How to Value a Stock! 📊

💥 7 Methods You Can Start Using Today

If you want to be a successful investor, you need a basic understanding of how to value a stock.

"For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments." - Warren Buffett

Even if you find a wonderful business, paying too high a purchase price can destroy your potential returns.

In this article, I’ll break down 7 ways to value a stock, starting with beginner-friendly methods and working our way up to more advanced strategies.

Let’s jump in.

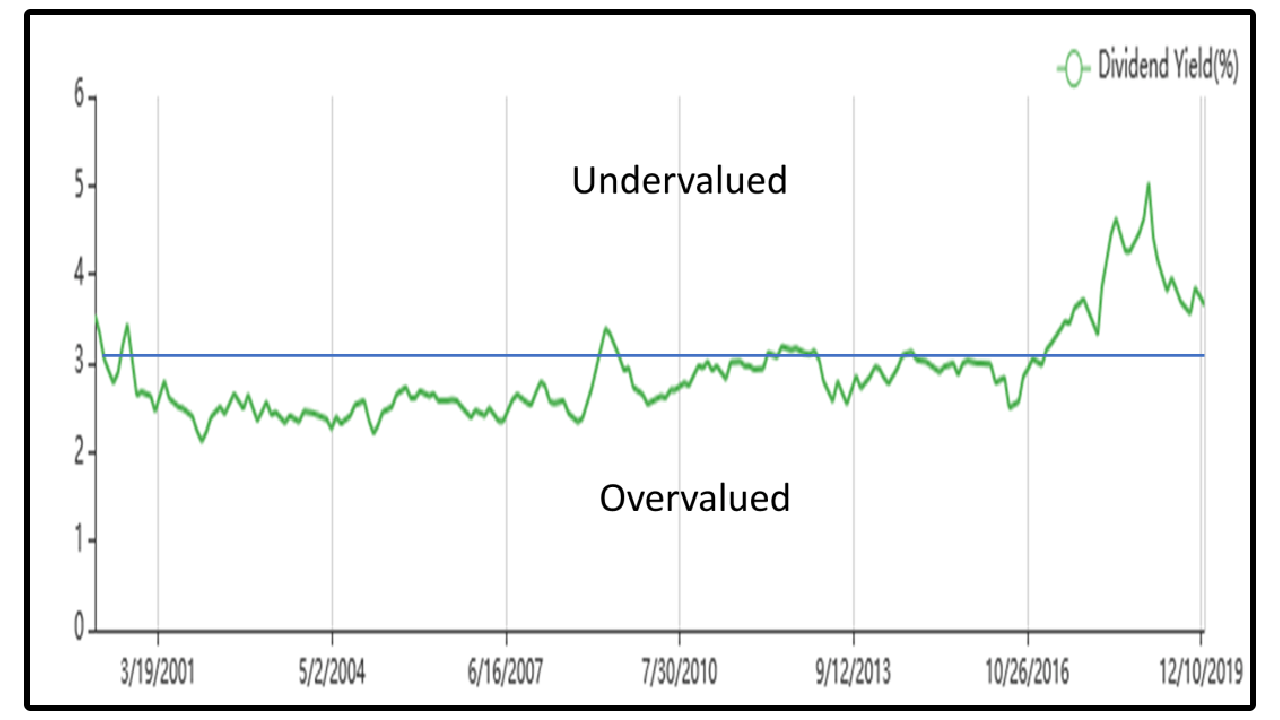

1. 📊 Dividend Yield Theory

Dividend Yield Theory is one of the most straightforward ways for dividend investors to start valuing a stock.

It’s based on a straightforward idea:

A stock’s dividend yield tends to revert to its long-term average over time.

So, according to this theory:

If a stock’s current yield is higher than its historical average, the stock may be undervalued.

If the current yield is lower, the stock may be overvalued.

Let’s look at an example.

In the above example, the stock would be considered undervalued, since the dividend yield was above its historical average.

See? Fairly straightforward.

However, Dividend Yield Theory has its limits, and I’m personally not a huge fan of this method because:

📉 Ignores fundamentals — A high yield *could* reflect real business decline

📊 Doesn’t account for future growth — A company with increasing growth projections will typically have an increased share price, leading to a lower yield. But this doesn’t mean the company is overvalued.

🕰️ Backwards-looking — Relies on historical averages, not forward-looking projections.

Dividend Yield Theory is a way beginners can immediately start valuing stocks.

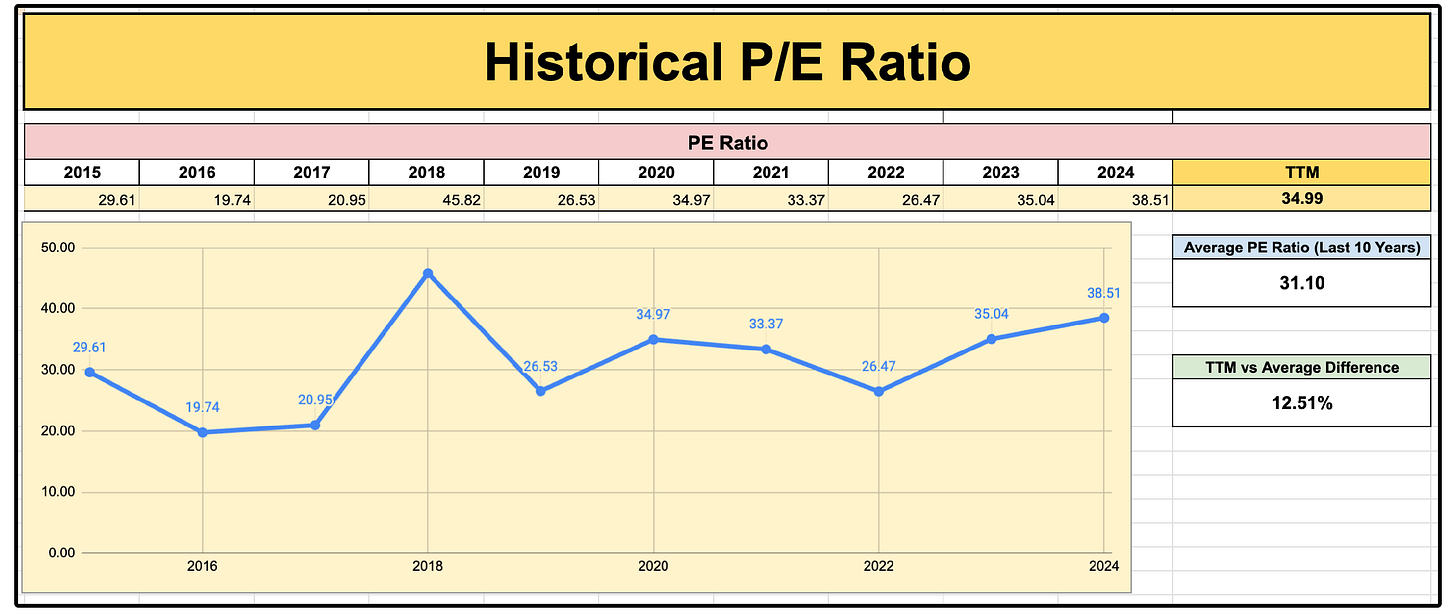

2. 📈 Historical Multiples Valuation

Instead of projecting the future, this method looks at how the company has been historically valued, compared to how it’s being valued right now.

Example (Microsoft):

Current P/E: 34.99x

10-Year Avg P/E: 31.1x

Microsoft appears 12.51% overvalued compared to its historical average.

You could also use:

Price/Free Cash Flow

Free Cash Flow Yield

Again, it’s important to remember that if the future earnings growth projections for a company increase, then they warrant a higher P/E ratio.

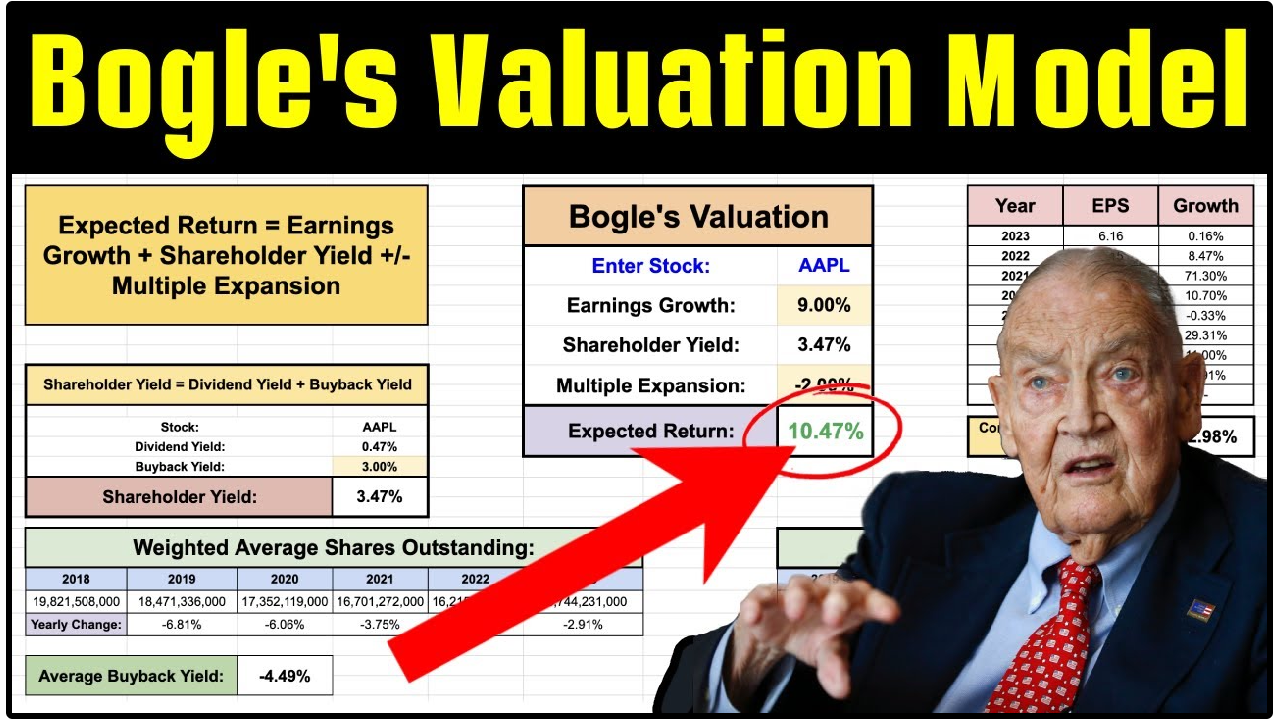

3. 🧮 Bogle’s Valuation

Named after Jack Bogle, this model estimates future returns.

Expected Return = Earnings Growth + Shareholder Yield ± Multiple ExpansionExample:

Annual Earnings Growth Projection: 11.5%

Shareholder Yield (Dividends + Buybacks): ~1.4%

Multiple Contraction: –4% annually (if P/E compresses)

5-Year Expected Return: ~8.9% per year

Simple but effective for setting return expectations.

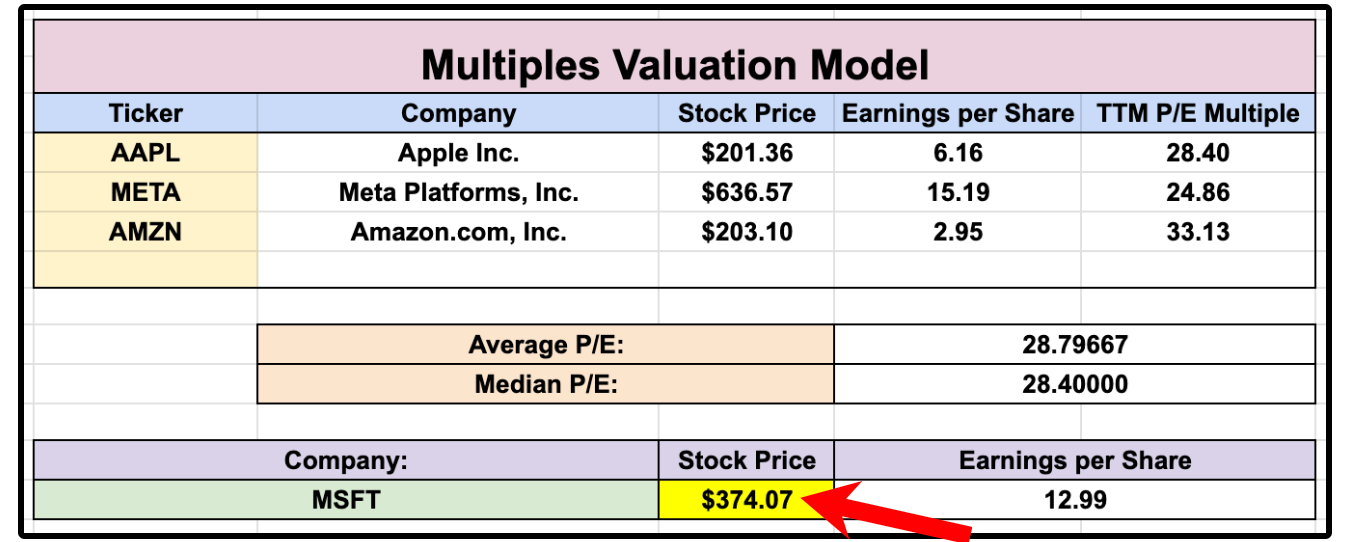

4. 🧠 Comparable Multiples Valuation

This method values the stock based on how the market is currently valuing stocks that are similar in structure.

Example (Microsoft):

Average P/E: 28.79 Median P/E: 28.40

Now apply the average peer P/E to Microsoft’s trailing 12-month EPS of 12.99:

Intrinsic Value = 12.99 × 28.80 = ~$374.99/share

Comparable Multiples Valuation for MSFT = $374.07

Remember: Some companies deserve to trade at a higher multiple than their peers.

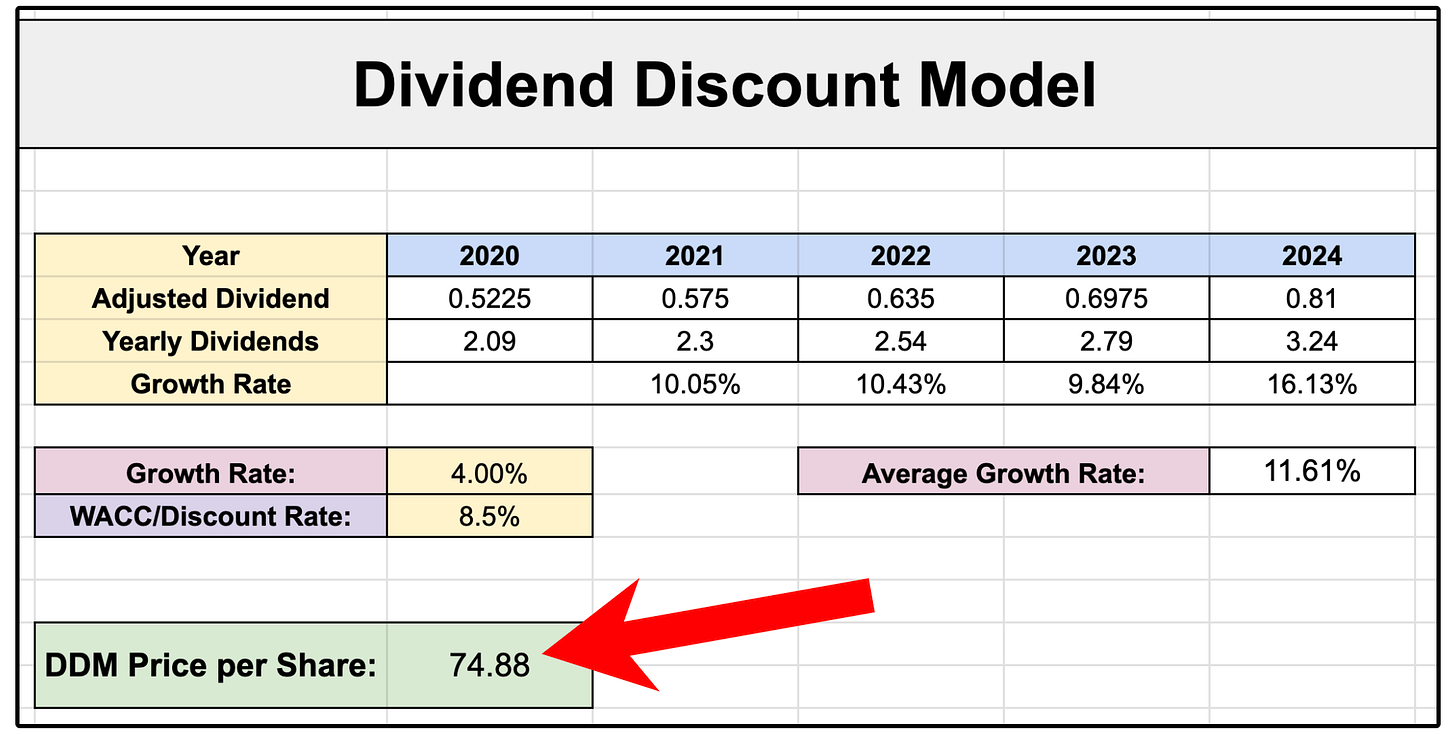

5. 💰 Dividend Discount Model

The dividend discount model values stocks based on how much they pay out in dividends, and how fast those dividend payments will grow over time.

We simply take the current dividend payout, and then project a dividend growth rate.

Example:

In this example, a stock that paid out $3.24 in dividends last year, with a:

4% dividend growth rate

8.5% discount rate

We come to a dividend discount model value of $74.88.

This valuation works best for mature dividend payers.

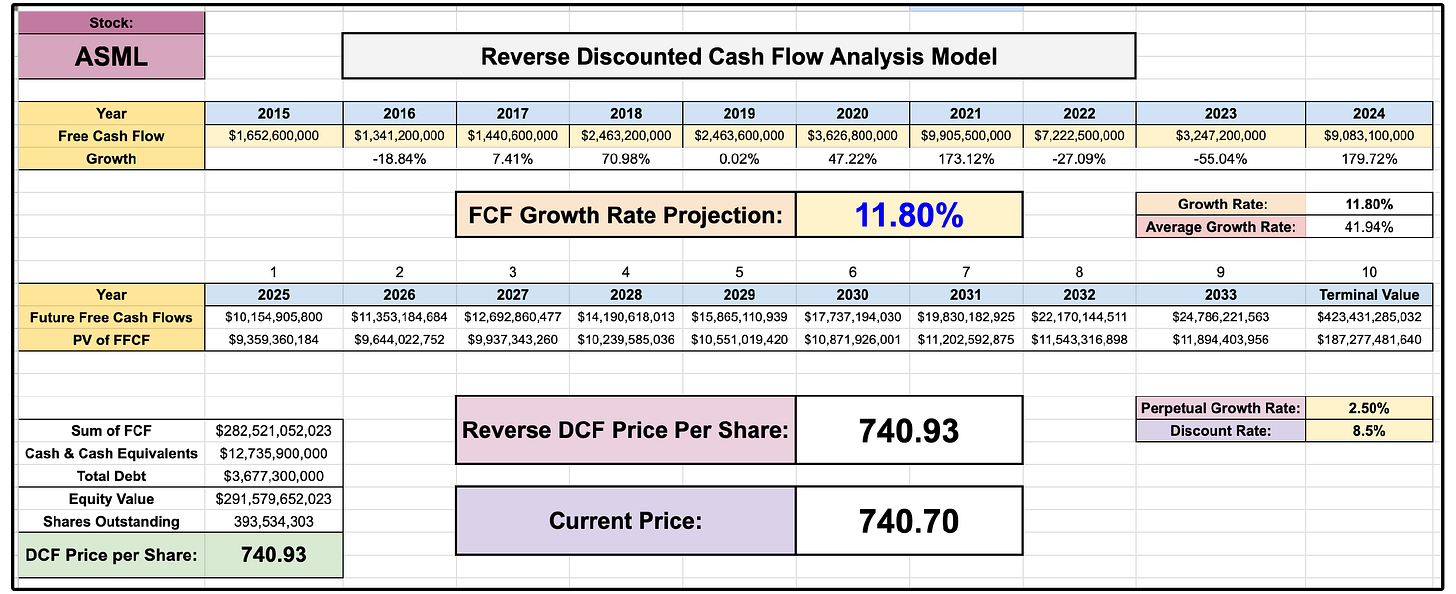

6. 🏦 Reverse DCF Analysis

“Invert, always invert” - Charlie Munger

Turn a situation or problem upside down. Look at it backward.

Instead of asking, ‘What is this stock worth?’, a reverse DCF asks:

“How much free cash flow growth is priced in?”

Example:

ASML (a company in my portfolio) is currently valued at $740.

Using a reverse DCF model, we find that to get to $740 a share, ASML needs to achieve 11.8% free cash flow growth over the next decade.

So the question we have to ask ourselves:

Do we expect free cash flow growth to be higher or lower than this in the future?

If we expect it to be higher, the stock is undervalued.

If we expect it to be lower, the stock is overvalued.

Analysts/Management are currently estimating ASML to grow free cash flow at above 16% moving forward.

Based on a reverse DCF, this would mean ASML is undervalued.

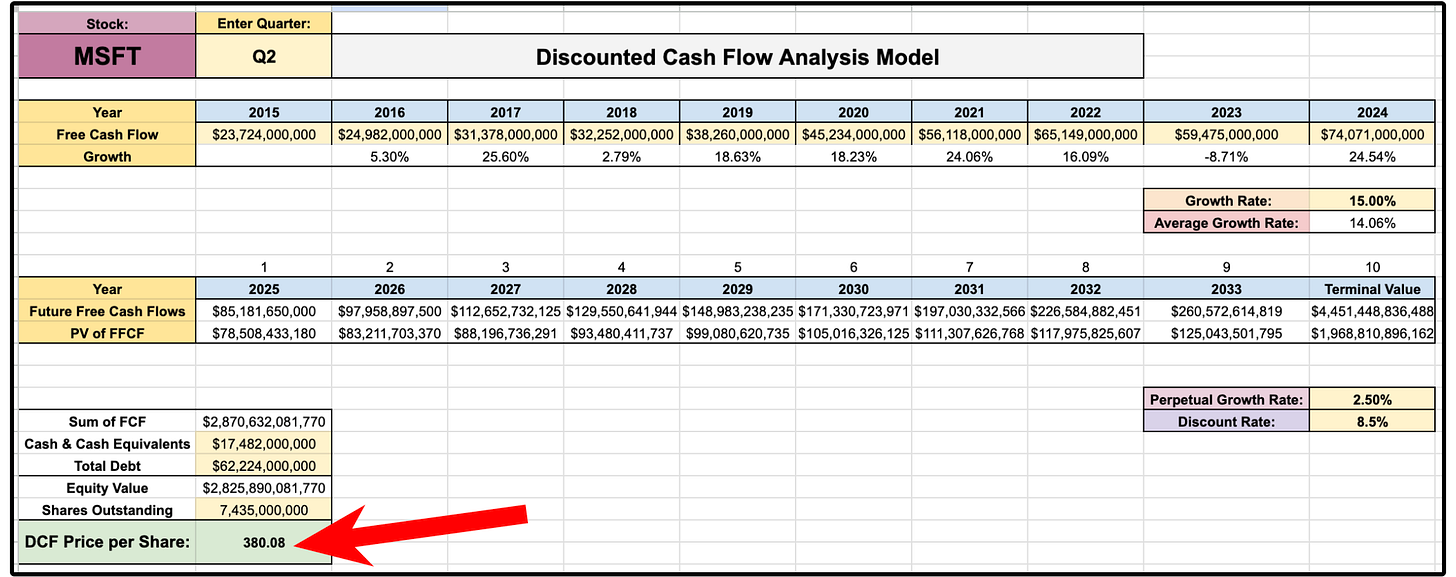

7. 🎯 Discounted Cash Flow (DCF) Analysis

“If you attempt to assess intrinsic value, it all relates to cash flows” - Warren Buffett, Berkshire Hathaway's 1997 annual meeting.

A DCF model projects a company’s future free cash flows and discounts them back to present value.

Key Inputs:

Free Cash Flow (FCF) History

Projected Growth Rate (EX: 15%)

Discount Rate & Terminal Value

After inputting Microsoft’s historical FCF, projecting growth, and accounting for debt & cash:

DCF Value = $380.08 per share

This sounds complicated, and in theory, it can get as detailed as you want.

But the reality is a DCF simply values a business based on all the cash flows it is projected to produce in the future, while also accounting for cash and debt on the balance sheet.

When done well, this is considered one of the more effective ways to value a business. With that being said, this model does not work as well for early stage businesses.

Which Valuation Is Best? 💭

Like all things in finance-

It depends.

Different valuations can be more effective based on:

Type of business

Stage of business life cycle

Predictability of cash flows

The best approach?

Use multiple models to cross-check your valuations and find opportunities.

Valuation is more art than science. No single method will give you all the answers.

All of the spreadsheets pictured above from Tickerdata are automated to import stock financials, so that you don’t have to waste any time when analyzing and valuing stocks.

The first 20 people to use code ‘VALUE’ at Tickerdata.com can get 30% off any of the Tickerdata annual plans. 🚀

Want to learn some of these valuations in video form?

You can check out this video:

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Great info, thank you!!

Great information, do you have all seven of these valuations in a ticker data spreadsheet