How to Invest at All Time Highs 🚀

The 2024 Bull Market Continues 🐂

The 2024 stock market has been on fire, with the S&P 500 up 26.44% over the past year and 14.77% year to date.

And I for one have definitely been reaping the benefits in my portfolio from this bull run.

In fact, I’ve already seen over $37,000 in gains!

While I’ve been enjoying the market run up, many fear this means it is a bad time to buy stocks.

And to be fair, I do believe many stocks are currently trading at the higher end of their valuation.

So this begs the questions-

How do we invest when markets are at all time highs?

Markets being at all time highs scare many investors, and even causes some to sell.

But it shouldn’t.

First off, we need to understand the simple truth that the market is often reaching all time highs.

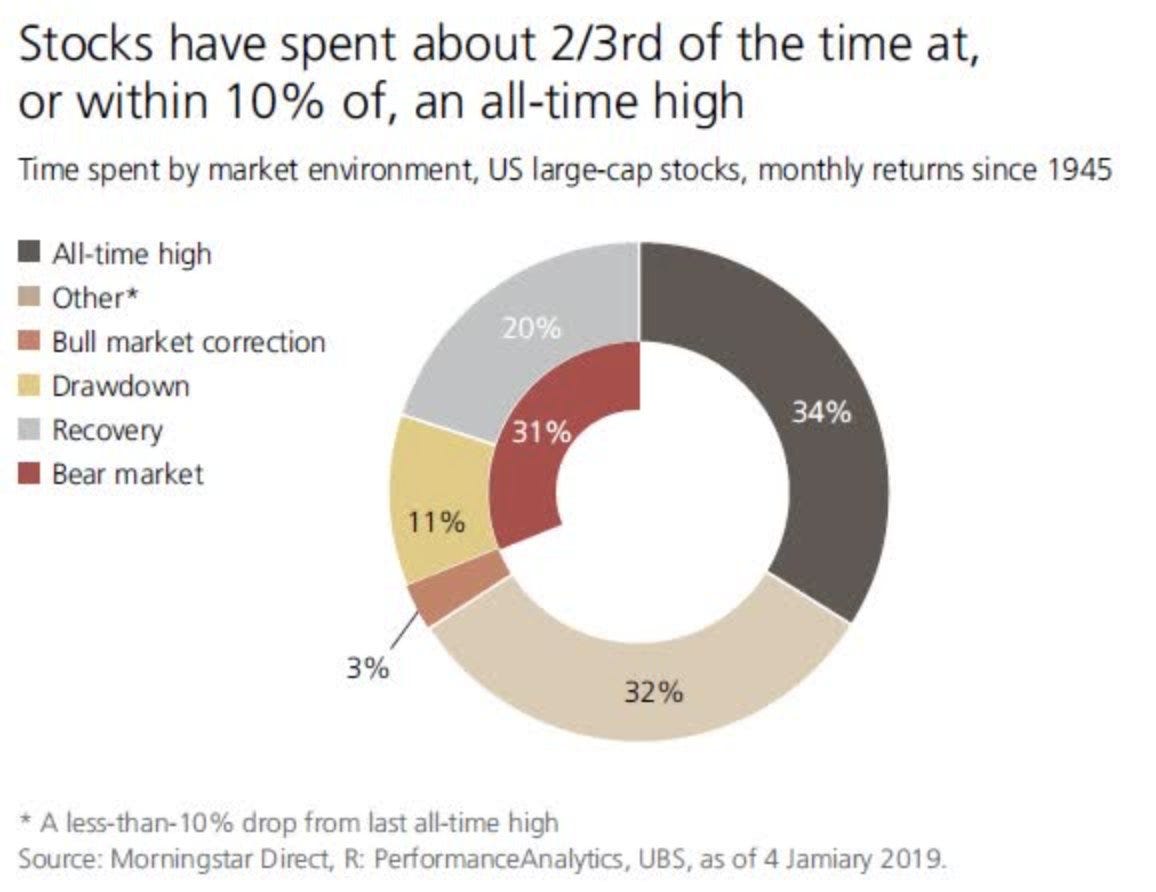

In fact, as we can see below, large cap stocks typically spend around 2/3rd of the time within 10% of all time highs. So being at all time highs is not a rare occurrence.

And this doesn’t just mean the market hits its high, drops, then goes back to the same high.

The highs are getting higher and higher.

The above reaffirms that we are constantly hitting new all time highs.

But let’s put this into even more perspective:

From 2010 to 2020, the market hit 242 new all time highs.

Keep in mind, this was during a time when the media was constantly telling us we were due for a massive market pullback.

Think of all the uncertainty of the world during that decade:

Inflation

Wars

Elections

None of these stopped the market from hitting new all time highs.

And the same was true in decades prior to the 2010s as well.

And as of January 30th of 2024, the market had already hit 110 new all time highs in the 2020s.

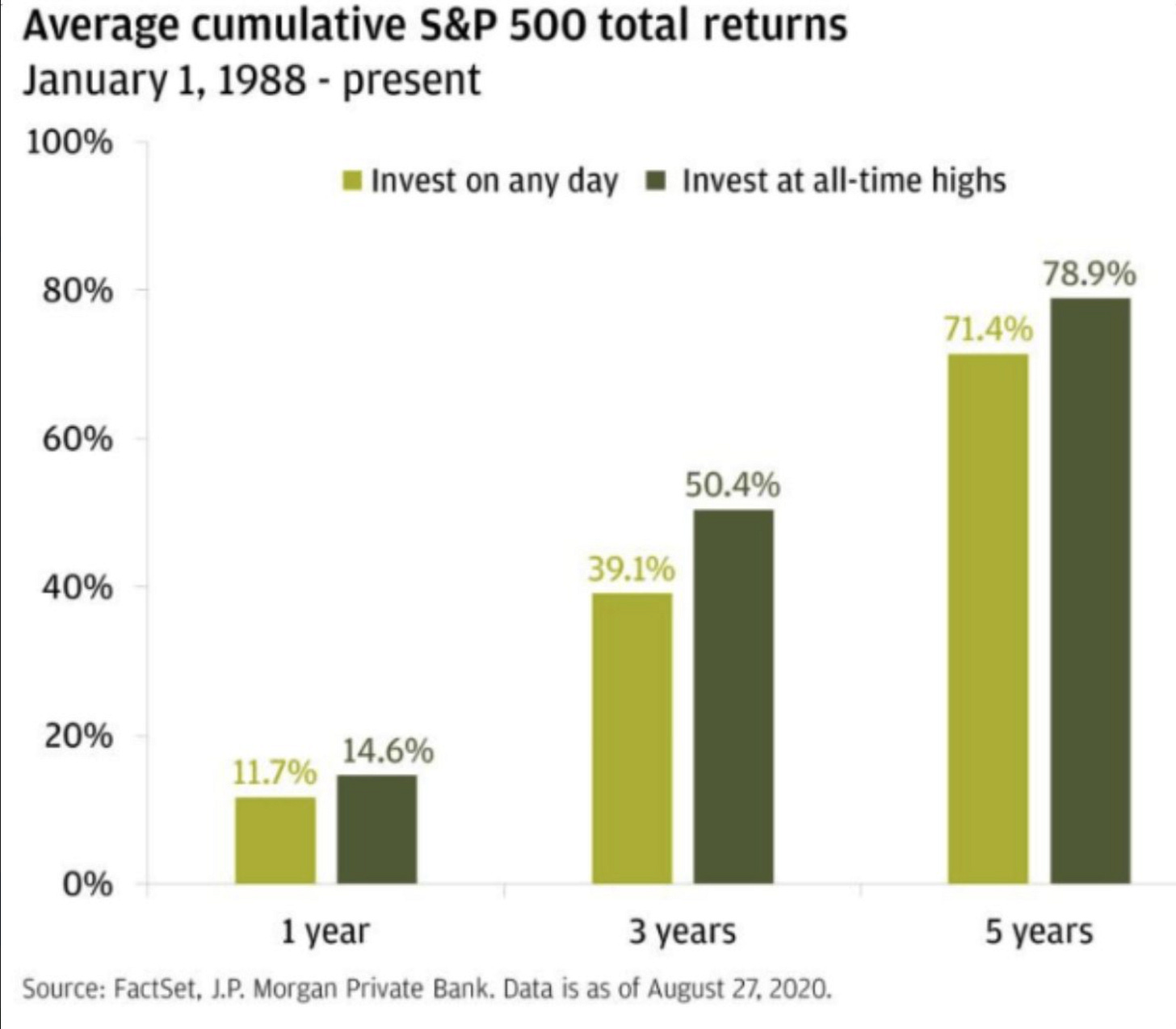

And to really nail the hammer home, look at this study that was released by JP Morgan in August of 2020-

This basically tells us that even if we only invested on days when the market was at all time highs, we would still be seeing phenomenal returns from our portfolio.

This isn’t something the media would have you to believe.

The investing world gives off the impression that you can only see great results if you invest at the perfect time, but this just simply isn’t true.

Sometimes we make investing too complicated.

Sometimes we just need to keep investing, and shut up and wait.

So the reality is that if you’re investing for the long term, all time highs shouldn’t scare you away from investing.

If you still want to reduce your risk over the short term, you can utilize a dollar cost averaging approach, where you consistently invest smaller sums of money over time, rather than a one time lump sum investment.

All time highs can be scary.

But they shouldn’t be.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

Other News…

At the end of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

This sheet was received by nearly 200 dividend investors last month. (Wow!)

If you’d like to receive this sheet at the end of this month, you can sign up here:

That’s all for now!

See you next week!

Dividendology