How to make $500 a Month in Dividends from $10,000 💵

The Power of Compounding 🔥

You’re likely familiar with the concept of compound interest.

It’s the idea that your money can make money, and then that money can make even more money.

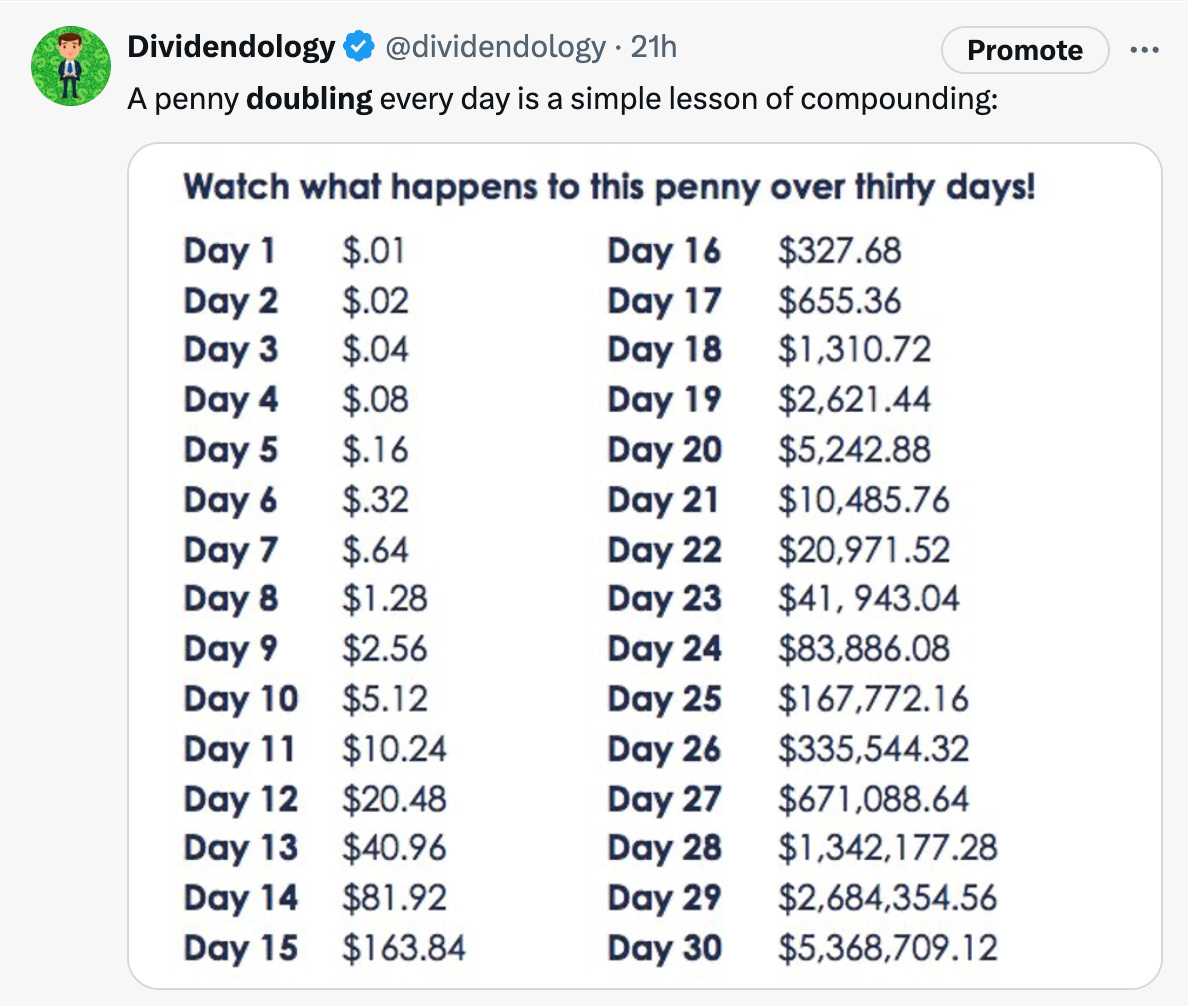

A simple way to understand compounding is the example of a penny doubling every day.

Starting out, the penny only goes from 1 cent to 2 cents.

By the end of the thirty days, it grows to $5,568,709.12.

Obviously, there is no place you can put your money where it will constantly be doubling, but the principle remains true.

For a lot of people, dividend investing doesn't seem like an exciting way to build wealth.

And to be fair, investing $10,000 into a stock with a dividend yield of 3% only pays you $300 a year-

Or $25 every month.

Even if you buy a high yield dividend stock with a yield of 8%-

This still only pays you $800 a year, or $66.67 a month.

And keep in my mind, these high yielding stocks typically underperform the market long term.

So at first glance, it's easy to see why people get discouraged when dividend investing.

But that's because there's something most don't understand about dividend investing.

And this concept is what could allow you to potentially make $500 a month in dividends from $10,000.

$500 a month from $10,000 is the equivalent of a 60% dividend yield!

This isn't some new concept.

And this isn't some secret.

In fact, this is the same strategy Warren Buffett used to achieve a yield on cost of over 50% on his Coca-Cola position.

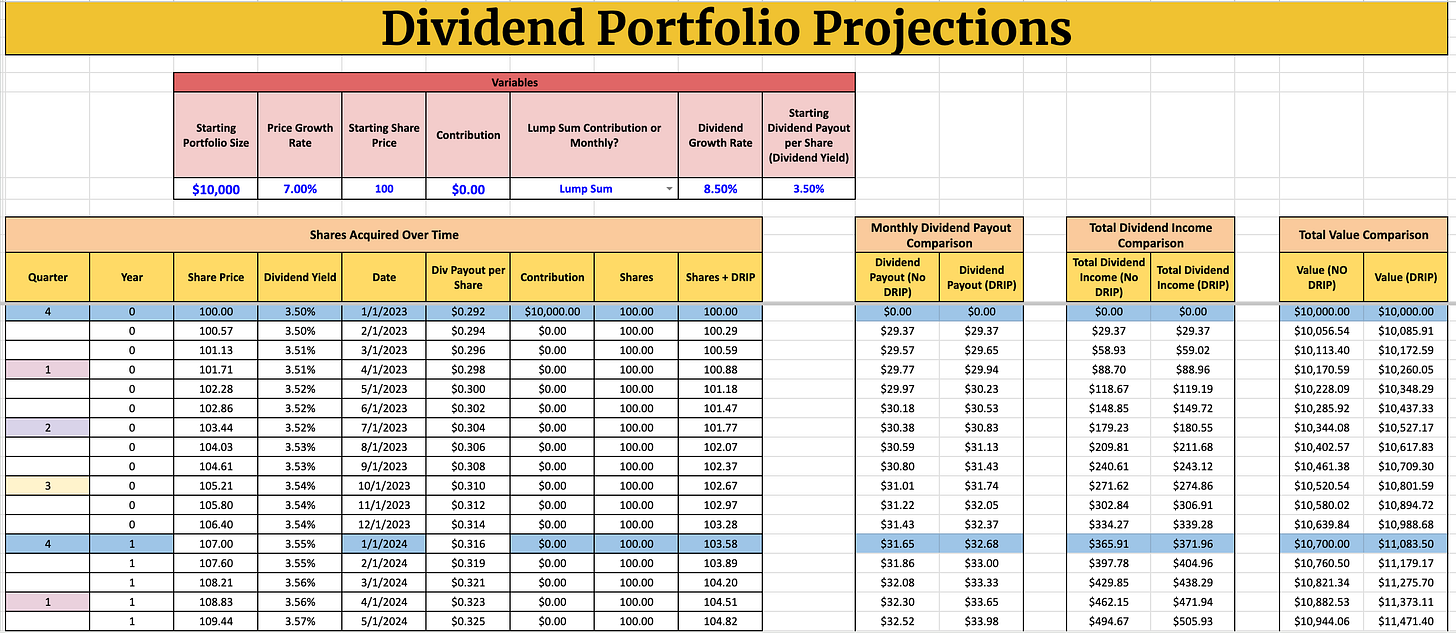

In this model I built, we're assuming

10k initial investment (no added contributions)

7% average price growth rate

8.5% average dividend growth rate

3.5% starting yield

Reinvesting dividends

Keep in mind, the dividend growth ETF SCHD has seen price returns of around 10%, and dividend growth rates of around 11.5% over the past decade, so we're staying on the more conservative side with our projections.

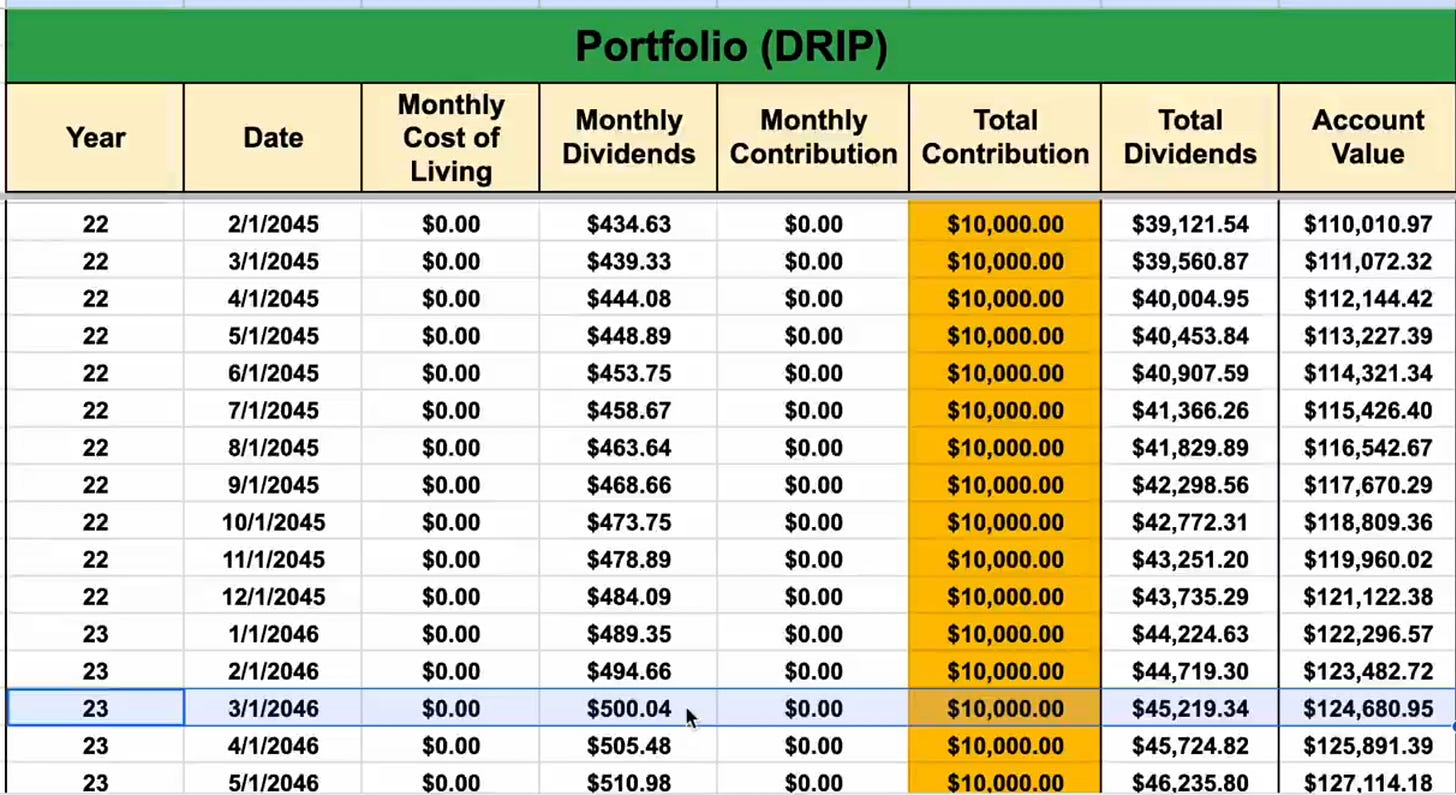

So what would be the results of our projections?

We can see in our model that after 23 years, our 1 time investment of $10k would now be paying us over $500 a month in dividends

But here's what else is crazy:

Our total dividend payment received during this time would be $45,219.34

Our total portfolio value would be $124,680.95

Our dividend yield on cost would be over 60%

All from a one time $10,000 investment!

Now, I know what you're thinking-

"$500 won't be worth as much in 23 years due to inflation"

And yes, you are right. But keep in mind, this is just the tip of the iceberg. In reality, we should be making monthly contributions during our 23 years as well.

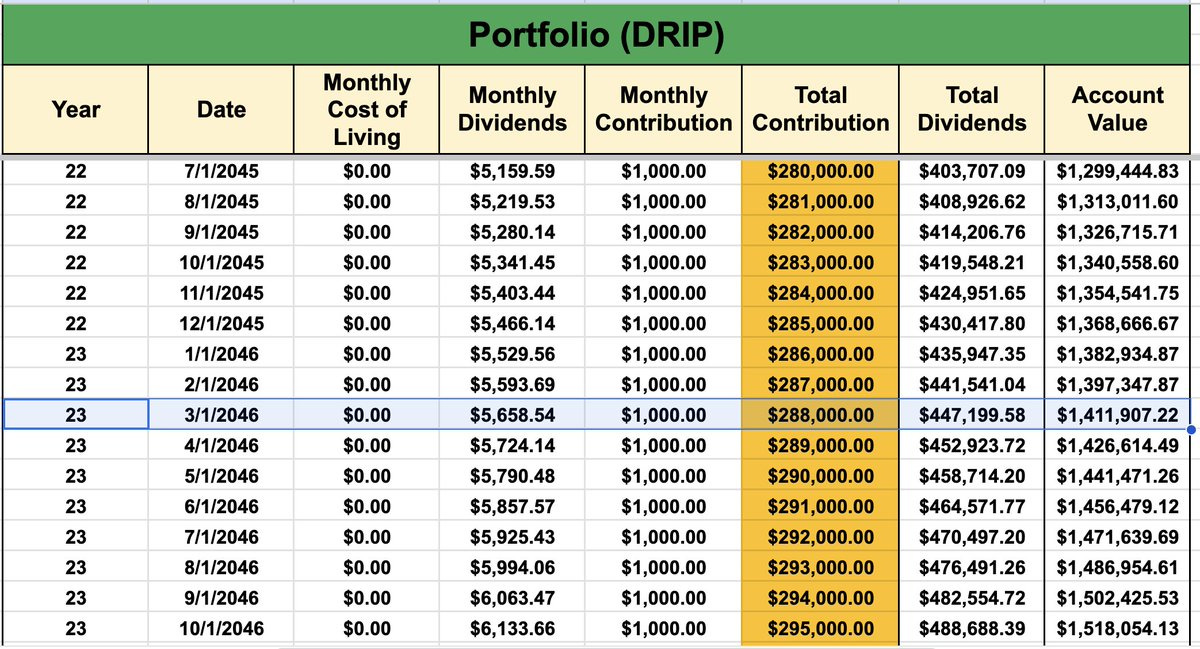

If we contribute $1,000 a month, along with our $10,000 initial investment, the results are amazing.

We would have:

$5,658.54 in monthly dividends

Portfolio value of $1.41M

Total dividends received would be over $447K

And if we really want to see the true effects of the snowball effect, we can stretch that 23 years out to 30.

This would give us:

$14,519.44 in monthly dividends

Portfolio value of $3.29M

Total dividends received would be over $1.22M

Keep in mind reinvesting dividends play a major role when trying to achieve the snowball effect.

The results of reinvesting dividends vs not reinvesting dividends is staggering.

The dividend snowball effect is powerful.

So powerful, that it can allow you to make $500 in dividends a month from a one time $10,000 investment.

The key, is to simply get started, and stay consistent.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

Other News…

At the end of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

This sheet was received by over 300 dividend investors last month. (Wow!)

If you’d like to receive this sheet at the end of this month, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀