Isaac Newton Was a Terrible Investor 🤦 📊

He Would Have Loved Wall Street Bets 🤷

There are currently almost 23,000 people subscribed to the Dividendology Newsletter.

Among those 23,000 people (myself included), I’d bet that very few, if any, are smarter than Isaac Newton was.

But with that being said-

I’m willing to bet almost all of you are better investors than Isaac Newton was.

Let’s go back about 300 years…

The South Sea Company was a British joint-stock company founded in 1711.

It was granted a monopoly to trade with South America.

At the time, there was significant excitement and speculation about the potential wealth from this trade, even though Britain was at war with Spain, limiting actual trade opportunities.

By 1720, speculation in the stock of the South Sea Company reached a fever pitch.

(The keyword here is ‘speculation’.)

The company's stock price soared due to the public's enthusiasm and the company's promises of untold riches, which were largely exaggerated.

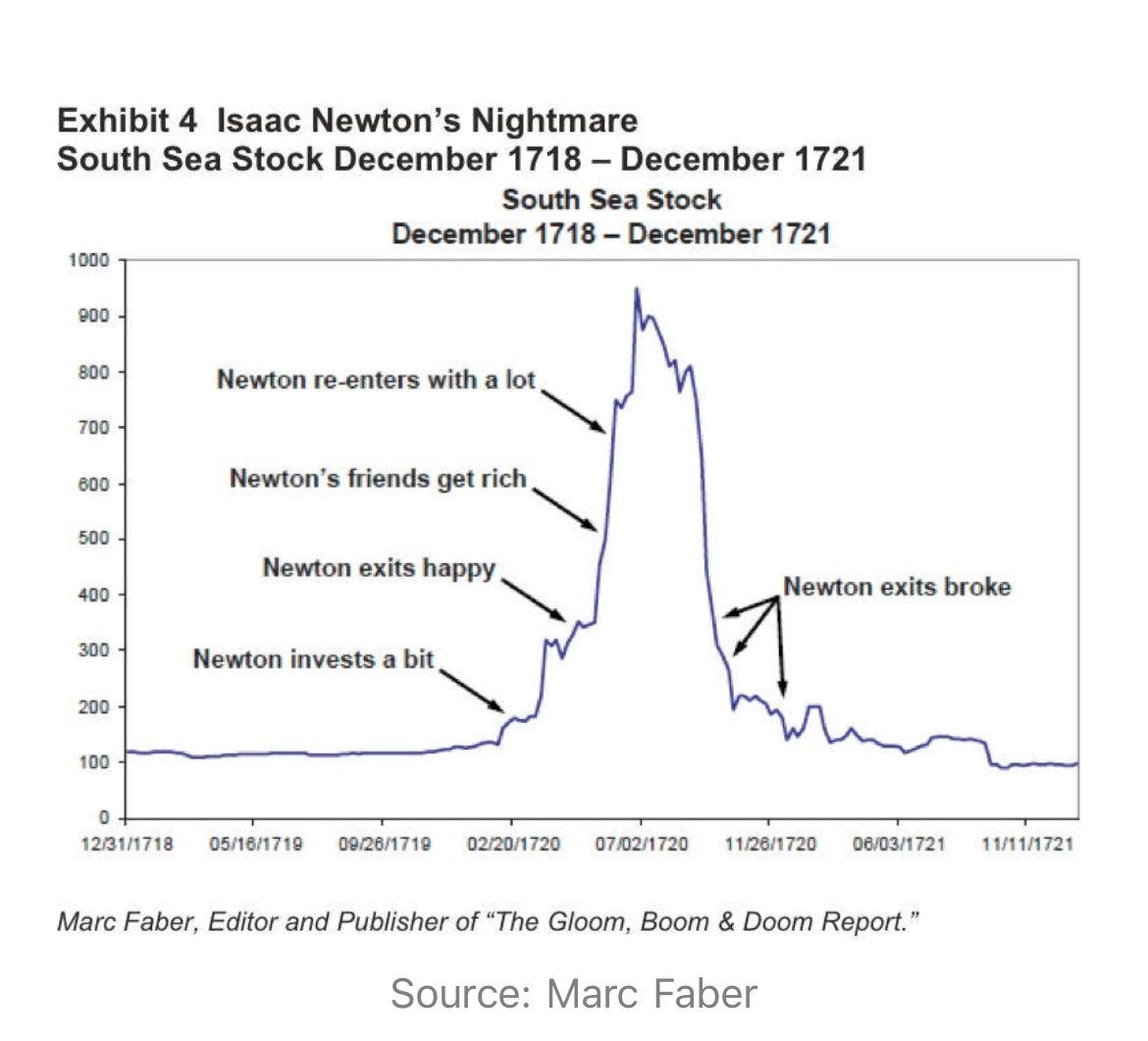

Isaac Newton, one of the greatest minds in history, initially invested in the South Sea Company when its stock price was still relatively low.

He sold his shares early on for a tidy profit and was satisfied with his earnings.

But that wasn’t good enough for Newton.

The stock price continued to skyrocket, and all of Newton’s friends got rich.

Swept up in the excitement, Newton reinvested a significant portion of his wealth at a much higher price.

The bubble burst later that year, and the stock price plummeted.

Newton lost almost all of his investment, which amounted to millions in today’s dollars.

Newton reportedly said, "I can calculate the motions of heavenly bodies, but not the madness of people."

So where was Newton’s mistake?

Speculation.

Chapter 1 of ‘The Intelligent Investor’ by Benjamin Graham is ‘Investment versus Speculation’.

In that chapter, Graham explains that investing requires thorough analysis, risk protection, and seeking reasonable returns, while speculation is more like betting on price movements without deep analysis.

Initially, Newton’s first investment in the South Sea Company was closer to a true investment—he entered at a reasonable price and took a profit based on rational evaluation.

However, when he re-entered with a significant amount after seeing others get rich, he transitioned into speculative behavior.

So ask yourself this:

Are you an investor, or a speculative trader?

Because if you are a trader, then the same thing that happened to Newton could unfortunately happen to you.

NOTE: I recently made a video summarizing every chapter of The Intelligent Investor. You can watch it HERE.

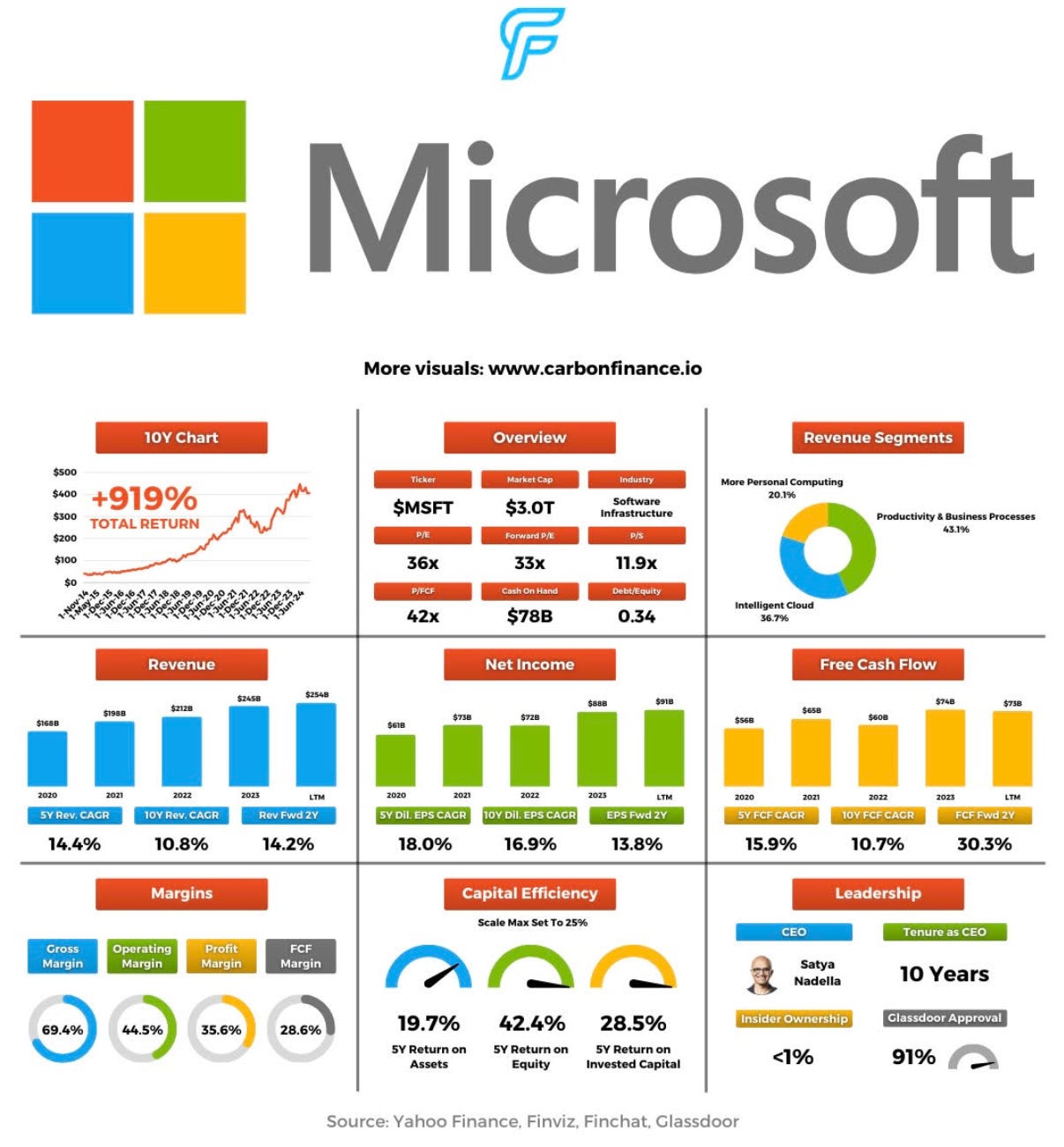

Billionaires, hedge fund investors, and money managers have armies of analysts to stay ahead in the stock market and analyze data.

But what if you don’t have that?

Then you should be reading Carbon Finance: the visual investing newsletter.

It’s simple — sign up, and each week, get top investing infographics, insights, and insider trades delivered right to your inbox, all for free.

Don’t miss out — join 21,000+ investors right now.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

In Other News…

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀