It’s NOT just your investments that compound over time… 😬

Cost of Living Spreadsheet!!

The huge selling point of dividend investing (and investing in general) is that it compounds over time.

And while this is obviously great, it’s important to remember that it's not the only thing that compounds with time…

You know what else does?

Inflation.

You’ve probably worked out your monthly living costs to figure out how long it will be until you can live off your dividends.

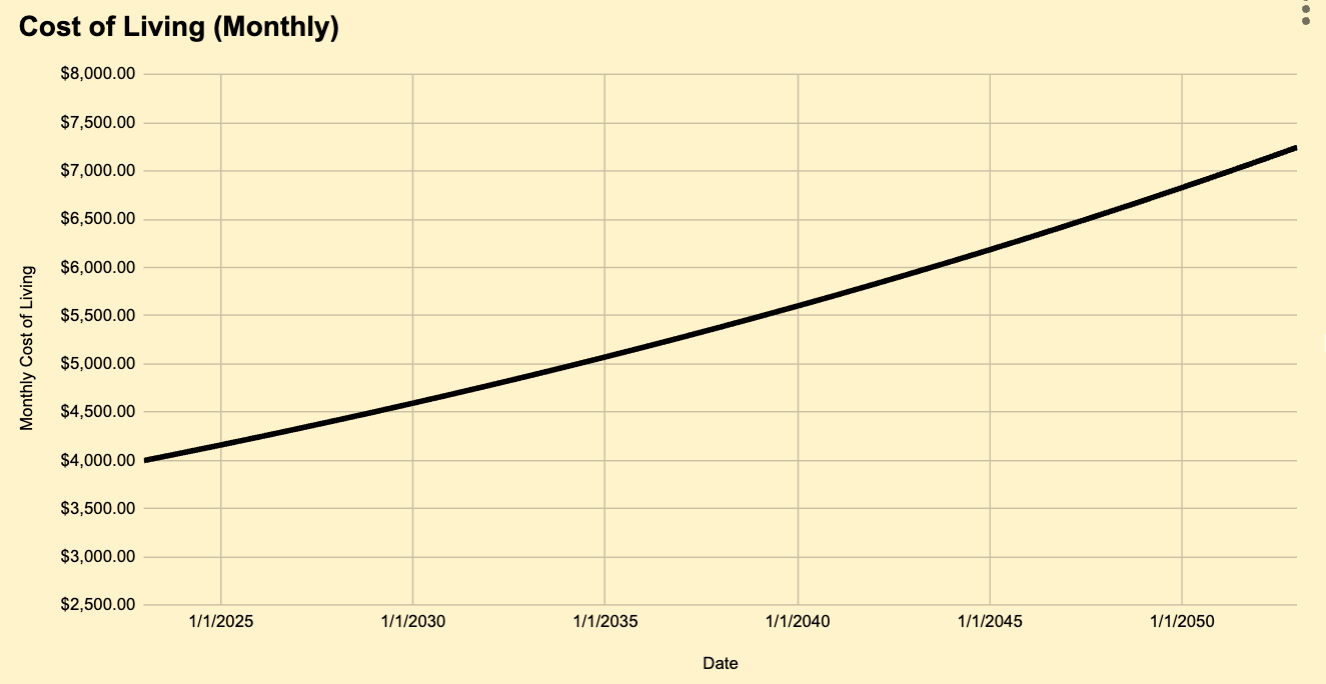

For argument’s sake - let’s say it's $4000 a month.

But here’s the kicker.

Because of inflation, in around 30 years, that $4000 monthly living expense will likely be upwards of $7000. 🤯

And that is why I believe that dividend investing is your key to freedom.

With your job, you *might* get an annual 2% pay raise. And that’s great!

BUT…

That’s barely enough to keep up with inflation (and certainly not enough during current times).

With dividend growth investments though…

You can receive inflation beating returns.

It’s the one way you’re able to beat inflation consistently.

What’s my point?

If you want to beat inflation, then you have to invest in stocks that consistently increase their dividend payments at a high rate.

If their dividend increases are lower than the rate of inflation, they are technically paying out less in dividends.

Inflation beating dividend growth is the key.

This is how to actually become financially free.

Not with get-rich-quick schemes or crypto pumps…

But with simple math.

Dividendology

P.S. Feel free to respond to this email and let me know what you think the average monthly cost of living will look like 30 years from now!

And for my paid subscribers, I’m providing you with a spreadsheet (down below) that will allow you to calculate exactly what your monthly cost of living will be 10, 20, or 30 years from now based off of projected inflation.