🏆 List of Undervalued Dividend Stocks (September '25)

These Stocks are Undervalued 🔥

At the beginning of each month, I send out a spreadsheet that lists out the dividend stocks that I believe to be undervalued.

This is the end result of 100’s of hours of research every month.

It’s time to dive in.

But first…

Have You Heard The News? 📝

Dividendology will be transforming into a full scale investment research platform on September 8th! (less than one week away!)

Here’s everything you get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with now over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

The full launch is almost here.

1. UnitedHealth Group (UNH) 🏥

Warren Buffett has repeatedly stated over the decades how he loves insurance companies.

And when you understand the business model, it’s quite easy to see why.

At its core, insurance is simple:

Customers pay premiums today to protect against potential future losses.

Insurers get to hold and invest this money (called float) until claims are paid. Done right, float can last for years and often grows over time.

Eventually, the insurer must pay out to policyholders who experience losses.

The profit comes from two ways

Underwriting Profit: If premiums collected exceed claims + expenses.

Investment Profit: By investing the float (the premiums collected) until claims come due.

This business model has the ability to be incredibly powerful.

Buffett understood this early in his career, and just added a new insurance company to his portfolio:

UnitedHealth Group.

The company is down -47.62% in the last year.

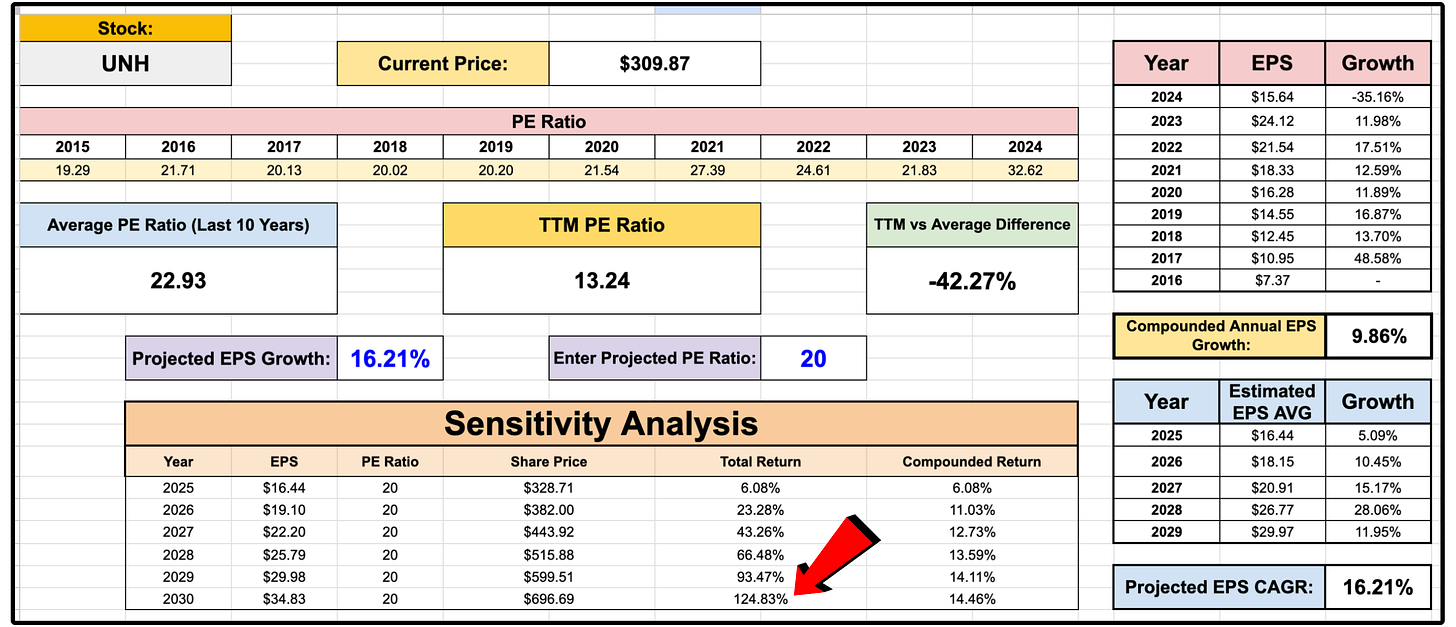

Historically, they’ve grown EPS at a consistently high rate.

EPS in 2014 was $5.78, and by 2023 it had grown to $24.12.

That gave them a compounded annual EPS growth rate of 16.7%.

However, as you probably already know, the company has seen an onslaught of bad news over the past year and a half.

Let’s summarize:

The sell off is fear-based, with uncertainty remaining surrounding the DOJ investigation.

However, there are now a few things to take into consideration.

Warren Buffett has always stated the importance of investing in companies where you can trust management.

UNH has seen more congressional members buying than selling for the first time in years

UNH was the number 1 most frequently bought stock by super investors last quarter

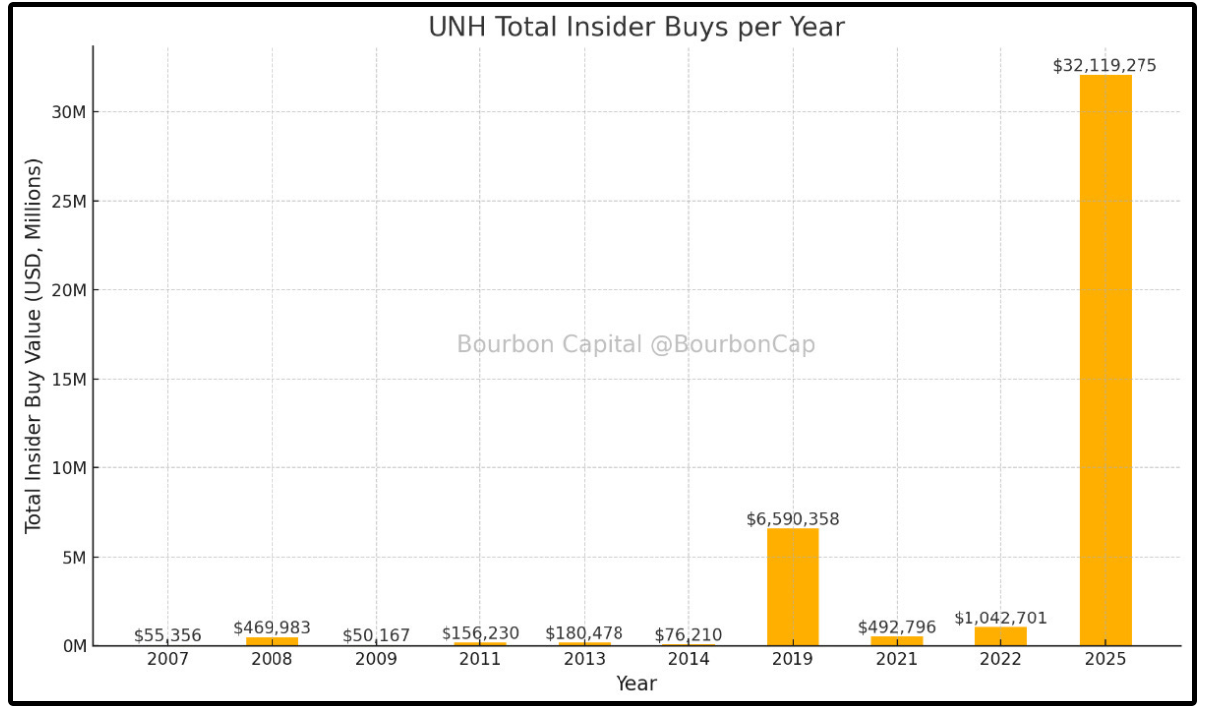

Insiders have bought more shares in 2025 than they bought from 2007 - 2024 combined.

This is incredibly important to take note of, as the investment case for UNH entirely hinges on the DOJ investigation, because UNH is undeniably undervalued from a fundamental standpoint.

If UNH simply:

Reverts back to a PE ratio of 20 (still below its historical average)

Achieves the average EPS estimates from analysts

Then UNH would provide a 124.8% return by 2030, not including dividends.

Everything hinges on the investigation.

Nothing is guaranteed, but all the big money seems to be flowing into this stock.

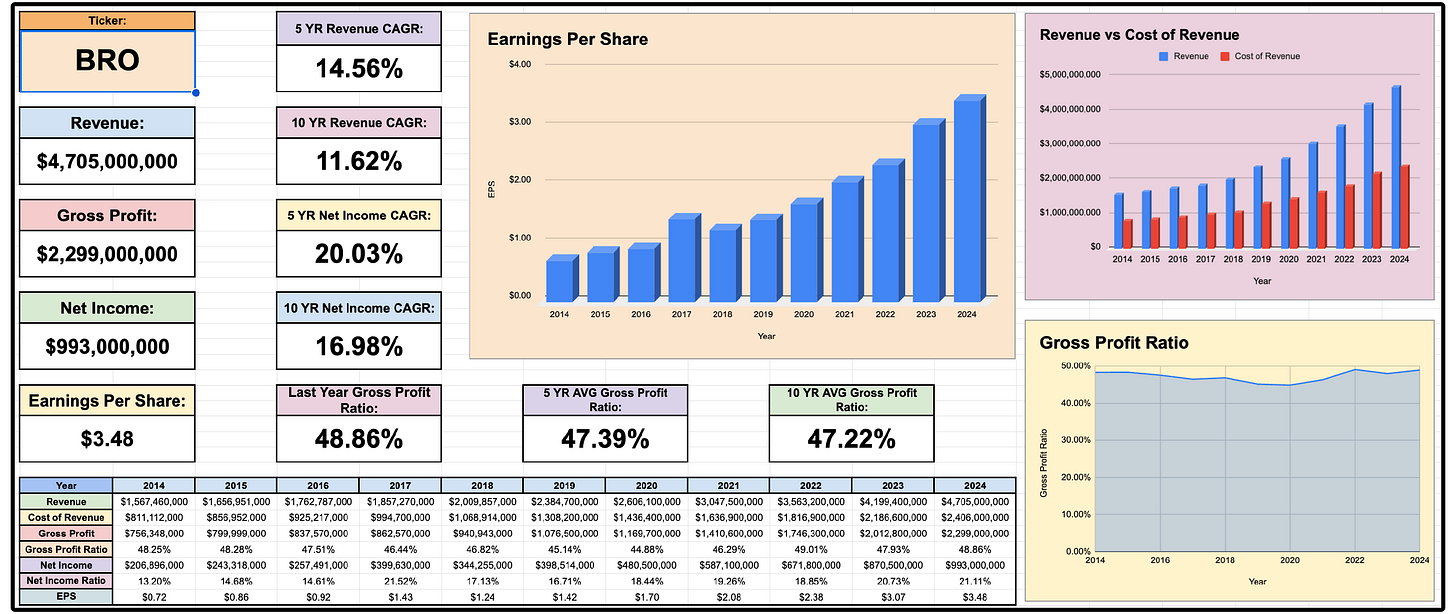

2. Brown & Brown (BRO) 🏦

Unlike traditional insurers that take on risk, BRO acts as a middleman.

BRO connects customers with the right insurance carriers and earns commissions and fees.

There are 2 main sources of revenue:

Commissions (70% of revenue)

BRO earns a commission (typically 10–15% of the annual premium) every time they place a customer with an insurance carrier.

Fees (30% of revenue)

BRO charges fees directly to customers for specialized services like risk management, employee benefits consulting or claims administration.

This capital-light model avoids the balance sheet risk of underwriting, while still benefiting from rising premiums over time.

Today, more than 90% of revenues are generated in the U.S., across four business segments:

Retail (58%)

National Programs (24%)

Wholesale Brokerage (13%)

Services (5%)

BRO recently completed their largest acquisition ever buying Accession Risk Management Group in a $9.8 billion cash-and-stock deal.

This acquisition grows BRO’s ‘specialty distribution’ segment of the business, which typically has higher margins.

This should also add around $1.7 billion in revenue.

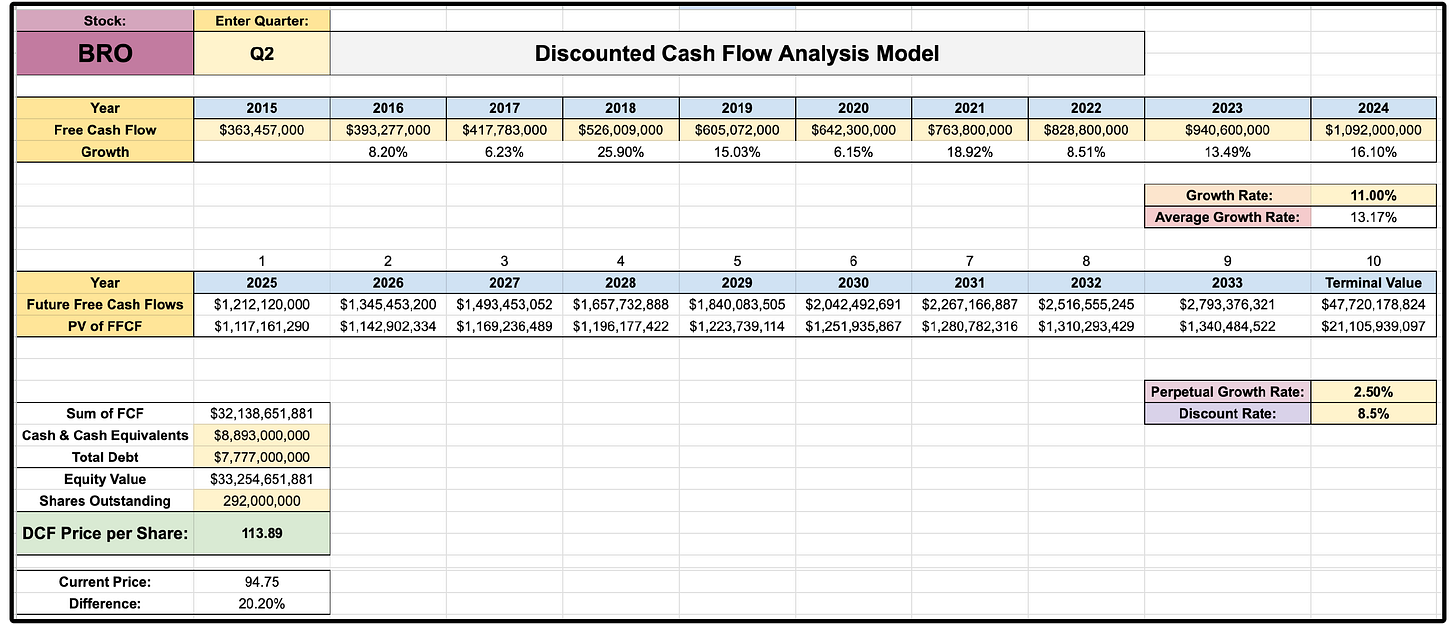

Assuming 11% free cash flow growth moving forward (which is in line with estimates)-

BRO has 20% upside at its current prices.

3. Brookfield Corporation (BN)

Brookfield Corporation is one of the world’s largest alternative asset managers.

Brookfield focuses on direct control investments across five key sectors:

Real Estate

Renewable Power & Transition

Infrastructure

Private Equity & Credit

Insurance Exposure

Brookfield Corporation is one of the largest holdings of Bill Ackman’s Pershing Square Capital Management.

In fact, he even increased his position in the most recent quarter.

Here is the recent statement his fund made surrounding BP-

“We estimate Brookfield will grow distributable earnings, which is the company's metric for earnings per share, at a midteens percentage this year, before significantly accelerating the growth rate to as much as 30% in 2026, as carried interest and BWS (Brookfield Wealth Solutions) both experience a step-function change in their earnings contribution.”

From a relative valuation perspective, BN looks quite attractive.

They trade at a substantial discount to comparable U.S. peers, KKR and Apollo, despite expectations that they will grow distributable earnings at a higher rate.

BN remains high on my watchlist.

Now, let’s jump into this month’s full list below. 👇

You can access this months list by clicking below.