🧾 List of Most Upside Dividend Stocks

Wall Street Price Targets Revealed 🎯

One of the most valuable things about being a Dividendology member?

The Dividendology Database.

Traditional softwares don’t provide the essential information on income assets like Covered Call ETFs, BDCs, and REITs.

That’s why I’ve invested over $10,000 into building out the Dividendology Database, and taking the time to make manual calculations to update it every month.

And today, we’re adding a new feature to the database!

Every month, I’m updating a sheet that has all Wall Street analyst price target estimates-

And then compiling that data to list the dividend stocks with the most upside based on those analyst estimates.

Members will get access to the full list every month, as well as all other Dividendology features.

I’ve had incredible feedback from Dividendology members lately, and I just wanted to say…

Thank you! The best is yet to come.

Now, let’s take a look at some of top rated Wall Street stocks.

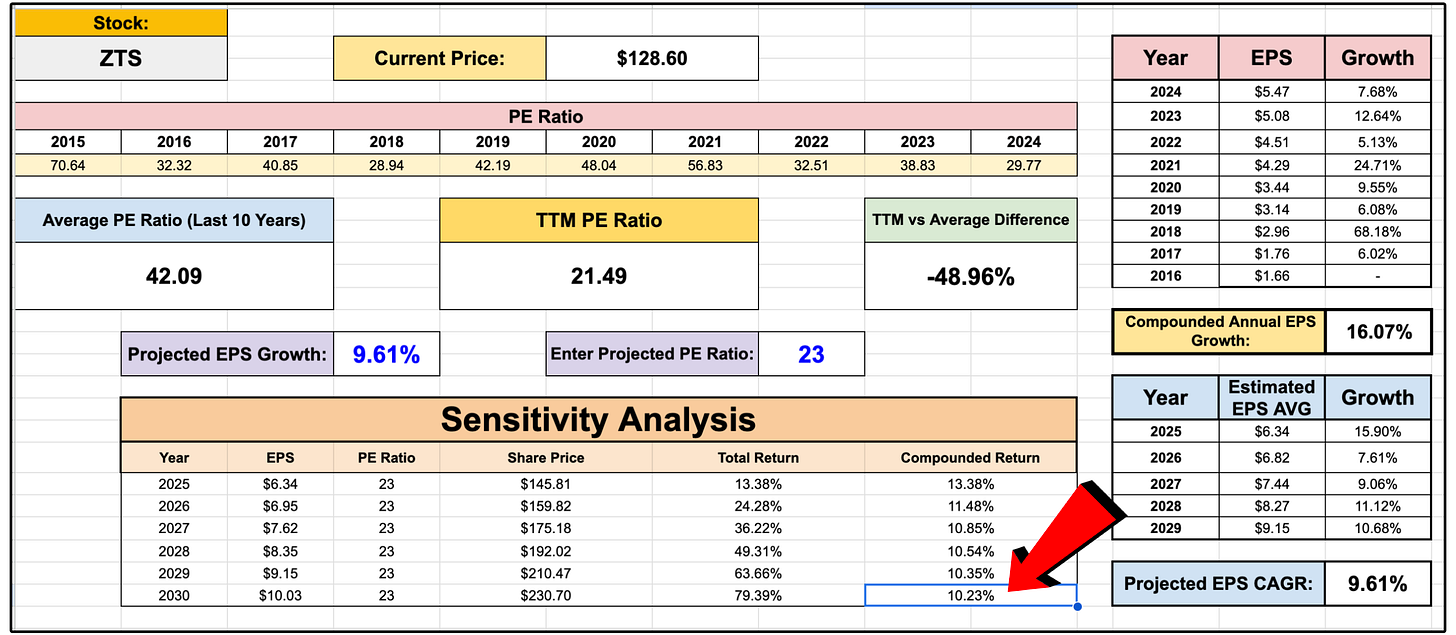

1. 🐾 Zoetis (ZTS)

Wall St. Price Target: $167.25 | Upside: 37.11%

Zoetis is the world’s largest animal health company, providing medicines, vaccines, diagnostics, and treatments for both companion animals (pets) and livestock.

The business is split into two major segments:

Companion Animals (68% of revenue)

Livestock (32% of revenue)

Zoetis is essentially the Pfizer of the animal world-

But with higher margins, less regulatory complexity, and more durable demand trends.

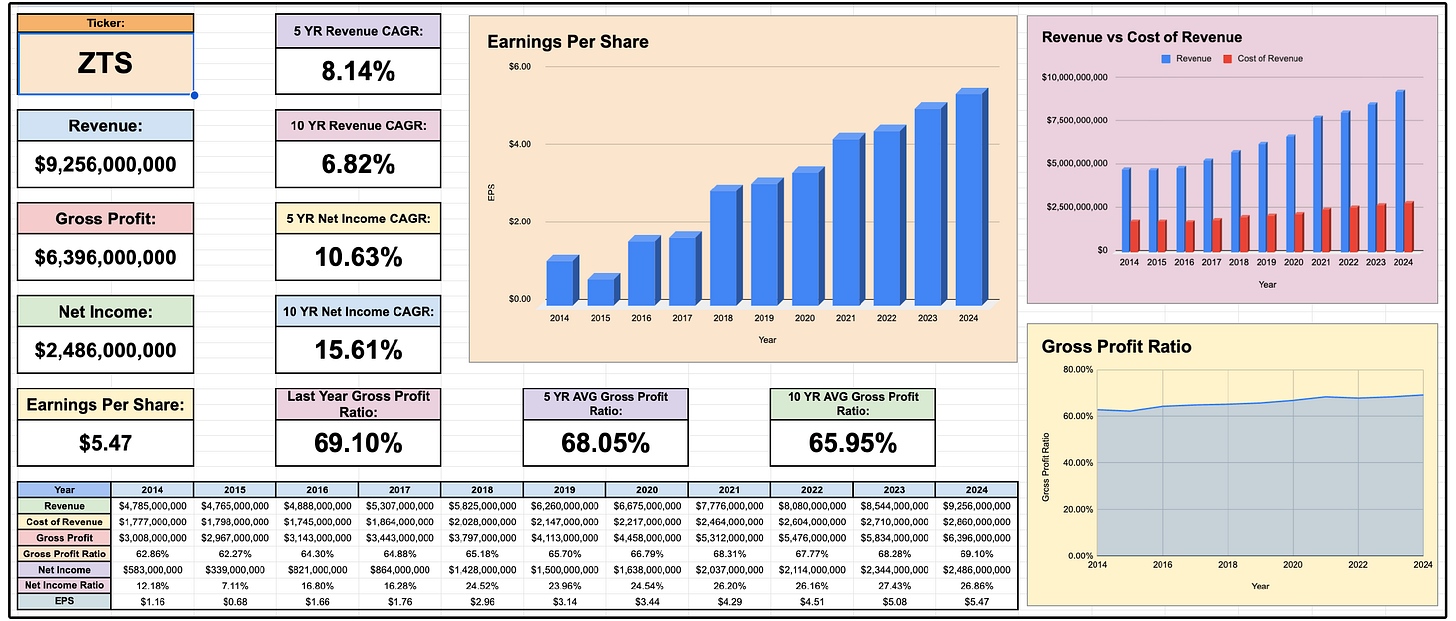

Their 5 year revenue CAGR is above 8%, and is aided by gross margins going from 65.95% to 69.10% over the past decade, leading to faster earnings growth.

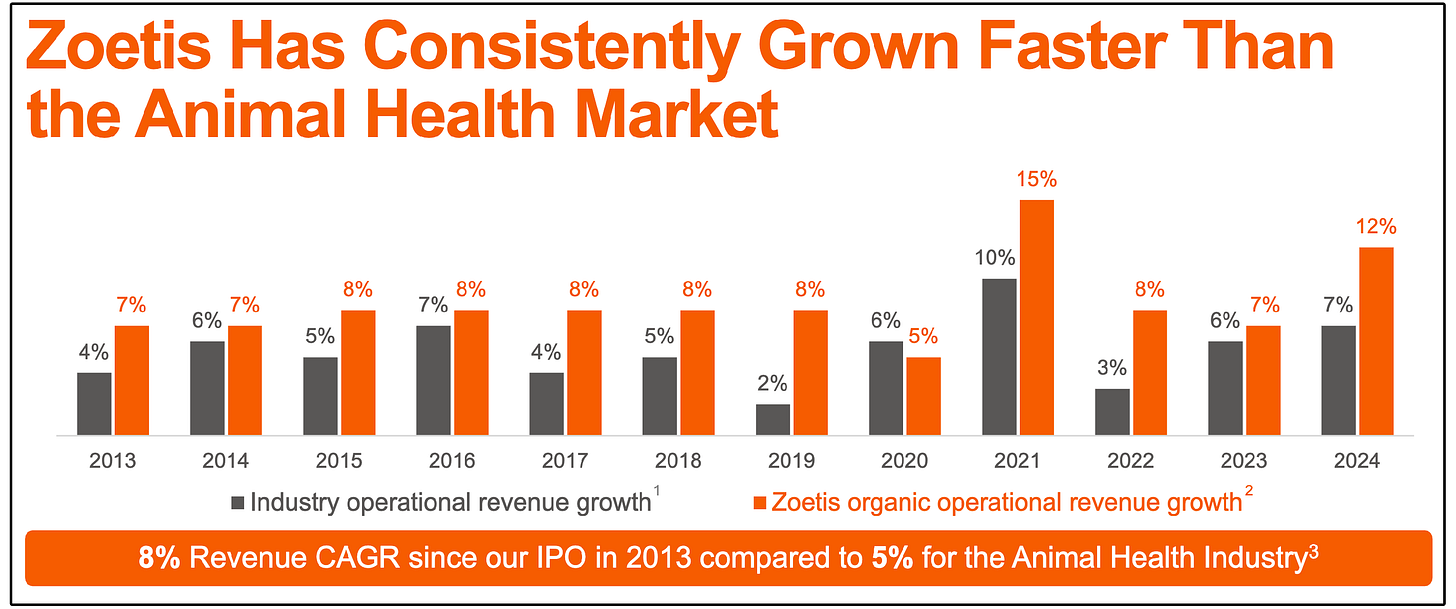

Zoetis has outgrown the animal health industry every single year for more than a decade.

Since their IPO in 2013-

Zoetis has compounded revenue at 8% per year

The overall animal health industry has grown at 5% per year

It’s easy to see that the secular demand will continue to grow in the future, and the demand drivers are powerful.

A quick analysis of this industry will show:

Rising pet ownership

Higher spending per pet

Global growth in protein (cattle, poultry, pork)

The company has a low yield of 1.56%, but the 5 year dividend CAGR is above 20%!

And with the com[any selling off 28% in the last year, forward looking returns are starting to look much more attractive.

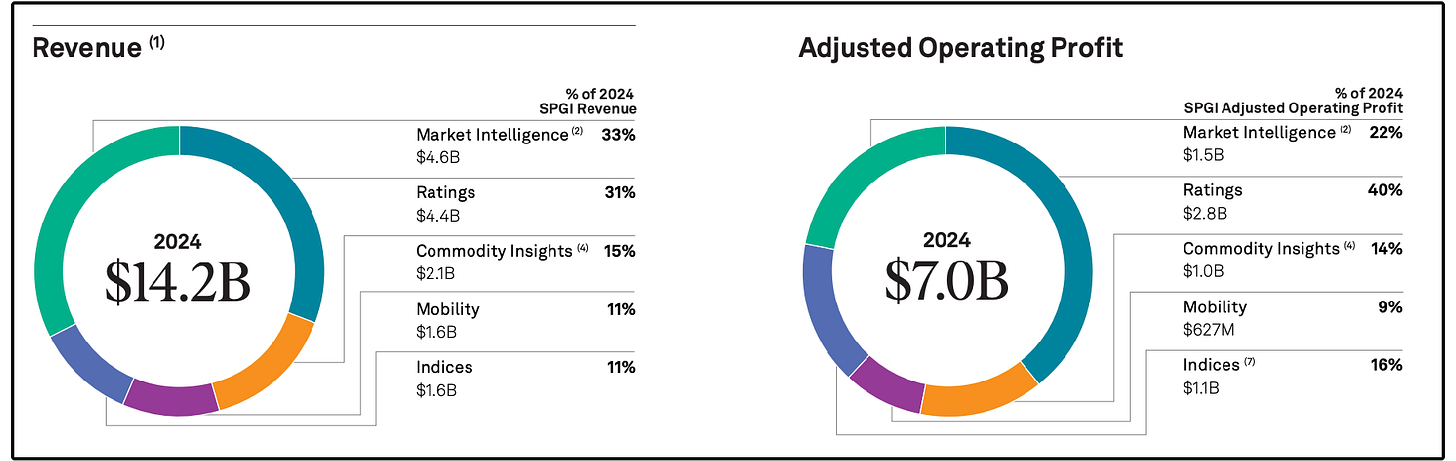

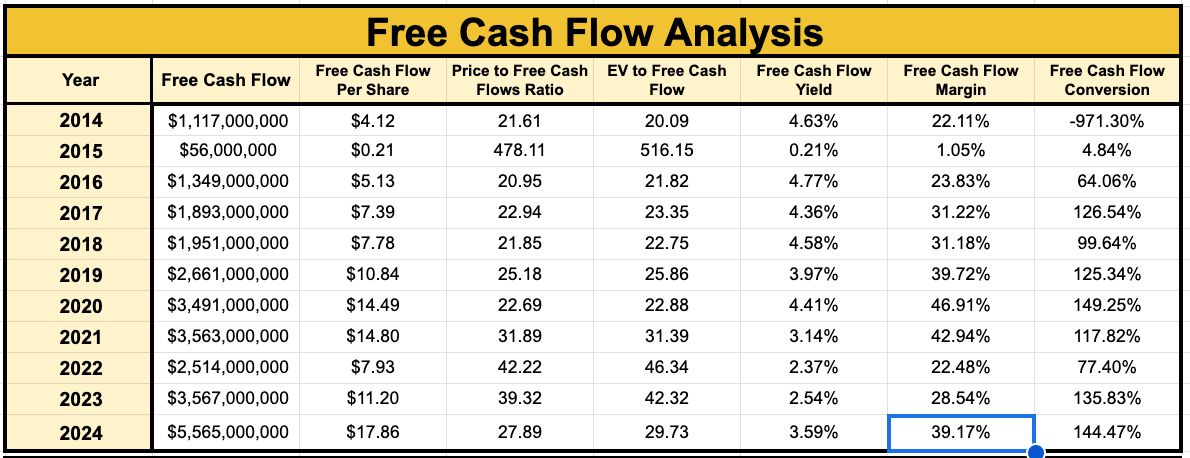

2. 🧮 S&P Global (SPGI)

Wall St. Price Target: $611.40 | Upside: 24.52%

I’m a big fan of S&P Global in general, but especially so at current prices.

SPGI provides essential financial infrastructure through four main segments:

S&P Global Ratings – Provides credit ratings for corporate, sovereign, and structured debt. (~31% of revenue, ~40% of operating income)

S&P Dow Jones Indices – Home to the S&P 500 and thousands of benchmarks used globally by ETFs, index funds, and pension plans. (~11% of revenue, ~16% of operating income)

S&P Global Market Intelligence – Offers platforms like Capital IQ that analysts, bankers, and corporations use for market research and data. (~33% of revenue, ~22% of operating income)

S&P Global Commodity Insights & Engineering Solutions – Delivers proprietary energy, commodities, and industrial data analytics. (~15% of revenue, ~14% of operating income)

I’ve said many times that investors pay higher valuation multiples for companies that offer two things:

Strong earnings growth

Highly predictable earnings and cash flow

SPGI shines because its cash flows are among the most reliable in the entire financial sector.

In 2024, an incredible 95.9% of its revenue was recurring, providing stability that few companies can match.

And with free cash flow margins of 39.17%, SPGI turns almost $40 of every $100 in revenue directly into cash.

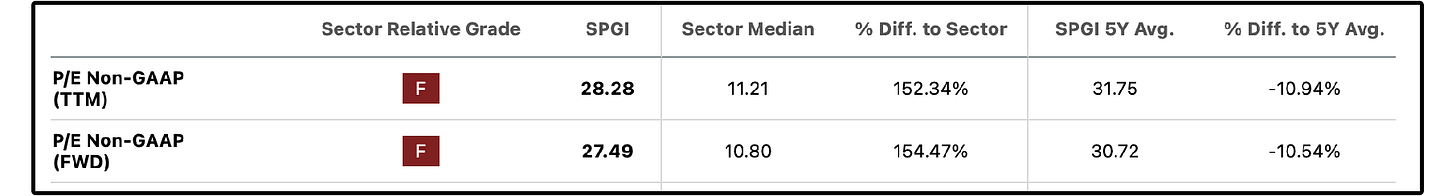

This company has historically traded at a high premium due to its quality characteristics, and I believe that will soon be the case again in the near future.

But as for now, their trading over 10% below their historical valuation multiples.

3. 💼 Intuit (INTU)

Wall St. Price Target: $829.33 | Upside: 27.71%

Intuit is one of the most dominant software companies in the world.

There is a high likelihood that you’ve used or at least heard of their tools like TurboTax, Credit Karma, Mailchimp, and QuickBooks.

All of these softwares are great and growing at healthy rates, but what is happening under the hood is far more interesting in my opinion.

It’s the ecosystem.

This is a company that has embedded itself into the financial lives of:

Individuals

Small businesses

Accountants

Freelancers

Growing enterprises

And once you’re plugged into Intuit’s ecosystem, you rarely leave.

And due to the ‘digitization’ of the economy and the growth of AI, the barriers to entry of creating a business or even operating as a freelancer are lower than ever, which brings more people into their addressable market.

With their addressable market growing, and current customers remaining sticky, Intuit has been able to achieve one of the most beautiful revenue per share charts that you’ll see today.

As discussed by their management team recently, their entire product strategy is essentially AI-driven:

Automated bookkeeping

Predictive cash flow forecasts

Smart invoicing and payment reminders

AI-guided tax return optimization

Personalized lending recommendations inside Credit Karma

Automated marketing and segmentation inside Mailchimp

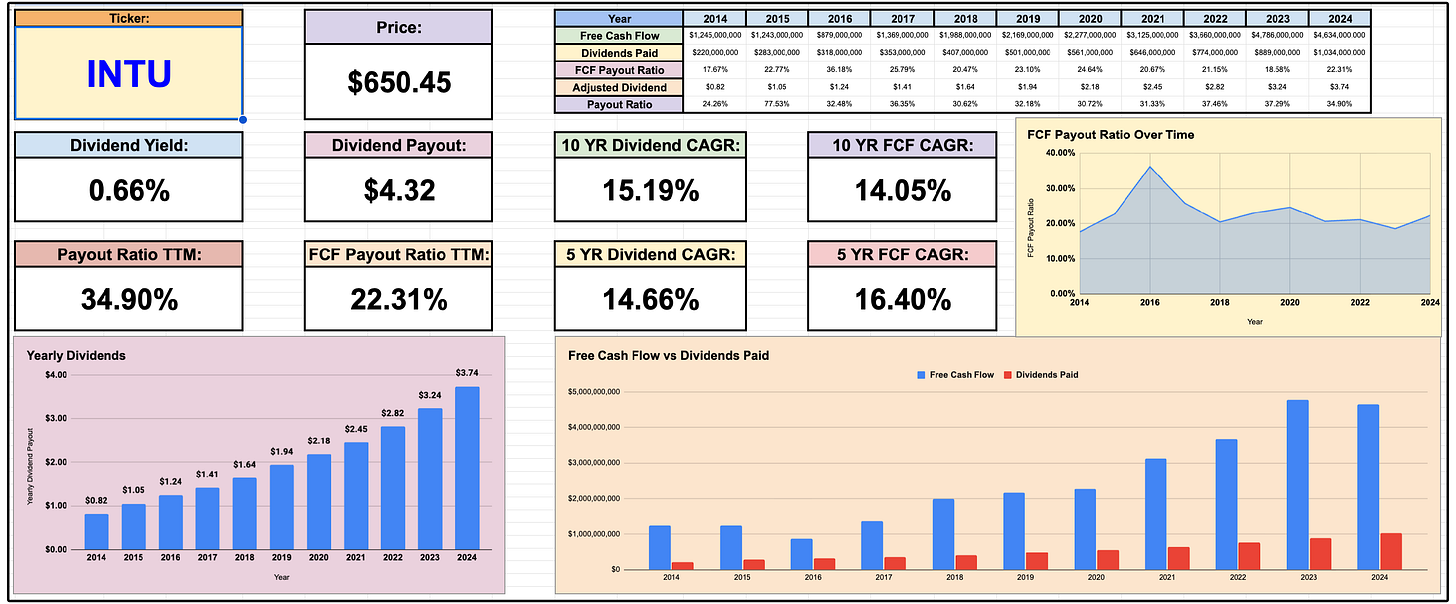

Free cash flow has grown at above 16% annually for the last 5 years, which is even faster than the previous 5 years.

Not to mention, they’ve been able to grow their dividend at above 15% annually for the past decade without seeing any meaningful increase in the free cash flow payout ratio.

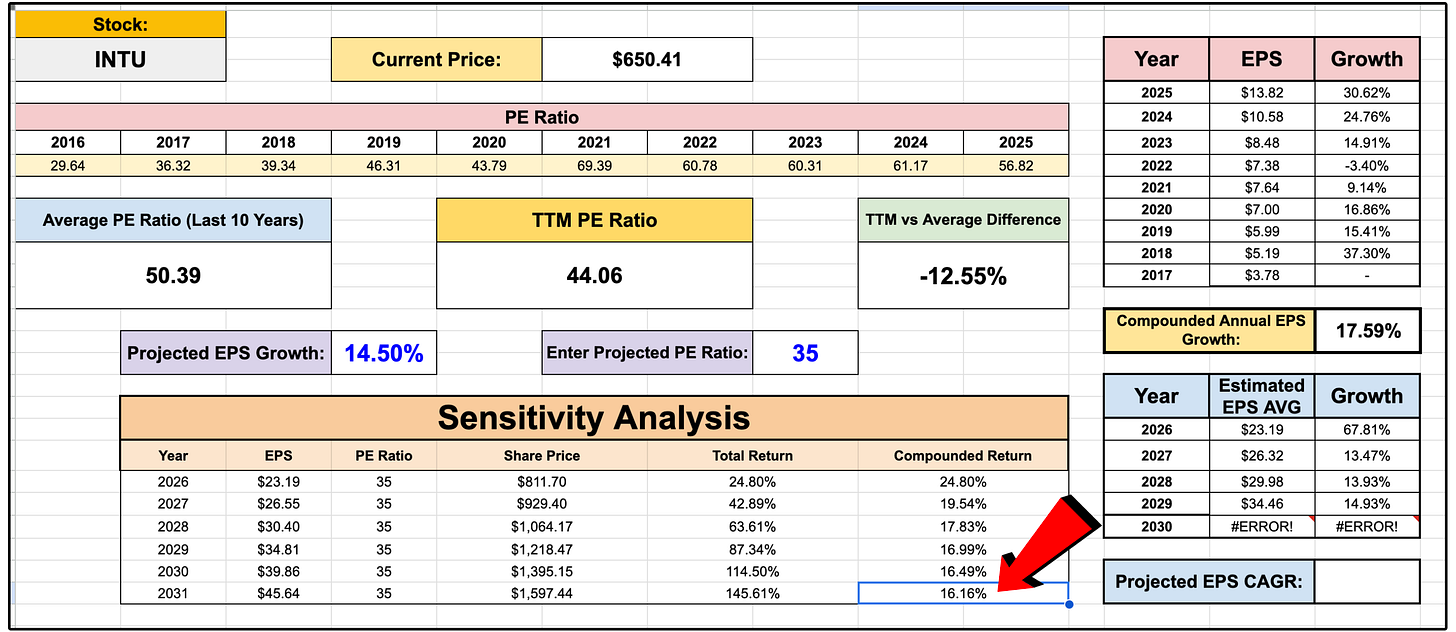

Like SPGI, the company has historically traded at premium valuations, which is exactly what I would expect of a company growing free cash flows at 16% that has a subscription model business creating predictable cash flows.

But Intuit is currently looking like a quite nice play from a risk/reward perspective.

They’re already trading over 12.5% below their historical valuation multiples, and even if the valuation multiples continue to drop significantly (as we see modeled out below)-

They still easily have market outperformance potential.

Now, let’s dive into the full list of dividend stocks with the most upside according to Wall Street.