🏆 List of Undervalued Dividend Stocks (August '25)

These Stocks are Undervalued 🔥

The reason for the email today?

Something just came across my desk that is perhaps the best thing I’ve seen in the last 6 months.

If you have 60 seconds, I’d like to share it with you.

Okay, okay, I’ll leave the sales tactics to The Wolf of Wall Street.

The real reason for the email?

At the beginning of each month, I send out a spreadsheet that lists out the dividend stocks that I believe to be undervalued.

This is the end result of 100’s of hours of research every month.

Have You Heard The News? 📝

Dividendology will be transforming into a full scale investment research platform in just over a month.

Here’s everything you get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with now over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

The full launch is almost here.

Now, to the undervalued stocks.

1. Armada Hoffler Properties (AHH)

REITs are one of the most interesting asset classes right now-

Recent underperformance has pushed them off most investors radar, but letting recency bias guide your decisions would be a costly mistake.

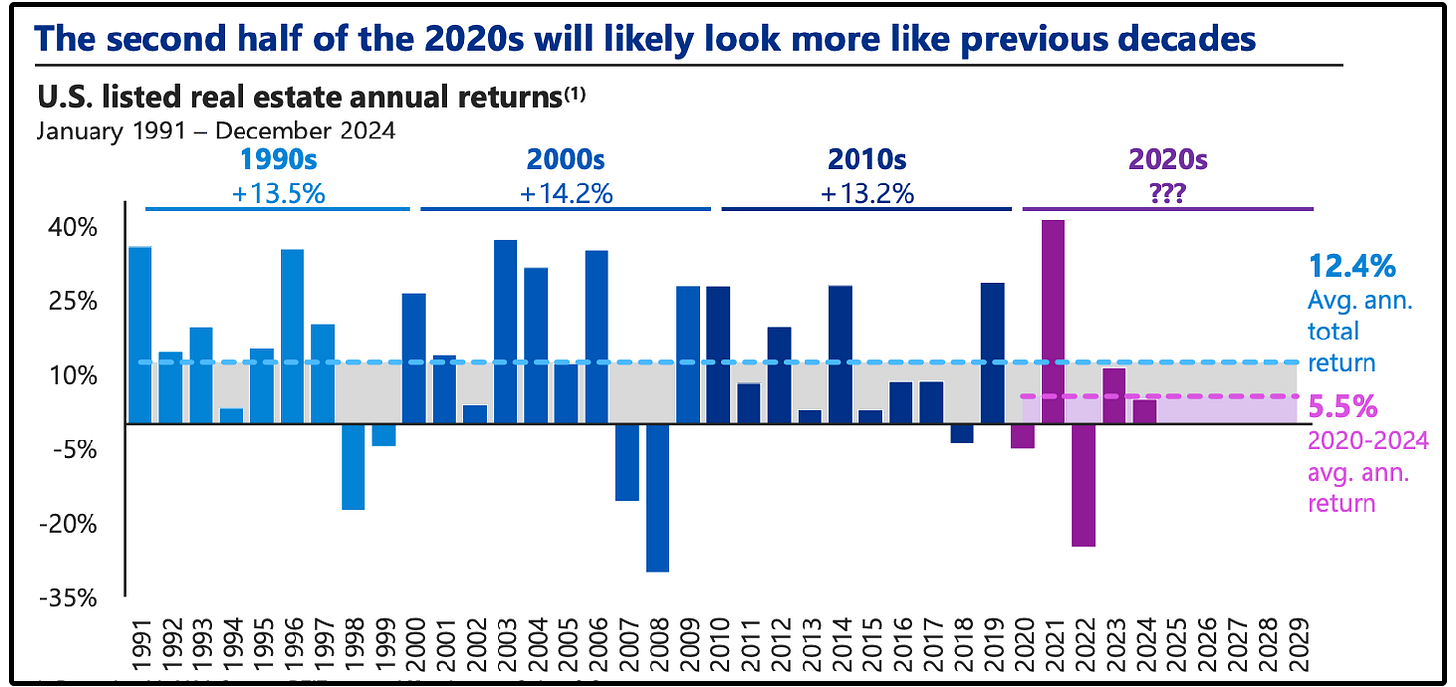

REITs have seen double digit returns each of the past 3 decades with an average annual return of 12.4%.

But the average return over the last 5 years?

Just 5.5%.

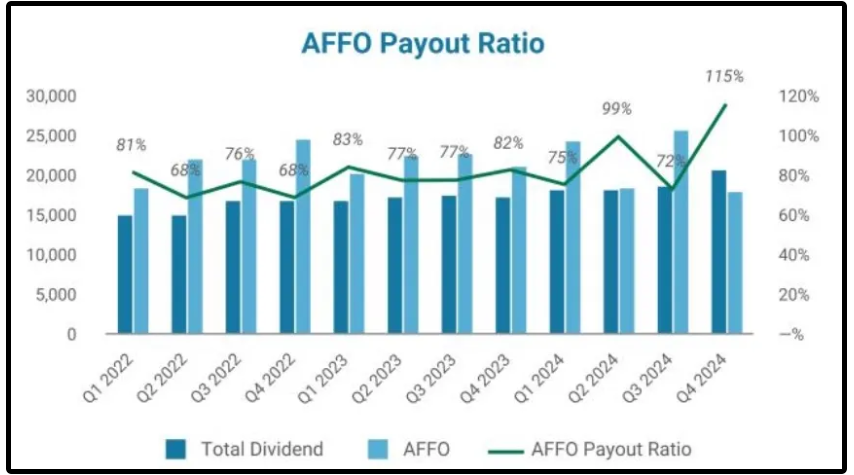

Quality REITs have been growing AFFO, while their share price goes down.

This is creating attractive valuations.

One of the under-the-radar RETIS that I’ve been following closely lately is Armada Hoffler Properties.

Armada Hoffler isn’t your typical REIT.

While most real estate investment trusts just buy buildings and collect rent, AHH develops them from the ground up often for itself, sometimes for others.

This in-house development strategy allows them to earn development profits and own top-tier assets at below-market cost.

This also provides them with flexibility:

In strong markets: Armada Hoffler can develop and retain high-quality properties at below-market cost, capturing both development profits and long-term rental income.

In weak markets: Instead of acquiring buildings, Armada Hoffler can generate revenue by building projects for other companies, helping them stay profitable even when real estate deals slow down.

What’s interesting is this REIT recently cut its dividend by 30%, which was to be expected as the AFFO payout ratio climbed well above 100% by the end of 2024.

This led to an expected sell off.

AHH is now down nearly 44% in the last year.

However, the dividend cut put this REIT in a much healthier financial position.

After the dividend cut, management noted “The payout is now fully covered by property income without any consideration of fee income.”

Before the dividend cut, AHH was having to rely on fee income (from its construction business) along with rental income to cover the dividend.

As management noted, the dividend is now fully covered by rental income.

Along with this, insider buying has ramped up significantly in the last few months.

Insiders now own 10.2% of the business.

And as discussed in this post from a few a few months ago, stocks with heavy insider ownership have historically outperformed.

Insiders have been buying these shares while the REIT is trading at its lowest price to book value in 3 years.

This REIT currently has a starting yield of around 8.37%, and is expected to grow funds from operations at around 4% for the next few years.

2. ASML Holding (ASML)

ASML is one of the most important tech companies in the world.

ASML is the sole manufacturer of extreme ultraviolet (EUV) lithography machines, which are critical for producing the world’s most advanced computer chips.

The best way to understand the importance of ASML, is to understand the AI semiconductor value chain.

ASML is the backbone.

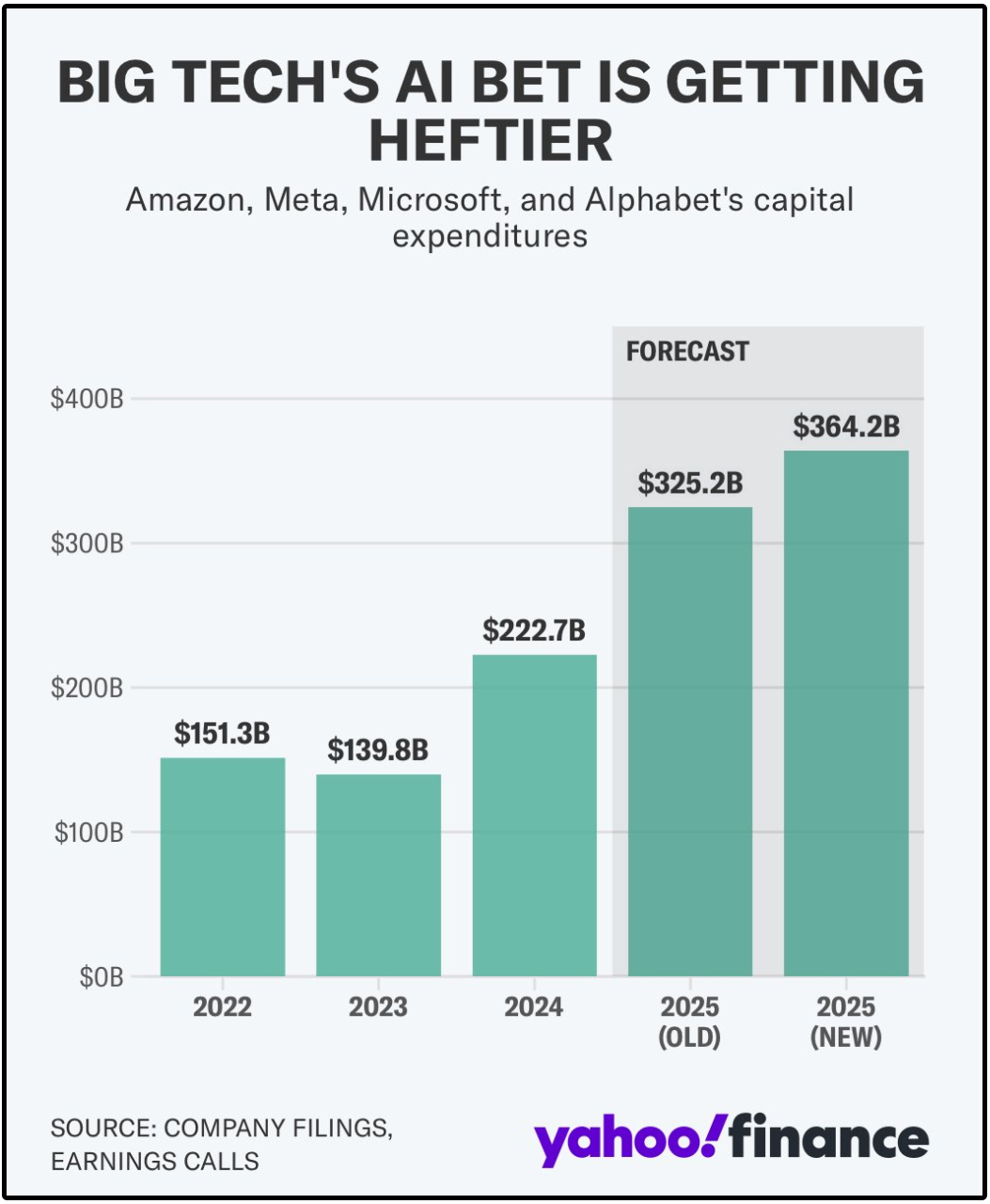

And while everyone was paying attention the last few weeks to the stellar earnings reports from big tech-

The real story was their capital expenditures.

As Big Tech pours more money into AI infrastructure, capital spending is exploding.

In fact, expected capital expenditures for big tech in 2025 had increased by over $40 billion since the beginning of the year.

This is capital that will funnel into ASML’s top lines.

If AI is the new gold rush, ASML is selling the shovels, and the market is completely dependent on them.

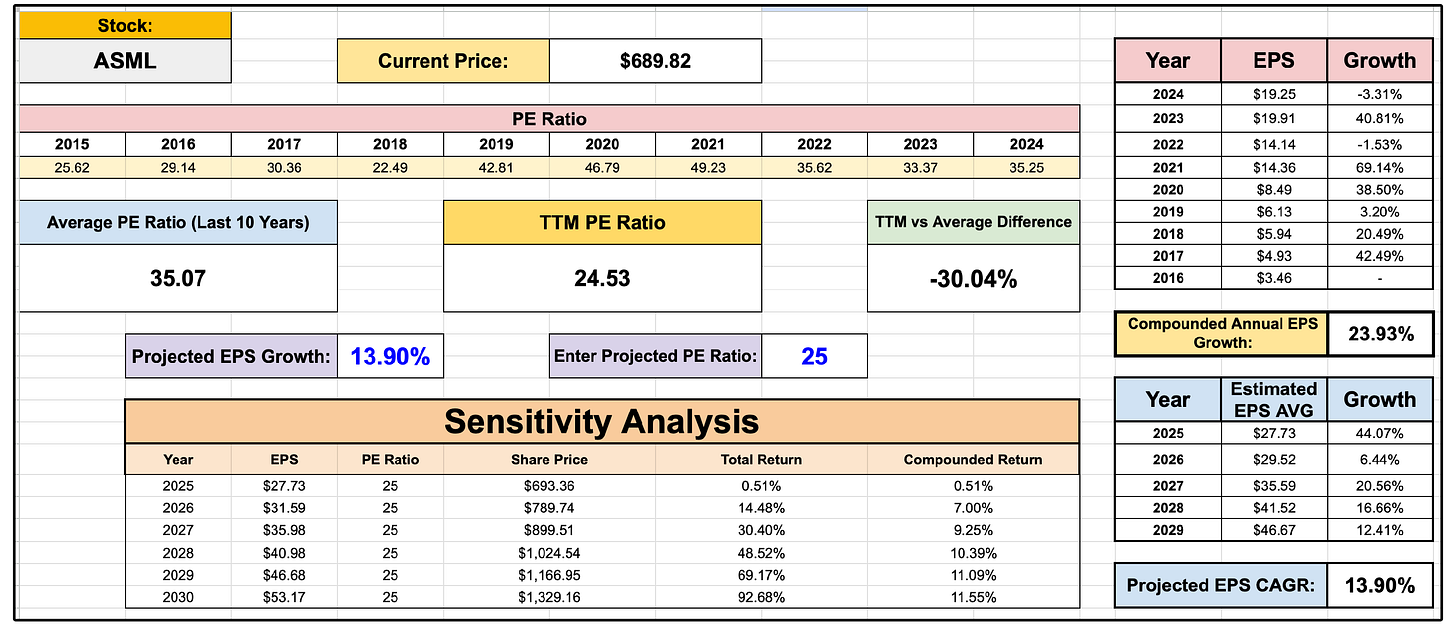

Assuming they achieve the average analyst EPS growth rate and assuming NO multiple expansion-

You’d be looking at a compounded annual growth rate of 11.55% through 2030.

3. Lockheed Martin (LMT)

Lockheed Martin is one of the most iconic defense contractors in the world, best known for its F-35 fighter jets, missile defense systems, and Black Hawk helicopters.

And ironically enough, I consider this a very defensive investment.

The stock market has historically been quite volatile.

For some investors, this is something to take advantage of.

But some investors look for safe havens from this volatility, searching for companies with stable and predictable cash flows.

This is where Lockheed Martin comes in.

Around 92.5% of Lockheed Martin’s revenues come from government contracts, with the vast majority of that being the United States.

Not to mention, there is currently a record backlog of more than $166 billion, meaning it already has that much in signed contracts lined up for future work.

This massive backlog gives the company predictable revenue, stable cash flows, and confidence in continuing to fund dividends payments, which they’ve been growing for 22+ years.

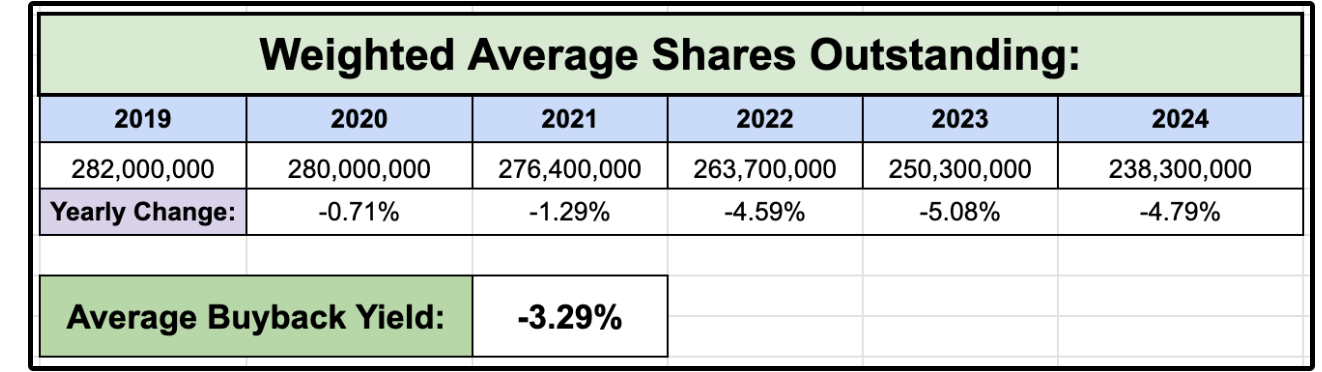

Lockheed Martin is a true shareholder yield stock, with the current dividend yield being around 3.14%, and the average buyback yield being close to 3.3%.

This would give them a shareholder yield of over 6%.

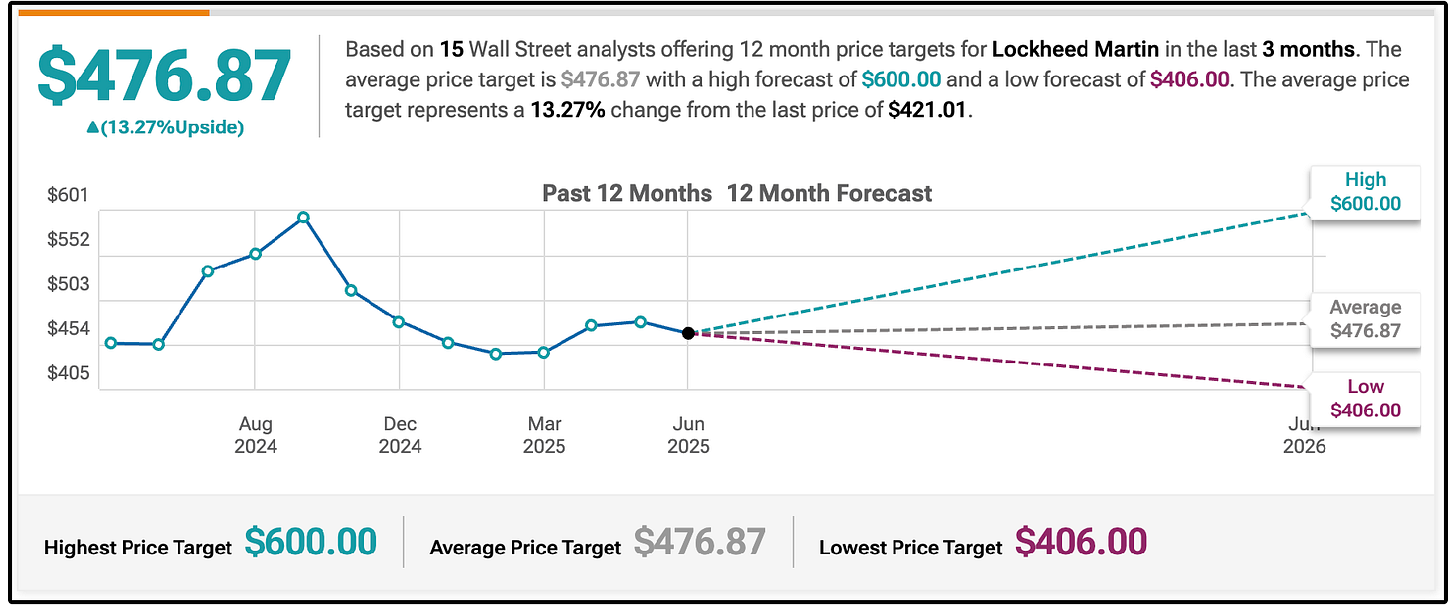

LMT is currently at a 52 week low and is down -23% in the last year after their earnings sell off.

The average analyst gives them 13% upside, which is solid when you consider the 6% shareholder yield.

This will not be a fast growing stock, or a large dividend payer by any means, but it’s certainly an interesting opportunity for defensive investors.

Now, let’s jump into this month’s full list below. 👇