July Dividend Portfolio Update 2025 🔥 🚀

New All Time Highs! 💰

My portfolio is turning into a Dividend Tsunami in 2025.

The companies in my portfolio keep growing stronger.

So the dividend payments keep rolling in, and keep growing larger.

Earnings Week 📊

This past week was full of massive earnings reports-

And many of my top holdings announced stellar results.

As a result, my portfolio continued to climb higher in the month of July, again hitting new all time highs.

A few key highlights:

Waste Management increased free cash flow guidance for 2025

Altria increased 2025 EPS guidance

Microsoft (my largest position) hit new all time highs after beating top and bottom lines

Visa beat on top and bottom lines

And of course, there were some losers, such as Novo Nordisk who lowered guidance.

Management cited ongoing concerns over the continued sale of unlawfully compounded GLP-1s, with company research showing that multiple entities are essentially copying and selling their patented drug.

The beauty of investing?

You only need a few winners to have a successful portfolio.

“The secret is if you have a lot of stocks, some will do mediocre, some will do okay, and if one of two of them go up big time, you produce a fabulous result.” - Peter Lynch

My Big Winners 👑

Some of my highest conviction investments, have also turned out to be my best performing investments.

Here are my biggest winners:

Broadcom: +477%

JP Morgan: +182%

Caterpillar: +152%

Microsoft: +103%

Jefferies Financial: +96%

It’s also important to note these are money-weighted returns, not time-weighted.

This means in reality, the returns are even higher.

Big News… 🔥

I’ve been publicly sharing my portfolio for years.

But there’s a problem.

Not everyone gains as much value in following my portfolio anymore, because it's grown larger, built over many years, and tailored to my specific financial situation.

And over the years, two questions have come up more than almost any others:

“How would you invest right now if you were starting from scratch?”

“What would you buy if you were building a high-yield portfolio today?”

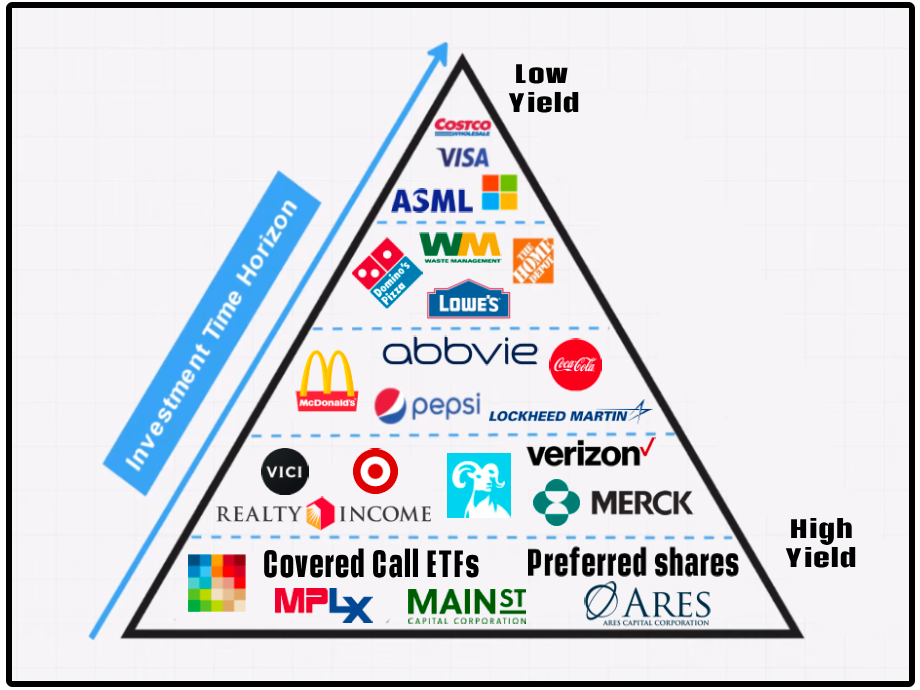

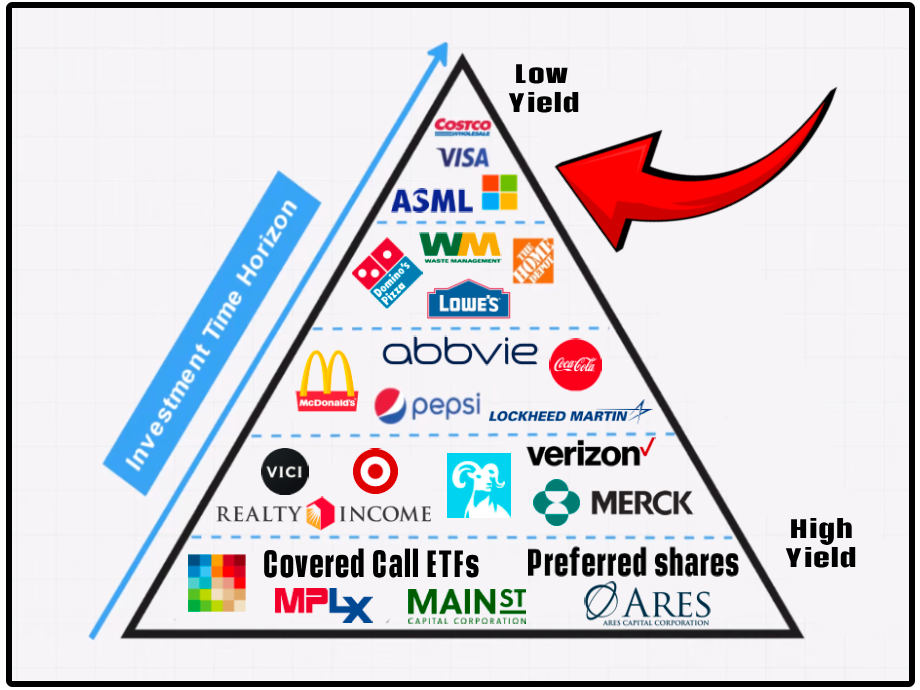

How you invest completely depends on where you are on the dividend pyramid.

I’ll be launching two real-money portfolios on Dividendology.com:

💰 The Dividend Growth Portfolio – Built from $0, showing exactly how I’d begin investing today if I were starting from scratch

🧾 The High-Yield Portfolio – Designed to maximize immediate dividend income (think 8%+ yields) without sacrificing capital

These aren’t mock portfolios.

I’ll be investing real money, tracking every move, every dividend, and every update with full transparency, just like I always have.

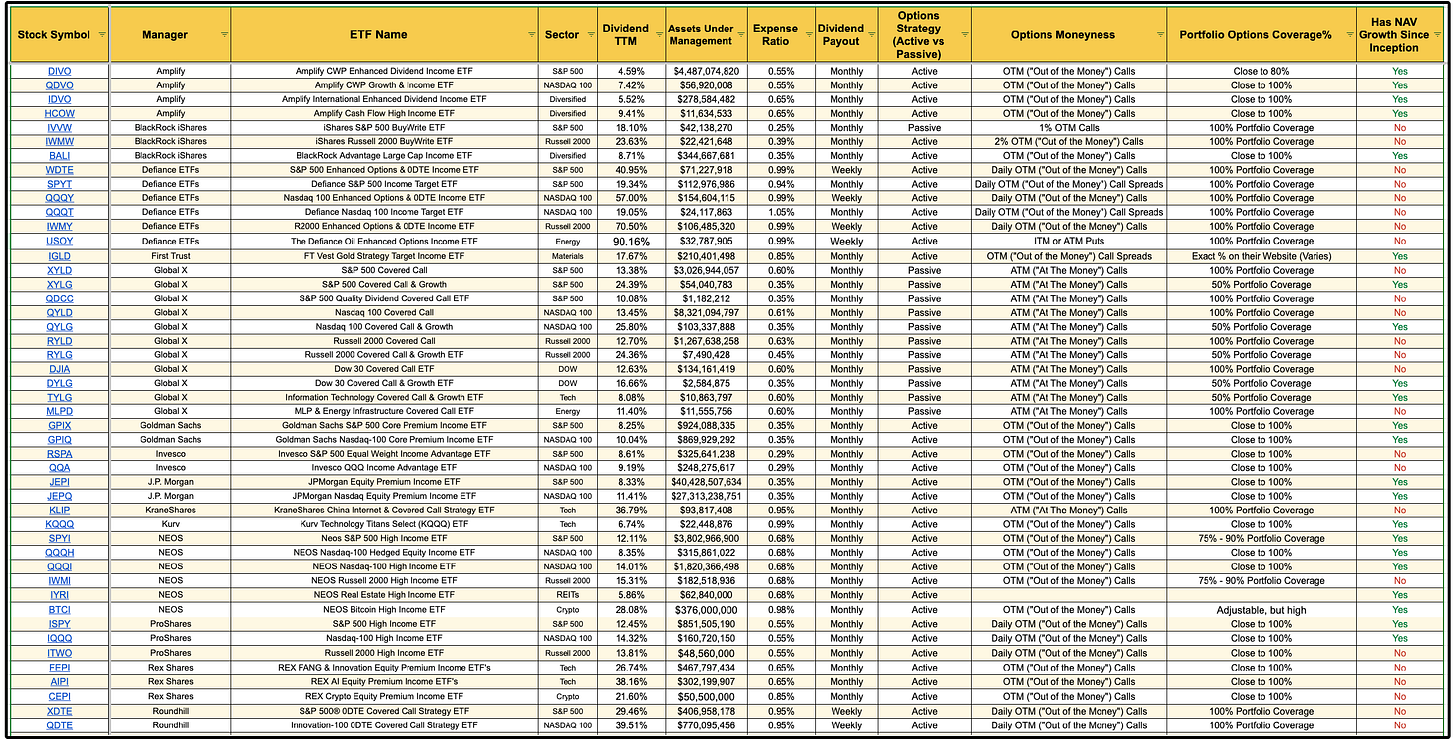

And behind the scenes, I’ve been pouring in countless hours (and a lot of capital) into what will soon become the Dividendology Database.

This will be a game-changing platform for income investors.

The full launch for both will be in 1 to 1.5 months.

Stay tuned.

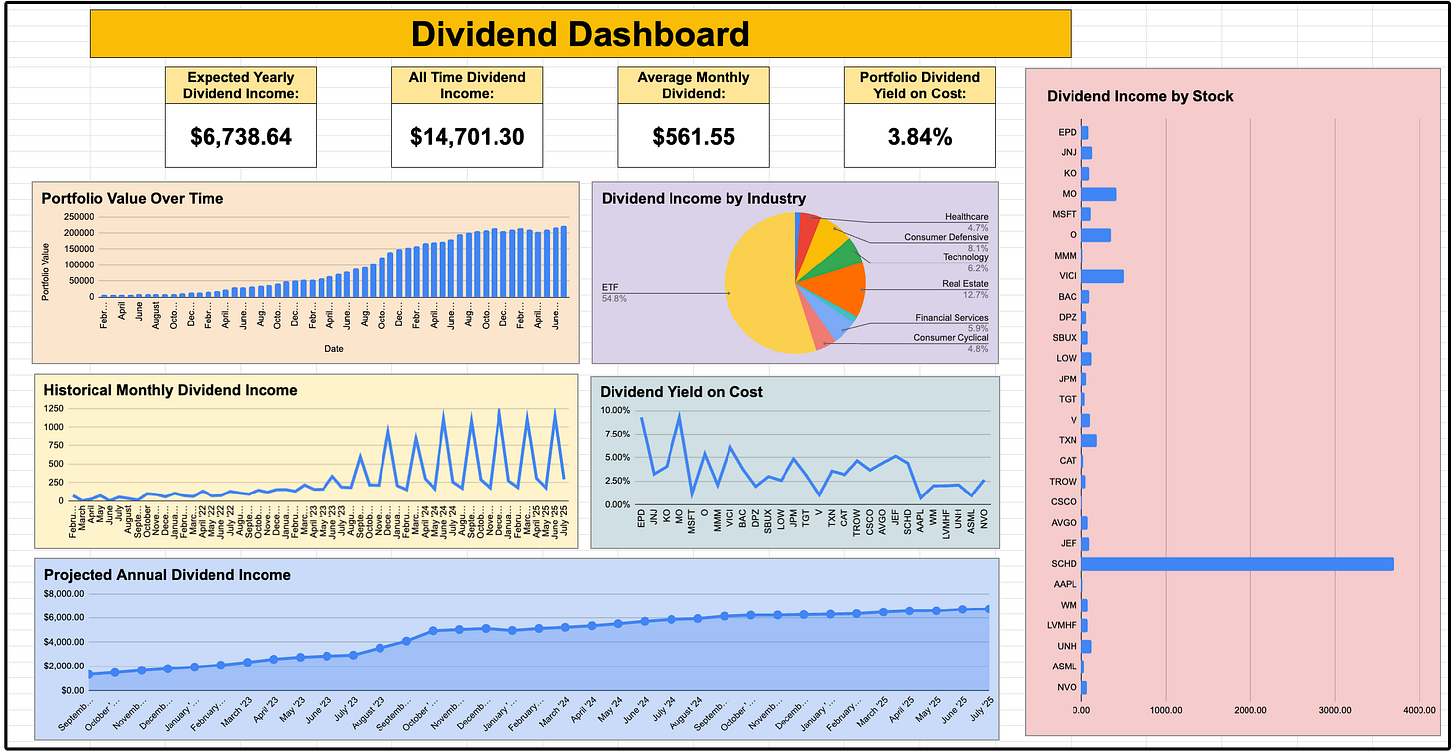

My Dividends 💰

In the month of July, I received $294.14 in dividend income.

More importantly, my average monthly dividends climbed up to $561.55.

Regardless of what’s going on in the market, I have $561 being collected in dividends each month.

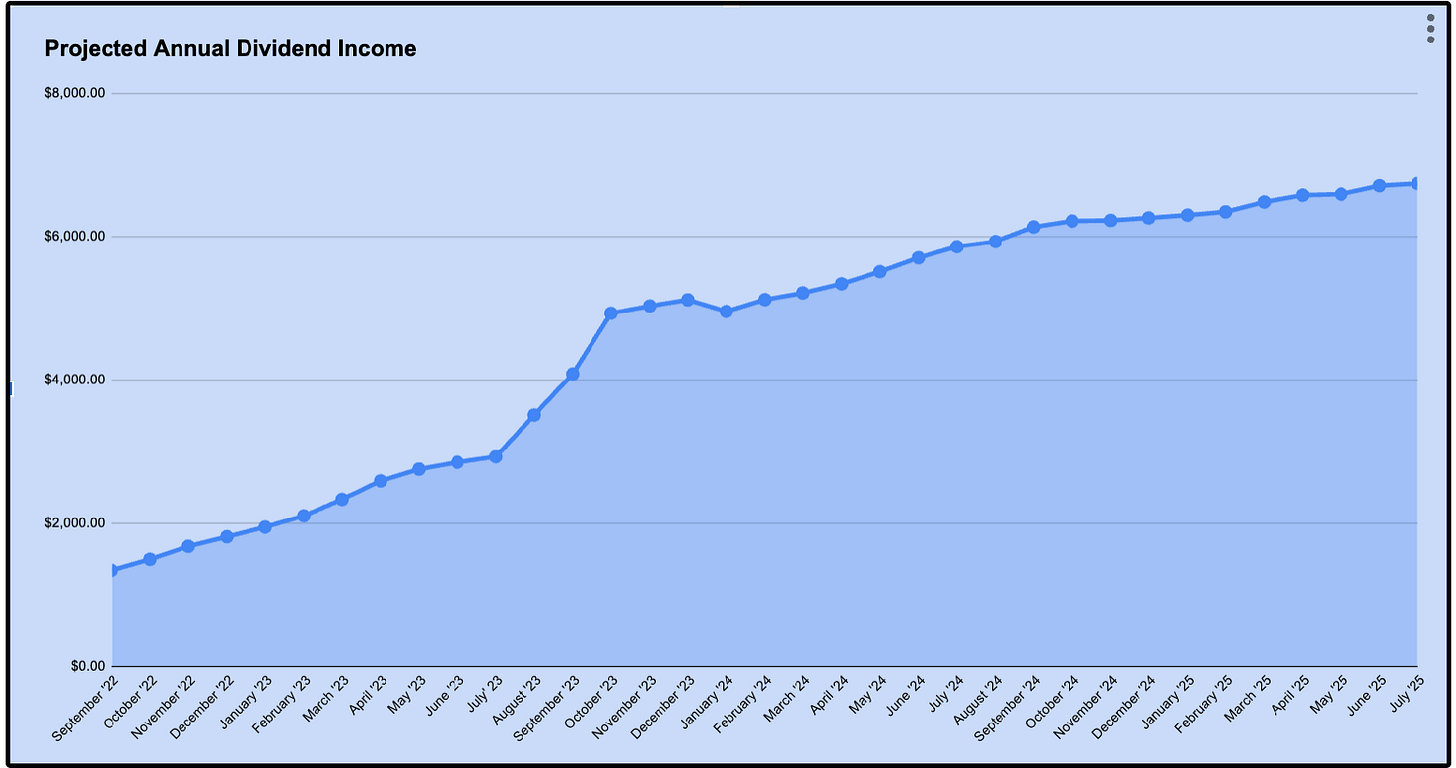

But what is even more exciting, is seeing my projected annual dividend income climb higher every single month.

This number grows larger every month due to 3 reasons:

New Contributions

Reinvesting Dividends

My Holdings Increasing Dividend Payouts

It’s important to note that my projected annual dividend income could be significantly higher if I was currently utilizing a high yield strategy.

But since I have a longer time horizon, the focus is currently dividend growth.

Here are the dividend payments I received in July:

🥤 Coca-Cola (KO) – $23.17

🚬 Altria (MO) – $100.44

🏨 VICI Properties (VICI) – $124.33

🏢 Realty Income (O) – $29.45

🌐 Cisco Systems (CSCO) – $1.77

🏦 JPMorgan Chase (JPM) – $14.98

Every month, the snowball gets bigger, and keeps rolling faster.

This is the ultimate sleep-well-at-night strategy.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, as well as access to the future perks to be released, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

would you be open to sharing your spreasheet?

I'm a little bit confused with the subscriptions that I purchased for you for $60. Is the access to your portfolio included, or how can I get access to this?