Dividend Portfolio Update - May 2023

The markets falling and I'm buying

The S&P 500 is up a little over 3% over the past month. But if you’re a dividend investor, your portfolio probably dropped over the past month.

Why is this?

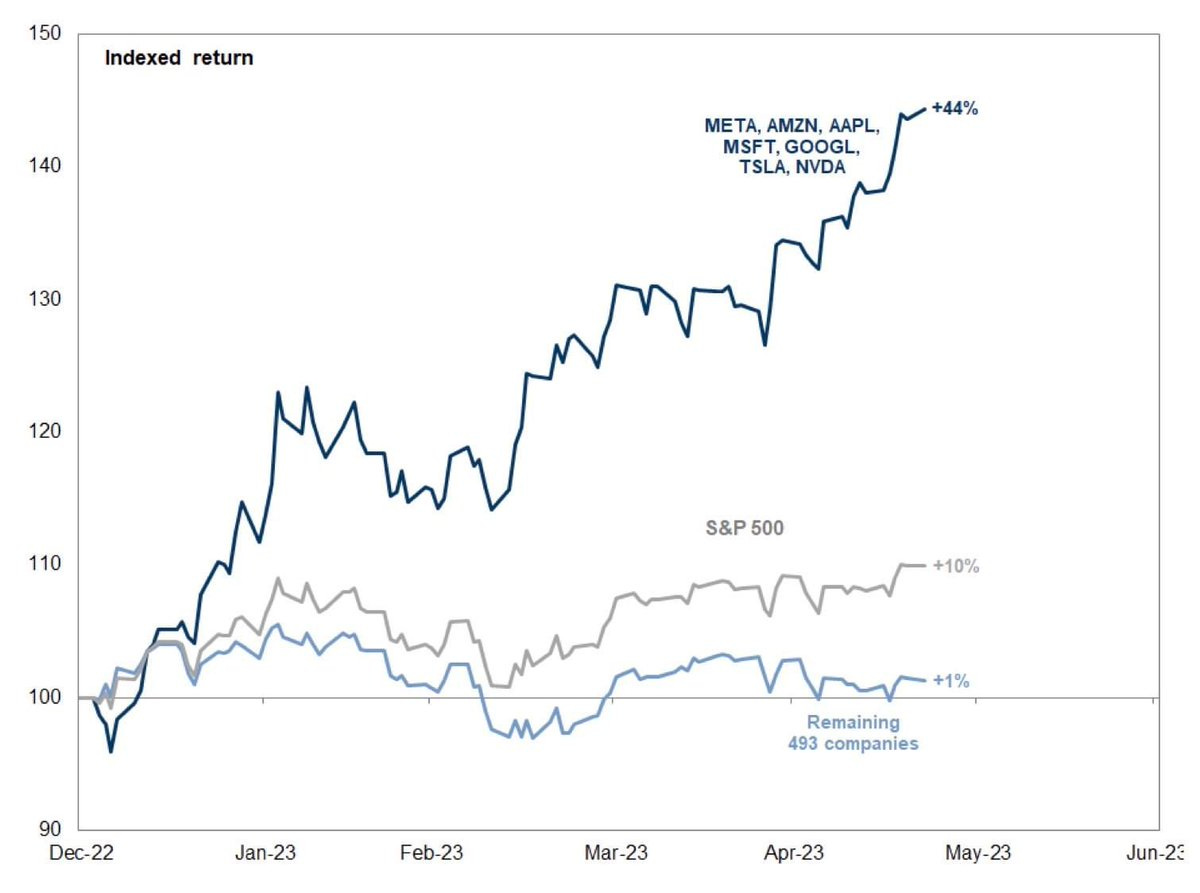

Because META, AMZN, AAPL, MSFT, GOOGL, TSLA, and NVDA have contributed almost all of the returns to the S&P 500 year to date.

Don’t believe me?

Check out this chart below.

Those 7 companies are up +44% year to date.

The S&P 500 is up 10% year to date.

But how has the S&P 500 performed without those 7 companies? Year to date, the remaining 493 companies are only up 1%.

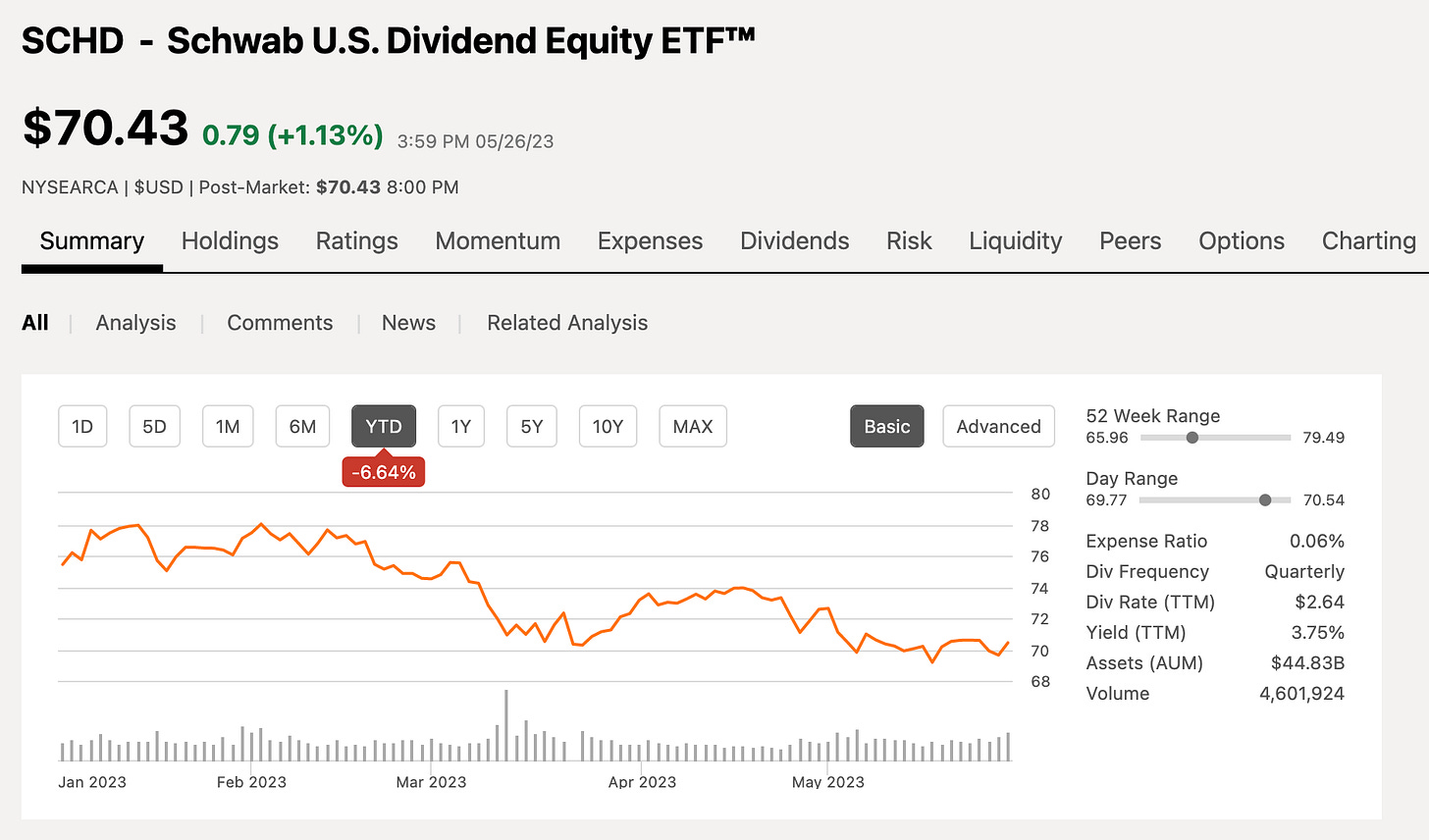

The dividend ETF SCHD’s performance year to date has made it pretty clear that tech companies are the only thing moving the S&P 500 upward. SCHD is down 6.64% in 2023.

The good news about dividend stocks falling?

You guessed it.

Opportunity.

(You can download my spreadsheets here)

And while I didn’t add any new positions to my portfolio this month, I did add quite a bit of capital to existing positions.

Those positions were:

SCHD

TXN

O

MO

JNJ

JEF

It’s not often that I add capital to that many positions in a single month, but I did feel that at some point throughout the month these companies were trading at a good value, and aligned with my long term goal of one day being able to live off dividend income.

With the addition of these positions, my yearly dividend income is now sitting at $2,736, and my average monthly dividend income is at $228.

I’m quickly approaching the impressive milestone of $250 a month in dividend income. This is typically the area where the dividend snowball really starts to take off.

That would be around $3,000 a year that gets (re)invested into your portfolio, regardless of how much you contribute.

This is how wealth is built through dividend investing.

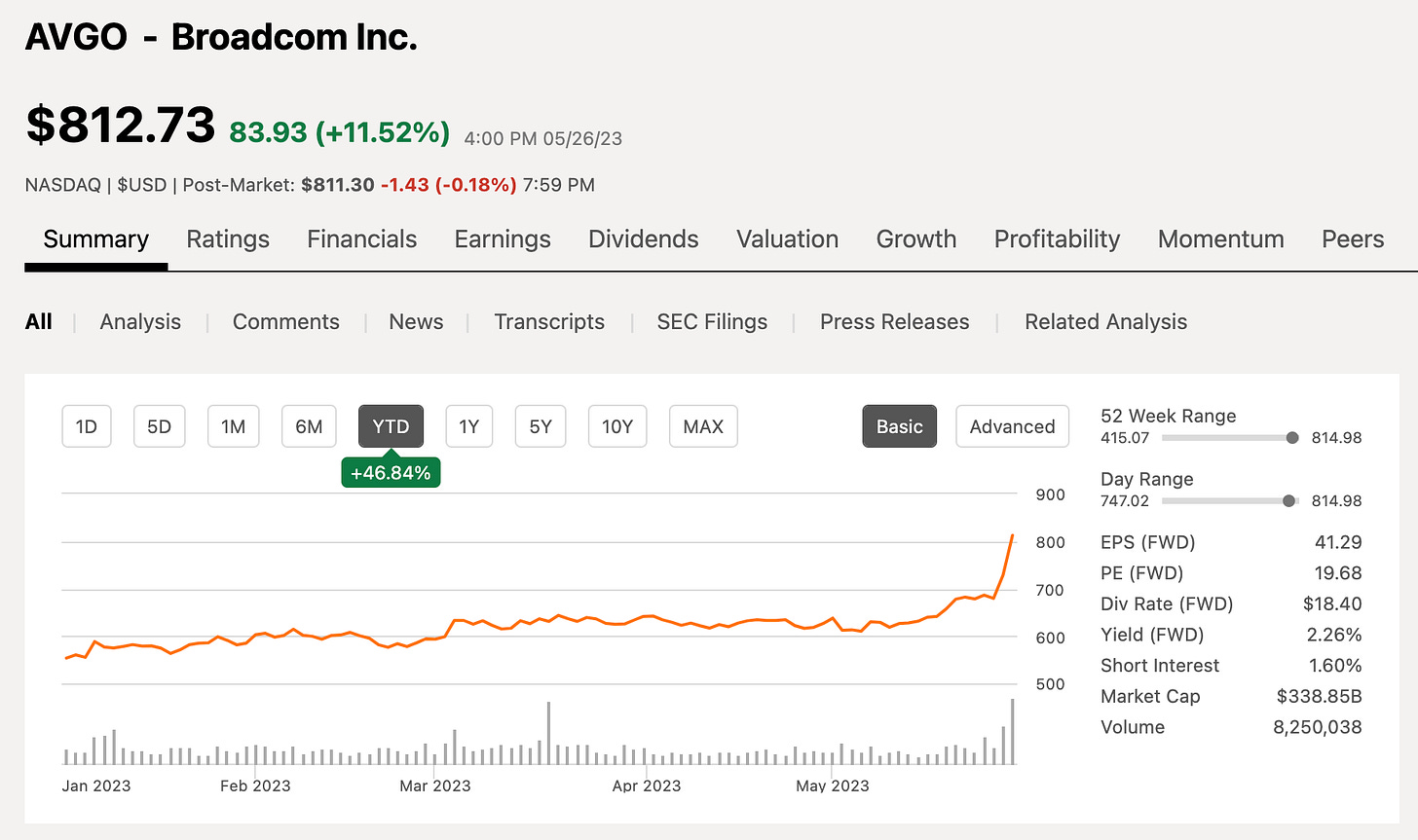

In other news, one of my favorite dividend stocks has been on an absolute tear lately. The company is up about 47% year to date, and I’m personally up around 56% on this position.

The dividend growth this company has seen over the past decade has been simply astounding.

The 10 year dividend CAGR is sitting at 38.50%. (Wow!)

While I’m happy to own this position, I keep finding myself wishing I bought more.

For my overall portfolio, I’m still looking to trim my positions to around 30 for the time being.

It’ll be a process to get to that point, but I believe it will be a wise move long term.

That’s a wrap on this months update! Let me know if you have any thoughts!

Link to download my spreadsheets:

https://www.patreon.com/dividendology

Get a 14 day free trial for Seeking Alpha Premium!

https://www.sahg6dtr.com/9D5QH2/R74QP/

Social Media (and other fun stuff):