🔥 Buying an 8%+ Yielding REIT!

Undervalued with Insiders Buying! 🔍

Today, we are buying the second position in our High Yield Portfolio.

As a reminder-

The goal of the High Yield Portfolio is simple:

Deliver a sustainable dividend yield of around 8%

Preserve capital (no long-term value erosion)

Provide predictable cash flow

Why 8% yield?

Because the amount of capital we would need to retire is cut in half.

Members of Dividendology will be able to view all the holdings of the High Yield Portfolio on Dividendology.com.

🏅Our First Purchase

Our first purchase was made 2 weeks ago.

It was a fund that:

Yields over 9%

Pays monthly dividends

Grows its dividend annually

Does NOT utilize options to generate income

If you missed it, you can read about that purchase here, as well as read my interview with the fund manager.

🏙️ The REIT Market

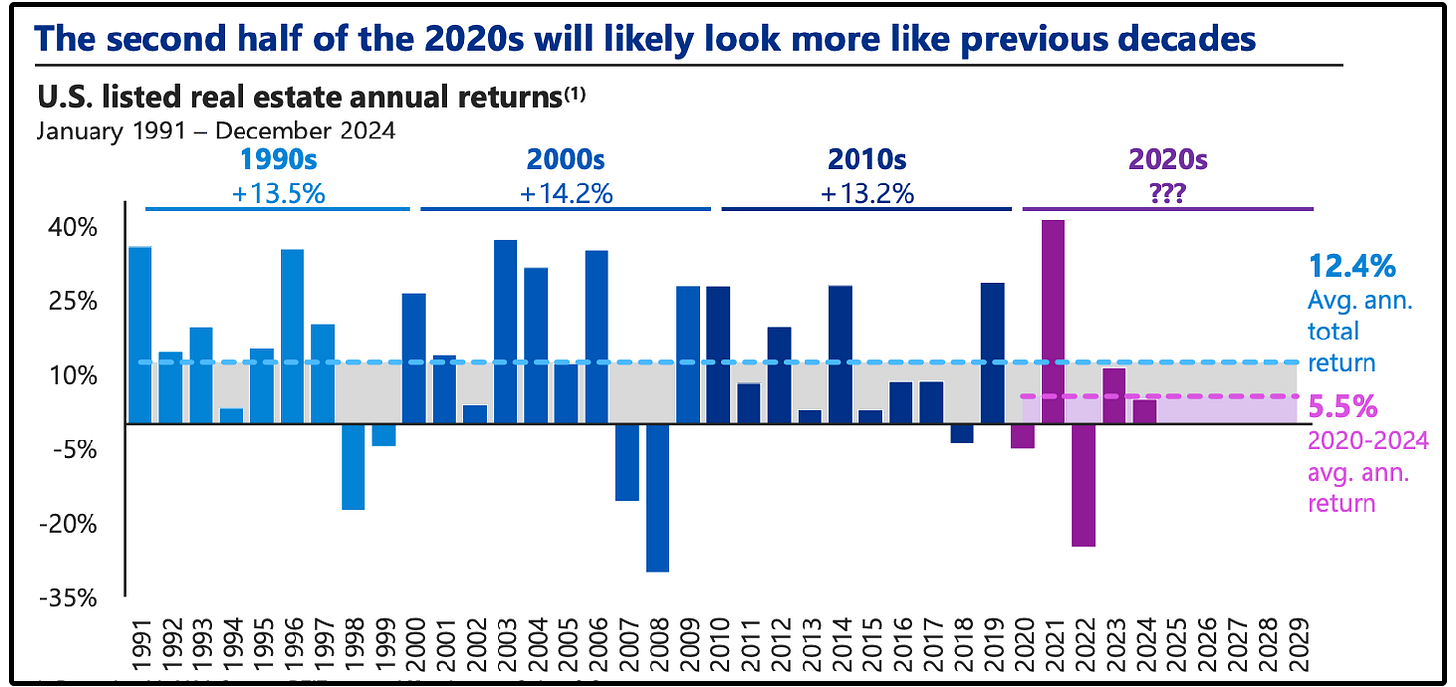

The REIT market has been left behind in the last 3 years.

It’s an out of favor asset class that has historically provided double digit returns.

On top of the fact that REITs are trading at historically low valuations, we now have the short term catalyst of declining interest rates.

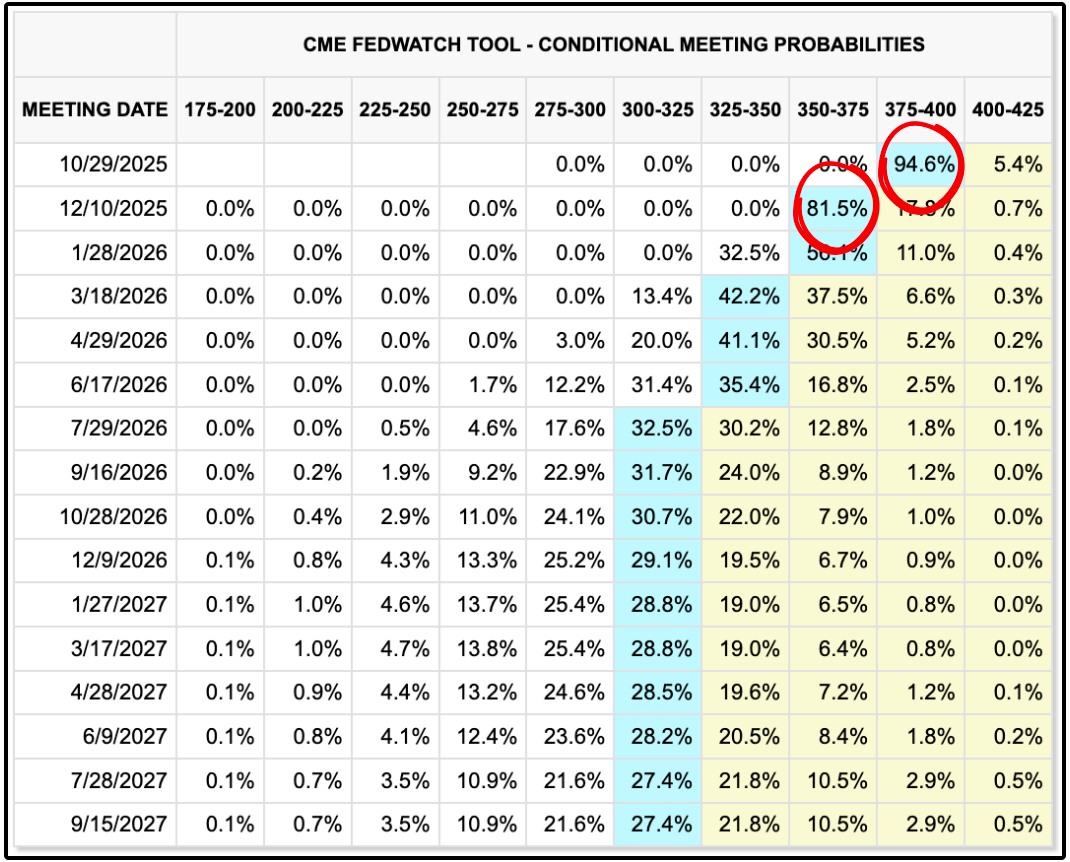

The FED started a rate cutting cycle this past September-

And the odds are currently showing a 94.6% chance of another rate cut on October 29th and an 81.5% chance of another rate cut on December 10th.

If you missed Tuesday’s breakdown of the REIT market, you can read it here.

💰 Today’s Buy

With REITs currently trading at very compelling valuations, along with the short term catalyst-

Now looks like a great time to make the first REIT addition to our High Yield Portfolio.

The REIT we will be adding has a multitude of characteristics that make it interesting:

Yielding well over 8%

Trading more than 40% below its historic P/AFFO multiple

After adding shares of this REIT, our high yield portfolio now has an average yield of around 8.71%.

Below, we will be taking a deep dive into this REIT.

If you’d like to get access to the High Yield Portfolio, as well as everything mentioned below, you can do so here:

Now, let’s dive into our second High Yield purchase…