here.

Looking forward creating this dividend snowball with you! 💪

The high yield portfolio wont be just a fund from that manager you spoke with, right ? You just take ideas from him ?