June Dividend Portfolio Update 2024 🔥 🚀

My Largest Month of Dividends Ever! ✅

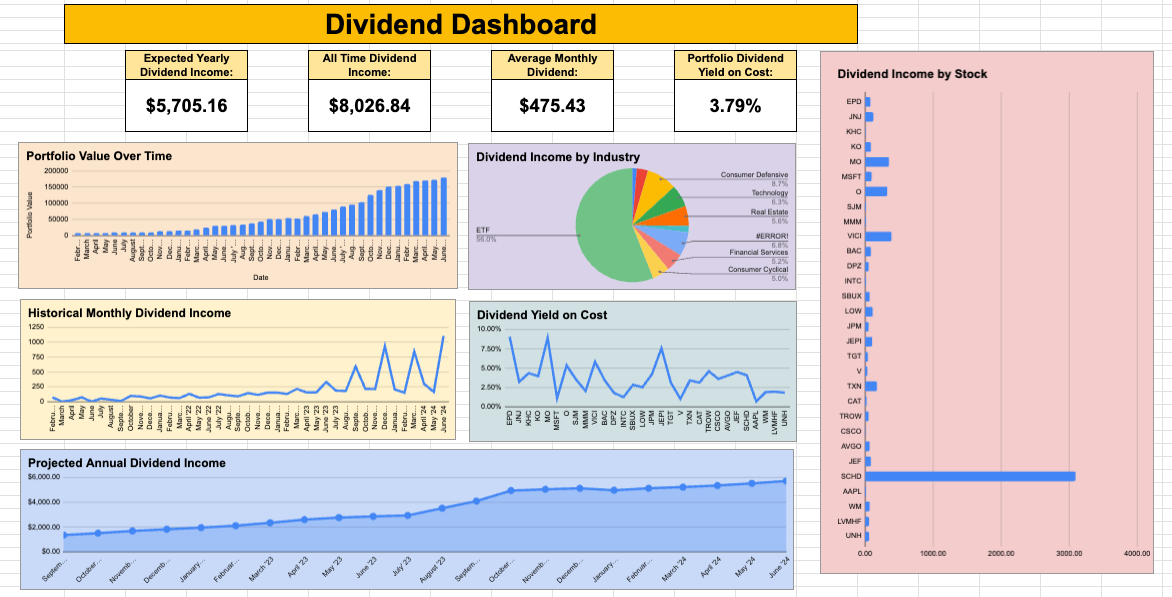

June was a massive month for my portfolio.

My portfolio hit multiple major milestones during the month, with one being a milestone I’ve been pursuing for quite some time.

I had my first month of over $1,000 in dividend income.

In the month of June, in total, I made $1,108.17 in dividend income.

Let’s put this into perspective.

When I started investing, I was contributing $50 a month.

I made over 22 times that strictly from dividend income this month.

And I’m reinvesting all my dividends, meaning I’m contributing 22 times more this month than when I started simply from reinvesting my dividends.

A huge reason for my massive month of dividend income, is the fact my largest holding, the dividend growth ETF SCHD, just paid it’s largest dividend payment ever.

This Q2 2024 SCHD dividend payment was 24% higher than the Q2 2023 SCHD dividend.

That’s pretty remarkable, and definitely goes to show the power of dividend growth.

You can see my in depth breakdown of SCHD’s most recent dividend payout and what it meant for my portfolio here:

I put the growth of my dividend payments into perspective in a tweet the other day, and it had thousands of people wondering how they could do the same:

Now let’s be perfectly clear-

Dividend growth investing isn’t a ‘get rich quick’ scheme.

But it is a get rich scheme.

And you aren’t just building a portfolio that you will one day cash out of-

You’re building a perpetually cash flowing machine, and those dividend payments will continue to grow every year.

When you utilize a dividend growth strategy, it means you’re buying quality stocks that increase the amount of dividends they payout every year.

The end result is you’ll never have to sell out of positions in your portfolio for income.

Think of it this way-

Your portfolio is like a Ferrari, taking you to your destination. And when you it gets to your destination, you sell the car.

But with a dividend growth portfolio, you get to your destination, but get to keep the Ferrari. (Because you don’t have to sell shares in your portfolio!)

This is one of the many beautiful things about dividend investing.

The other major milestone, was that for the first time ever, my portfolio hit $180,000 in value!

This comes after seeing some amazing gains from companies like:

AVGO (+240%)

JPM (+98%)

CAT (+89%)

MSFT (+74%)

JEF (+69%)

AAPL (+61%)

BAC (+53%)

DPZ (+51)

Over the next month, I’ll be looking at each individual position, and make sure they align with my long term goal of one day living off dividend income.

Any that I find are not strong conviction plays and don’t align with my goals, I’ll consider selling.

Over the past month, I’ve added shares of:

LVMHF

V

SCHD

I believe these are high quality stocks/funds, that will help me one day live off dividends.

In fact, based off my projections, I could live off dividend income in just 14 years!

The dividend snowball effect is undoubtedly taking place with my portfolio, all because I made the simple decision to just get started with $50 a month years ago.

And now?

My average monthly dividends is sitting at $475!

If you haven’t already, now it the time to get started.

Trust me, you’ll be glad you did

Tweet of the Week:

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

Other News…

At the end of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

This sheet was received by nearly 200 dividend investors last month. (Wow!)

If you’d like to receive this sheet at the end of this month, you can sign up here:

That’s all for now!

See you next week!

Dividendology

What core stocks would you recommend for someone getting started today? Ive just started purchasing SCHD. But seems like some of the single stocks are at all time highs which makes me pause jumping in.