June Dividend Portfolio Update 2025 🔥 🚀

New All Time Highs! 💰

Portfolio Update 📊

The first half of 2025 is officially over, and the market has proven to be wildly volatile during that time.

We went from a max drawdown of -15%, to now up over 6%.

Despite this volatility, my projected annual dividend income climbed higher every single month.

It climbs higher every month, despite what is going on the market due to 3 reasons:

New contributions

Reinvested Dividends

My holdings increasing their dividend payouts

This is exactly what causes the dividend snowball effect, and it is the reason my projected annual dividend income is now at an all time high of $6,707.

Tickerdata Independence Day Sale 🇺🇸

Celebrate freedom from manual data updates.

The first 50 people can get 30% off all annual Tickerdata plans with code ‘FREEDOM’.

✅ Pull live stock data, financials, and key metrics straight into your spreadsheets

✅ Access premium-ready templates for faster analysis

New Buy 🚀

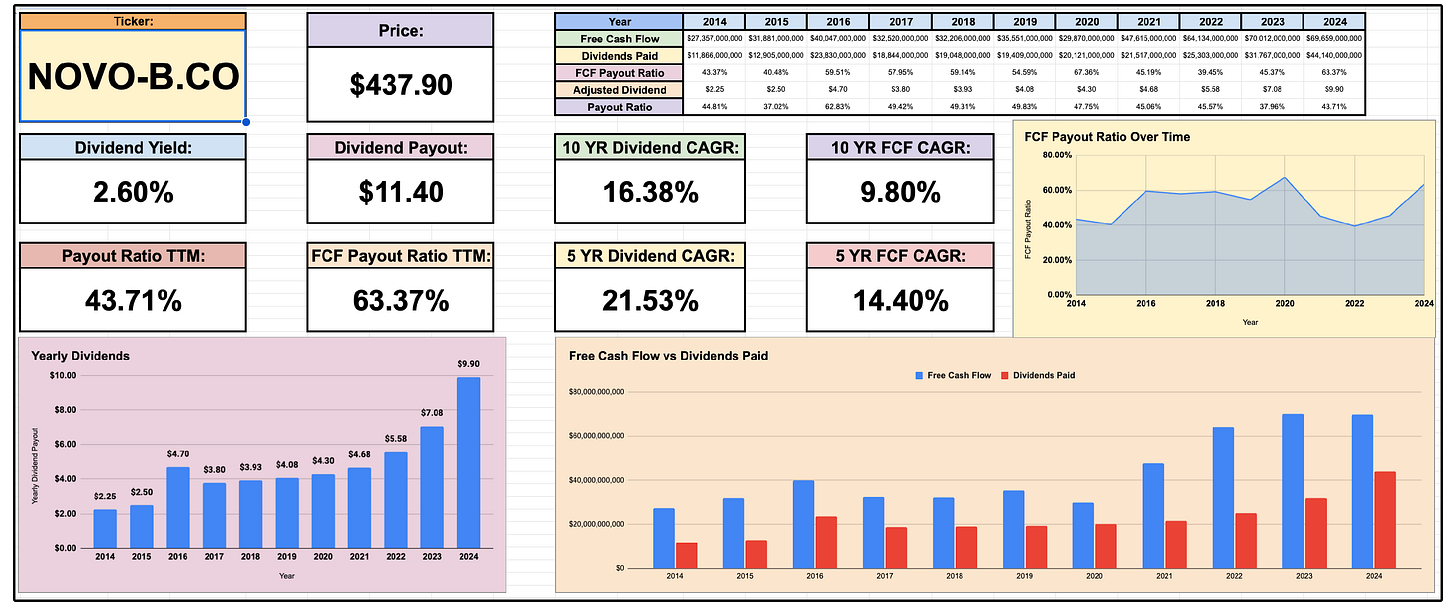

For just the second time this year, I added a new stock to my dividend growth portfolio: Novo Nordisk (NVO).

My goal is to build a portfolio I can one day use to live off dividends-

Which means I need companies with strong free cash flow growth and a long runway for dividend increases.

Novo fits the bill.

Right now, the stock yields 2.6%, with a 5-year dividend CAGR of 21.5%.

But what really caught my eye is the disconnect between price and fundamentals:

As we can see from Forecaster.biz below, The stock is down over 50% this past year, yet net income and free cash flow continue to climb.

Novo dominates the diabetes and obesity market, with a 62% share compared to Eli Lilly’s 35%, and the entire market is projected to grow 32% annually, hitting $170B by 2030.

Even after a small guidance cut, management is still projecting:

13–21% sales growth

16–24% operating profit growth

Novo trades at a forward P/E of 16.88, despite elite fundamentals:

39% ROIC

84.7% gross margins

If EPS grows at 13% annually (average per analyst estimates), and the P/E simply reverts to 22.5 by 2030 (below 10 year average), the total return could top 149%, or nearly 16.5% annually.

There are risks, especially from Eli Lilly.

But in my view, Novo has the margin profile, market leadership, and dividend growth to thrive long term.

My June Dividends 💰

In the month of June, I received $1,172.28 in dividend income.

💳 $V – $24.98

🛍️ $TGT – $10.90

💊 $JNJ – $33.34

💻 $MSFT – $28.05

🏠 $O – $29.26

🗑️ $WM – $19.11

🏥 $UNH – $31.17

🏦 $BAC – $23.68

📊 $TROW – $12.78

📡 $AVGO – $18.58

🍕 $DPZ – $16.16

📈 $SCHD – $924.27

It’s important to remember that this $1,172.28 in dividend income wasn’t achieved by chasing any unsustainable high yields, but by seeking our quality companies that will continue to grow their dividend payouts over time.

There are instances where a properly implemented high yield strategy can be quite effective-

But at this point in the game, dividend growth will still be better at maximizing dividends over the long term.

If you want to learn more about how to safely implement high yield strategies, you should read this.

🛠️ P.S. – Something BIG is Coming…

Dividendology is about to evolve into a full-scale investment platform. 🚀

Over the years, two questions have come up more than almost any others:

“How would you invest right now if you were starting from scratch?”

“What would you buy if you were building a high-yield portfolio today?”

Both are great questions, because how you invest depends entirely on where you are in your dividend journey.

So instead of just answering…

I’m going to show you.

I’ll be launching two real-money portfolios on Dividendology.com:

💰 The Dividend Growth Portfolio – Built from $0, showing exactly how I’d begin investing today if I were starting from scratch

🧾 The High-Yield Portfolio – Designed to maximize immediate dividend income (think 8%+ yields) without sacrificing capital

These aren’t mock portfolios. I’ll be investing real money, tracking every move, every dividend, and every update with full transparency, just like I always have.

And these portfolios are only the beginning.

Behind the scenes, I’ve been pouring in countless hours (and a lot of capital) into what will soon become the Dividendology Database.

This will be a game-changing platform for income investors.

You’ve already seen a glimpse with the Covered Call ETF database (featuring portfolio coverage, option moneyness, and more coming soon).

But the full platform will go much deeper — including research and data on:

🧠 Owner-Operator Dividend Growth Stocks

🥇 Super Investor Buying Activity

💼 BDCs

🏢 REITs

💸 Covered Call ETFs

💰 Preferred Shares

📊 High-Yield Opportunities

… and a lot more.

Most investors have no idea just how many quality dividend opportunities are out there, or how to properly evaluate them.

This platform is being built to change that.

Stay tuned!

Check out these resources:

Tickerdata 🚀 (Independence Day Sale! Code: ‘FREEDOM’ for 30% off premium annual plans)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($60 off!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Hello sir. I would like to start my first long term portfolio from scratch. How would you suggest I start my journey and does your subscription include your portfolio so I can look into the stocks myself using ticker data. Tia.

Absolutely fantastic news! Super pumped to see the new platform — can’t wait! You’ve been doing an incredible job consistently, and it just keeps getting better. Keep up the amazing work🔥