I Just Made Some Investors Upset... 😬

Price Does NOT Equal Value ❌

I posted a video on YouTube the other day that made a few investors upset.

In the title of this video, I stated:

“Visa Stock is Cheaper Than it Was 5 Years Ago!”

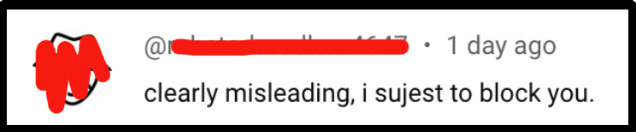

Here are two comments I received:

They didn’t seem to be too happy with my title stating Visa is cheaper than it was 5 years ago.

And let me be perfectly clear-

I don’t blame them at all.

Visa stock is trading at an all time high. 👇

So… does that mean Visa is expensive?

When I first started investing, I made the exact same mistake that the ‘upset commenters’ made.

I would look at stock chart, and if the stock’s price was trending upward, I thought the stock was “expensive”.

And if the stock was trending down, I thought the stock was “cheap”.

But this is where I made, and where beginner investors make a MASSIVE mistake (and the commenters made the same mistake as well).

Price does NOT equal Value.

What does this mean?

The stock price does not determine how valuable something is.

Let’s look at a simple example.

Say there are 2 money printers for sale. (Money Printer A & Money Printer B)

‘Money Printer A’ costs $100 and prints $10 a year.

‘Money Printer B’ costs $120 and prints $20 a year.

Which one is cheaper?

‘Money Printer A’ costs less…

But ‘Money Printer B’ pays more for the price.

With ‘Money Printer A’, you pay $10 for every $1 of earnings you get.

With ‘Money Printer B’, you pay $6 for every $1 of earnings you get.

Now which one sounds cheaper?

Even though ‘Money Printer A’ costs less, clearly ‘Money Printer B’ is cheaper.

This is what beginner investors struggle to understand.

And this is exactly why Visa is cheaper than it was 5 years ago:

(Chart below is the Price to Earnings ratio over the last 5 years)

The stock price is at an all time high, but the price to earnings ratio is far lower than it was 3, 4, or even 5 years ago.

And actually, this is a concept I mentioned in last weeks newsletter:

If you want a deeper dive into this concept, I’d suggest you watch this Visa stock analysis video:

Again, I don’t blame the people who made the negative comments on the video.

I made the exact same mistakes when I was a beginner.

But the sooner you understand this concept, the sooner you can become a great investor.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News…

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Well said!

Thanks, as a person always looking for a discount, would you happen to have a coupon code for your tickerdata subscription?