🛒 Buying This Wide MOAT Dividend Grower!

Inside the Outperforming Dividend Growth Portfolio 💎

We are still in the beginning stages of building out our Dividend Growth Portfolio-

And as of our most recent update (which you can read here), we’ve outperformed the market by a wide margin.

While this is exciting, it means very little right now.

Why?

Because I’m much more concerned with the evolution of the intrinsic value of our holdings over the long term rather than the short term price performance.

With that being said, I am quite excited about the way our portfolio is shaping up.

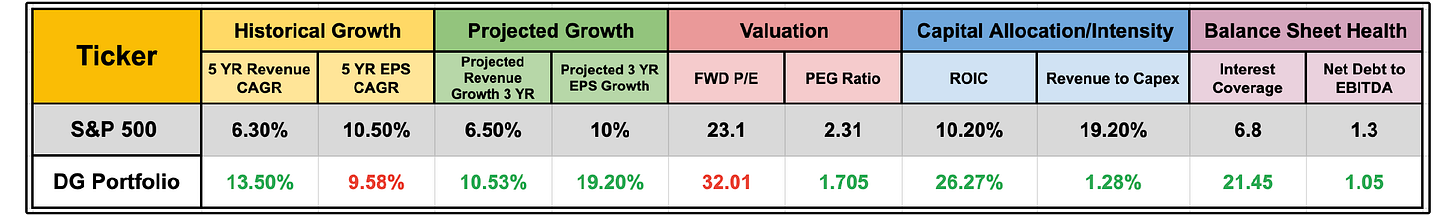

In a market that many would argue is overvalued, we’ve been able to add positions to our portfolio that:

Are fundamentally healthier than the S&P 500

Are growing revenues and EPS at a faster rate than the S&P 500

Trade at a more attractive valuation than the S&P 500

And of course, our positions are growing dividends at a double-digit rate on average.

Today, we will be adding a new position to the Dividend Growth Portfolio that I am quite excited about.

🧩 The Portfolio

As a reminder-

The goal of the Dividend Growth Portfolio is simple:

To achieve dividend income growth of 7–10%+ annually, while maintaining capital appreciation in line with or better than the S&P 500 over a full market cycle.

Achieving the above goal would allow us to take full advantage of all of the benefits of dividend growth investing, which you can see here.

Members of Dividendology will be able to view all the holdings of the Dividend Growth Portfolio on Dividendology.com.

💰Our New Buy

The stock we’re adding to our portfolio today has many attractive characteristics, such as the fact they:

Are projected to grow EPS at above 15%+ annually over the next 5 years

Are trading below historic average valuation multiples

Have a Wide MOAT

Have exceptional ROIC

Are growing dividends at a double digit rate

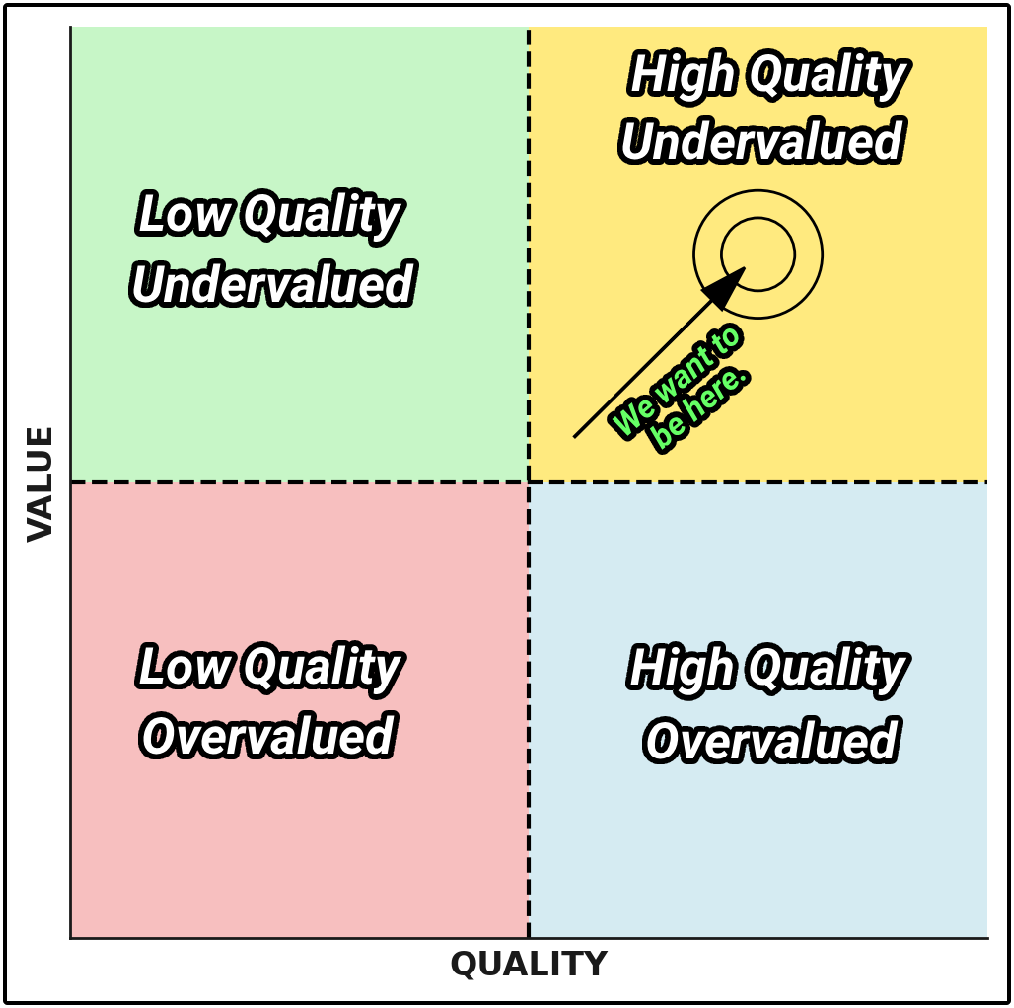

As always, the quality of the business is of utmost importance, but this is a stock we believe just recently shifted into the ‘undervalued/high quality quadrant’.

This is the third purchase for our Dividend Growth Portfolio.

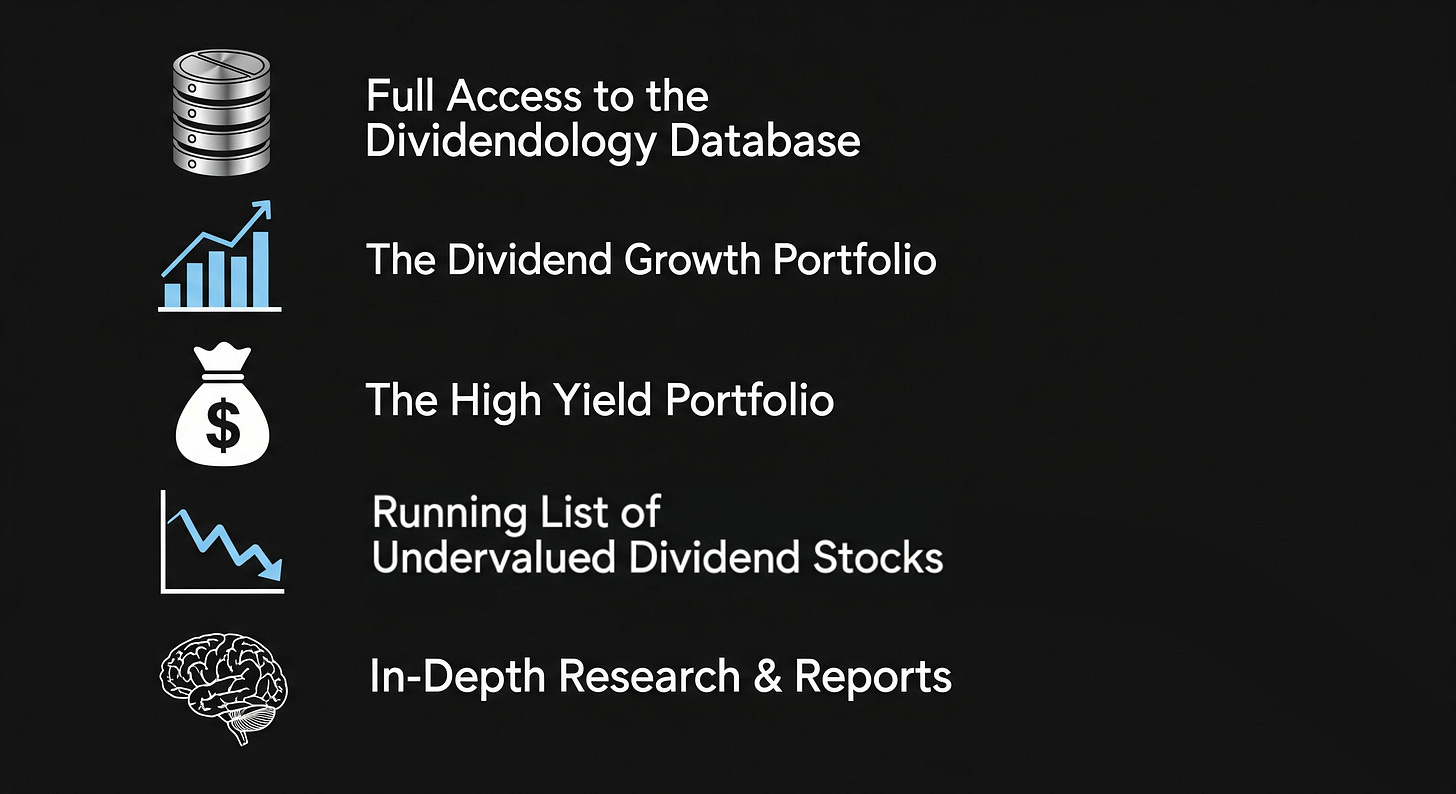

If you haven’t joined already, you can get access to everything pictured below here:

Now, let’s dive into our third Dividend Growth addition…