How to Pay $0 in Taxes on Dividends 🔥

Legally pay $0 Taxes on Dividends

One of the best kept secrets of the tax code?

The fact that under the right circumstances, you could pay $0 in taxes on dividends.

To explain exactly how this is possible, I’m bringing on my CPA friend, “The Money Cruncher” to explain.

If you enjoy this breakdown, be sure to subscribe to his free newsletter!

Qualified dividends are one of the most efficient investment returns.

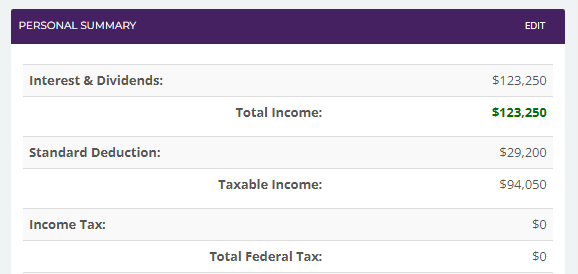

Did you know that you can actually live off $123,250 of dividend income and pay $0 in federal taxes?

Here is a screenshot directly from the tax software:

Generating $123,250 of federal tax-free money is almost equivalent to generating a before-tax salary of $165,000 (since you would pay approximately 25% in federal taxes)!

In other words, you would need to earn $165,000 from your day job to have the exact same net pay of $123,250 with qualified dividends.

Remember, the tax code wasn’t designed for employees; it was meant for business owners and investors.

So, how does this actually work?

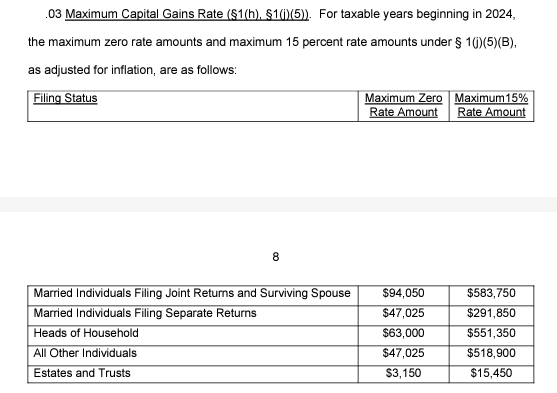

Qualified dividends get a preferential tax treatment. According to the IRS, if your taxable income is less than $94,050 and you file jointly, you will pay $0 in tax.

Link to the source: https://www.irs.gov/pub/irs-drop/rp-23-34.pdf

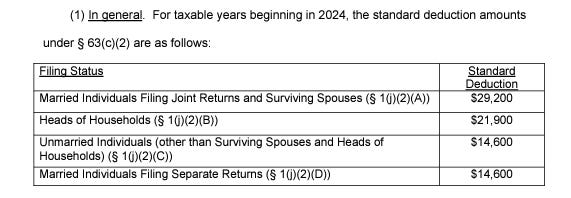

The taxable income calculation is after the standard deduction gets applied.

(same source)

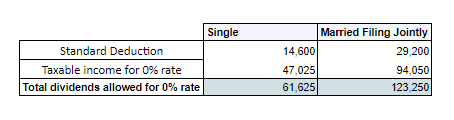

The standard deduction is $29,200 for married individuals, so here is how you can calculate the maximum amount you can generate in qualified dividends and pay $0 in taxes:

If you are filing as single, you can generate $61,625 of dividends and pay $0 in federal taxes.

That’s equivalent to almost an $80,000 salary!

Now, this applies only to federal taxes.

You might still need to pay state taxes, unless you live in one of the following states: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, or Wyoming.

One concern many people have with this approach is, 'What about inflation? I can’t live off this amount forever!'

But, living off dividends can actually be quite sustainable even with inflation.

Tax brackets and deductions get adjusted with inflation

For example, the standard deduction in 2023 was $13,850 instead of $14,600. The tax bracket went from $44,625 to $47,025.

So these numbers always get adjusted accordingly.

However, it’s important to note that the future legislation might change the amounts.

Selecting stocks/ETFs with a long record of annual dividend increases

The second way you can protect yourself against inflation is by selecting high quality stocks/ETFs.

For example, Starbucks has a 3 year dividend growth rate of 8.55%.

Along with tax brackets inflation adjustment, you will be easily outpacing inflation.

What if I have other income types?

Even if you have other income types, such as wages, Required Minimum Distributions (RMDs) from retirement accounts, or Social Security incomes, as long as you earn less than $123,250 (if married), your qualified dividends will be taxed at 0%.

If you've built a substantial dividend portfolio, you will only pay taxes on the taxable income above $123,250, and you will only pay 15% tax above that amount.

If you generate $200,000 in qualified dividend income, you will only owe approximately $11,500 in federal taxes and can potentially owe 0% in state taxes (if you live in one of the previously mentioned states).

On the other hand, if you earned that $200,000 income in a corporate job, you would pay around $37,700 or 3.25 times more!

The tax code heavily favors dividend investors.

If you missed it..

I recently launched Tickerdata!

Tickerdata is a spreadsheet integration tool that gives you the ability to automatically pull in live stock data for over 70,000 different stocks, 30+ years of historical financial statement data, other key financial metrics, and it can pull in data from over 70+ stock exchanges all across the world, straight into your spreadsheet.

You can access Tickerdata and download my spreadsheets here:

You can also subscribe to the Tickerdata YouTube here, where I'll post tutorials and even more stock analysis!

Other News…

At the end of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

This sheet was received by nearly 200 dividend investors last month. (Wow!)

If you’d like to receive this sheet at the end of this month, you can sign up here:

Also—

For the last few months I’ve been testing out different brokerages as I’ve been deciding which I like best.

After trying out nearly 10 different brokerages, I’ve settled on Interactive Brokers.

If you’d like to check them out, you can do so below: 👇

That’s all for now! Feel free to respond to this email and let me know of any thoughts you have!

See you next week!

Dividendology