🏆 List of Undervalued Dividend Stocks (November '25)

These Stocks are Undervalued! 🔥

At the beginning of each month, I send out a spreadsheet that lists out the dividend stocks that I believe to be undervalued.

This is the end result of 100’s of hours of research every month.

It’s time to dive in.

🔍 Quick Market Update

I’m not a believer in making short term market predictions-

But you can’t deny that we’re currently operating under interesting circumstances.

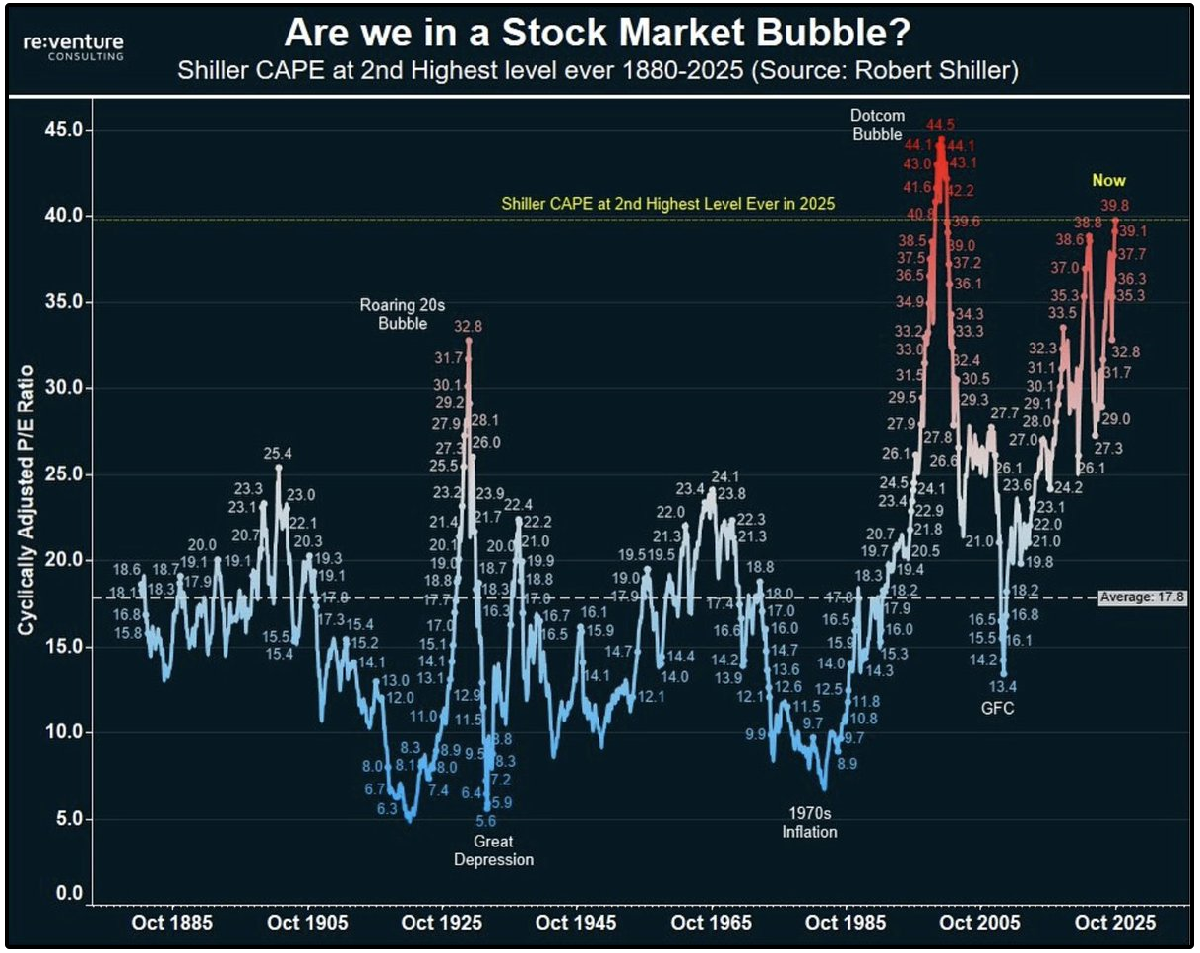

When you zoom out over the last 140 years of market history, the data tells a clear story-

Valuations have only reached today’s levels twice before:

The Dot-Com Bubble (2000)

The Post Covid Boom (2021)

However, that’s not to say the run up can’t continue.

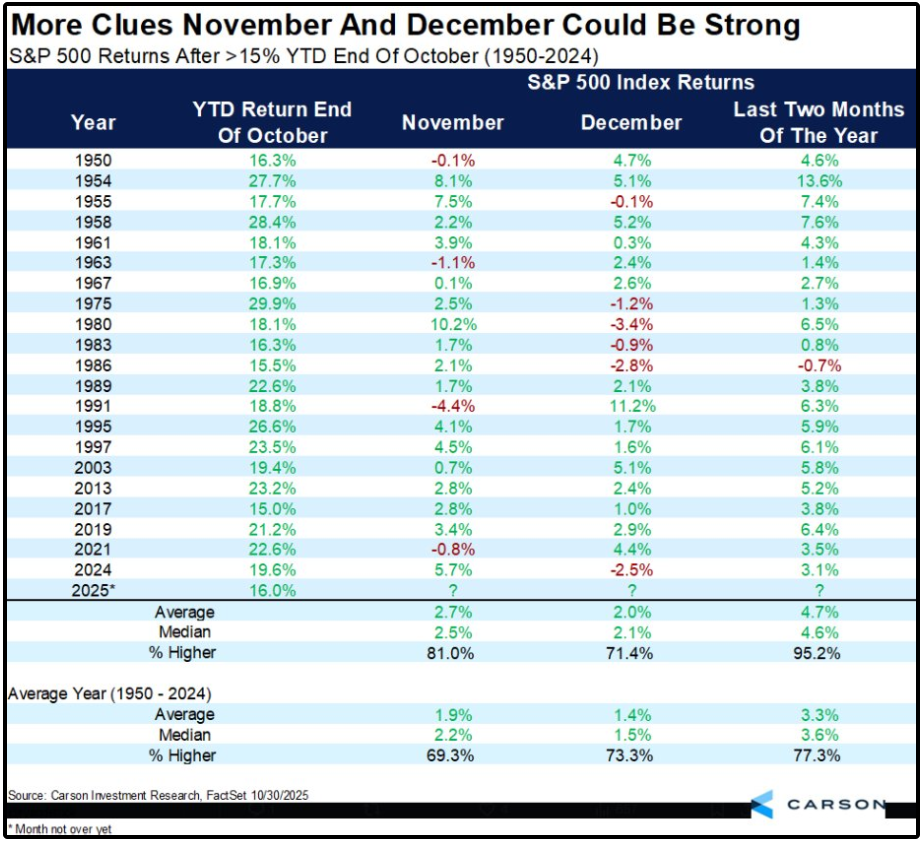

The S&P 500 is currently up over 16% year to date.

When the S&P 500 is up 15%+ by the end of October, the last two months of the year tend to stay strong.

From 1950–2024:

Avg. Nov gain: +2.7%

Avg. Dec gain: +2.0%

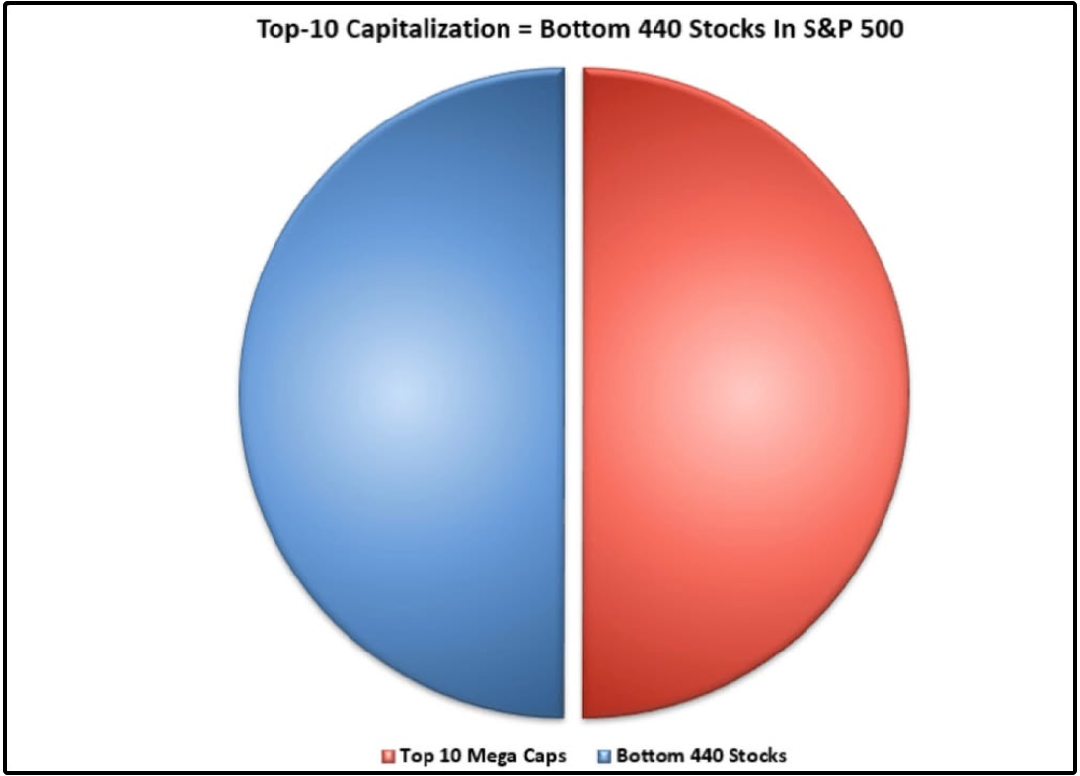

Keep in mind, much of the valuation run up we are seeing is simply due to an increase in tech stock valuations.

The combined market cap of the top 10 stocks in the S&P 500 is now equal to the combined market cap of the bottom 440 stocks.

Buying the S&P 500 now makes you less diversified than ever.

This is a major risk to passive index investors-

But this is also a major advantage to active investors.

It means there are still opportunities in the market.

Fortunately, our strategy changes very little based on market conditions.

We are looking to buy stock below their intrinsic value, that are still growing their intrinsic value.

With the Fear & Greed index currently in ‘Fear’, now is a great time to take advantage.

Let’s dive into the opportunities.

1. 💳 Mastercard (MA)

Mastercard is essentially a global payments network that connects consumers, merchants, banks, and governments across more than 210 countries.

They earn fees every time a transaction is processed through their network.

The end result is an incredibly ‘capital-light’ business model:

2024 Gross Profit Ratio: 76.31%

2024 Return on Invested Capital: 44.41%

Mastercard is also the ultimate hedge against inflation.

As prices rise due to inflation, the fees Mastercard collects naturally increase, since they’re based on a percentage of each sale.

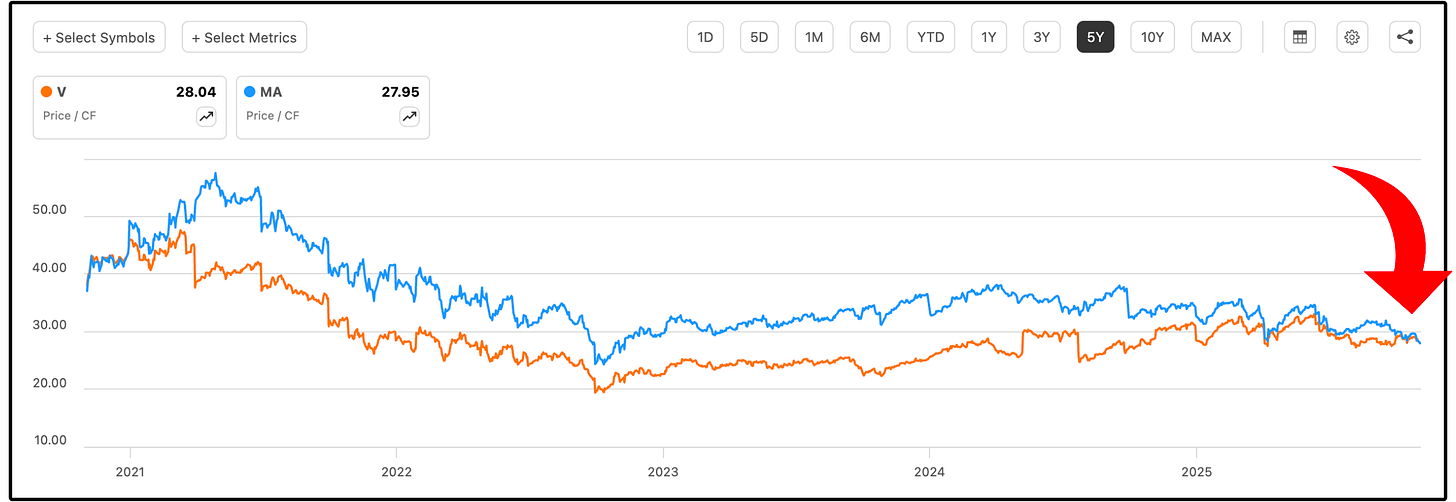

In regards to valuation, something rare is currently happening to Mastercard.

For the first time in 5 years, Mastercard is now trading at a lower price to cash flow ratio than their peer, Visa.

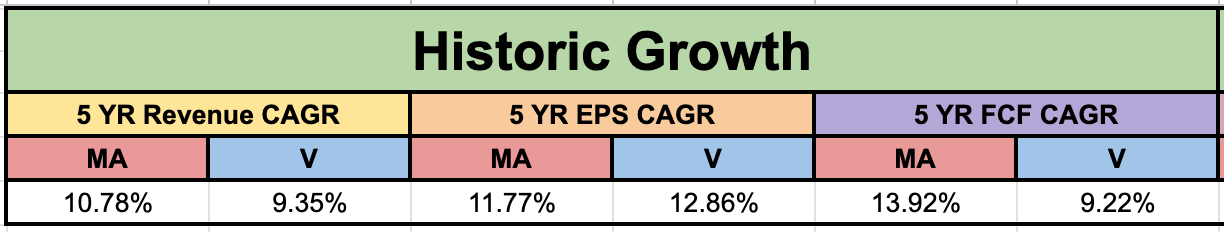

Mastercard trading at a premium to Visa was likely fair, as they were growing revenues and free cash flows at a higher rate over the past 5 years.

So what changed?

In the grand scheme of things, nothing.

In fact, revenue and earnings growth for Mastercard is projected to be even faster in the coming years than it has been previously.

From their recent earnings report, management stated:

“For full year 2025, net revenues are expected to grow at the low teens range on a currency-neutral basis, excluding acquisitions.”

Essentially, revenues are now projected to grow between 13%-14%.

With revenues growing and free cash flow margins expanding, free cash flow will grow at higher rates in the future as well.

Based off the current P/FCF multiple and the guidance management has given us, Mastercard’s valuation is the most attractive it has been in 5 years.

2. ☎️ Verizon (VZ)

Verizon is one of the largest telecommunications companies in the world.

Verizon has three primary sources of revenue:

Wireless Service Revenue (≈75% of total)

Broadband & Wireline (≈20% of total)

Other & Corporate Solutions (≈5% of total)

Verizon is not a business I believe is ideal for investors with long time horizons.

The reason is simple.

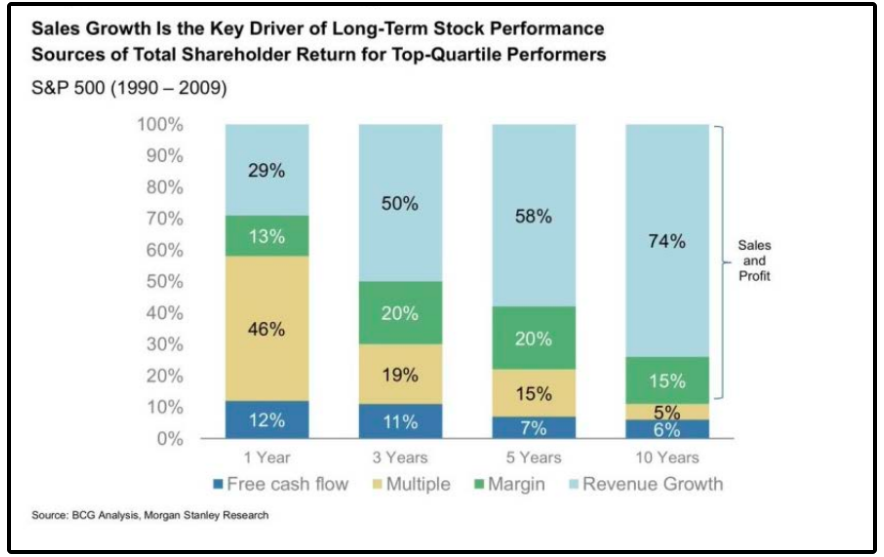

Revenue growth has been close to non-existent.

And as I’ve mentioned many times before, revenue growth is the ultimate driver of long-term stock performance.

Along with this, Verizon’s business model is quite capital intensive.

Capital intensive businesses are not typically ideal, however, there is an advantage.

Very few companies can afford to build a competing network, making the sector they operate in have high barriers to entry.

This is one of the reasons we see very little volatility with Verizon’s cash flows.

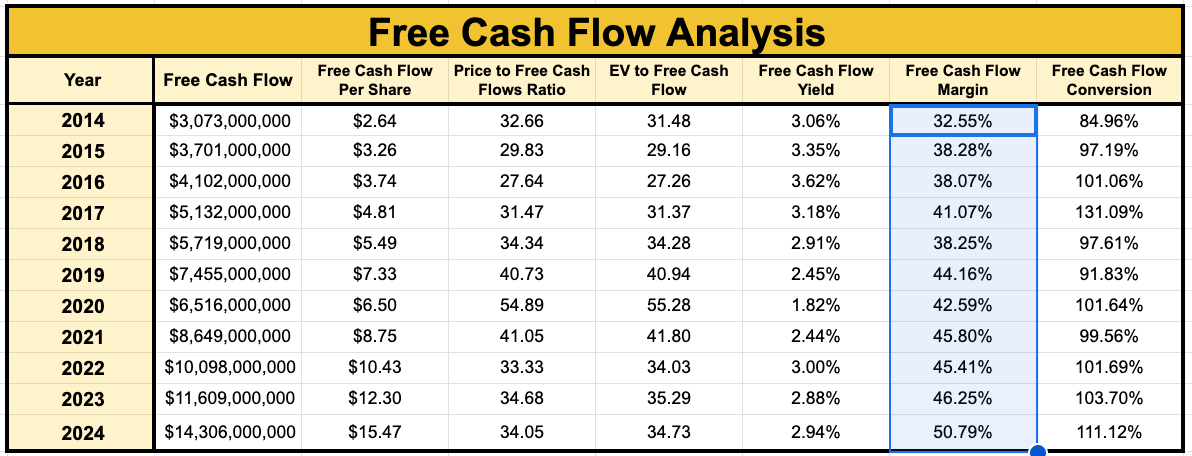

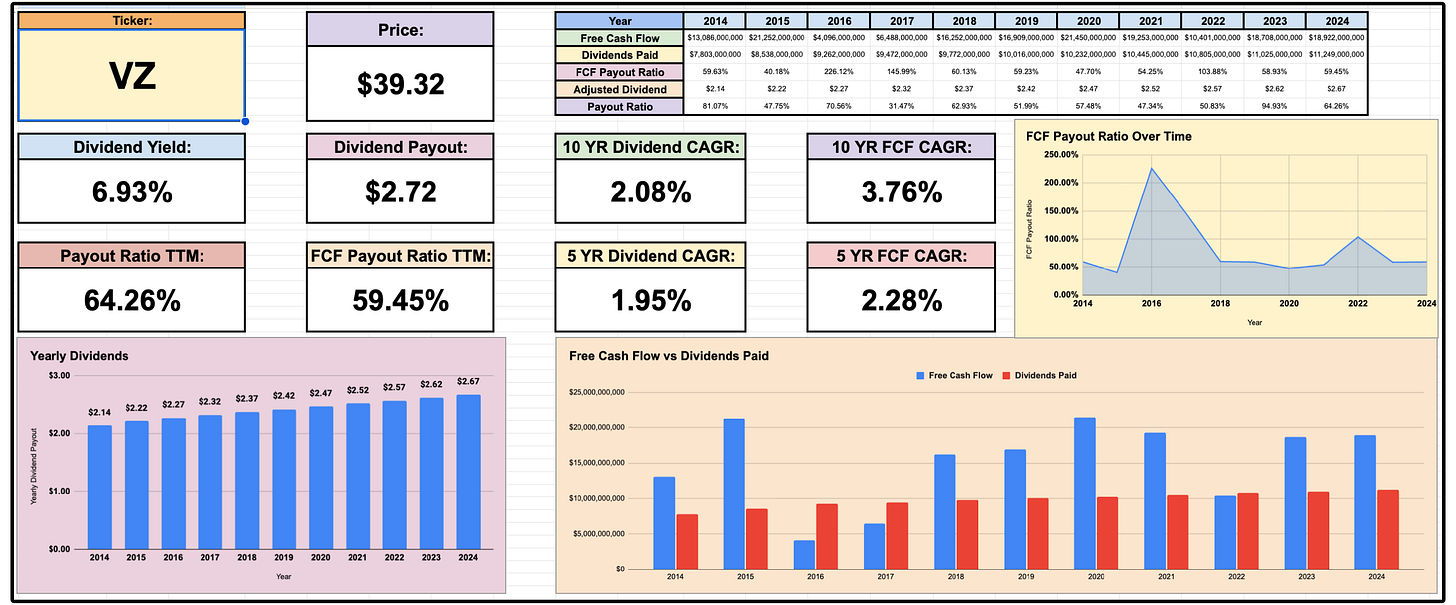

Verizon currently has a high dividend yield of around 7%.

So the real question is:

Is the dividend sustainable?

The short answer is yes.

The free cash flow payout ratio is quite healthy at just under 60%.

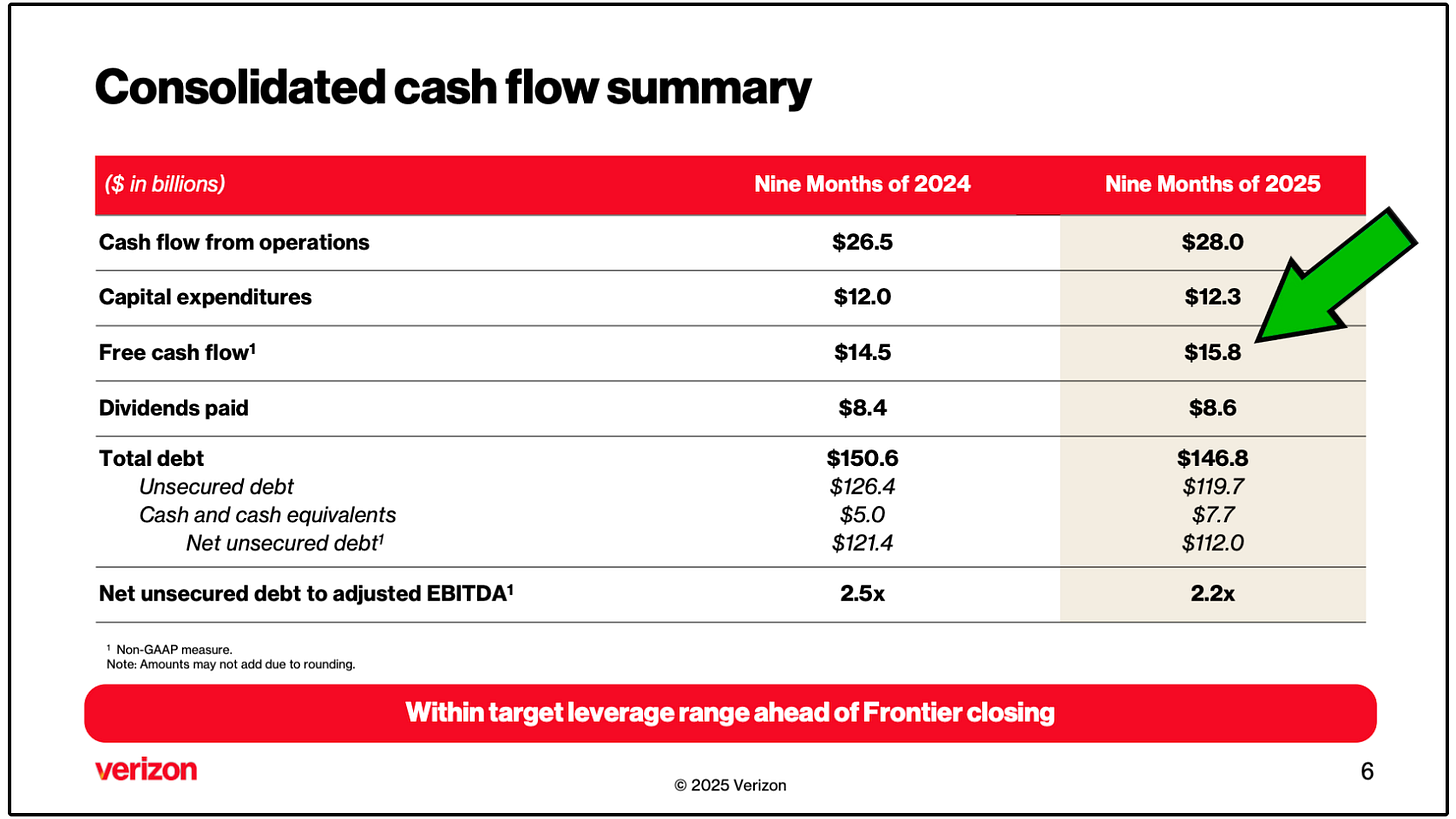

On top of this, free cash flow through the first 9 months of 2025 is around 9% higher than it was through the first 9 months of 2024.

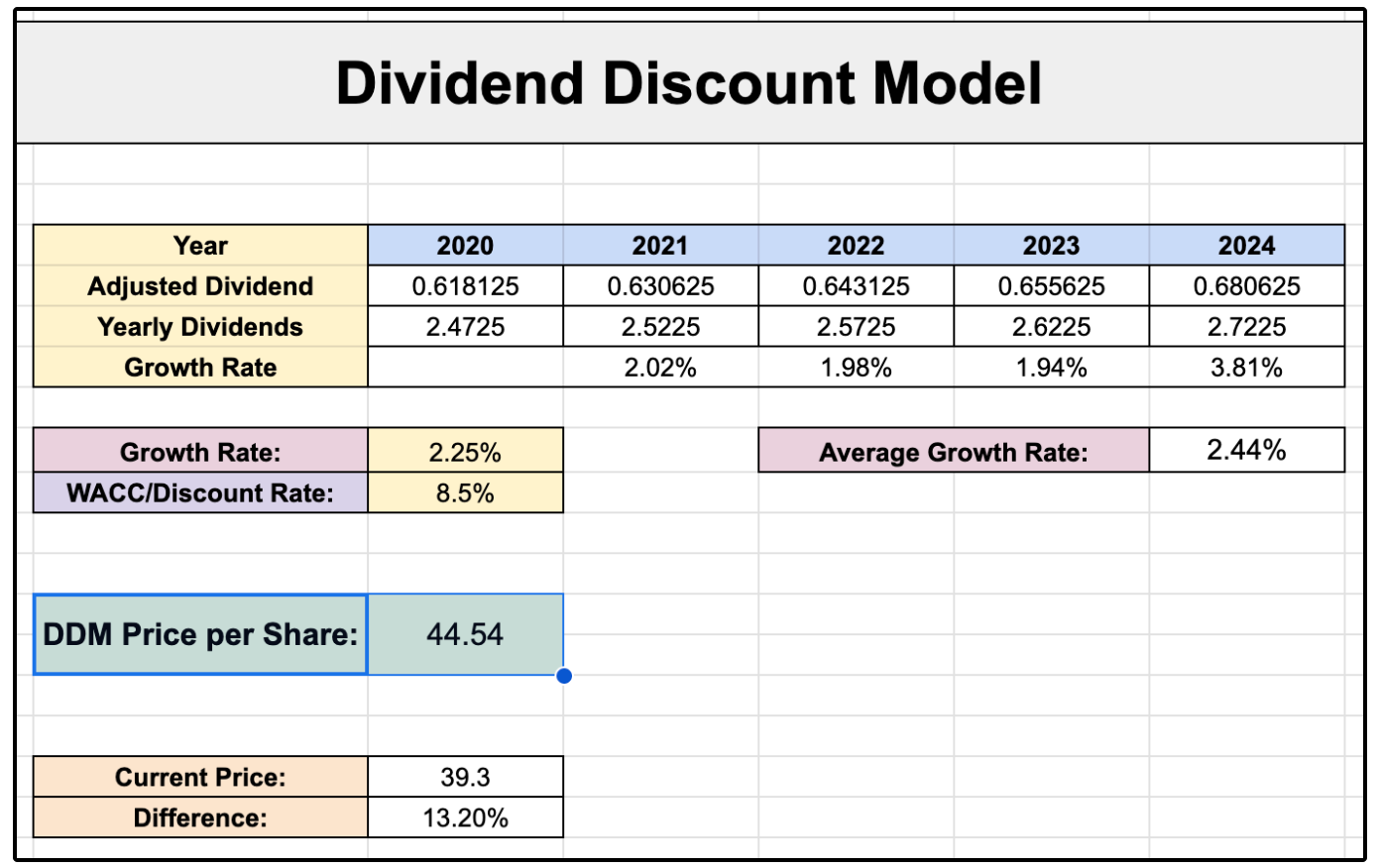

The most effective way to value Verizon is with a dividend discount model.

With earnings projected to grow at 2.5% over the next 5 years, dividend growth of 2.25% should be sustainable.

This would give Verizon a fair value of $44.54, or upside of 13.2%.

Sit back and enjoy the 7% yield while waiting for the company to revert to intrinsic value.

3. 🎰 VICI Properties (VICI)

REITs are currently selling off as I write this.

VICI is now down over 6% in the last month, pushing their starting dividend yield to 6%.

VICI is one of the largest experiential real estate investment trusts (REITs) in the world, and arguably one of the most unique.

VICI owns the real estate, leases it out long-term to operators primarily in Las Vegas like Caesars, MGM, and the Venetian.

Historically this model has worked quite well for VICI, with AFFO per share growth and dividend growth that is far above their peers.

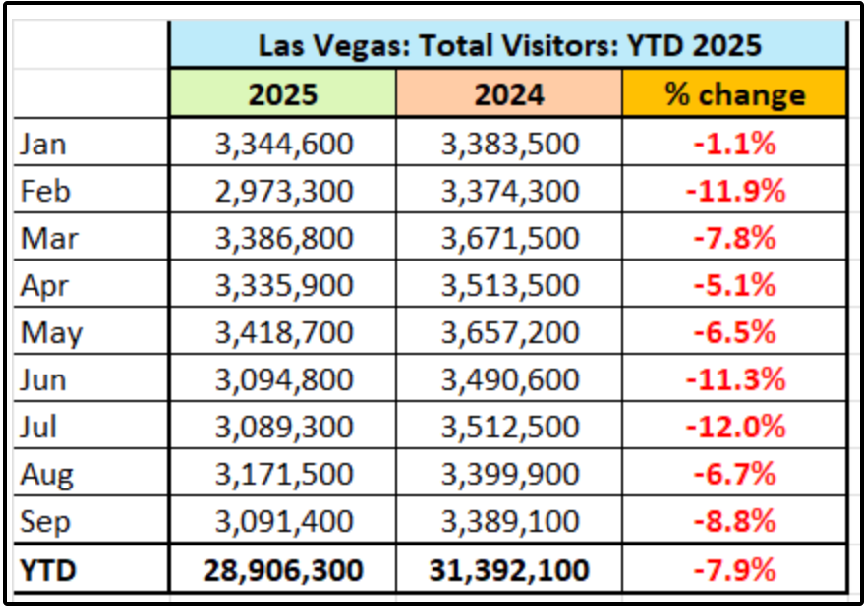

However, some concerns have recently arisen, primarily surrounding Las Vegas.

For the first time in many years, we are seeing declines in Las Vegas tourism year over year.

This is something to be aware of, but there are a few characteristics VICI has that we need to note:

100% rent collection history since IPO (even during COVID)

Long-term inflation-linked leases providing inflation protection

Triple-Net Leases force the tenant to pay property taxes, insurance, and maintenance costs, creating incredibly predictable cash flows for VICI

Investment grade balance sheet

100% occupancy

VICI has positioned themselves far better than many realize to mitigate slow downs in Vegas, and the quality of their tenants absolutely matters.

The fact that they collected 100% of their rent during 2020 was unheard of for REITs.

Vegas tourism is a secular trend we must monitor, but I don’t see it as a long-term threat.

To add on, their recent earnings report was quite impressive:

Guidance for AFFO per share was raised slightly at the lower end from $2.35 to $2.36, and the midpoint growth expectation increased from 4.4% in Q2 to 4.6% in Q3.

AFFO per share growth improved from 4.9% in Q2 to 5.3% in Q3.

AFFO per share growth is the lifeline for dividend growth for REITs.

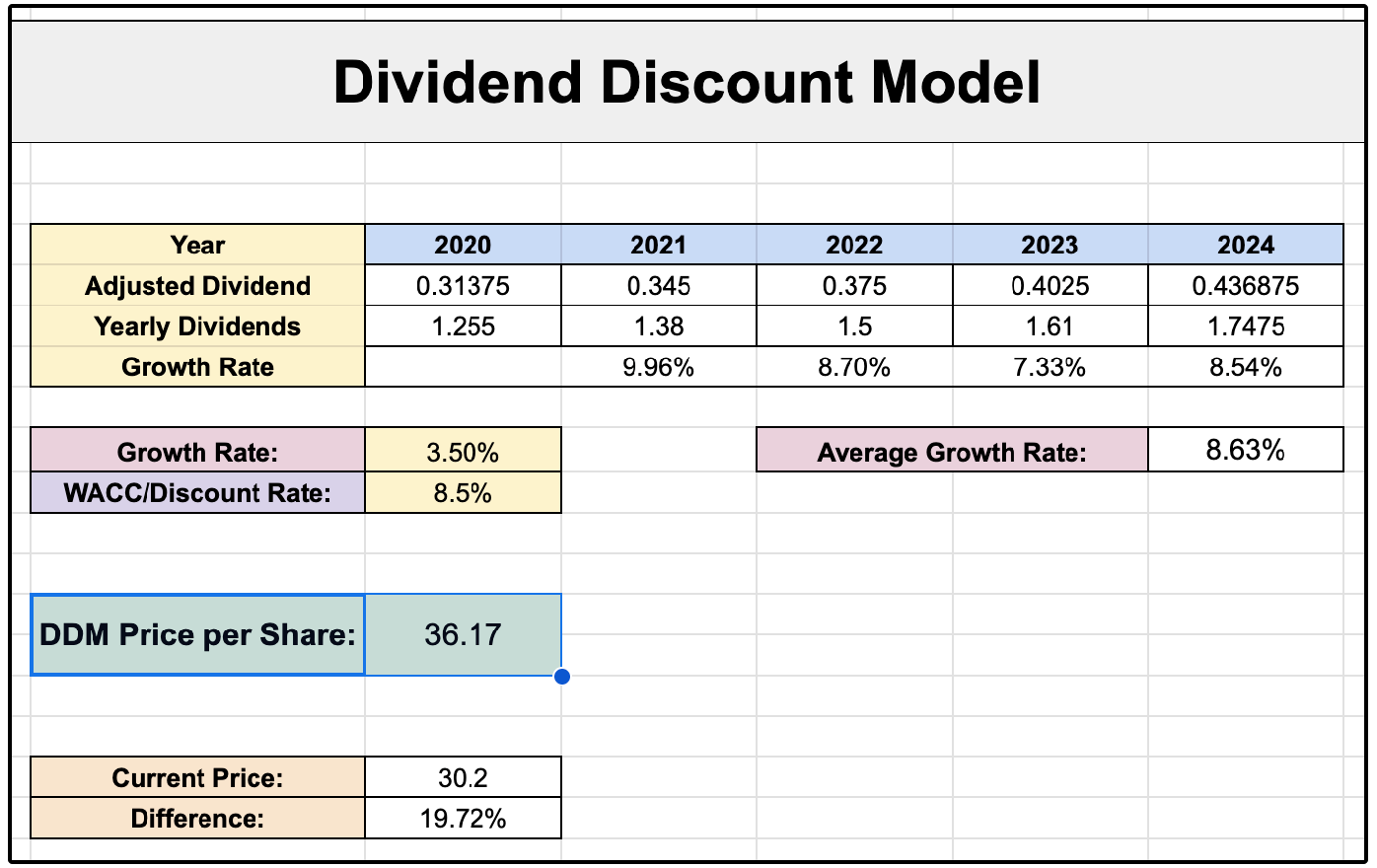

If VICI achieves 3.5% dividend growth moving forward, then fair value sits at $36.17, giving them nearly 20% upside.

Now, let’s jump into this month’s full list below. 👇