🏆 List of Undervalued Dividend Stocks (December '25)

These Stocks are Undervalued! 🔥

At the beginning of each month, I send out a spreadsheet that lists out the dividend stocks that I believe to be undervalued.

This is the end result of 100’s of hours of research every month.

It’s time to dive in.

🔍 Quick Market Update

You already know this-

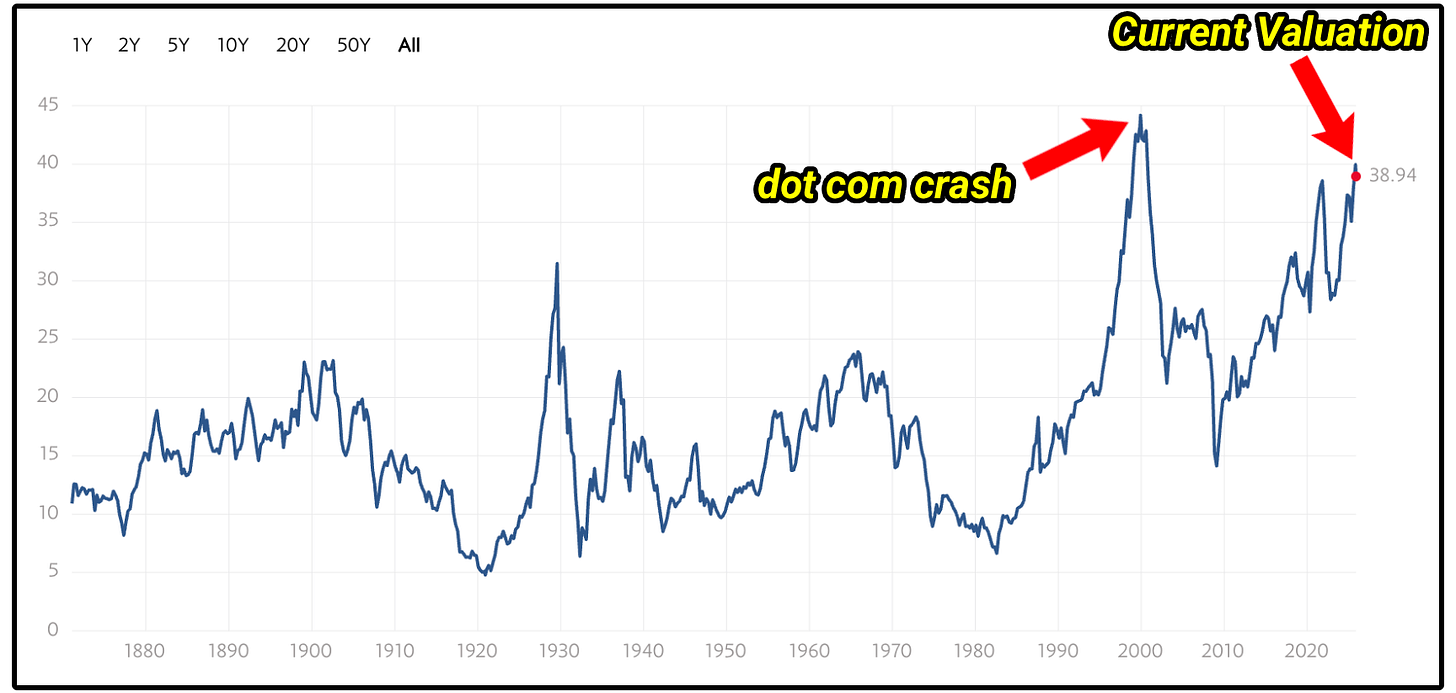

But the stock market is trading at one of its highest valuations ever.

This has largely been driven by investors expecting higher future profits due to the surge of AI.

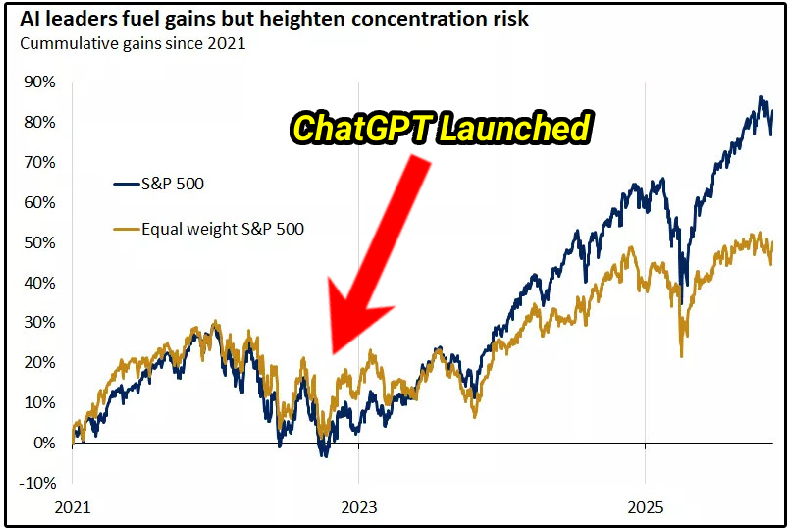

In fact, the S&P 500 has outperformed the equal weight S&P 500 by a wide margin since the launch of ChatGPT in November of 2022.

With that being said, digging just a bit deeper reveals there are still plenty of opportunities in what is a potentially an ‘overvalued market’.

How do I know this?

Because while the S&P 500 is essentially trading at its highest Shiller PE valuation ever, less than 5% of the stocks in the S&P 500 are trading at their 52-week high.

Nearly all of the returns are being driven by a small handfull of stocks.

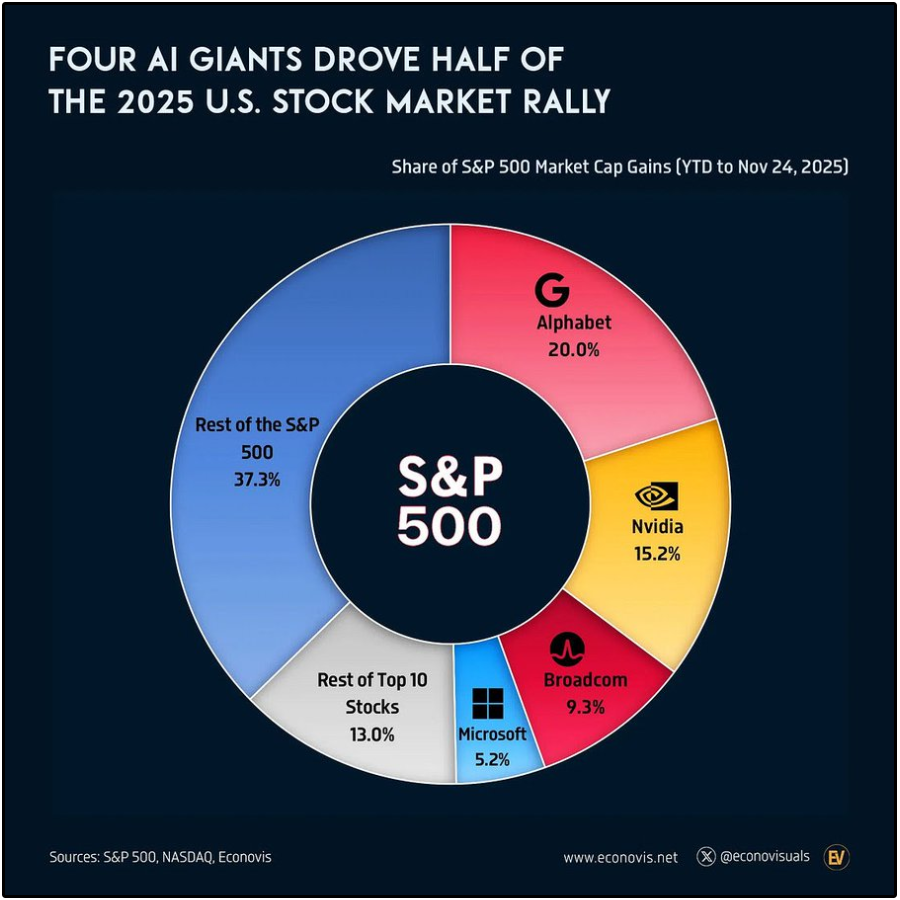

In fact, just 4 stocks have driven half of the returns of the S&P 500 year to date.

This means there are still massive opportunities in the market for those willing to look deeper for them.

Let’s dive into the opportunities.

🔥 Tickerdata Black Friday Sale — 30% Off

For a limited time, you can get 30% off all yearly plans on Tickerdata, the Google Sheets integration that powers every valuation model, dashboard, and spreadsheet I use.

Import live financials, build custom models, and access global markets instantly.

Use code ‘BLACK’ at checkout.

Now available only to the first 20 sign-ups.

1. 🛢️ Western Midstream Partners (WES)

Western Midstream Partners is one of the largest midstream infrastructure operators in the Permian Basin.

WES gathers, processes, transports, and handles natural gas, crude oil, NGLs, and water for producers, most notably for its parent and controlling company, Occidental Petroleum (OXY).

WES has four primary business segments:

Natural Gas Gathering & Processing

Crude Oil Gathering & Stabilization

NGLs

Water Gathering, Disposal & Recycling

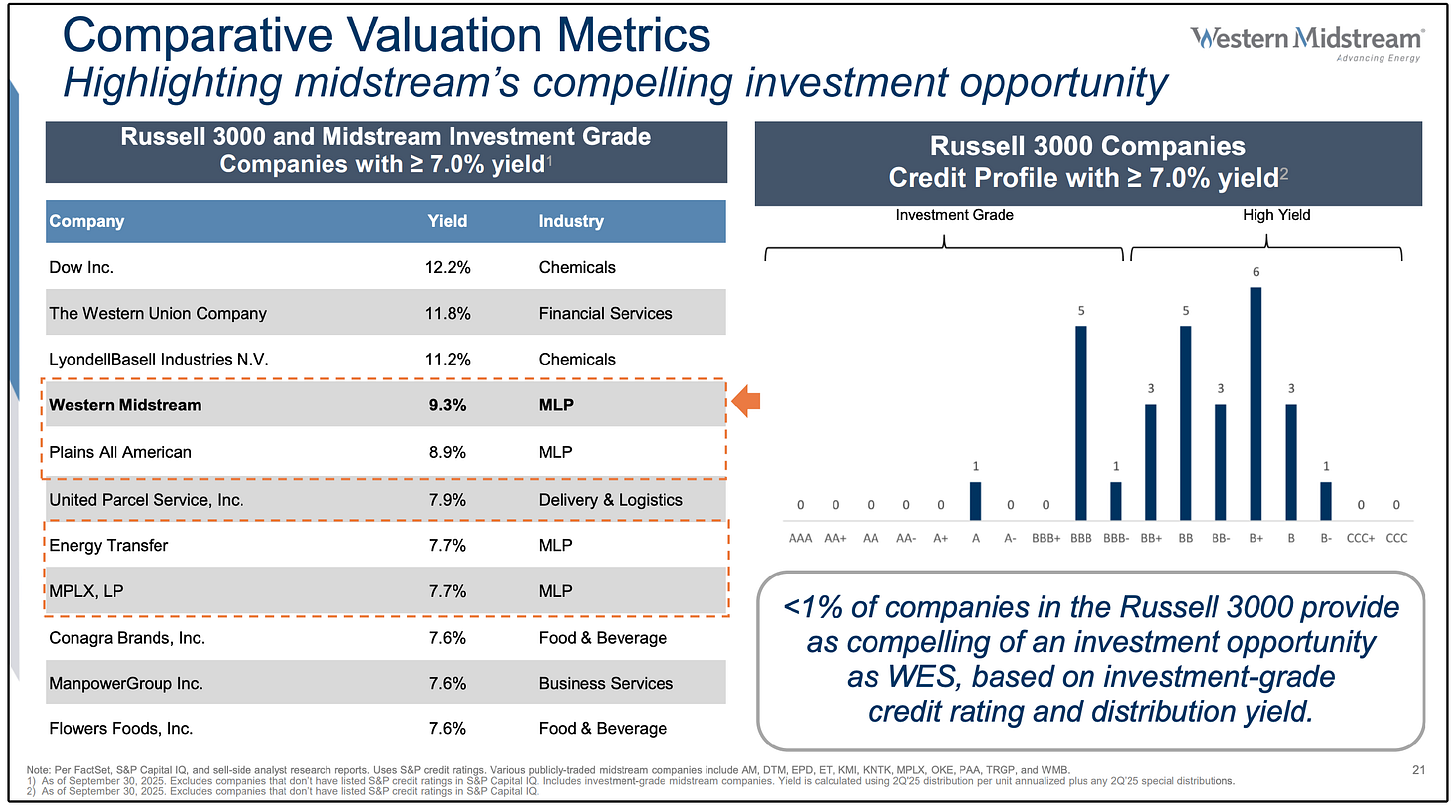

WES is one of the very few high-yield (9.26% yield) companies I consider ideal for long-term income investors.

The reason is simple.

The yield is extremely high… but the risk is relatively low.

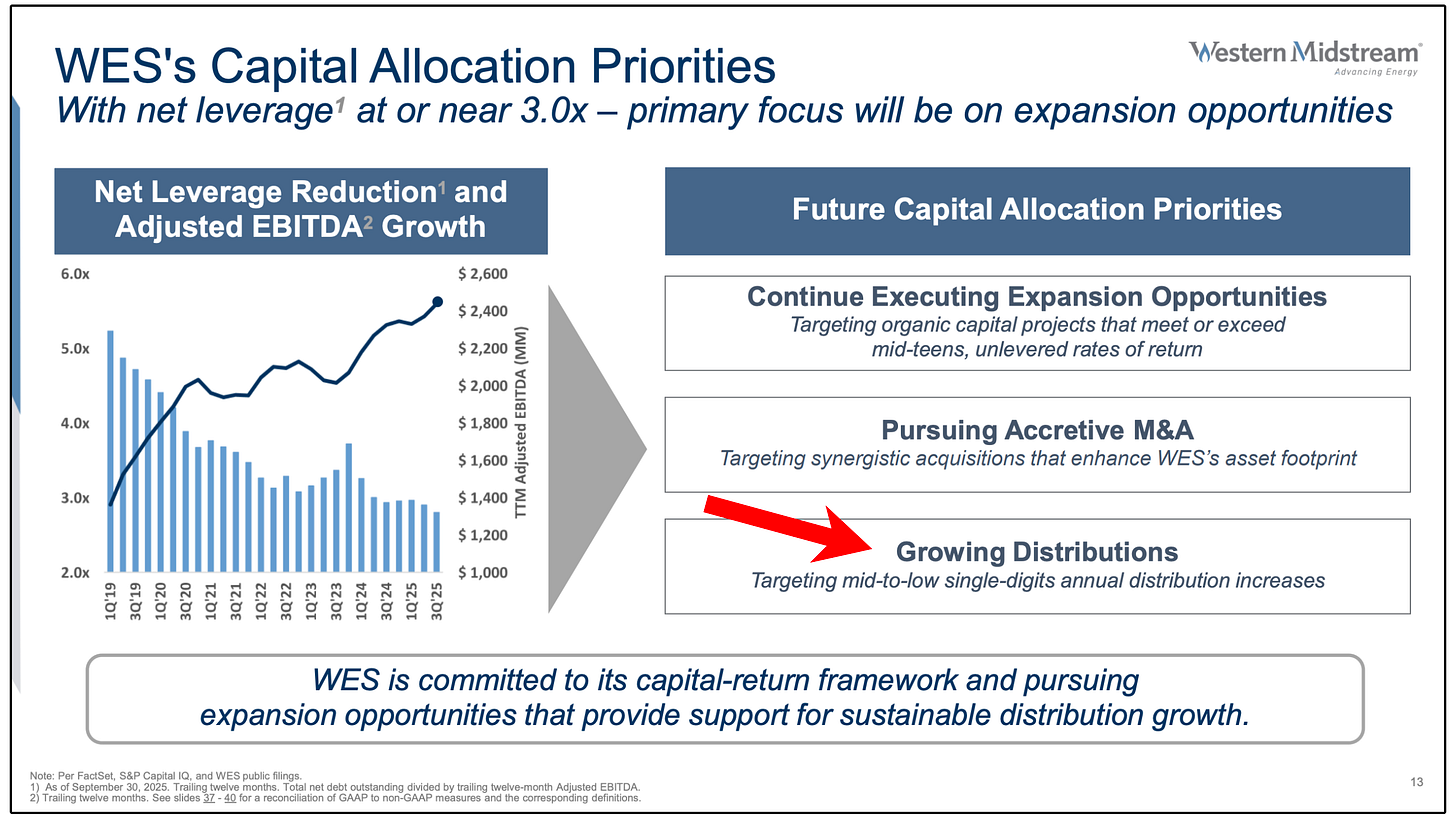

In fact, they highlight that their future capital allocation priorities are based off the fact they feel their leverage ratios are in a healthy position-

Allowing them to pursue expansion opportunities and grow dividends at a mid to low single digit rate.

WES currently has a healthy distribution coverage ratio of 1.12.

And with the way distributable cash flow per share is projected to grow over the next 4 years, that coverage ratio has the ability to expand.

Most high-yield companies carry red flags.

WES does not.

In fact, the opposite is true:

Investment Grade credit

Very low leverage (≈2.9×)

Strong and rising free cash flow

Distribution coverage expanding

And a sponsor (OXY) that wants the distribution to rise

This combination is incredibly rare in the income-investing world.

When a company with this profile yields around 9.2%, one of two things happens:

The distribution gets cut

The unit price rises until the yield compresses

Given WES’s improving fundamentals, investment-grade credit, and sponsor incentives, the second scenario is far more likely.

A re-rating to a 6%–7% yield, which is typical for healthy midstreams, would imply significant upside beyond the income alone.

2. 🌐 Meta Platforms (META)

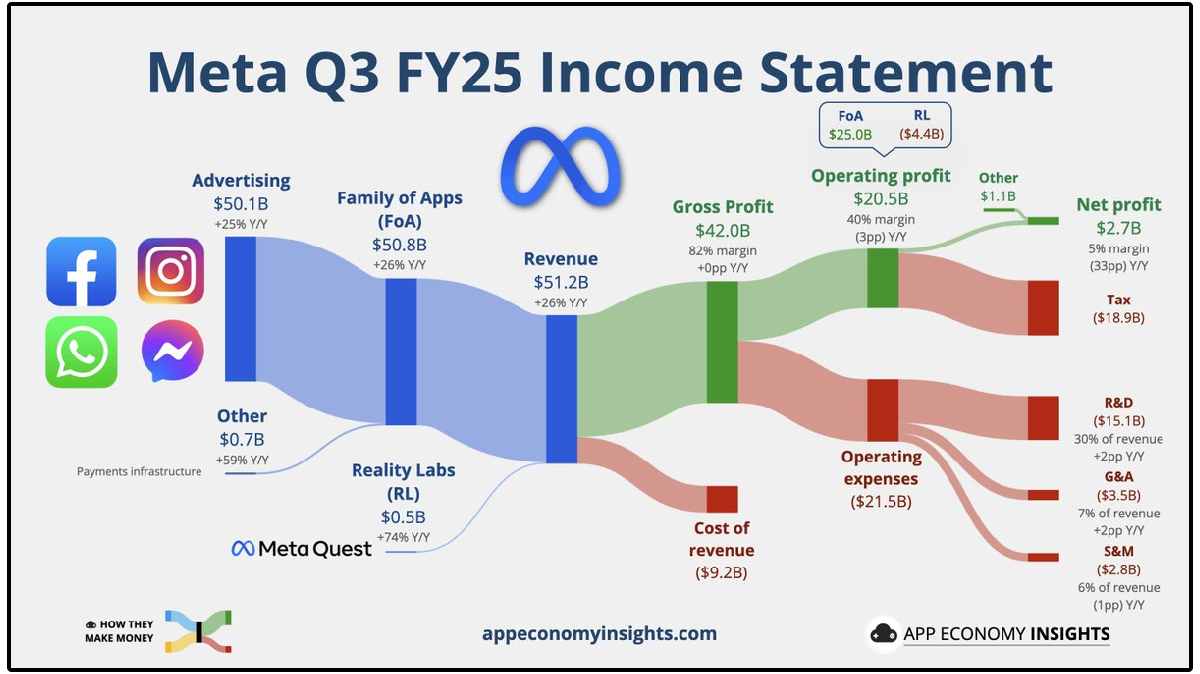

Meta’s revenue model remains straightforward:

99% of all revenue comes from advertising across:

Facebook (3B+ monthly users)

Instagram (2B+ daily users)

WhatsApp (3B+ daily users)

Messenger

This family of apps gives Meta one of the largest advertising ecosystems ever created.

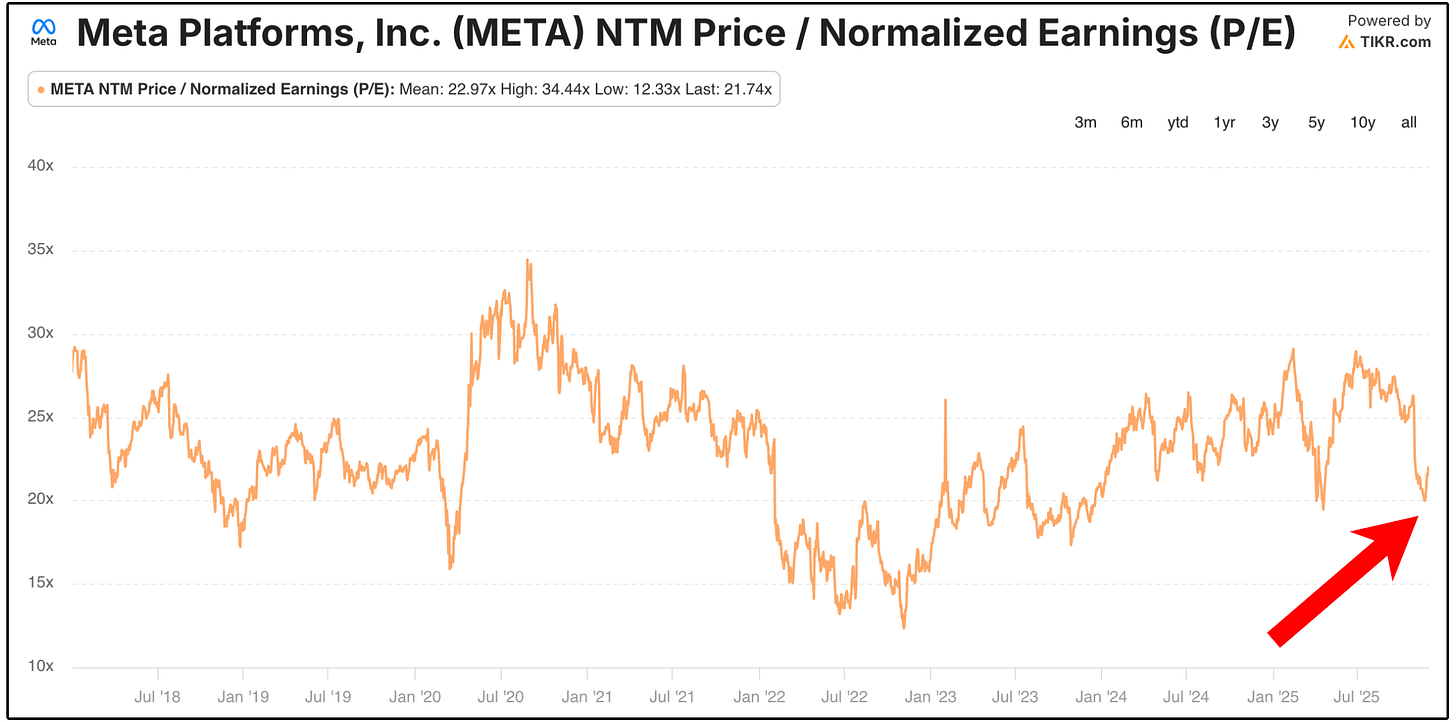

And despite the recent selloff, the long-term growth metrics remain exceptional.

In fact, this seems to be one of Wall Street’s favorite stocks right now, with the average analyst giving them over 30% upside.

So why is META selling off?

The recent decline is tied to two primary fears:

Record CapEx spending

Meta recently announced a $30 billion bond sale to fund rising AI infrastructure costs.

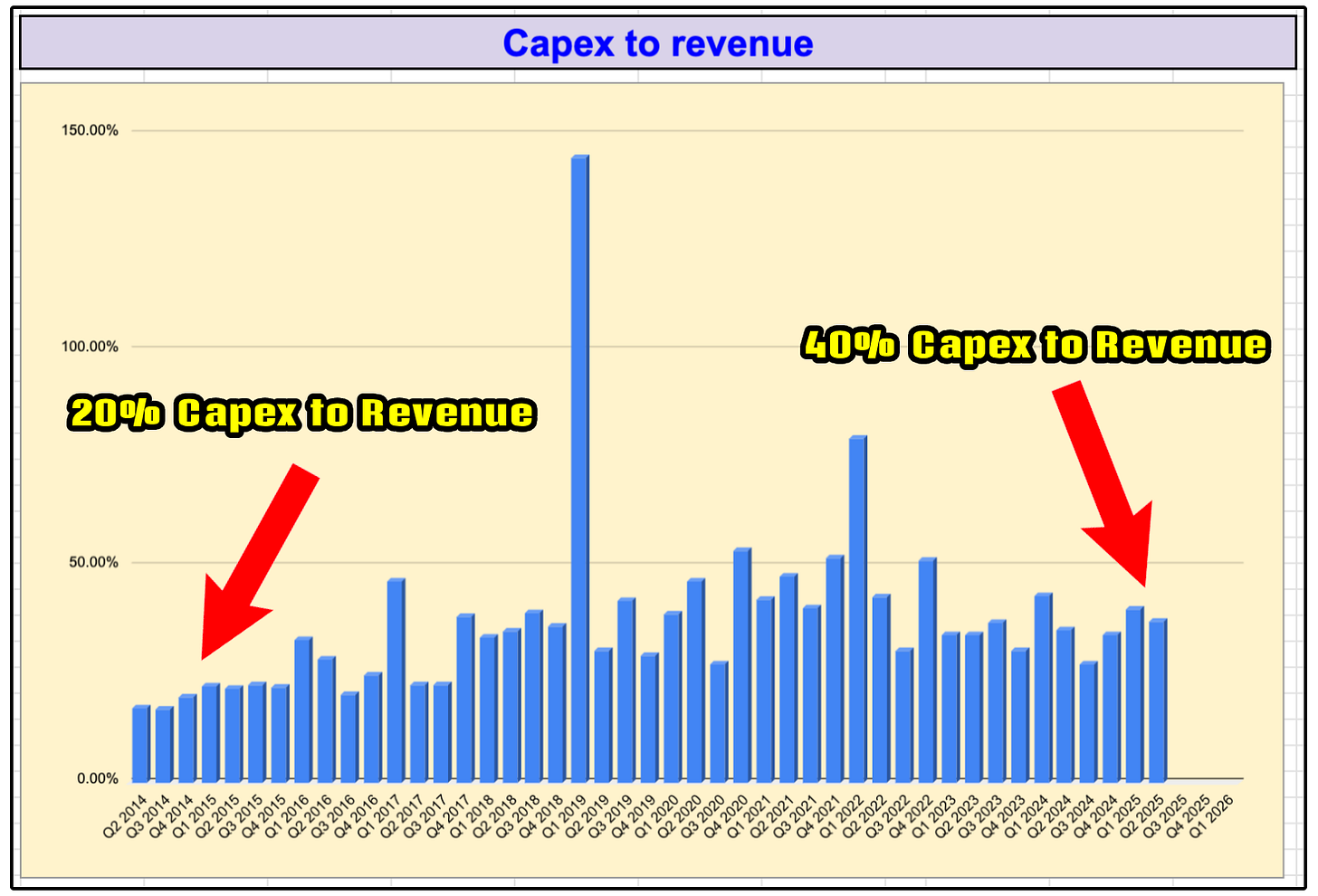

On top of that, CapEx as a % of revenue has surged:

Historically: ~15%

Last quarter: 36.75% (a record)

This of course reminded investors of the metaverse spending era, when Meta burned billions on projects that produced very little ROI.

CapEx spending to this degree simply must pay off, or Meta will be looking at billions of capital lost with nothing to show for it.

A one-time tax charge

Net income fell 82.7% YoY due to a non-recurring, non-cash tax adjustment of around $15.9B.

Without this, Meta’s tax rate would have been 14%, and net income would have looked normal.

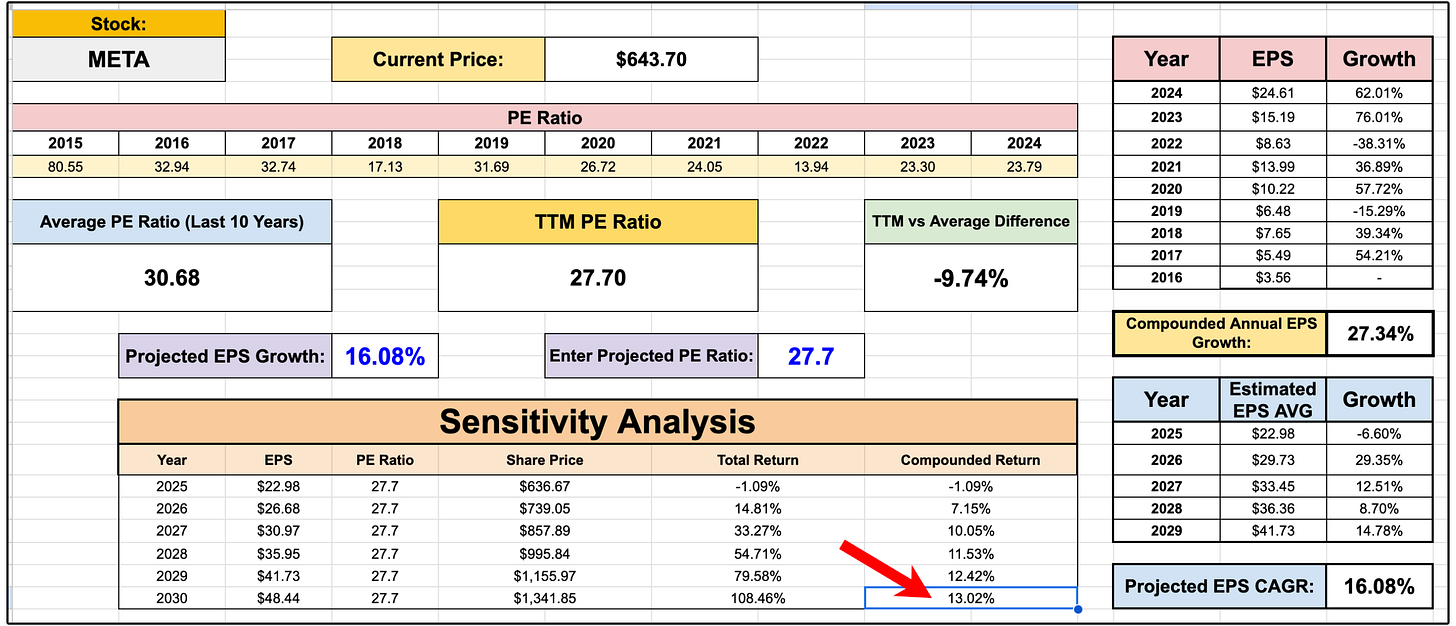

This sell off has caused Meta to trade at a multiple below its historical average.

Forward looking returns for Meta have begun to look incredibly attractive at these prices.

If Meta achieves the average analyst EPS growth estimates-

Even if they don’t see any multiple expansion, you would still be looking at above a 13% share-price CAGR.

3. ⚡NextEra Energy (NEE)

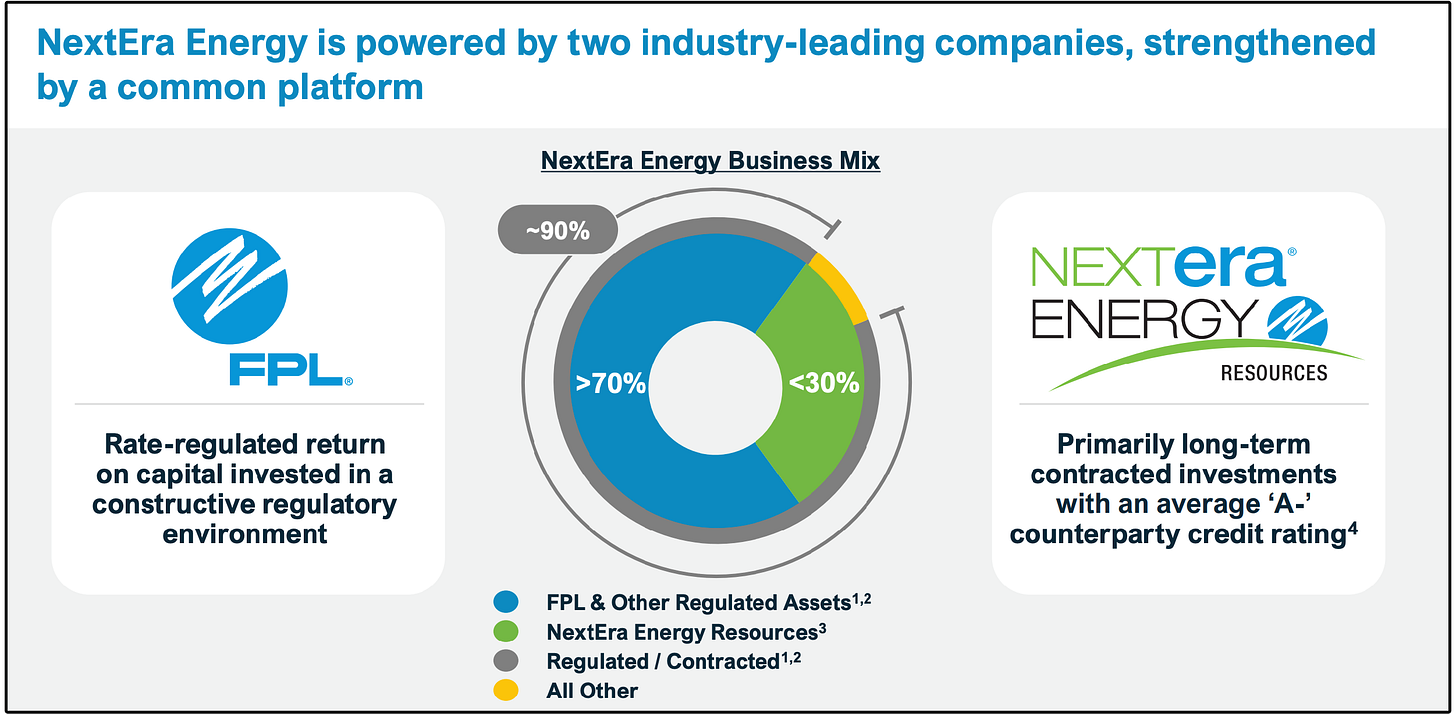

NextEra operates through two core segments:

Florida Power & Light (≈70%) – A regulated utility serving millions of customers in Florida.

NextEra Energy Resources (≈30%) – One of the largest renewable energy generators in the world.

Together, these two “engines” are expected to drive 8% annual EPS growth through 2027.

As a capital-intensive company, NextEra’s growth is heavily influenced by borrowing costs.

Their capital expenditures-to-revenue ratio has nearly doubled over the last decade, rising from about 20% to roughly 40% in recent quarters.

Higher capex typically means more debt, which makes the cost of that debt a critical factor.

That’s where rate cuts come in.

Lower interest rates reduce NextEra’s cost of borrowing, directly improving its interest coverage ratio, which measures how many times the company can cover its interest payments with operating earnings.

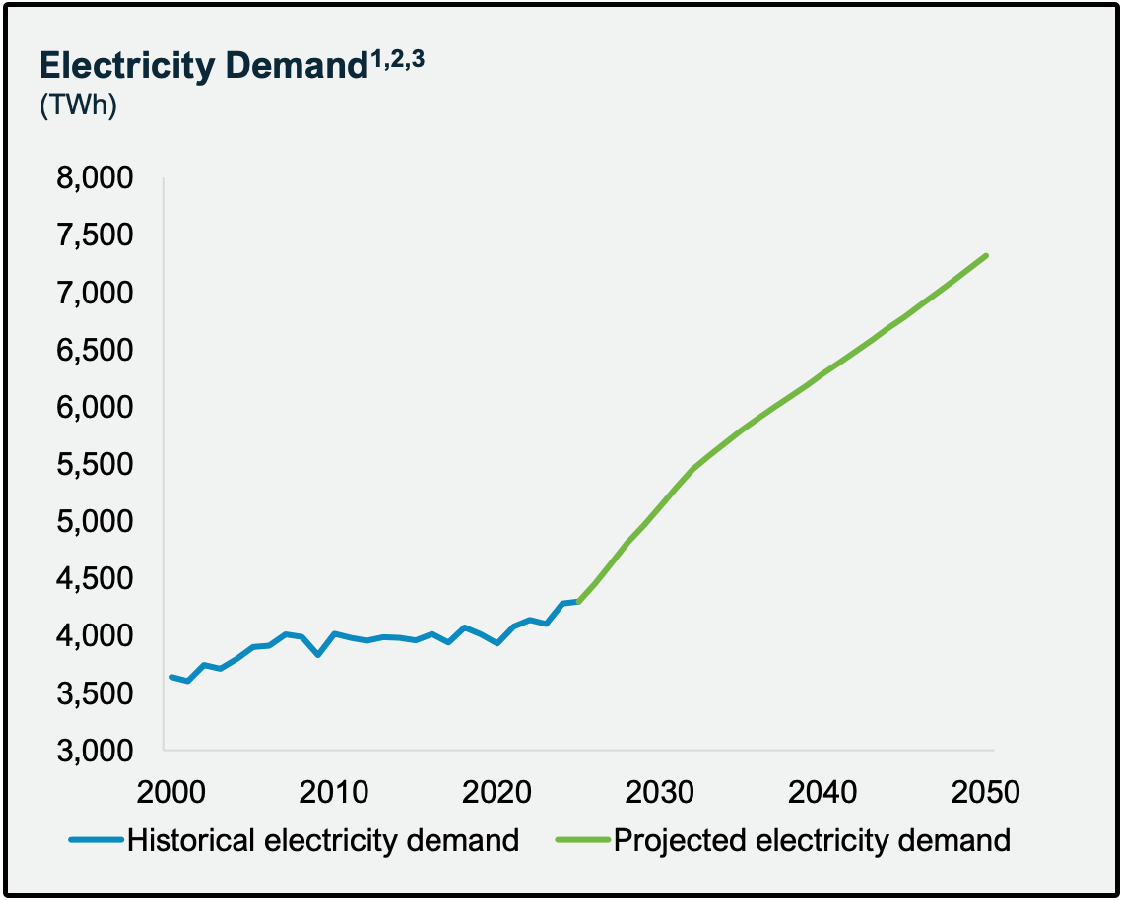

NextEra’s management also recently noted that the global demand for electricity is expected to grow more over the next decade than it has over the past three decades combined.

As companies like OpenAI, Meta, and Amazon build massive data infrastructure, the power demand surge directly benefits utilities like NextEra that are expanding renewable generation capacity.

The biggest recent development?

NextEra’s new 25-year agreement with Google to restart the Duane Arnold nuclear plant in Iowa.

615 MW of baseload nuclear capacity

Expected restart by 2029

Management estimates +$0.16 of EPS per year for the first 10 years

Nuclear is still a relatively small piece of total capacity for NEE (~8.5%), but it already contributes around 18% of actual power generation, and that share is set to grow.

In a world of AI-driven, 24/7 power demand, carbon-free baseload nuclear attached to long-term contracts with hyperscalers is an extremely attractive asset.

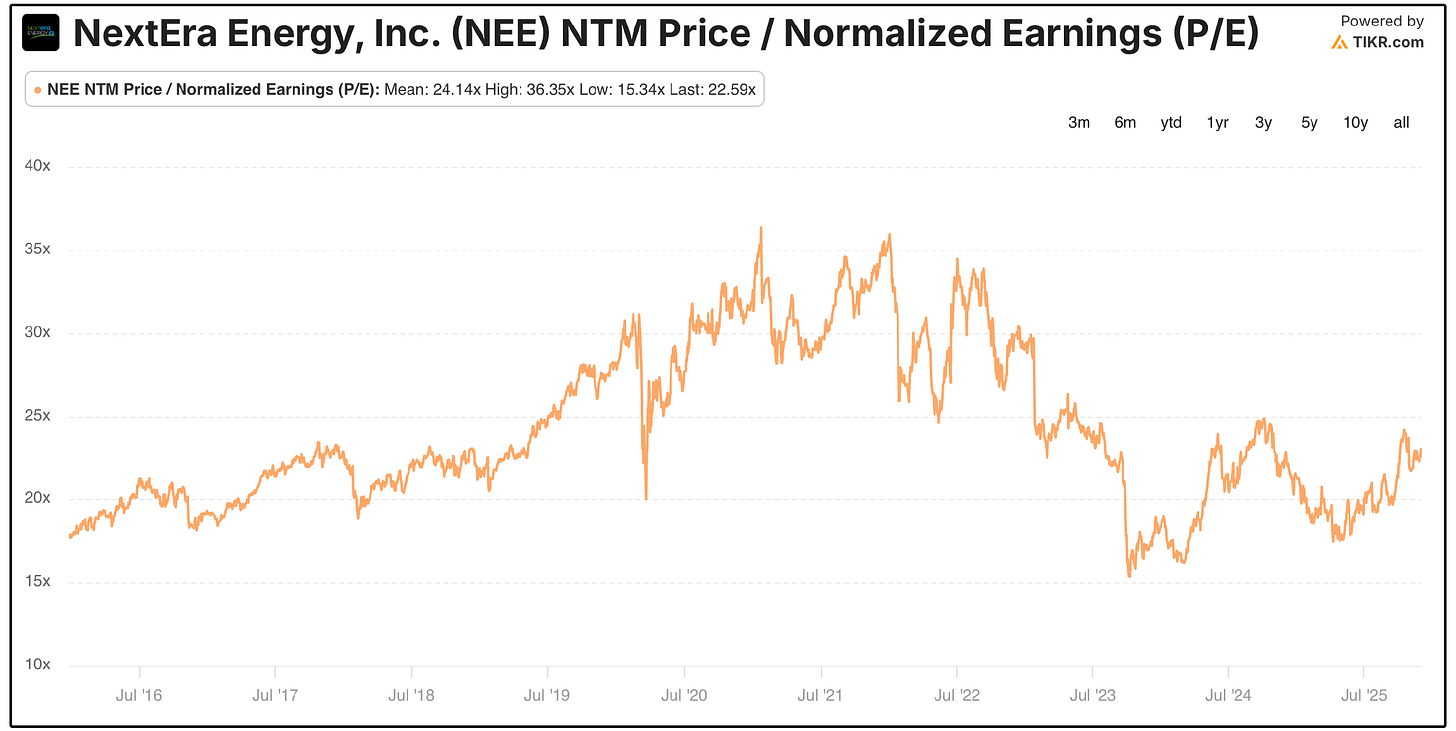

NextEra Energy trades at a premium valuation compared to their peers, but that premium is grounded in its superior growth profile, industry-leading profitability, and long runway of clean-energy and nuclear expansion that most traditional utilities simply don’t have.

Now, let’s jump into this month’s full list below. 👇