💰 Building the High Yield Portfolio

Creating Massive Streams of Income 🌊

Last week, we officially began the journey of building our two real money portfolios:

The Dividend Growth Portfolio

The High Yield Portfolio

This past Friday, we discussed the goals for our Dividend Growth Portfolio.

Today, we will discuss the goals for our High Yield Portfolio.

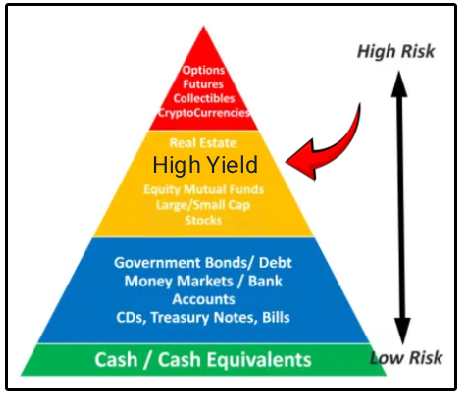

🚨 The Risks

As of last month, there were only 4 stocks in the S&P 500 with a dividend yield of above 7%-

Because there are so few opportunities inside the index, investors who want higher yields are forced to look elsewhere.

There are typically 5 main asset classes investors turn to when seeking to build a high yielding portfolio:

🏢 REITs

🛢️ MLPs

💼 BDCs

📈 Covered Call ETFs

🏦 Preferred Shares

Unfortunately, these high yield asset classes tend to be far riskier than many realize.

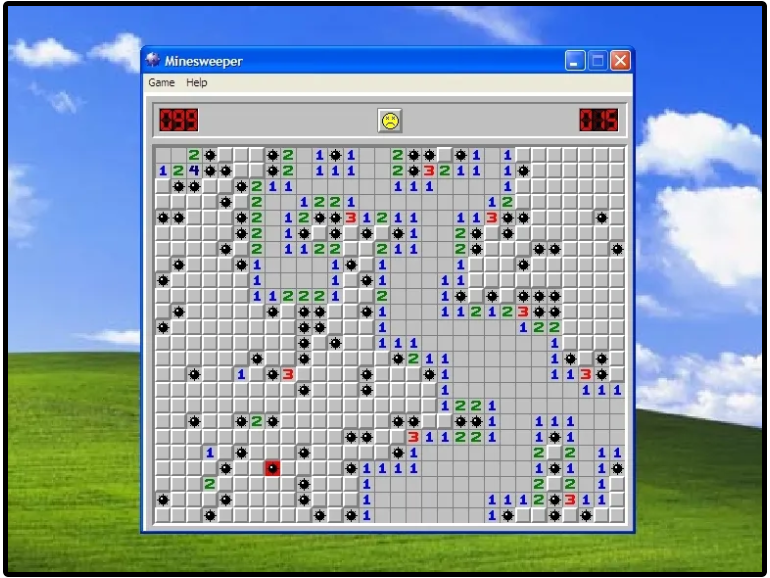

Because of this, I’ve mentioned in the past how high yield investing is quite similar to the old game minesweeper.

The premise of the game is some squares are safe to click on, but some squares are hidden mines.

If you go around randomly clicking on squares, you are basically guaranteed to hit a mine, ending your game.

But if you know what to look for, you can strategically avoid the mines.

The vast majority of people do NOT know how to avoid the mines-

And to be honest, it’s hard to blame them.

Here’s why.

⚠️ The Problem With High Yield

Retail investors have had a massive disadvantage when it comes to high yield investing over the years.

Their disadvantage boils down to one single thing:

Lack of data.

The way we analyze each of the above mentioned asset classes is radically different than any other asset class.

Examples:

Portfolio Options Coverage for Covered Call ETFs

Tangible Book Value Per Share CAGR for BDCs

AFFO Payout Ratio Over Time for REITs

I’ve tested every software out there imaginable, and none of them provide the necessary information on these asset classes you need to make informed decisions.

This is exactly why I spent the last 9 months building the Dividendology Database, which was released last week.

This database provides all the necessary information we need to make high yield investment decisions.

🏆 The Advantage of High Yield

This is rarely talked about-

But there are also some huge advantages for investors who utilize a high yield strategy.

The shift away from the S&P 500 and traditional investments into these alternative income plays creates two interesting dynamics:

📝 Limited analyst coverage & market inefficiencies

Unlike the mega-cap S&P 500 names that have Wall Street analysts dissecting every detail, many high-yield alternatives trade with less attention. This lack of coverage often results in pricing inefficiencies and misvaluations, both on the upside and downside.🔍 Greater opportunity for diligent investors

For those willing to roll up their sleeves and learn the nuances of these asset classes (things like AFFO for REITs, NAV growth for BDCs, or option coverage ratios for Covered Call ETFs), there are chances to capture both yield and capital appreciation where the broader market overlooks it.

In other words, the scarcity of yield in the S&P 500 pushes capital into corners of the market that are less efficient-

Which is exactly where disciplined, income-focused investors can find hidden gems.

(Yes, this should make you excited)

💼 Why High Yield

Based on the 4% rule that is commonly touted, you would need a $1 million portfolio to live off $40,000 a year.

But what if we could achieve our goal of building a portfolio that yields 8%, with no capital erosion?

All of a sudden, the amount of capital we need to retire is cut in half.

With a portfolio that has a dividend yield of 8%, you would only need $500k to generate that same $40,000 a year.

But there is one more thing to consider:

Inflation.

However, this can still be accounted for 2 ways with a high yield portfolio:

Dividend Growth

Reinvesting a small portion of dividends to offset inflation

This approach also reduces sequence of return risk (the danger of bad market performance early in retirement) because instead of selling assets to fund withdrawals, you’re living off dividends that continue to get paid regardless of market volatility.

A sustainable high yield has the potential to be extremely powerful.

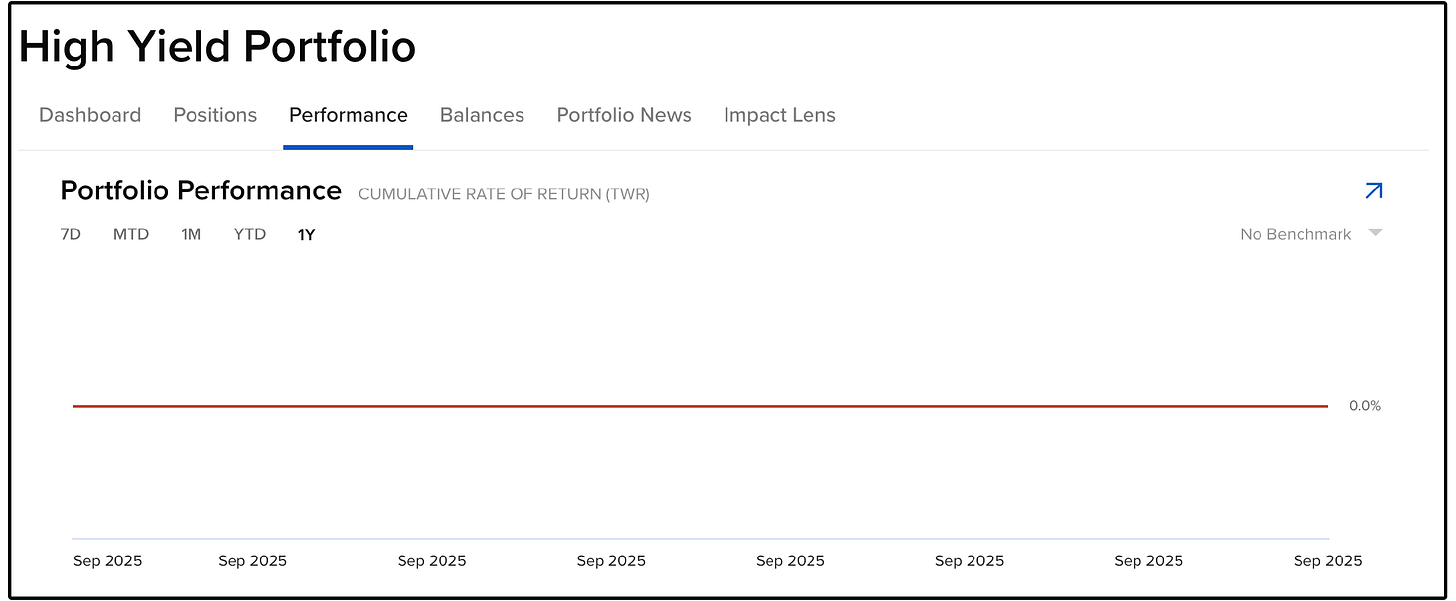

🗂️ The Goal

The goal of the High Yield Portfolio is simple:

Deliver a sustainable dividend yield of around 8%

Preserve capital (no long-term value erosion)

Provide predictable cash flow

That’s rather straightforward.

With that being said, I do believe that high yield investments are rarely ‘Buy and Hold Forever’ investments.

We must have a deep understanding of the inner workings of each of the holdings we add to our portfolio-

And be sure to watch for any deterioration in the underlying fundamentals.

If we see fundamentals weakening, we will be quick to exit a position.

📋 Execution

Just like the Dividend Growth Portfolio, we will not limit our scope of research to the U.S. only.

We will search worldwide for the best opportunities.

Because of this, I’ve opened an account with Interactive Brokers to start building out our portfolio.

If you’d like to checkout Interactive Brokers, you can do so here:

Keep in mind, members of Dividendology will be able to view all the holdings in the portfolio with complete transparency in real time, by going to https://www.Dividendology.com/.

If you aren’t yet a member of Dividendology and want to be a part of the full experience, you can join here: 👇

I have another zoom call with a fund manager this Friday to further research a potential opportunity for our high yield portfolio.

I’ll be making the interview available to members in the near future.

See you on Friday!

Dividendology 🚀

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($30 off! + 7day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Want More?

Consider becoming a Dividendology member.

Here’s everything you’ll get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with now over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

Disclaimer: As a reader of Dividendology, you agree to our disclaimer. You can read the full disclaimer here.

I’m doing basically the same and journaling it on the go as well ✌🏻🔥