December Dividend Portfolio Update 2023 🔥 ✅

My Highest Month of Dividends Ever!!

2023 has finally come to a close, and my portfolio closed it quite nicely.

December was another groundbreaking month for my portfolio for a multitude of reasons.

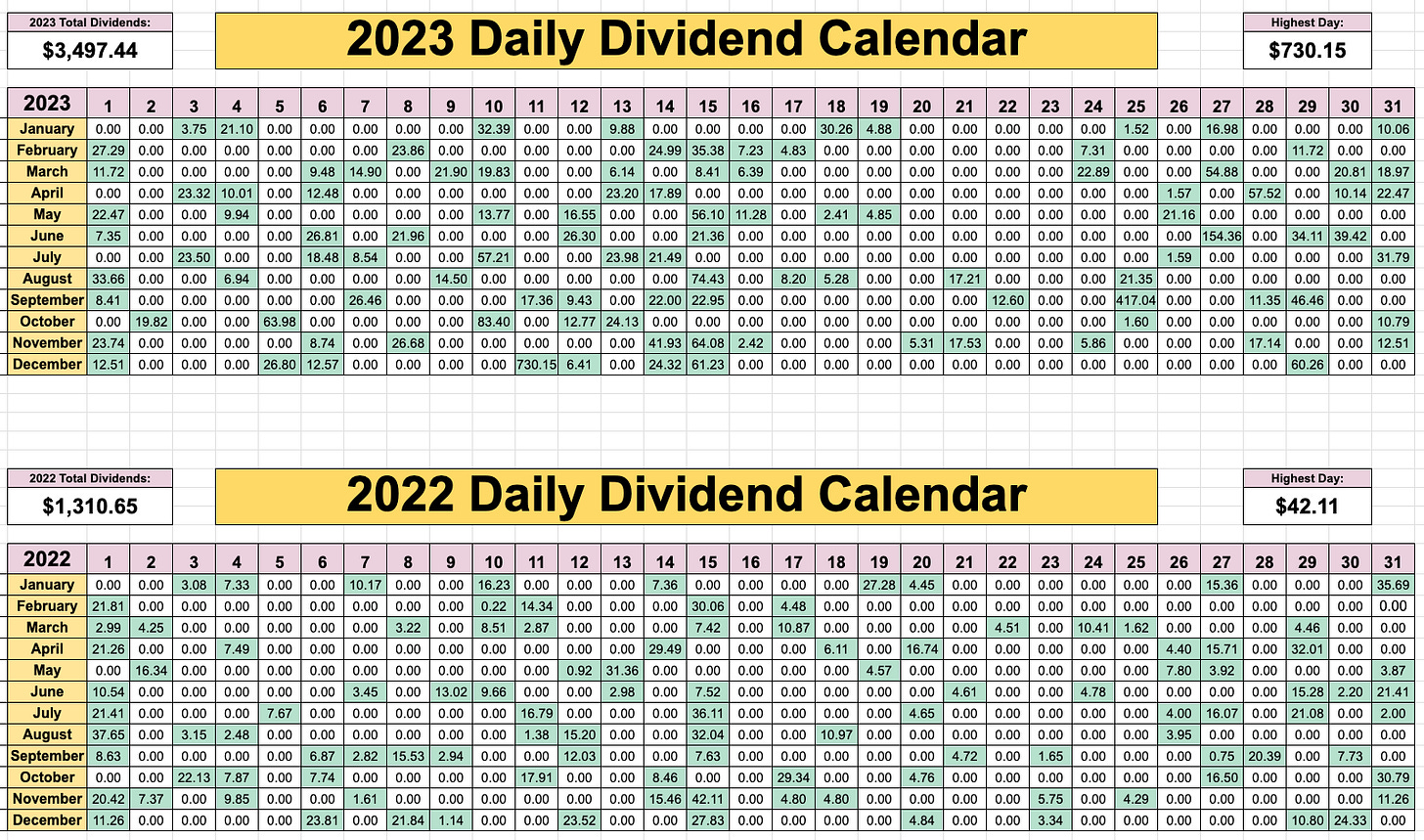

With the end of the year, we can also compare my dividend income year over year.

My total dividend payments in 2021?

$520.89

My total dividend payments in 2022?

$1,310.65

My total dividend payments in 2023?

$3,497.44

And my goal for 2024...

$6,000 🔥

That would be an average of $500 every single month.

The compounding effect is really starting to take place.

And with a quick glance from my daily dividend calendar, we can see a huge a quick visual of what that jumped looked like from 2022 to 2023.

You’ll also notice that my highest day of dividend income in 2022 was $42.11, but in 2023, it was $730.15.

What a jump.

This large dividend day was mainly due to receiving my largest payment ever from SCHD, at around $712.

The market rally also continued in December, pushing my portfolio value to another new all time high of around $153,000.

Keep in mind, I have contributed very little capital to my portfolio over the past 2 and a half months.

Earlier in October, I was sitting on a large cash position, and saw quite a few opportunities to put that capital to work.

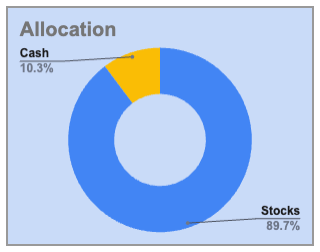

I was able to add capital to positions I felt were trading at a good value, but this pushed my cash position to around 3%, which is the lowest it had been in years.

After making minimal buys in my portfolio the past couple of months, I’ve been able to build my cash position back up to 10.3%.

This will give me the capital needed to take advantage of future opportunities.

There’s no doubt valuations are considerably higher than they were in just October, and definitely much higher than they were at the start of 2023.

As far as buy’s this month, I simply added a few shares of SCHD while increasing my cash position.

While I’ll continue to search for opportunities, it’s times with high valuations that I believe dollar cost averaging into SCHD could be a good option for dividend growth investors like myself.

As for my dividend metrics, it’s pretty clear to see that my monthly dividend income is starting to take off.

And with my annual dividend income now sitting at $5,118.76, my average monthly dividends is now sitting at $426.56.

That’s $426.56 that’s being reinvested right back into my portfolio, regardless of how much I contribute to my portfolio.

That’s how you build a perpetually growing, perpetually cash flowing passive income machine.

And that machine will one day allow me to live off my dividend payments forever.

And that day is coming sooner than many realize.

I’m currently around 15 years away according to my model, but since I use conservative projections, I’m hoping it could be even sooner. 🔥

Real Quick:

Seeking Alpha is still running their New Year’s Sale for a few more days! Get a huge discount here.

Download my spreadsheets here.

Some personal news… 🔥

Starting at the end of this month, paid newsletter subscribers will be getting access to a spreadsheet every month with a list of dividend stocks that I believe to be undervalued.

This will be the result of extensive research done by myself each month.

As a result, I’ll be bumping up the price of becoming a paid newsletter subscriber in 26 days.

This means this month will be the lowest price you will ever get to become a paid subscriber.

You’ll also get access to other resources (such as spreadsheets) and insights that I only make available to paid subscribers.

With a yearly subscription, you can currently get access to all of this for only 13 cents a day.

Whenever you’re ready, join to lock in the lowest price possible.

Tweet of the Week:

P.S.-

I typically send out my Newsletter on Friday's, but earlier this week I wanted to give a gift to my newsletter subscribers earlier this week to celebrate the new year.

I sent out a FREE spreadsheet with details on the most bought dividend stocks by super investors over the past few months.

To receive the spreadsheet, all you guys had to do was reply to the email sent on Monday.

Let me say, I underestimated you guys.

I manually replied to probably 1,000 replies in a 24 hour period just to send you guys the spreadsheet.

Pretty amazing what you guys are capable of!

That’s all for now.

Happy new year and happy investing!

Dividendology

Ohh okay

How do we go about getting Stock Valuation Spreadsheet? Do you only offer it on Patreon?