📝 Creating The Investable Universe!

From 70,000 Stocks, Down to 700 🔍

There are currently around 70,000 publicly traded companies in the world.

Not only do we not have time to analyze them all-

But many of them are terrible investments.

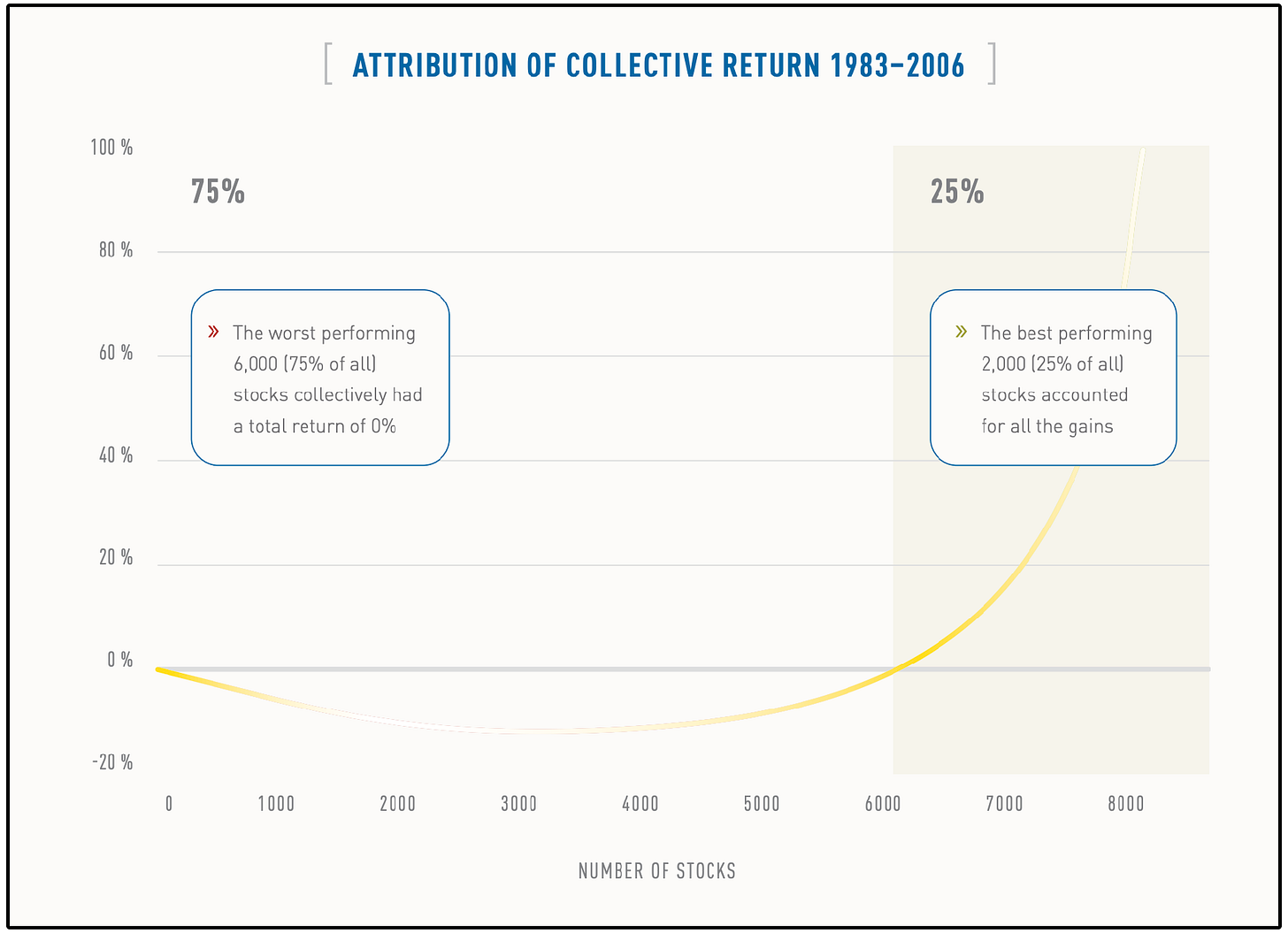

39% of all stocks from 1983 - 2006 had negative returns!

It’s imperative that we avoid these value destroying stocks.

How?

By creating our investable universe.

🎯 The Pareto Principle

The Pareto Principle is simple. The key concept is this:

Roughly 80% of results come from 20% of causes.

Business & Sales: 80% of a company’s revenue often comes from 20% of its customers.

Productivity: 80% of results come from 20% of your most effective work or tasks.

Customer Service: 80% of complaints come from 20% of customers.

I’ve found this to be true with investing as well.

In fact, from 1983 - 2006, only 25% of stocks accounted for all the gains.

75% of all stocks collectively had a total return of 0%!

The companies that actually compound your wealth do so at a high rate over long periods of time.

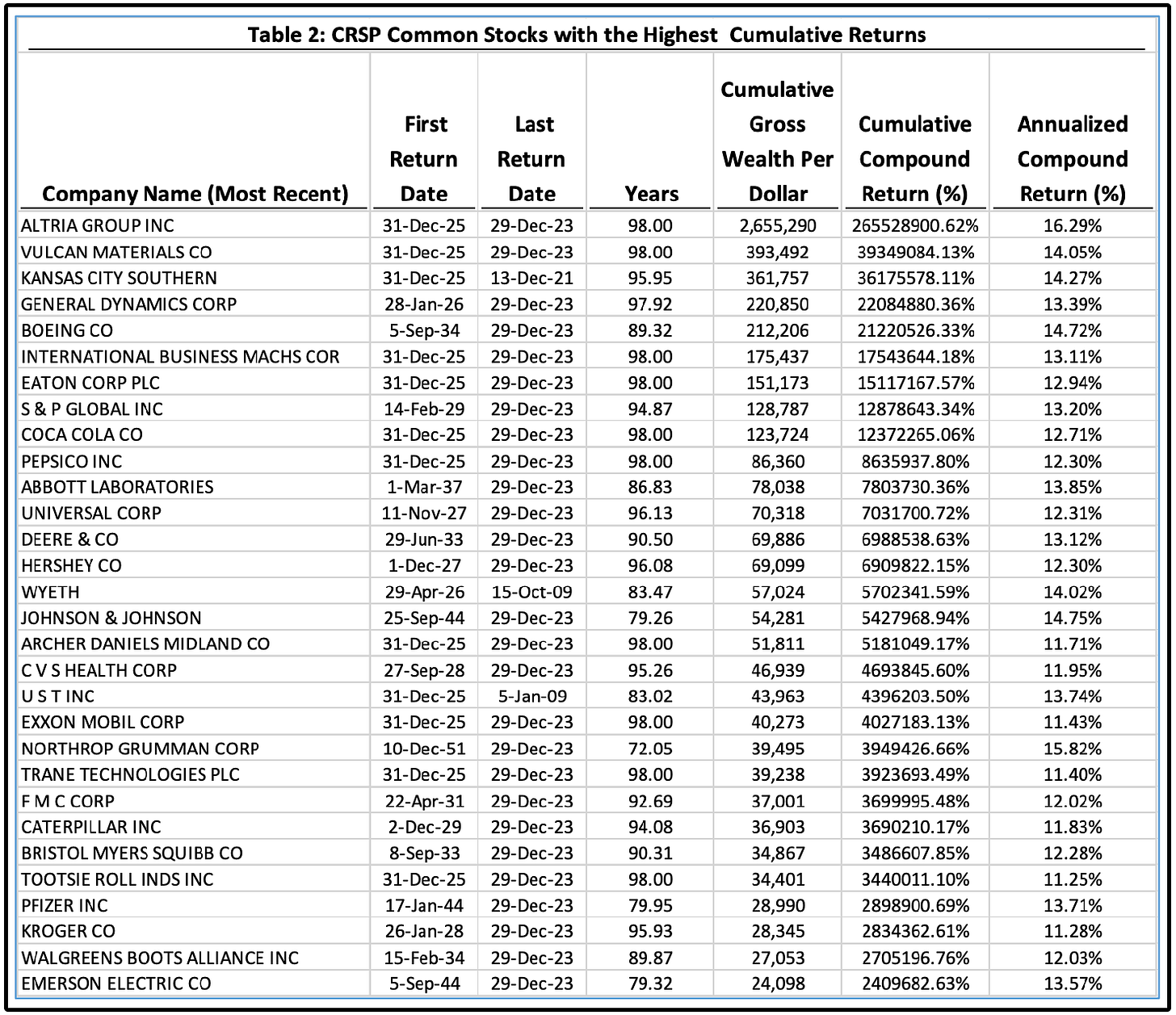

Here’s a list of stocks with the highest cumulative compound returns:

If you had invested $1 in Altria Group in 1925, that single dollar would have grown to $2,655,290 by the end of 2023, a total cumulative return of 265,529,000%.

That’s the equivalent of compounding at 16.29% per year for 98 years straight.

So how do we find today’s equivalent of these long-term compounders?

We must create our investable universe.

🌍 The Investable Universe

Out of roughly 70,000 publicly traded companies in the world, only a small fraction are truly worth owning.

Our goal isn’t to predict the next 10-bagger.

It’s to systematically filter out the 75% of businesses that go nowhere, and identify the small group that can potentially compound value for decades.

Let’s create a very simple Dividend Growth Investable Universe.

We can do this by running just a few simple screens.

Let’s use TIKR.com to create our universe.

💡Creating Our Universe

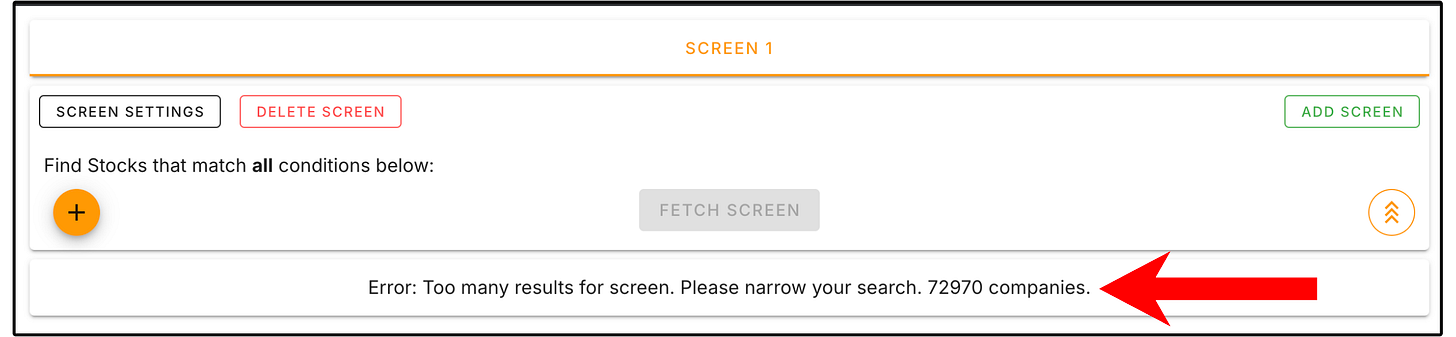

TIKR starts us with 72,970 different equities.

We need to narrow this down.

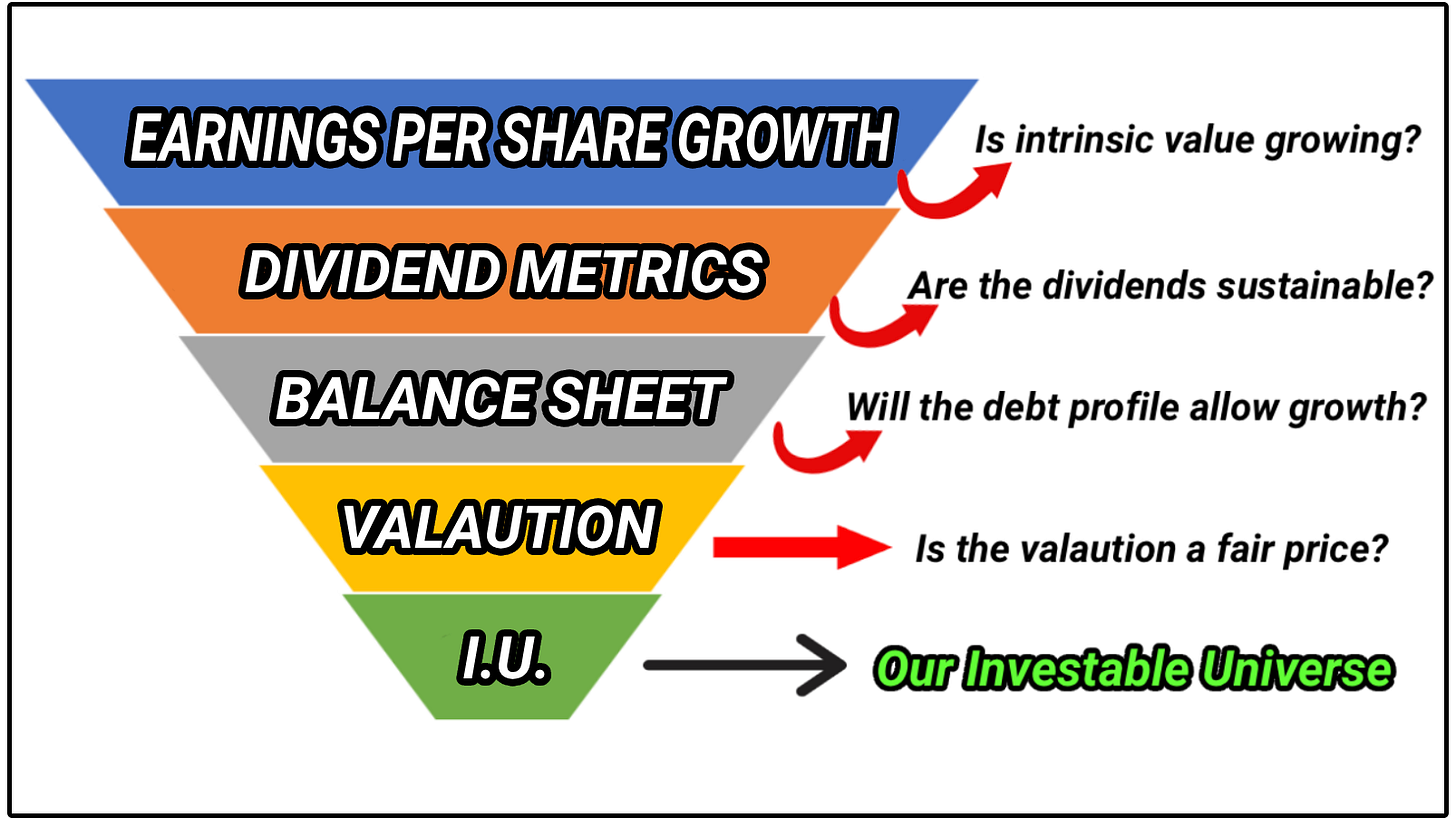

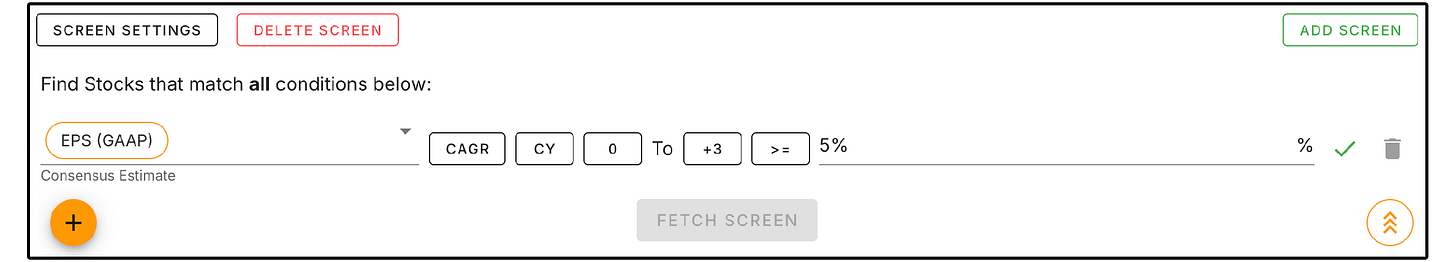

To start, we want our companies to grow earnings.

We will run a screen for companies that are projected to grow EPS at a rate of at least 5%.

All of a sudden, our list of equities went from over 70,000, all the way down to 8,526!

We’ve already filtered out almost 90% of equities.

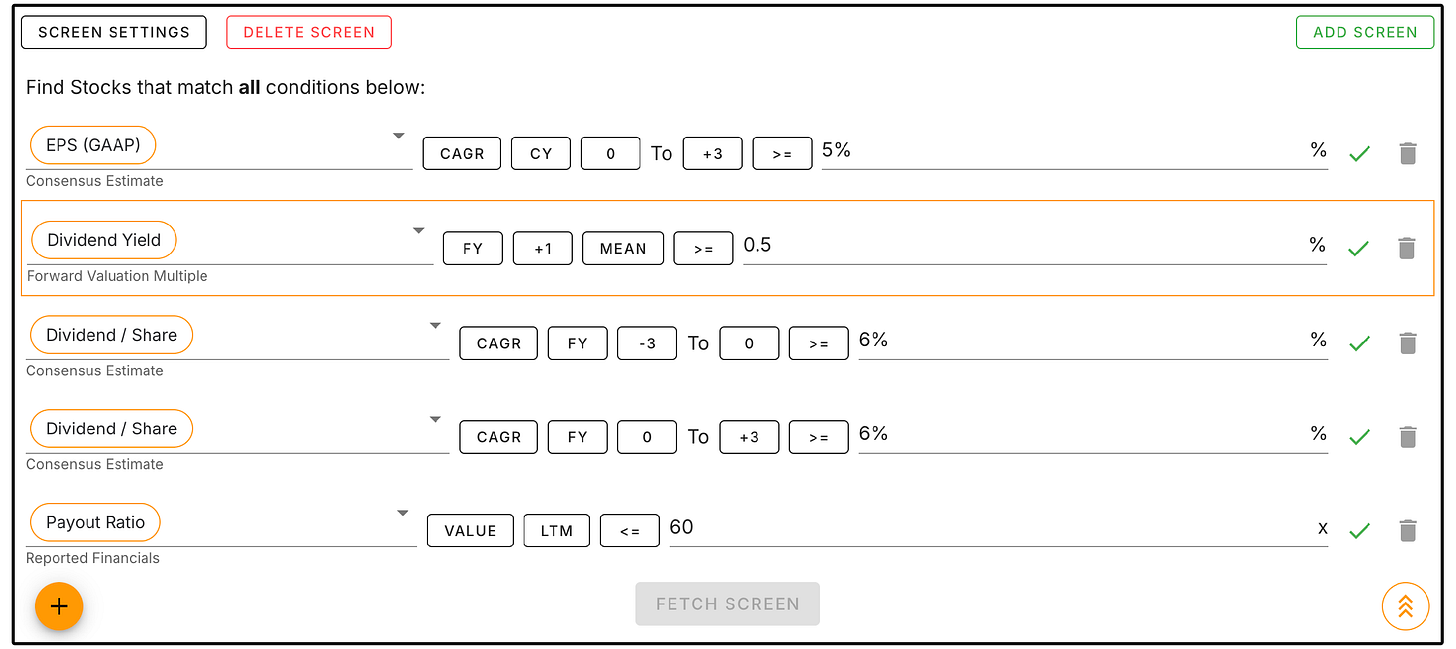

Now, we need to be assured the dividends being paid are sustainable and growing at a healthy rate.

We will filter for stocks that:

Yield at least 0.5%

Have historically grown dividends at a rate of at least 6%

Are projected to grow dividends at a rate of at least 6%

Have a payout ratio of less than or equal to 60%

After applying our screen, we have now narrowed down our investable universe to just 920 stocks!

We’ve filtered out around 99% of companies.

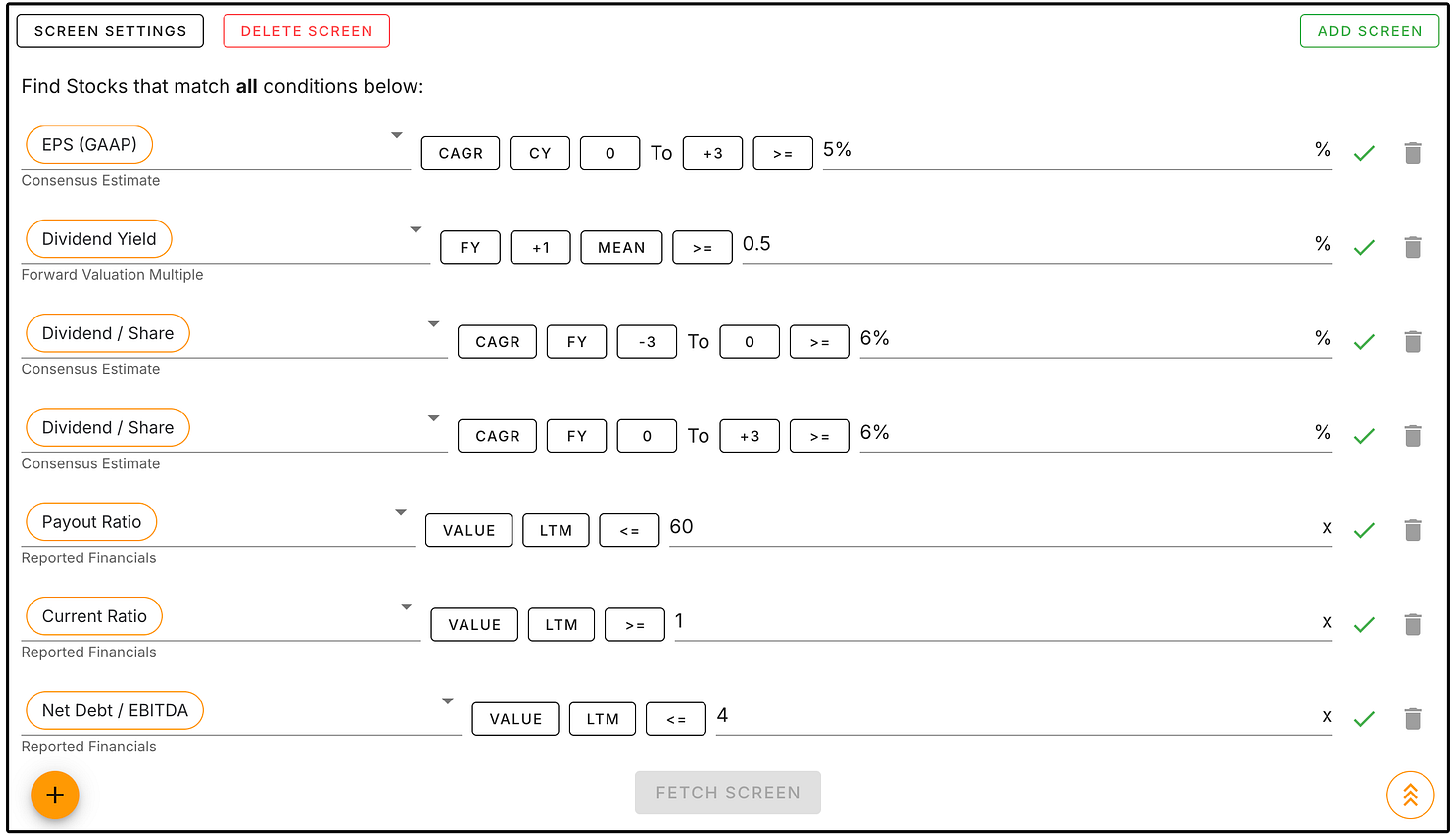

Now, let’s filter for debt obligations.

To do this, we will screen for stocks that:

Have a current ratio of at least 1

Have a Net Debt/EBITDA ratio of 4 or less

This will help ensure the company can meet short term debt obligations, as well as maintain a manageable long-term debt load without putting the balance sheet or dividend at risk.

This brings our investable universe all the way down to just 705.

We went from around 70,000, to 8,526, to 920, and now at 705.

We now have our list of higher quality dividend growth companies.

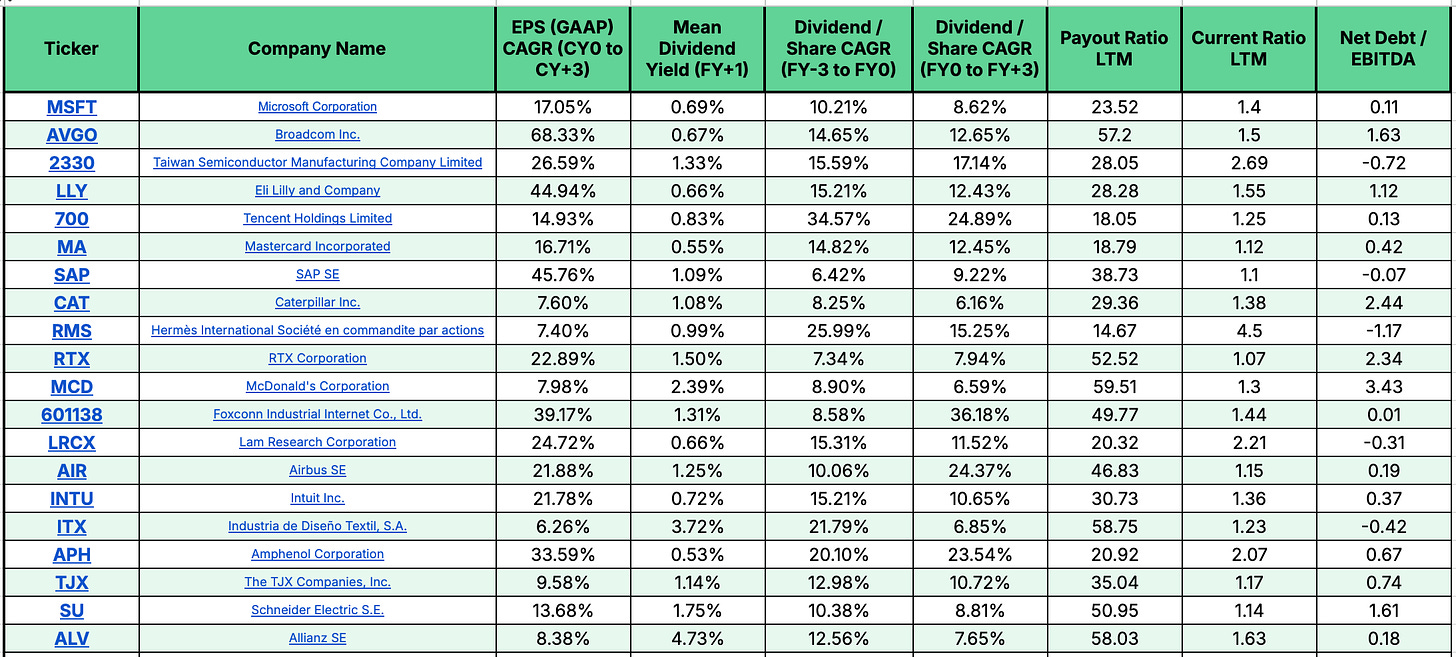

Here are the top 20 companies in our list by market cap:

You can download the entire list of 705 companies here:

The final thing we must account for?

Valuation.

Valuation is certainly more of an art than a science, but it can still narrow down our search further.

While you could certainly screen for stocks below a certain P/E multiple, or screen by free cash flow yield-

The reality is valuation multiples tell you nothing without accounting for the future earnings growth potential of the stock and the predictability of its earnings.

A stock with a 30 PE multiple can be cheaper than a stock with a 15 PE multiple.

This is why I am a big believer that we must look at investments through the lens of Sources of Returns.

🏛️ The Universe

It’s important to note that we can take ‘creating our universe’ far further if we intend to do so.

When it comes to things like dividend growth stocks, ideally I want to see things like:

Expanding profit margins

15%+ Return on Invested Capital

Healthy Interest Coverage Ratio

Shrinking Shares Outstanding

And when I’m analyzing high yield assets like REITs, BDCs, or even Covered Call ETFs, my criteria is far different, and far stricter.

Although it’s nearly impossible to analyze these assets through traditional software, that’s why I created the Dividendology Database.

This database is updated monthly, providing you all the necessary information to analyze these assets.

If you want to get access to it, as well as all the features mentioned below, you can do so here.

Here’s everything you’ll get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 ($30 off! + 7 day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

New video on zoetis after the recent dip? 🔍

Utilty stocks like Consolidated Edisn make it into most investable universes because they check all the boxes. Regulatd monopoly buisness model means predictable earnings growth and sustainable dividends with low balance sheet risk.