Buy These 4 Dividend Stocks Cheaper Than Insiders! 🔥

Insiders are Buying These Stocks! 🚀

One of the quickest ways to get investment ideas?

Find out out what insiders are buying.

Why?

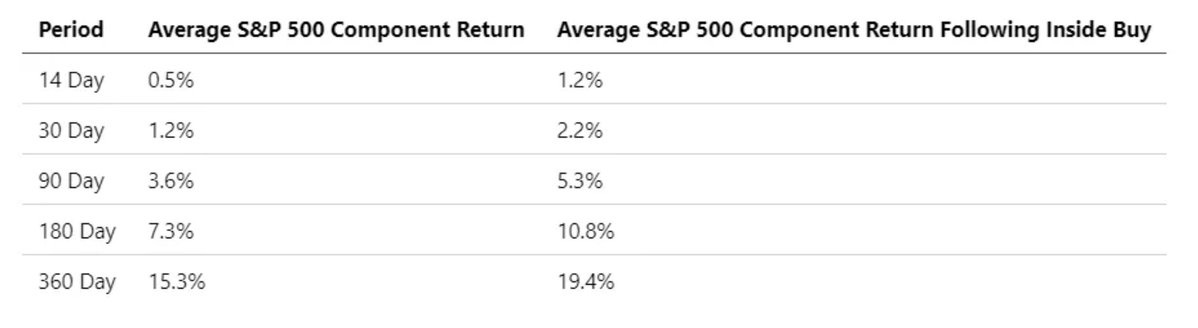

Because the data is clear-

Stocks that have insider purchases tend to outperform the market.

Here are 4 dividend stocks that you can currently buy cheaper than the price insiders bought in at:

1. $OXY Occidental Petroleum Corp.

Warren Buffett’s Endorsement: Buffett’s Berkshire Hathaway has heavily invested in $OXY, with an estimated average purchase price of $54.50—higher than the current $46.80.

Dividend Stability and Cyclicality: The company’s current dividend yield is 1.82%, but dividends remain volatile due to the cyclical nature of the energy sector.

Improved Cash Flow Margins: Recent years have shown strong free cash flow margins, and capital expenditure stability provides a positive outlook for near-term profitability.

2. $DINO HF Sinclair Corp

Insider Confidence: Insiders have been purchasing shares at prices significantly higher than the current $34

High Shareholder Yield: DINO has a 5.9% starting dividend yield combined with a $1 billion share buyback program

Cyclicality and Valuation: While energy sector cyclicality introduces unpredictability, the company appears undervalued based on trailing 12-month metrics, though sustaining current free cash flow levels is uncertain.

3. $PSEC Prospect Capital Corp

High Yield with Risks: A starting dividend yield of 12.75% is enticing, but has historically come with significant share price decline.

Strategic Shift: The company is realigning its business to focus on safer senior secured middle-market loans, potentially increasing long-term dividend stability after a 25% cut.

Insider Buying: Heavy insider purchases reflect optimism about the strategic pivot and its potential impact on the company's financial health.

4. $LVMHF LVMH Moet Hennessy Louis Vuitton

Founder-Led Confidence: Bernard Arnault’s significant insider purchases and majority stake (over 50%) highlight strong confidence in the company’s long-term prospects.

Exceptional Margins: High gross profit margins (68.8% last year) and a portfolio of luxury brands underscore the company’s market strength and pricing power.

Dividend Growth: With a 2% starting yield and double-digit dividend growth over the past decade, the company offers a strong combination of growth and income, despite short-term economic headwinds.

Again, insider’s buying doesn’t mean you should go buy these stocks.

Always assess your risk tolerance, goals, and time horizon.

But it can be a great place to find ideas.

Out of the 4, I own and will continue to hold $LVMHF Louis Vuitton.

If you own or plan on buying any of these stocks, respond to this email and let me know!

Today’s Sponsor:

Professional investors have access to premium tools and armies of analysts to stay ahead in the market.

StockIntent gives you access to professional-grade investment tools and proprietary insights, including the StockIntent Score—a trusted metric built on decades of rigorous analysis, demonstrating 25%+ returns in backtest simulations.

Our tools simplify investing, helping you make smarter decisions and stay ahead of the market.

Don’t miss out. Start your 7-day free trial now and experience the power of professional insights in your hands. Risk-free. Cancel anytime.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

$PSEC has some negative news and rubbish thrown ar recently, but it will prevail.

Insider buys is a great sign.