Free Spreadsheet + June Dividend Portfolio Update 2023 ✅

Free Monthly Dividend Stock Spreadsheet & Portfolio All Time High!

Free Spreadsheet of Monthly Dividend Stocks 📈

My dividend portfolio AGAIN hit new all time highs this month.

But before we get to business…

Just like I promised, I’m sharing with you a FREE spreadsheet that details all 57 monthly dividend paying stocks.

This spreadsheet doesn’t include ETFs, only businesses.

In order to use this spreadsheet, open the sheet, click ‘file’, then click ‘make a copy’. Enjoy!!

Click Here for the Monthly Dividend Stock Sheet

Portfolio Updates- July 2023

In the month of July, I made $186.58 in dividend income.

While it wasn’t as high as last months $329.33, it’s pretty clear my dividend income is on a rapid upward trajectory.

My expected yearly dividend income is now sitting at $2,917.77. I’m getting very close to the $3,000 a year mark and the $250 a month mark. Both are nice milestones in my opinion.

This jump up in expected yearly dividend income is purely from reinvesting dividends, as well as adding to my SCHD position the past month.

The S&P 500 being up 19.98% year to date is great and has helped my portfolio hit new all time highs at nearly $93,000. (You can download my spreadsheets here)

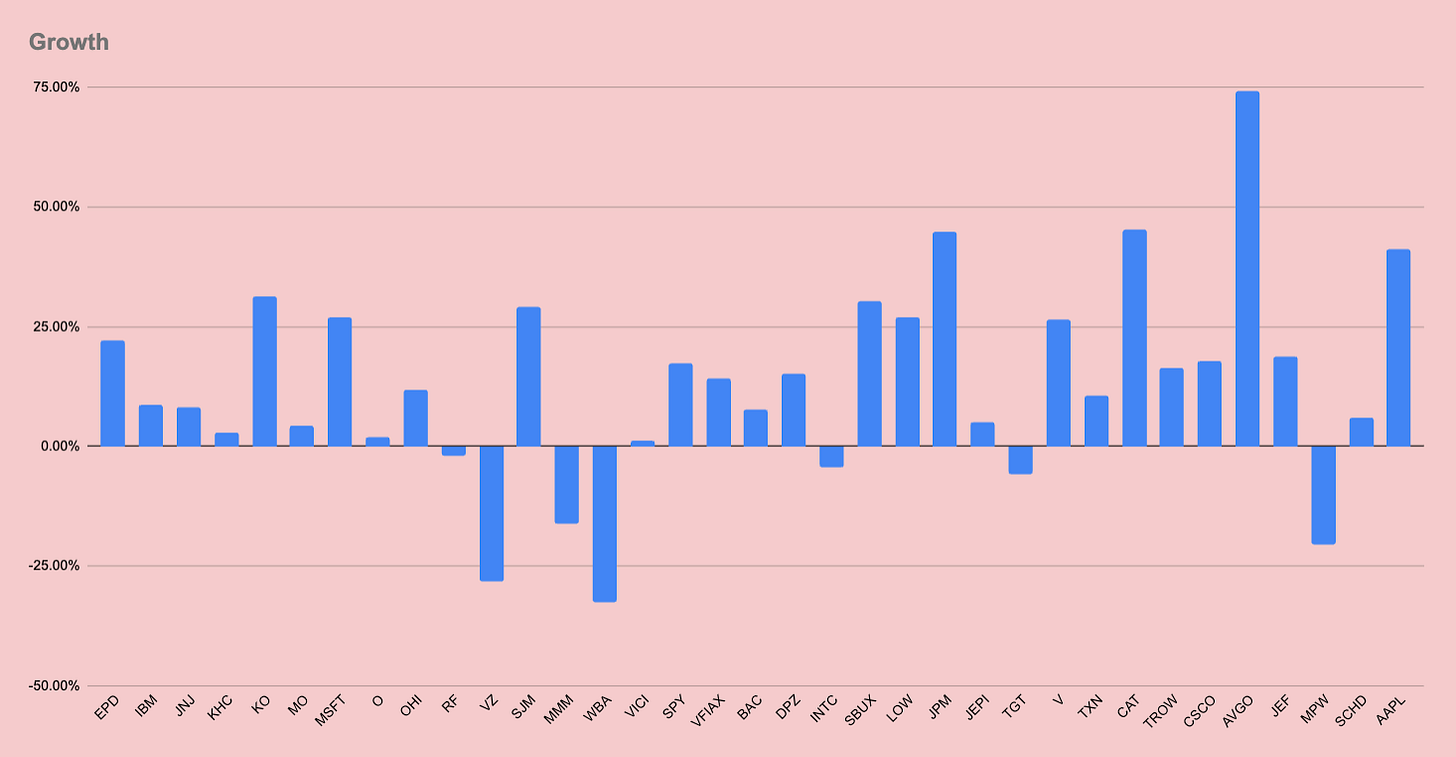

If we take a closer look at the positions in my portfolio, the vast majority of them are up quite a bit.

While it’s great to see this right now, it’s pretty clear it is much harder to find great companies trading at good values in the current market.

I’d love to continue adding shares of some of the quality companies currently in my portfolio, but it has become much harder to justify at the markets current prices.

Due to this, I simply decided to dollar cost average into my favorite dividend ETF this month, SCHD.

Short term, I don’t know what the share price of SCHD will do.

BUT-

Long term, I can feel confident that the businesses being held by SCHD will be able to increase free cash flow year after year, in turn providing returns to their shareholders in the form of dividend increases, share buybacks, or even organic growth which will lead to share price appreciation.

While the market is high, this is probably a good time to reduce my holdings to closer to 30. Long term, I would still like to get my total holdings closer to 25.

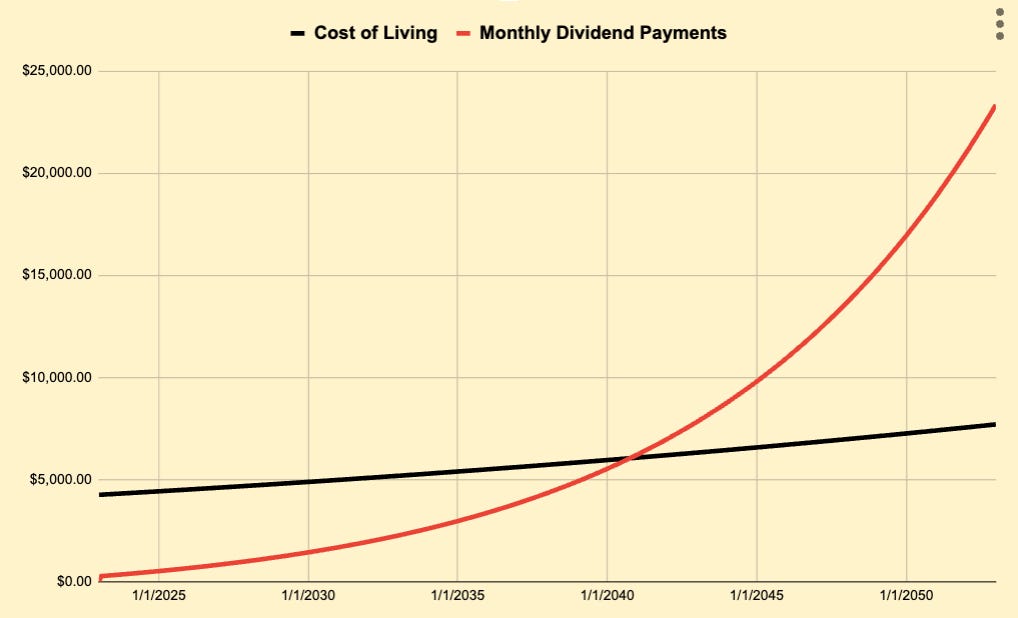

The end goal of my dividend portfolio has always been to be able to live off the dividend payments I receive, and after this month, I am now projecting that I am 17 years and 10 months away from being able to live off dividend income.

This is assuming conservative projections, so in reality, I could potentially make it happen much faster than that, which is very exciting.

For now, the focus remains on getting the dividend snowball rolling, so that compound interest can do its thing.

Tweet of the Week:

That’s a wrap on this months update! Let me know if you have any thoughts!

Link to download my spreadsheets:

https://www.patreon.com/dividendology

Get a 14 day free trial for Seeking Alpha Premium!

https://seekingalpha.me/Dividendology

Social Media (and other fun stuff):