February Dividend Portfolio Update 2024 🔥 ✅ (Free Spreadsheet)

All Time Highs + Free Spreadsheet!

Before we get started-

Like promised, I’m sharing a FREE spreadsheet with the 20 most frequently bought dividend stocks by super investors in Q4 of 2023.

You can access it here! Enjoy!

Portfolio Update 📈

The bull market of 2023 has continued into 2024, and did not slow down one bit in February. The market is up 7.25% year to date and has already hit multiple all time high this year.

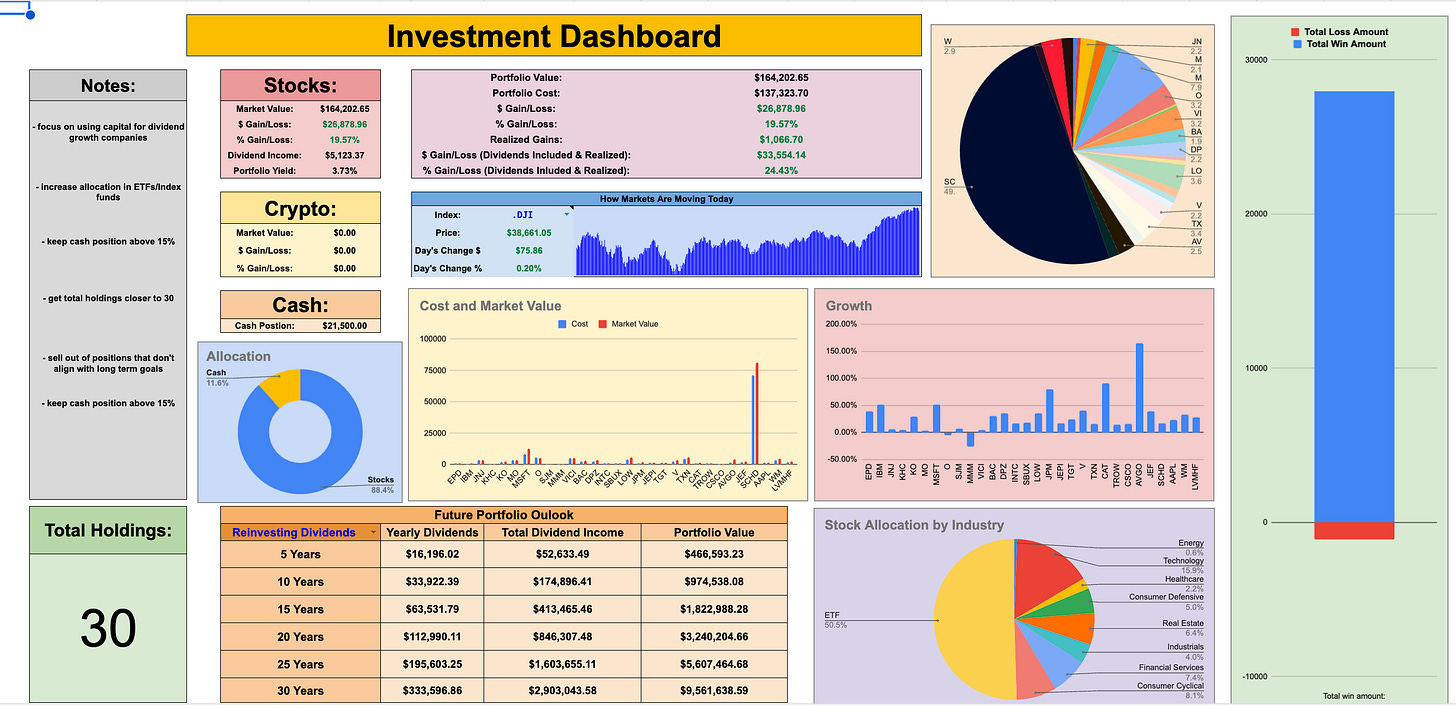

With the addition of some new capital along with this market run up, my portfolio is now sitting at slightly above $164,000, which is a new all time high for me.

Part of the exciting part is that nearly 25% of my portfolio value has come from the gains that I’ve seen from my holdings!

And while capital appreciation is no doubt a major part of my dividend growth investing journey, we have to keep in mind the end goal:

Living off dividends.

And like always, my dividend income grew in 3 different ways this month:

Contributing new capital

Reinvesting dividends

My holdings increasing dividend payouts

And while all these factors play a major role in causing the compounding effect to take place, I saw some especially nice dividend hikes in my portfolio this past month.

For example, Dominos Pizza is a stock I’ve held for awhile now, and I’m up over 35% on this position.

This company isn’t an exciting one or a stock that is in the news often, but they are phenomenal at something I love:

Growing their dividend payments over time.

In late February, Dominos announced a 24.8% increase to their dividend payouts. That is an absolutely insane dividend hike!

But here’s the best part about it-

Their dividend growth is completely backed by their free cash flow growth.

Dividends are paid out of free cash flow, so in order for a company to pay out growing dividends long term, it is imperative that they are able to grow their free cash flow over time as well.

Just look at Dominos dividend metrics. (Spreadsheet powered by Tickerdata)

Massive free cash flow growth. Low payout ratios. Phenomenal dividend growth.

Despite it’s low yield, this company undoubtedly qualifies as a company that I believe will help me achieve my long term goal of living off dividend income.

Speaking of dividend income, in February of 2023, I made $151.91 in dividend income.

This was the lowest amount I had made in quite some time, but that’s due to selling out of some higher yielding stocks that I don’t believe align with my long term goals. Plus, I’m expecting next month to be my highest amount of dividend income ever at over $1,000!

My expected yearly dividend income is now sitting at $5,123.37, which puts my average monthly dividends at $426.95.

That’s $426.95 on average being reinvested right back into my portfolio every month, regardless of how the market does or if I contribute capital. This is how the snowball effect takes place!

Overall, I’m very happy with where my portfolio is sitting at as of right now.

This past month, I added capital to 4 positions:

SCHD

VICI

O

SBUX

None of these were large purchases, but I did feel SBUX, O, and VICI were trading at a good value.

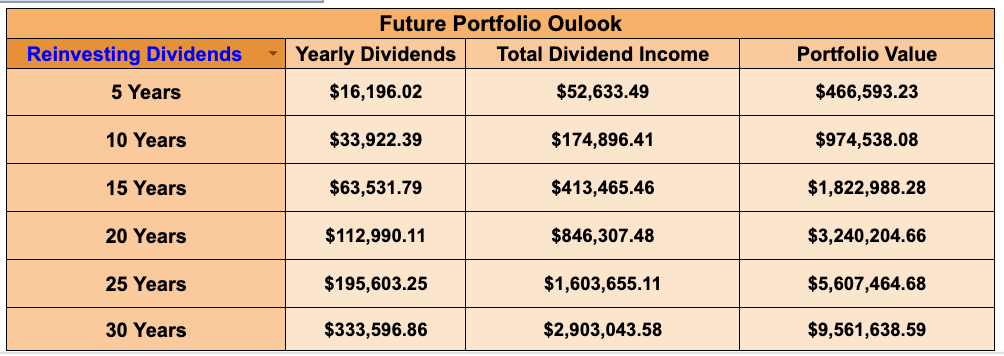

And now my future portfolio outlook looks as promising and motivating as ever.

I find tracking my portfolio and projecting what it will look like in the future extremely motivating. I believe it is something all serious dividend investors should be doing.

Like always, if you’d like to gain access to any of my spreadsheets to be able to do this, you can do so here.

Tweet of the Week:

If you missed it..

I recently launched Tickerdata!

Tickerdata is a spreadsheet integration tool that gives you the ability to automatically pull in live stock data for over 70,000 different stocks, 30+ years of historical financial statement data, other key financial metrics, and it can pull in data from over 70+ stock exchanges all across the world, straight into your spreadsheet.

You can access Tickerdata and download my spreadsheets here.

You can also subscribe to the Tickerdata YouTube here, where I'll post tutorials and even more stock analysis!

Lastly…

Earlier this week, I sent out a Newsletter to my paid newsletter subscribers that lists out the dividend stocks I believe to currently be undervalued.

I send out this Newsletter at the end of every month, so if you’d like to receive next months edition or even gain access to last months, the you can become a paid member below. 👇

That’s all for now! Feel free to respond to this email and let me know of any thoughts you have!

See you next week!

Dividendology