🏆 List of Undervalued Dividend Stocks (October '25)

These Stocks are Undervalued 🔥

At the beginning of each month, I send out a spreadsheet that lists out the dividend stocks that I believe to be undervalued.

This is the end result of 100’s of hours of research every month.

It’s time to dive in.

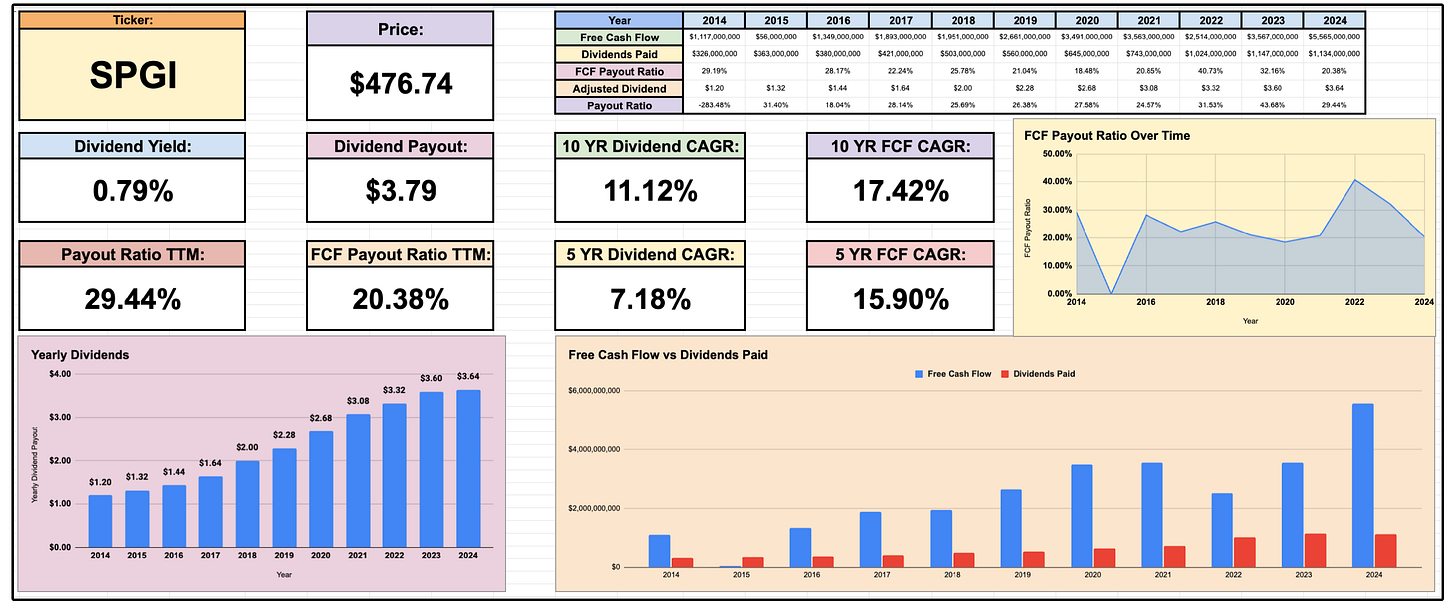

1. 🧮 S&P Global (SPGI)

I haven’t spoken about SPGI much in the past, and regrettably so.

It’s an incredibly high-quality businesses, that checks many of the boxes that I’m looking for in a dividend growth stock.

S&P Global provides essential financial infrastructure, like credit ratings, market indices (like the S&P 500), and data analytics.

They have 4 main business segments:

S&P Global Ratings

S&P Dow Jones Indices

S&P Global Market Intelligence

S&P Global Commodity Insights & Engineering Solutions

They have a 5 YR free cash flow CAGR of 15.9%, and have grown dividends at above 7% during that time period-

But make note that the free cash flow payout ratio has also been declining in the last few years, meaning they could sustainably grow dividends at a higher rate if they chose to do so.

What makes this company’s free cash flow so attractive, is it’s predictability.

As of 2024, around 95.9% of their revenue was recurring!

SPGI is also quite capital light.

In 2024, the company had a free cash flow margin of 39.17%.

Essentially, for every $100 in revenue the company generated, $39.17 became free cash flow.

When you combine the fact that 95.9% of the company’s revenue is recurring, as well as the fact that free cash flow margins have been expanding-

You get free cash flow that is growing at a high rate.

SPGI has sold off over 12% in the last month, mainly due to weak reported performance from their peer, Factset.

SPGI is now trading at one it’s lowest price to free cash flow ratios in the last 3 years, at 26.34

For a company projected to grow earnings and free cash flow at a double digit rate, that has a capital light business model with 95.9% of their revenue recurring, it isn’t too hard to justify paying this type of multiple if you are willing to hold for the long term.

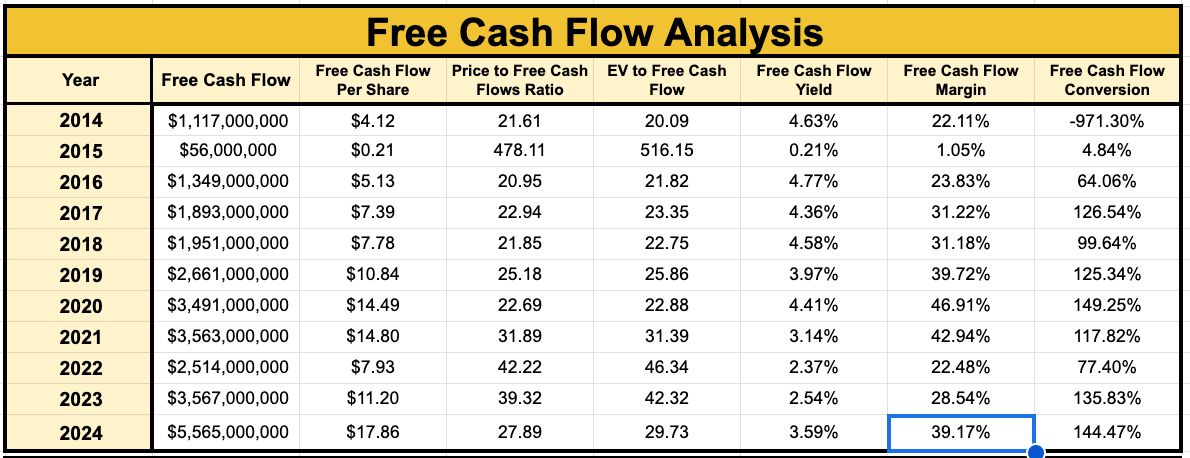

2. 🛢️ MPLX LP (MPLX)

MPLX is an MLP.

It owns and operates gathering, processing, storage, and logistics infrastructure across key U.S. energy basins, including the Permian, Marcellus, and Utica.

They have 2 main business segments:

Logistics & Storage – crude oil and refined product pipelines, terminals, and marine assets.

Gathering & Processing – natural gas gathering, processing, fractionation, and NGL transport.

I’ve stated before how I’m not a huge fan of oil/energy stocks, mainly due to how volatile oil prices can be.

But MPLX is different.

MPLX generates highly stable, largely fee-based cash flows, protected by long-term contracts and minimum volume commitments.

This makes cash flow far less sensitive to commodity price swings compared to traditional energy producers.

The company currently has a high starting yield of 7.7%, with a healthy distributable cash flow coverage ratio of 1.5X.

On top of this, management made this statement in regards to dividend growth in a recent earnings report:

We see a period of time where 12.5% is very doable. It’s tough to give you an extremely long horizon, but we certainly are trying to convey to you that distribution growth at 12.5% has the potential...to be durable for a period of time.

A starting yield of 7.7% with double digit dividend growth potential is simply amazing.

On valuation, MPLX trades at just 8.4x price-to-cash flow, near the low end of its 52-week range and below peers like ONEOK, Williams, and Kinder Morgan.

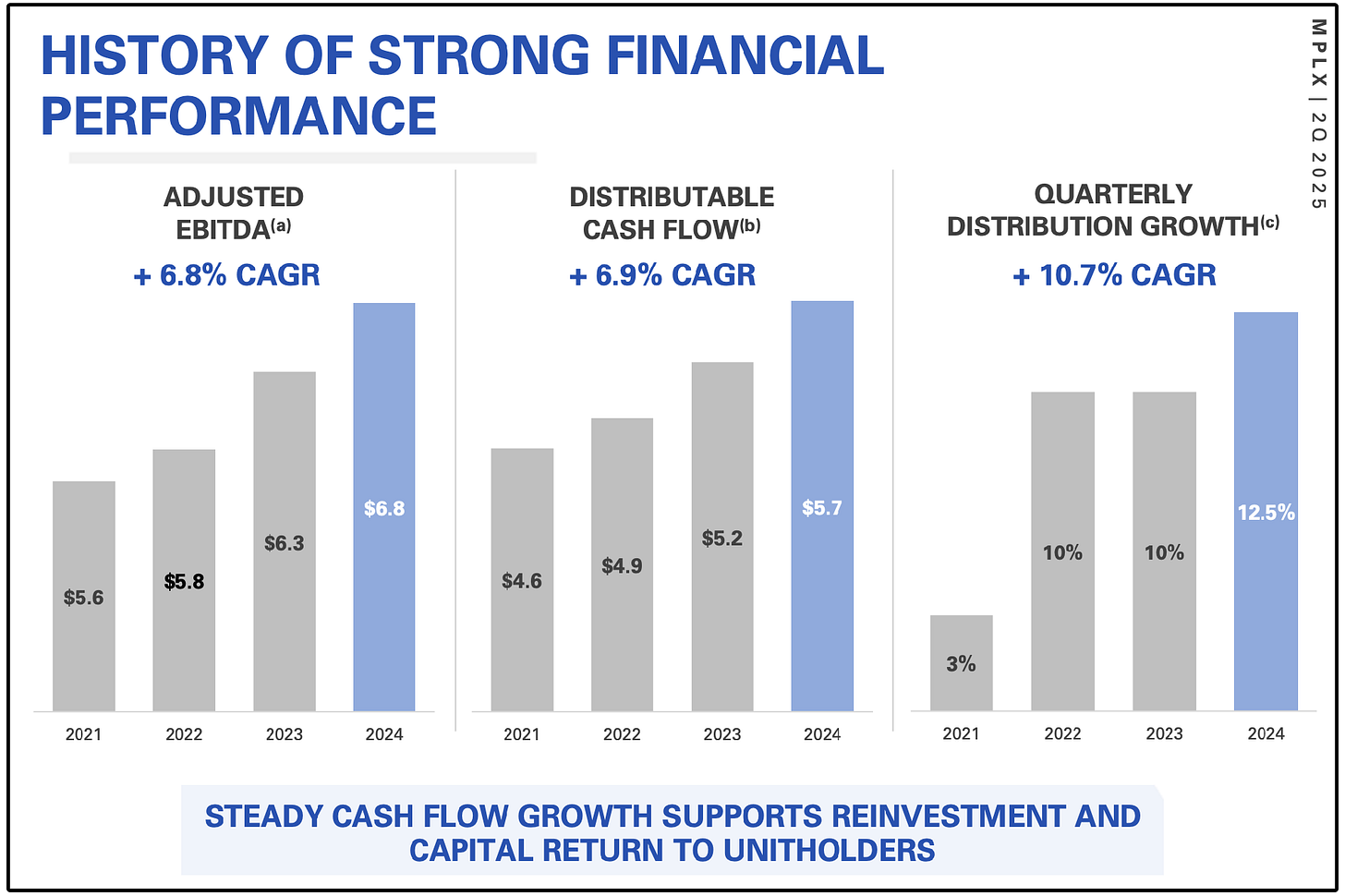

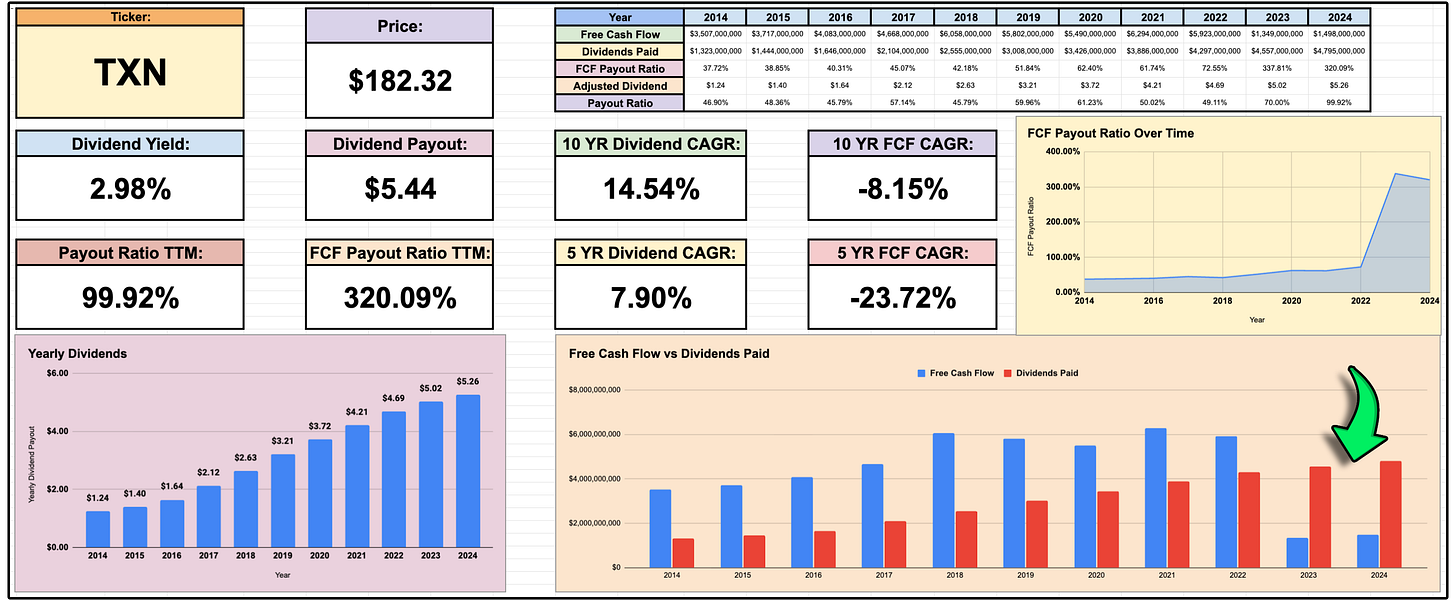

3. 💻 Texas Instruments (TXN)

Texas Instruments has historically been a phenomenal dividend growth stock.

They serve a wide variety of customers, but operate in 2 main business segments:

Analog – chips that convert real-world signals (like sound, temperature, or pressure) into digital data. This is TXN’s largest and most profitable segment, representing roughly three-quarters of revenue.

Embedded Processing – microcontrollers and processors that provide intelligence and control for systems in industries such as automotive and industrial applications.

The company has a high 14.54% 10-year dividend CAGR, and a starting yield of about 3%.

That’s a nice combination of yield and growth.

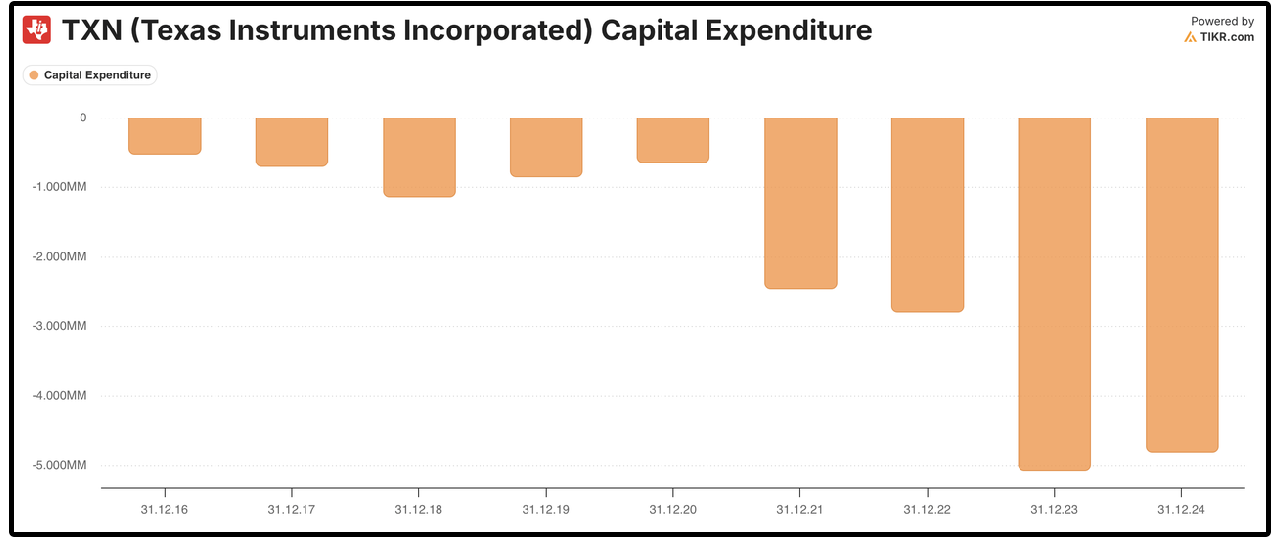

However, there is a glaring problem we can see above.

Free cash flow has dropped substantially in the last 2 years, pushing the free cash flow payout ratio to 320%.

This drop in free cash flow has been due to a substantial increase in capital expenditures.

This heavy capex spending is being done for a very specific purpose.

Management’s strategy is long-term focused: by shifting production from 200mm to 300mm wafer fabs, TXN expects to structurally reduce chip costs and lift gross margins over time.

Texas Instruments is nearing the end of a 6-year, capex-heavy reinvestment cycle to build out 300mm chip capacity.

While this has lowered free cash flow in the short term, management says this will:

Cut chip costs by ~40%

Boost gross margins

Set up long-term FCF growth starting in 2026+

This investment is nearing completion (about 70% of the way through)-

With free cash flow per share projected to rebound to $8–$9 in 2026 on the low end, and as high as $11–$12 if revenue grows faster.

For reference, the previous high of FCF per share was in 2021 when they generated $6.82 per share.

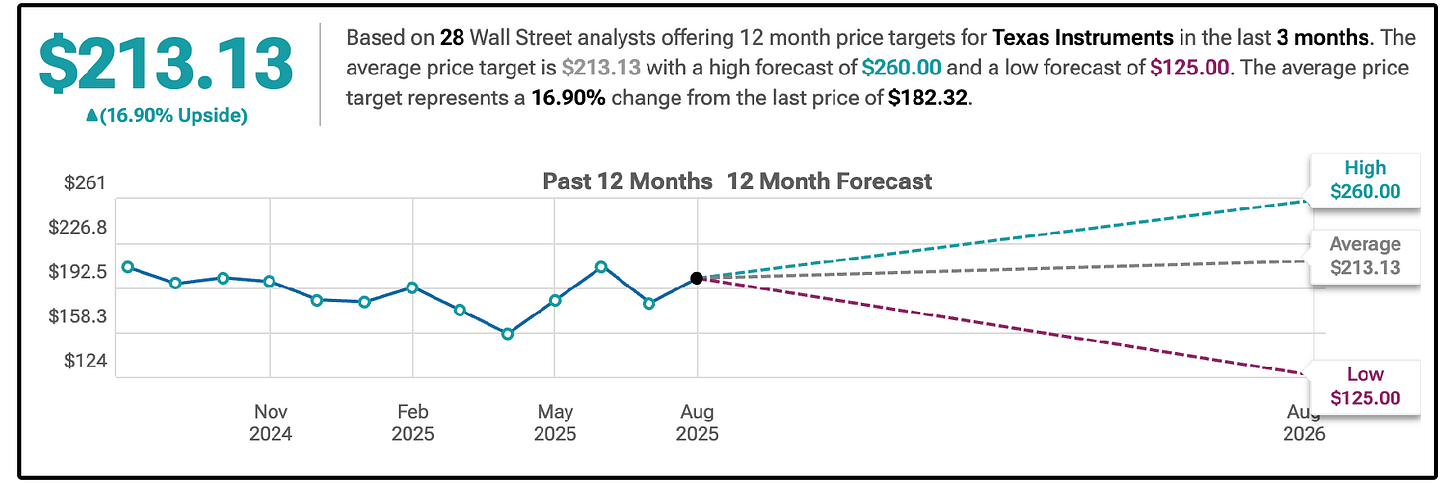

The average analyst is giving them 16.9% upside.

This was also one of the most frequently bought stocks by super investors 2 quarters ago.

If the capex spending pays off as planned, 2026 and beyond will prove to be quite profitable, with high-teen EPS growth projected by analysts.

Now, let’s jump into this month’s full list below. 👇

You can access this month’s list by clicking below.