🧾 List of Most Upside Dividend Stocks

Wall Street Price Targets Revealed 🎯

Every month, I compile data on the dividend stocks with the most upside based on Wall Street analysts price targets.

Members will get access to the full list every month, as well as all other Dividendology features.

Let’s dive in.

1. ⚡ Broadcom (AVGO)

Wall St. Price Target: $462.30 | Upside: 36.05%

Does the AI boom have the ability to continue into 2026?

Wall Street still seems to think so, even with the over 10% sell off of Broadcom over the last week after releasing their latest quarters earnings.

While many investors think of AVGO as “just another semiconductor company,” that framing completely misses what makes this business special.

Broadcom operates a highly diversified, cash-generating platform across two core segments:

Semiconductor Solutions (~61% of revenue)

AVGO designs custom silicon (XPUs/TPUs), high-speed networking, switches, optical components, and connectivity chips that are critical to hyperscale AI data centers. This includes industry-leading products like Tomahawk switches and custom AI accelerators used by companies like Google, Meta, and Anthropic.Infrastructure Software (~39% of revenue)

This segment includes VMware, mainframe software, and enterprise infrastructure tools that are deeply embedded in corporate IT stacks. These products carry extremely high margins and recurring revenue characteristics.

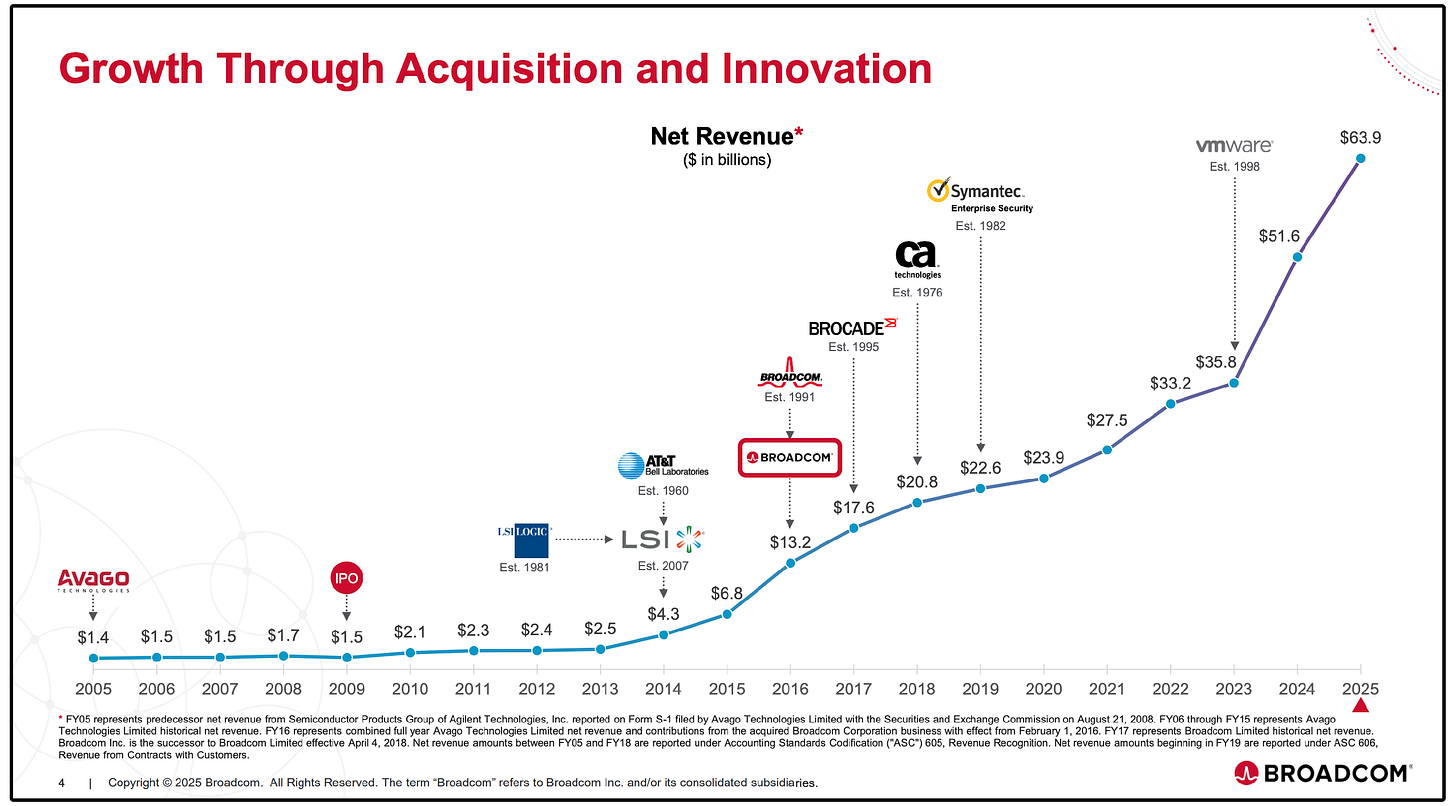

Much of Broadcom’s growth over the past couple of decades has been from successful acquisitions.

Before their most recent acquisition (VMware), Broadcom sold:

Silicon (chips)

Networking (switches, interconnects)

After acquiring VMware, Broadcom moved beyond just selling the physical building blocks of data centers and into controlling ‘the brain’ that sits on top of that hardware.

Instead of only providing chips and networking equipment, Broadcom now owns the software that determines how computing workloads are deployed, managed, and optimized across an organization’s infrastructure.

VMware’s software decides which applications run on which servers, how computing and memory resources are shared between different workloads, how data is routed efficiently across systems, and how the entire environment expands or contracts as demand changes.

This means Broadcom is no longer just supplying the tools that power data centers, but is also helping control how those tools are used every day, which dramatically increases customer dependence, switching costs, and long-term pricing power.

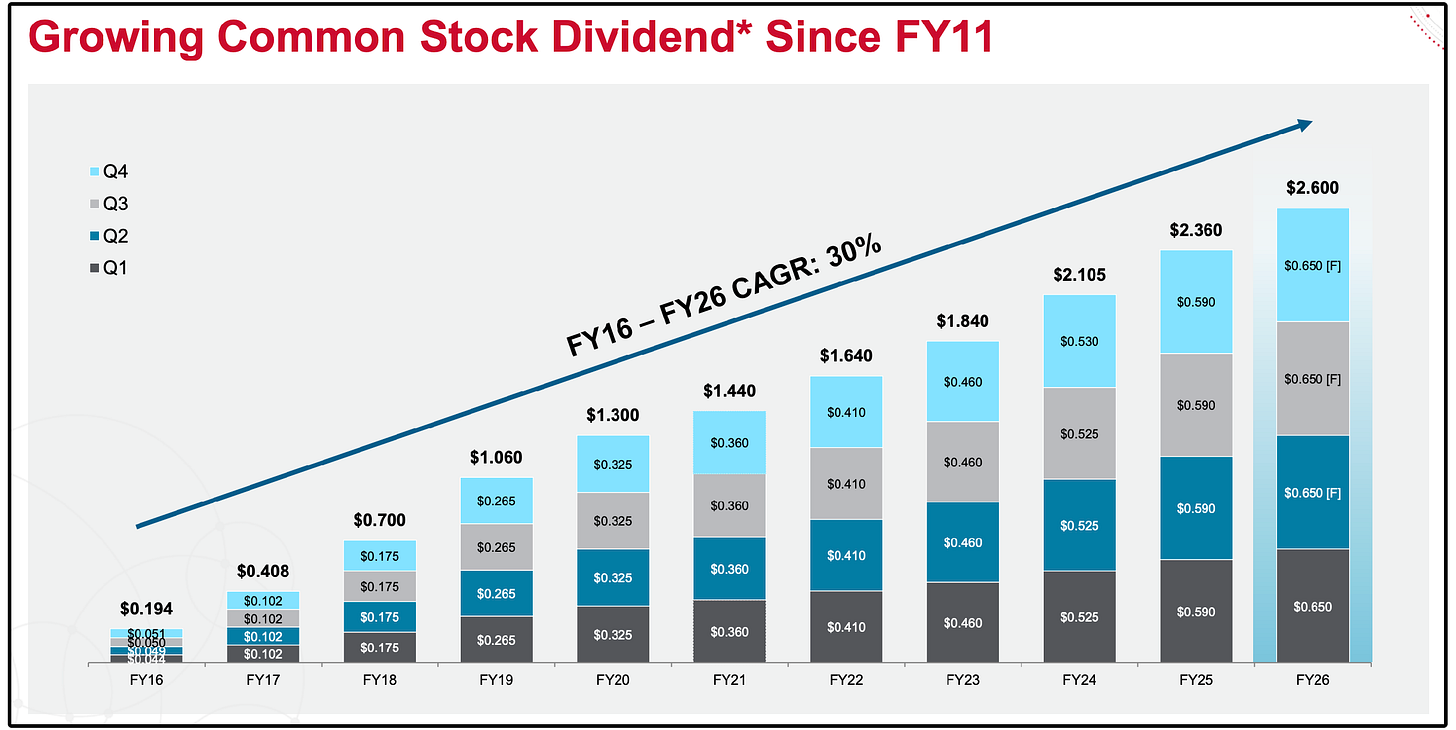

This strategy of acquisitions, combined with the AI boom, has led to rapid free cash flow growth and, in turn, incredible dividend growth.

Their free cash flow is projected to continue to grow at over 47% over the next year, and at around 30% annually over the next 5 years.

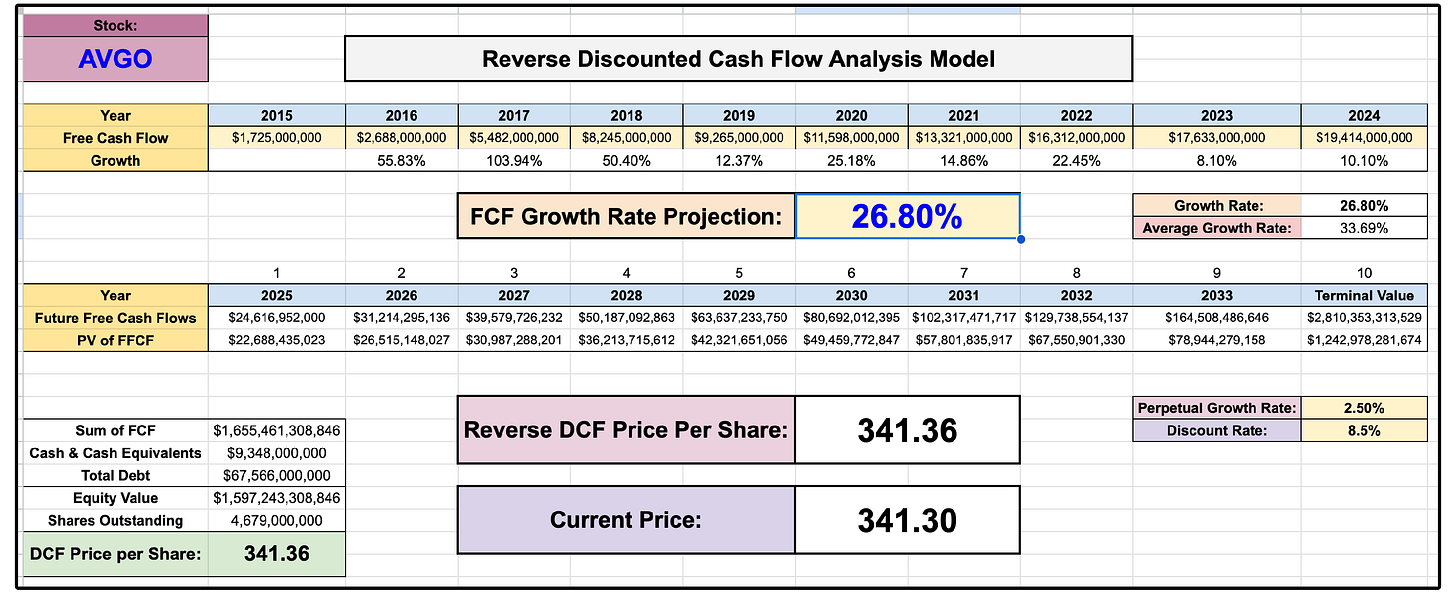

From a valuation perspective, the market is currently pricing in a 26.8% free cash flow compounded annual growth rate over the next decade.

2. 🏢 Digital Realty Trust (DLR)

Wall St. Price Target: $199.00 | Upside: 31.73%

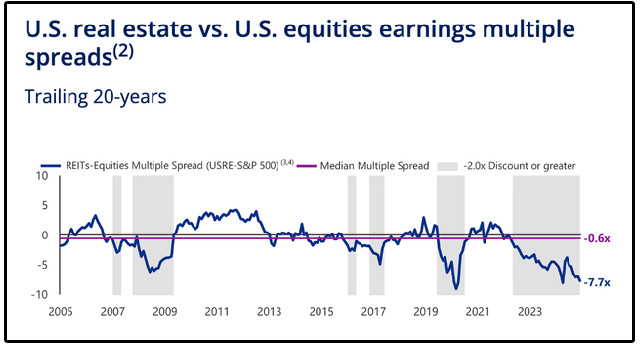

The REIT sector as a whole continues to trade at one of its lowest valuations relative to U.S. equities in decades.

But DLR is not your typical REIT.

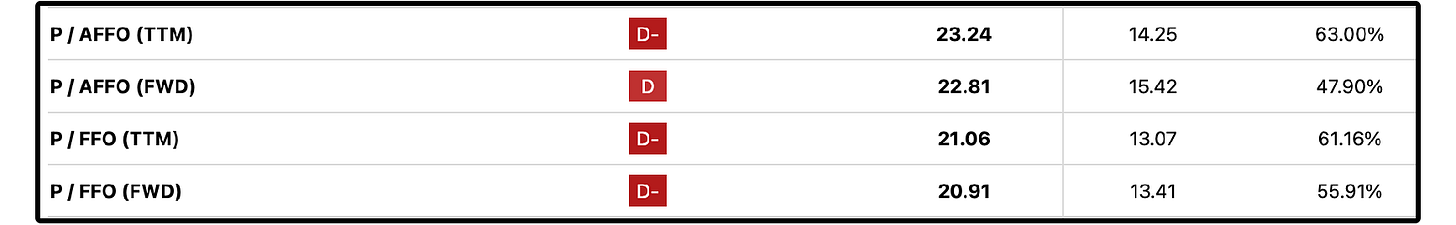

Most REITs are trading at a significant discount to their historical valuation multiples, but DLR is currently trading 40%-60% above their historical valuation multiples.

This is a rarity in the REIT market right now, so the question is… Why?

Valuation multiples are primarily determined by the growth rate of future earnings, and in the case of REITs, adjusted funds from operations per share.

With that being said, DLR is projected to grow AFFO per share at one of the fastest rates out of the majority of REITs in the market.

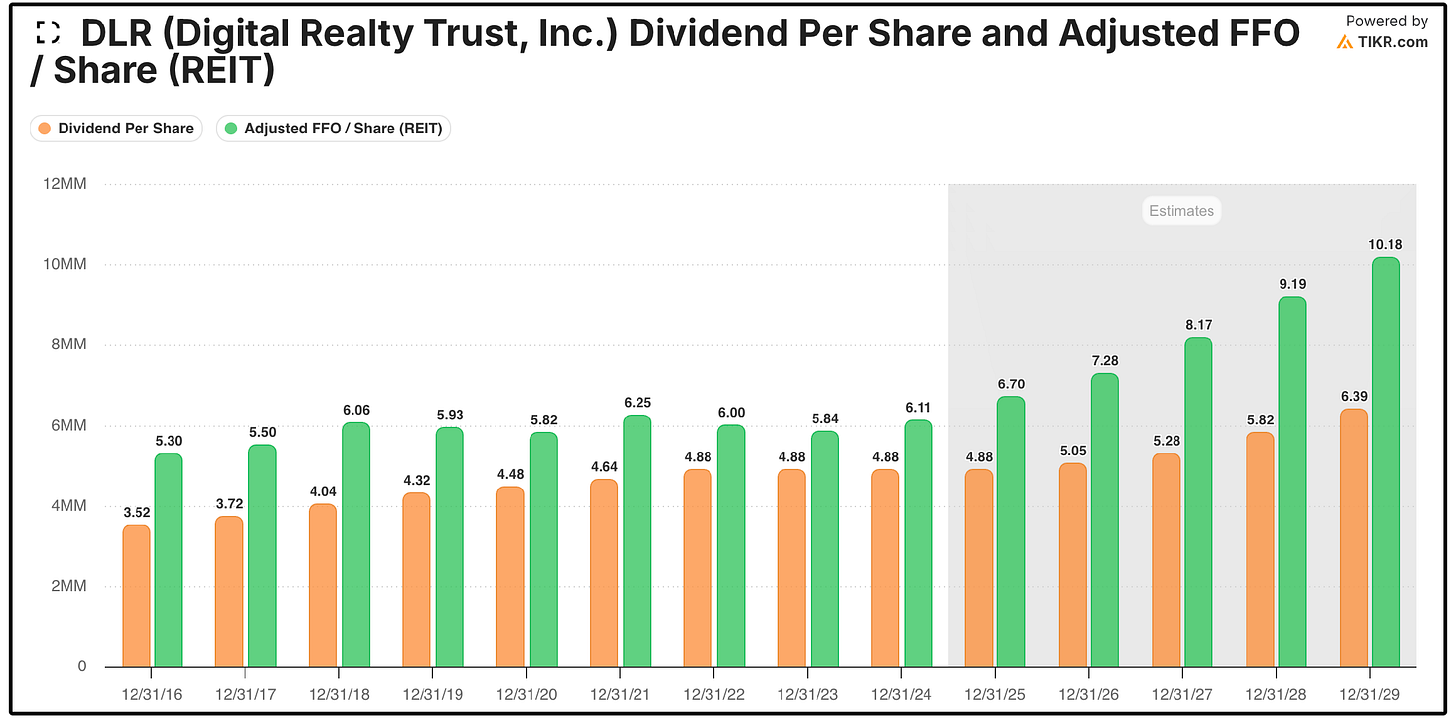

Here’s the projected AFFO per share each year over the next few years:

2025: $6.70

2026: $7.28

2027: $8.17

2028: $9.19

Keep in mind, growing AFFO per share at a high rate means they have the ability to grow dividends at a high rate as well.

DLR is a global data center REIT, owning and operating more than 300 data centers across 25+ countries focusing on mission-critical facilities that house servers, networking equipment, and cloud infrastructure for some of the largest technology and enterprise customers in the world.

If data needs to be stored, processed, or moved securely and reliably, Digital Realty is often involved.

They own data centers spanning across 25+ countries, essentially making them the most geographically diversified in the industry.

This geographic diversity is important for DLR when you understand how data center REITs operate.

Their large customers don’t want a single data center, they want:

Interconnected campuses

Redundant locations for uptime and disaster recovery

Low-latency access across regions

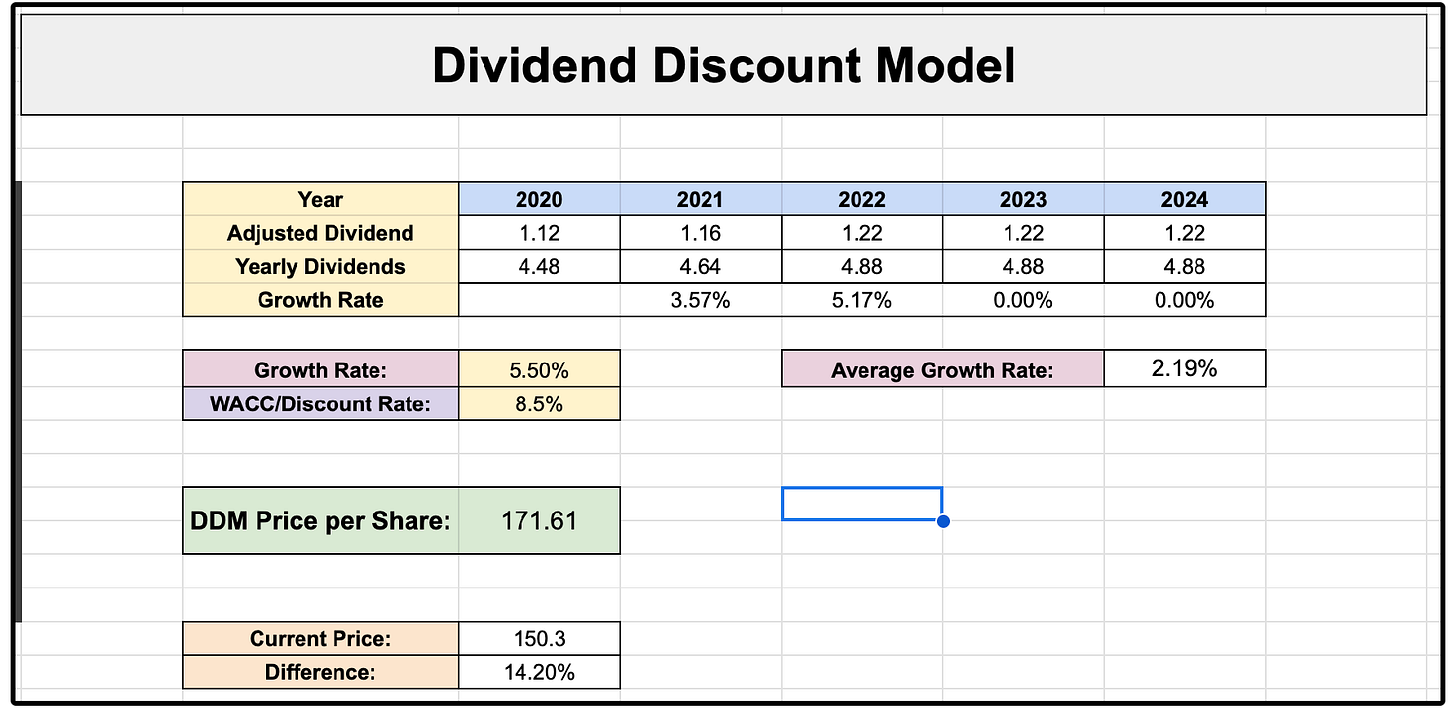

Assuming 5.5% dividend growth moving forward, the company has over 14% upside.

This is simply a REIT poised to majorly benefit from the AI surge and AI spending.

A starting yield of 3.19% is quite attractive for a REIT that’s growing AFFO per share and dividends the fastest in the industry.

3. 📊 Interactive Brokers (IBKR)

Wall St. Price Target: $80.00 | Upside: 25.09%

You may have heard of Interactive Brokers because it’s the broker we use at Dividendology.com to track our Dividend Growth and High Yield Portfolios.

You can check out Interactive Brokers here:

But have you ever considered Interactive Brokers as a potential investment?

They’ve quietly outperformed the market over the past 5 years, growing over 333%.

Despite this, Wall Street still sees 25% upside.

Their prior growth and future projected growth are due to the fact they’ve been able to take advantage of secular trends.

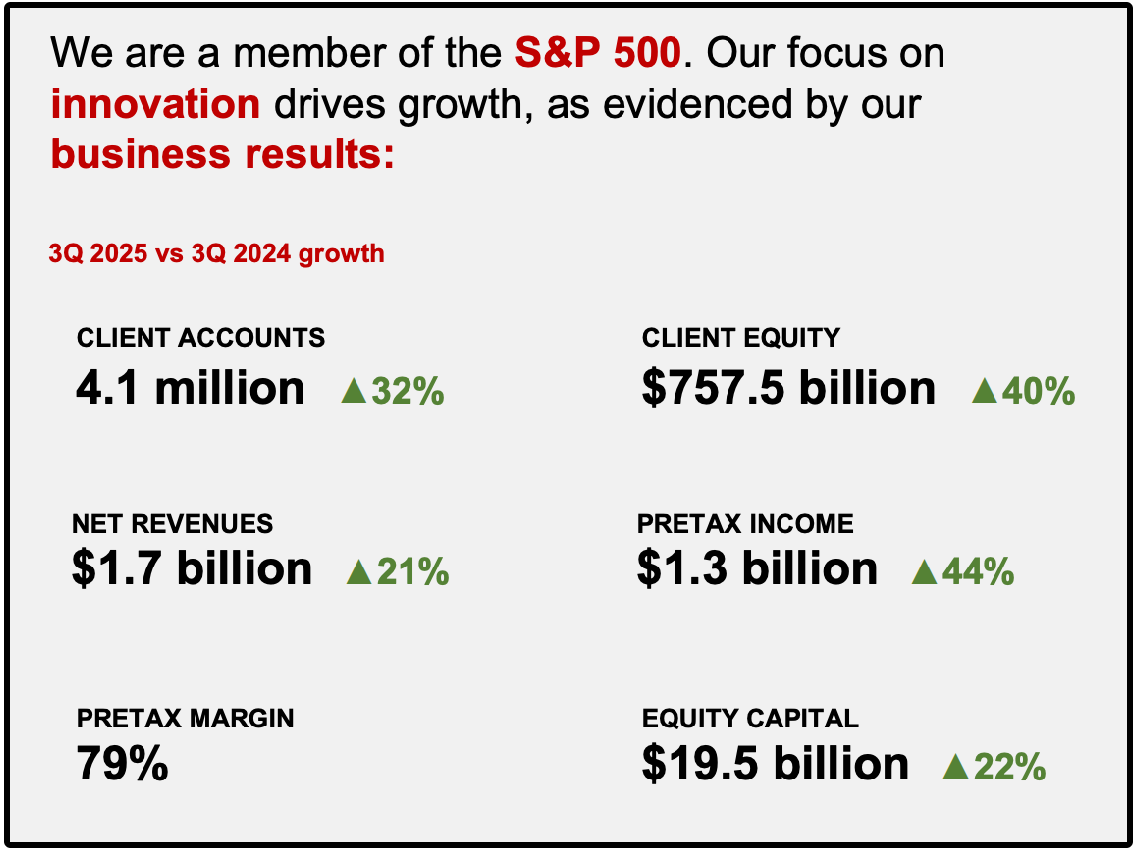

Over the last year, their client accounts have grown 32%!

But this is part of a long secular trend that IBKR has been perfectly positioned to take advantage of.

Global participation in financial markets continues to expand as investing becomes more digitized, international, and self-directed.

Retail investors are more active than at any point in history, institutions demand faster and cheaper execution, and capital markets are becoming increasingly global.

IBKR operates a fully automated trading platform that spans:

Stocks, options, futures, forex, bonds, and funds

Over 150 markets across 30+ countries

Multiple account types, including retail, institutional, and prime brokerage

Because the platform is highly automated, IBKR runs at far lower operating costs per account than traditional brokers.

This is why client accounts have grown at a staggering 33% CAGR since Q3 of 2020.

Unlike many brokers that rely heavily on payment-for-order-flow, IBKR earns a substantial portion of revenue from net interest income.

Client cash balances, margin loans, and securities lending generate predictable income streams that directly benefit from higher interest rates.

So as client accounts grow, their interest income grows.

This has been accelerated by the fact we’ve been operating in a higher interest rate environment in the last 3 years.

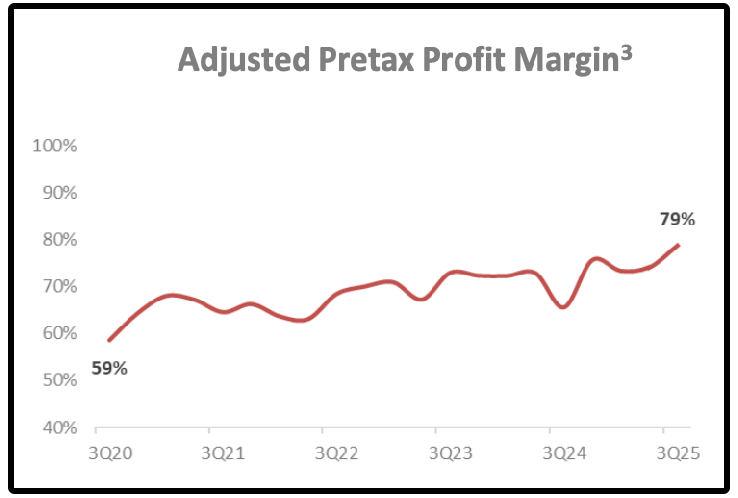

On top of this, increased trading from retail has contributed to higher profit margins for IBKR in the last few years.

Growing client accounts, combined with higher interest rates, increased trading activity and higher profit margins have been the perfect conditions for IBKR to compound at a high rate.

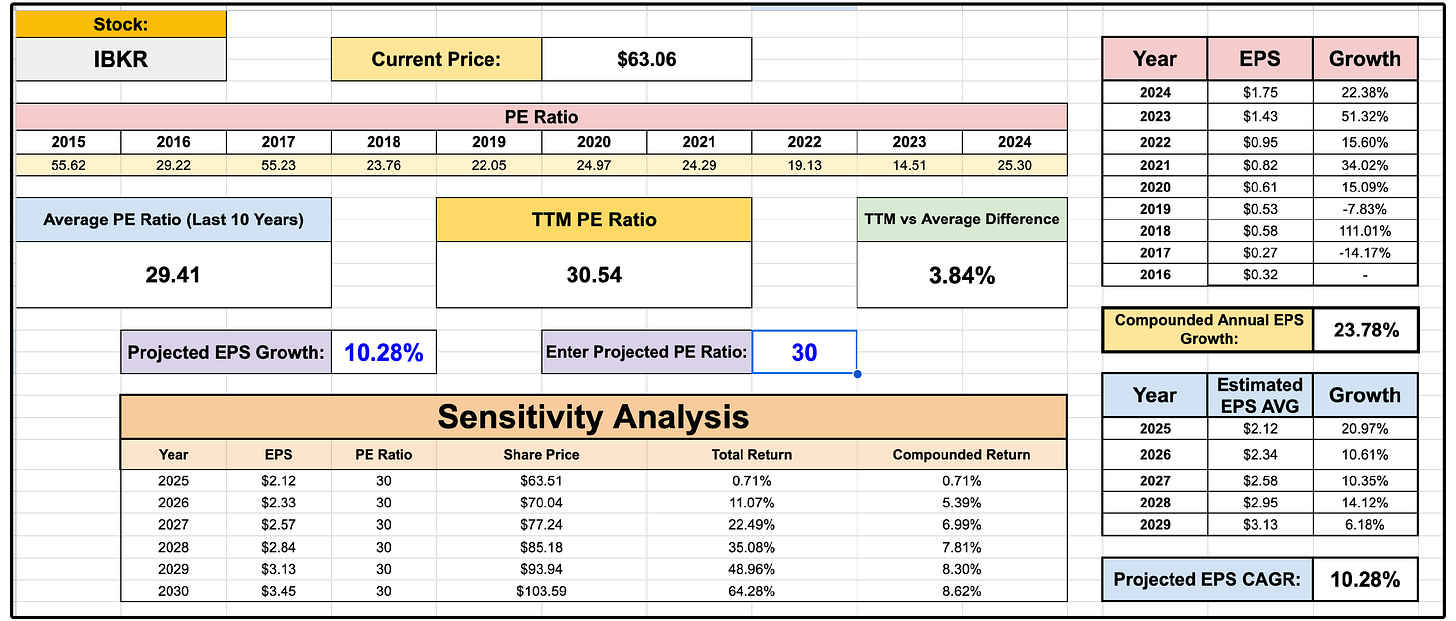

For IBKR to sustain returns of around 8.5% annually, they would need to maintain their 30x PE multiple and achieve the average analyst EPS growth rate projection of 10.28%.

Now, let’s dive into the full list of dividend stocks with the most upside according to Wall Street.

As a reminder, this list is updated monthly, and is always available on Dividendology.com by visiting our database.