I’ve been building out one of the largest databases on Covered Call ETFs for the last 6 months-

And running one of the most comprehensive research studies on them ever.

The results have been shocking.

There’s one question I’ve been obsessed with answering while building this database:

Which covered call ETF delivered the highest yield — without destroying its net asset value?

It sounds simple, but the answer is quite surprising.

Don’t Ignore Net Asset Value! ❌

Investors love to talk about the yield of covered call ETFs.

But no one seems to want to talk about Net Asset Value.

Considering the fact that NAV tells us whether or not those dividends are actually sustainable, ignoring it is a major red flag.

NAV is the value of all the fund’s assets minus its liabilities, divided by the number of shares.

It’s the true value of the fund on a per-share basis.

If NAV is rising, the fund is growing in value. If it’s falling, value is being lost.

But I Just Want Dividends… 💰

Covered call ETFs generate income by selling call options on the assets they hold.

If the NAV shrinks over time, the ETF has fewer assets to write calls on.

Fewer assets = lower premiums = smaller dividend payments.

Here’s why NAV growth is so important:

More income potential: A rising NAV gives the fund more assets to write calls against, which increases the size of option premiums and future dividends.

More upside potential: While covered call ETFs by nature do cap your upside, growing NAV means you’ll take part in some of the upside

Protection against erosion: If NAV falls too far, the ETF can’t recover during market rallies, because the calls it writes cap the upside. This is a big one, and it creates what I call “NAV bleed.”

The Big Winner 🥇

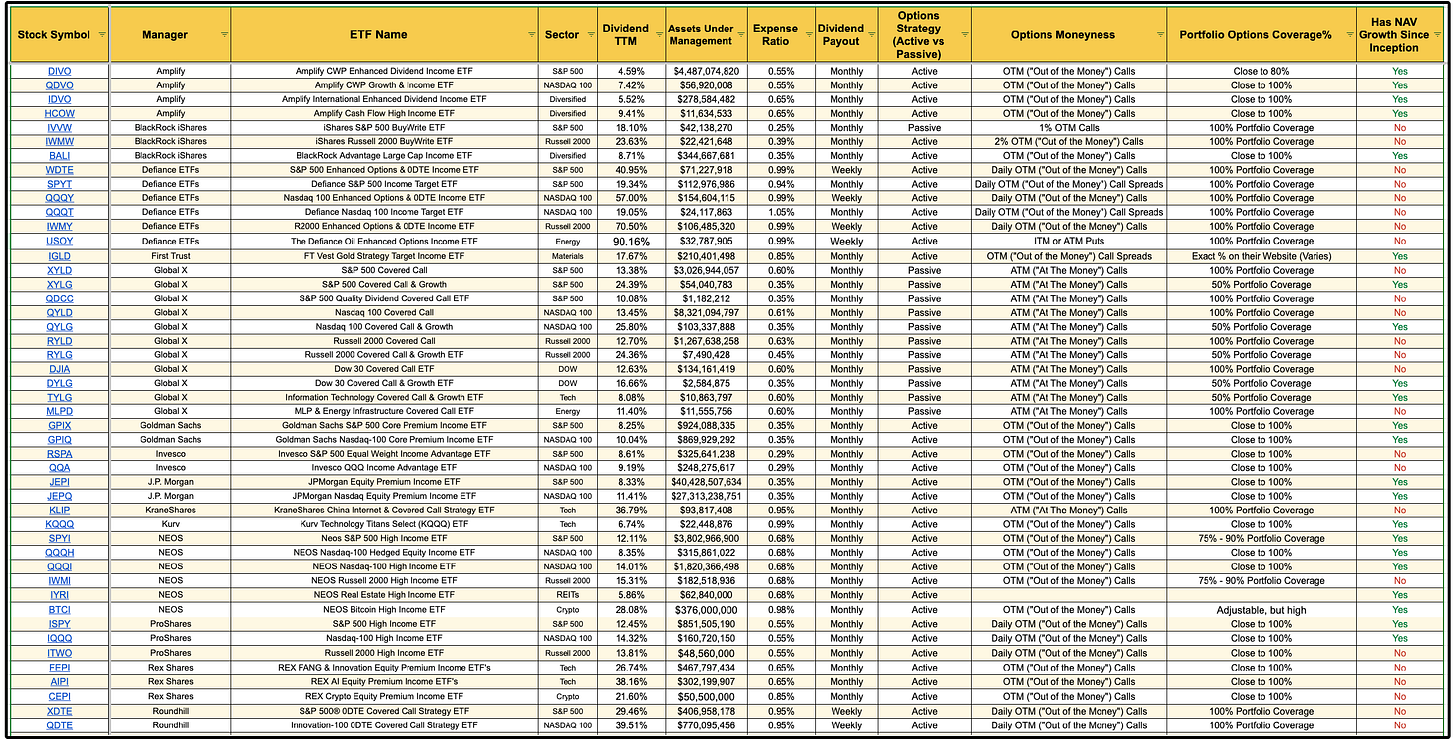

I’ve already added and analyzed 65 different covered call ETFs in the Dividendology Database.

While there are many key metrics I’ve added to the database, the most recent addition was a column indicating whether or not the fund has grown NAV since inception.

The results were shocking.

Of the 65 covered call ETFs in the Dividendology Database, only 26 have grown NAV since inception.

That’s only 40%.

Many of the highest yielding funds are simply not paying sustainable dividends.

So back to my original question-

Which covered call ETF delivered the highest yield — without destroying its net asset value?

The winner was…

BTCI - NEOS Bitcoin High Income ETF 👑

BTCI is a covered call ETF with an astounding 28.08% distribution rate and has still managed to grow NAV since inception.

Here’s how it works:

• Synthetic Bitcoin Exposure – BTCI uses the VanEck Bitcoin ETF (HODL) and options to mirror BTC performance.

• Income Generation - By selling layered call options on the CBOE Bitcoin ETF Index, BTCI is able to take advantage of Bitcoin’s high volatility.

• Tax Efficiency – Nearly all distributions are classified as return of capital, deferring taxes and making income smoother for investors.

But here’s why BTCI is really able to generate such large payouts without NAV decline:

Volatility.

When it comes to covered call ETFS-

Higher Volatility = Higher Premiums = Higher Dividend Payouts

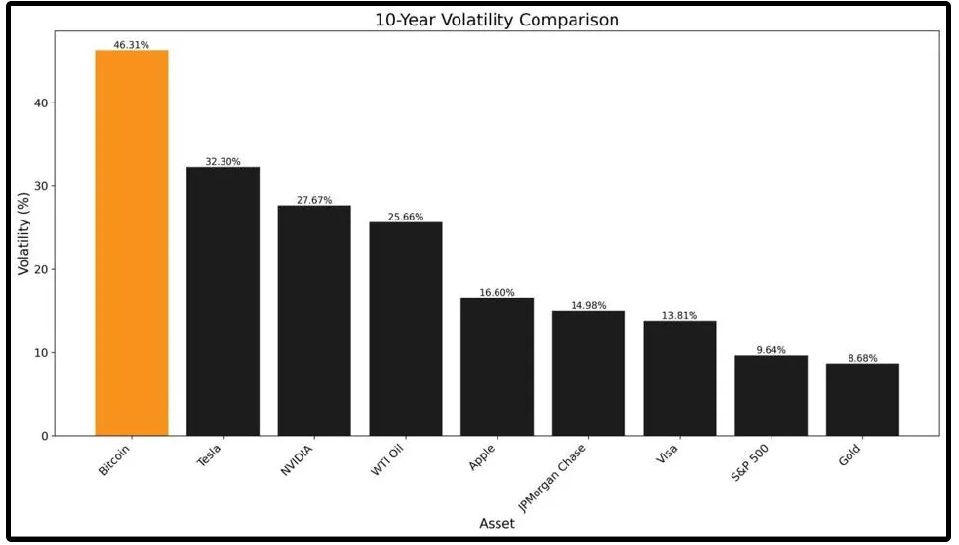

Bitcoin’s volatility (46.3%+) is nearly 5x higher than the S&P 500, and more volatile than every major asset.

That makes the premiums the fund generates significantly higher.

BTCI has been on an incredible run and continues to churn out massive payments-

But you need to be aware of the risks as well:

NAV is Tied to a Single Asset

BTCI’s NAV is almost entirely dependent on one highly volatile asset: Bitcoin.

Extreme Bitcoin Volatility

What happens to be a strength for BTCI, one could argue is also a weakness. Massive fluctuations in share price will be the norm.Lack of Data

BTCI launched in October 2024 and has only operated during a bullish Bitcoin environment. Its performance and distribution sustainability in a bear market have not been put to the test… But it will at some point.

While BTCI has been the clear winner of covered call ETFs since its inception, I personally still tend to favor SPYI and QQQI, as they have broader diversification, deeper track records, and more predictable NAV behavior.

The Dividendology Database

I’ve been quietly building something behind the scenes for months now — and it’s nearly ready.

It’s called the Dividendology Database, and it’s designed to become the most powerful research platform for dividend investors anywhere on the internet.

Most platforms stop at surface-level data.

Dividendology goes deeper.

You’ve already seen a snippet of the Covered Call ETF Database, where I track yield, distribution history, option moneyness, portfolio options coverage, and NAV growth metrics that you won’t find on Yahoo Finance or Seeking Alpha.

(In fact, the only reliable place I could find NAV data was a $3,000 subscription to YCharts. You’re welcome)

That’s the type of value I’m going to deliver.

But that’s just the beginning.

The full Dividendology Database will include in-depth research and real-time data on:

🧠 Dividend Growth Stocks

🥇 Super Investor Buying Activity

💼 BDCs

🏢 REITs

💸 Covered Call ETFs

💰 Preferred Shares

📊 High-Yield Opportunities

… and much more.

It’s the exact research platform I’ve always wanted — and now I’m building it for the entire Dividendology community.

And to go one step further...

Over the years, two questions have come up more than almost any others:

“How would you invest right now if you were starting from scratch?”

“What would you buy if you were building a high-yield portfolio today?”

I’ll be launching two real-money model portfolios that show you exactly how I’d invest in today’s market:

💰 The Dividend Growth Portfolio – Starting from $0, built for long-term wealth and compounding

🧾 The High-Yield Portfolio – Focused on 8%+ yields and maximizing income without sacrificing capital

These aren’t paper portfolios. I’ll be investing real dollars, tracking every dividend, every trade, and every update — with full transparency.

Most investors have no idea just how many quality dividend opportunities are out there, or how to properly evaluate them.

This platform is being built to change that.

Stay tuned!

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($30 off! + 7day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Dude, this is amazing! Your posts are absolutely brilliant.

Thanks so much for sharing - can't wait to see what you post next!

Eli....

You are right .. most investors somehow think that all the covered calls are a free lunch.. Until it dawns on them that their NAV is degrading..Thanks for the info. Nice Job!

Paddy P