January Dividend Portfolio Update 2024 🔥 ✅

Free Dividend Aristocrat Spreadsheet!

Before we get started-

Like promised, I’m sharing a FREE spreadsheet with details on every dividend aristocrat stock in 2024.

You can access it here! Enjoy!

Portfolio Update 📈

The market has started off hot in 2024, with the S&P 500 up 3.28%.

My portfolio has been reaping the benefits of the market run up over the past few months, with my portfolio value now sitting at over $155,000.

As I discussed in a video earlier this month, I made a major reallocation mov in my portfolio this month.

This move was made with my long term goal of living off dividends in mind.

In order to live off dividends, I need to find quality companies that have the ability to payout growing dividends.

In order for a company to payout growing dividends sustainably, then they have to grow their free cash flow year over year.

As a new investor years ago, this was something I did not understand.

Like most dividend investors starting out, I was far more focused on what the starting dividend yield for a company was.

This led to some poor decisions early on.

Now, I’m looking for companies that can be free cash flow generating machines, which will in turn allow them to grow dividends every year.

And, in my such for free cash flow machines, I found one trading at a good value this past month, and that company was LVMHF - Louis Vuitton

I added this company while it was trading at around $707 a share, and because they smashed their latest quarter’s earnings last week, I’m already up over 15%.

While it’s always fun to see short term gains, I made this buy with the long term in mind. I don’t have to let volatility get me excited or disappointed. That’s the beauty of buying great businesses and holding long term.

In fact, I wish LVMH would’ve gone even lower, as I would’ve been able to buy more shares at lower prices!

Here’s an overview of the growth of my current positions. I’m still in the process of trimming these down to around 25 holdings.

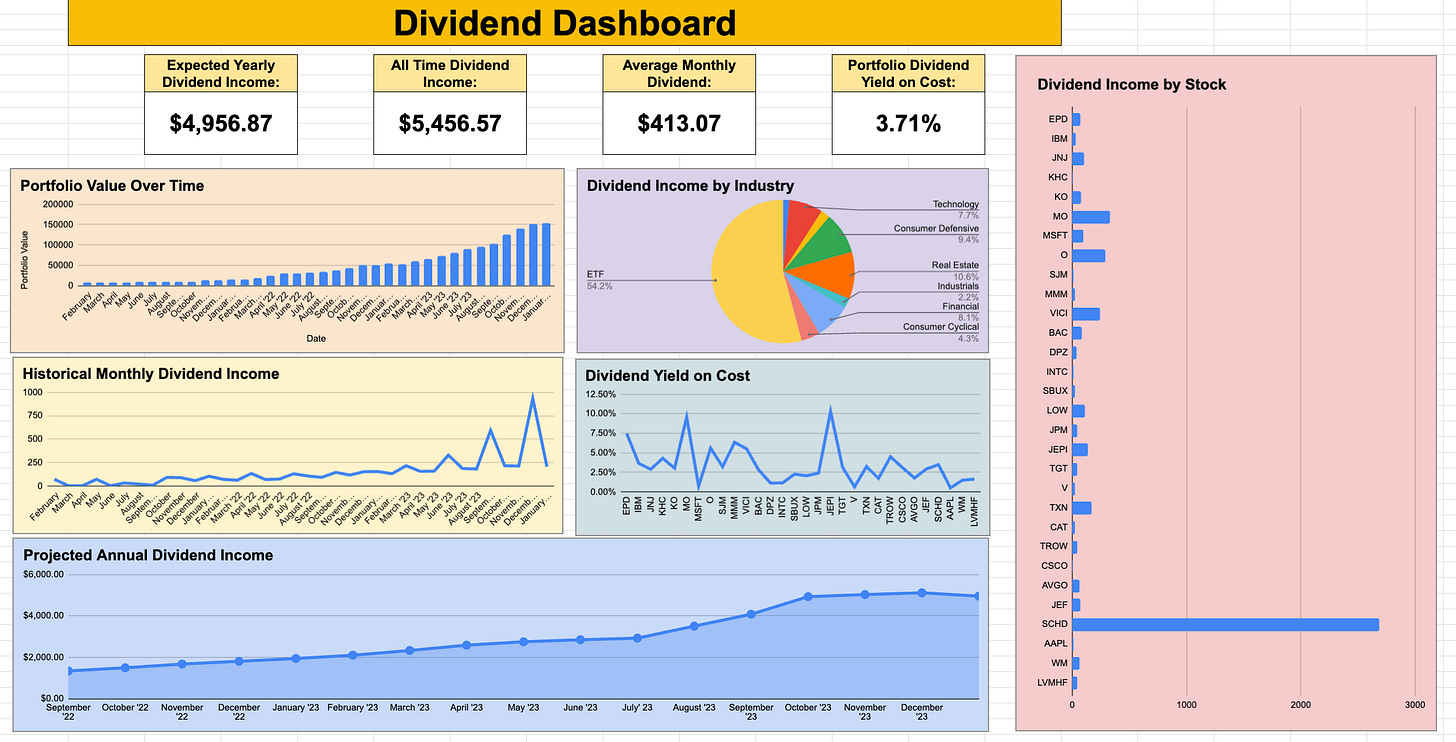

If we take a look at my dividend dashboard, we can see there was a slight decrease in my expected yearly dividend income. This comes after I sold out of a few higher yielding positions and reallocated the capital into the lower yielding LVMH.

Long term, I believe this will provide me with far more dividend income due to the dividend growth LVMH will provide.

This month I made $206.96 in dividend income. We’re starting to see a clear trend on my historical monthly dividend income chart.

I expect next month to be near the same, and the following month to be by FAR my highest month of dividend income ever at likely over $1,000!

It’s clear the snowball is really starting to take off with my portfolio, as my holdings increase their payouts and I reinvest there bigger and bigger dividend payments back into my portfolio.

In fact, my future portfolio outlook is looking quite nice. Based on my *somewhat conservative* estimates, I could easily be making over $15,904 in dividends a year in just 5 years.

I find tracking my portfolio and projecting what it will look like in the future extremely motivating. I believe it is something all serious dividend investors should be doing.

Like always, if you’d like to gain access to any of my spreadsheets to be able to do this, you can do so here.

Tweet of the Week:

Other Exciting News… 🔥

I recently published my first article to Seeking Alpha! This article was an in depth breakdown of my favorite REIT heading into this year.

You can read it here!

And if you aren’t currently a member of Seeking Alpha but still want to read, you can get a 7 day free trial and a $50 coupon here.

Lastly…

Earlier this week, I sent out a Newsletter to my paid newsletter subscribers that lists out the dividend stocks I believe to currently be undervalued.

I send out this Newsletter at the end of every month, so if you’d like to receive next months edition or even gain access to last months, the you can become a paid member below. 👇

That’s all for now! Feel free to respond to this email and let me know of any thoughts you have!

See you next week!

Dividendology