🏆 List of Undervalued Dividend Stocks (July '25)

These Stocks are Undervalued 🔥

At the end of every month, I send out a spreadsheet that lists out the dividend stocks that I believe to be undervalued.

This is the end result of 100’s of hours of research every month.

If you’d like to receive it, consider becoming a paid member.

Now, let’s dive in.

As always, before diving into the stocks, it’s important to revisit a few key principles.

I almost always discuss these points in my paid newsletters, but it’s important we revisit them for newcomers and as a reminder to ourselves.

Just because a stock is undervalued, does not mean you should buy it. (Make sure it fits into your portfolio.)

What’s considered a good buy for one person, may be a bad buy for another person.

It can take time for a stock to revert to intrinsic value.

The Market Moves in Cycles

Before we look at the sheet, let’s review a few interesting opportunities:

1. 👜 VICI Properties (VICI)

Is it possible for a REIT that has a total return of over 23% over the last year to still be undervalued?

The answer is absolutely yes.

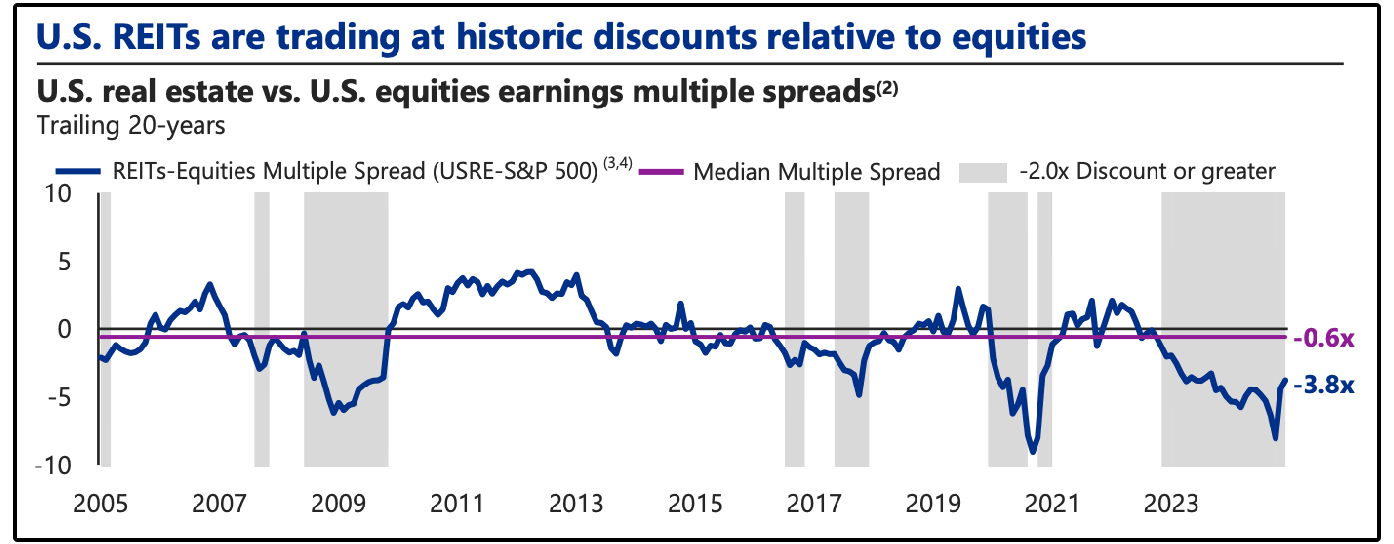

This chart shows how cheap U.S. REITs are relative to the S&P 500 based on earnings multiples.

The blue line = REITs vs. equities multiple spread

The purple line = 20-year median

Right now, REITs are trading at a -3.8x spread (one of the deepest discounts in 20 years)

Historically, when REITs have traded at a -2.0x discount or more, they’ve delivered returns that outperform the S&P 500.

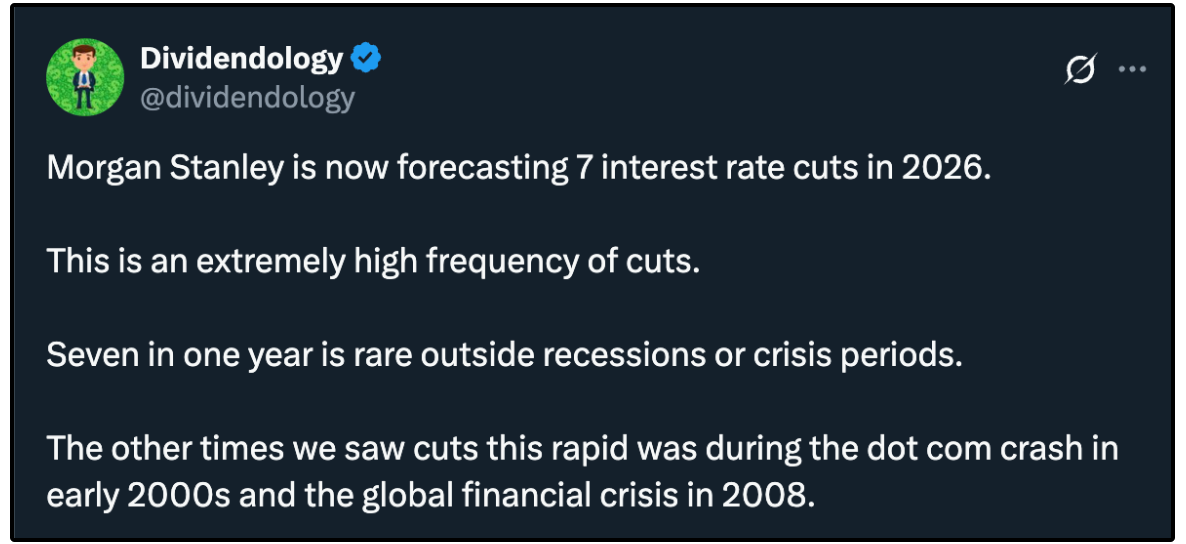

On top of this, REITs have a short term catalyst on the horizon.

With rates coming down, the high yielding REITs become more attractive to income investors.

So why VICI?

To start, the REIT has great dividend metrics:

Current dividend yield: ~5.3%

5-year dividend CAGR: ~6.4%

Dividend growth every year since 2018 (even during 2020)

That’s rare for a REIT and speaks to the strength of VICI’s tenant base.

In their most recent earnings report in April, FFO came in at $0.58, missing expectations by $0.10.

At first glance, that looks bad, but the miss was driven by a non-cash accounting adjustment due to CECL (loan loss reserves). It didn’t reflect real business deterioration.

In fact:

Adjusted FFO rose 5.4%

AFFO per share rose 3.6%

Moody’s upgraded their credit rating

2025 guidance was increased

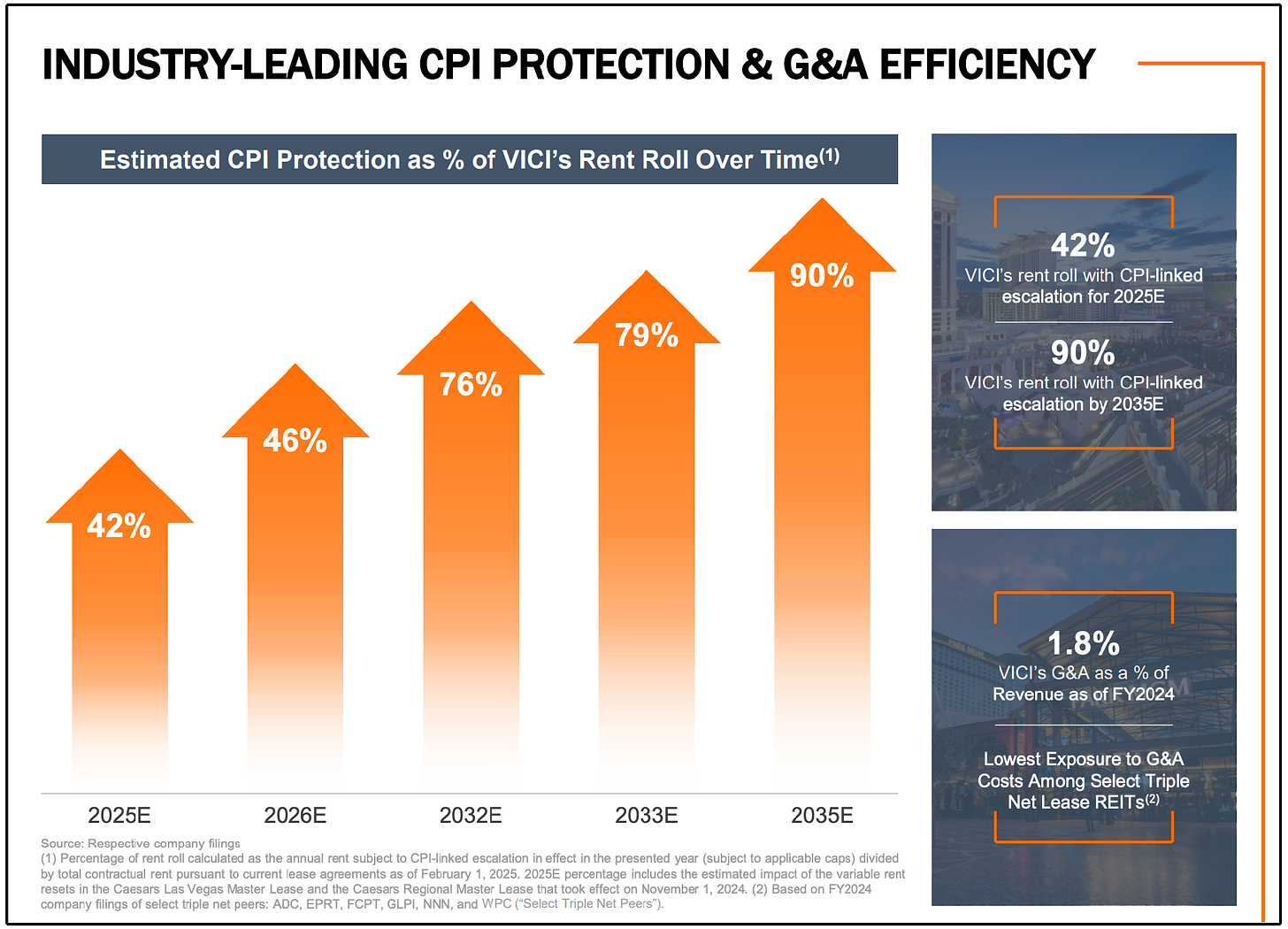

One of the biggest threats (particularly for REITs) is inflation.

However, VICI investors don’t have to be concerned with this.

42% of rent is CPI-linked today

Expected to be 90% by 2035

This helps protect purchasing power and supports sustainable dividend growth.

VICI also has built one of the better balance sheets in the REIT sector, and that matters, especially in a high-rate environment.

99% of debt is fixed-rate

This shields them from rising interest costs and locks in lower rates from previous years.83% of debt is unsecured

No specific properties are pledged as collateral, giving them more flexibility to raise capital or refinance.6.7 years average maturity

Debt is spread out over time, with no near-term pressure to refinance.Staggered maturity ladder

Debt is evenly spaced over future years, reducing risk during tighter credit conditions.

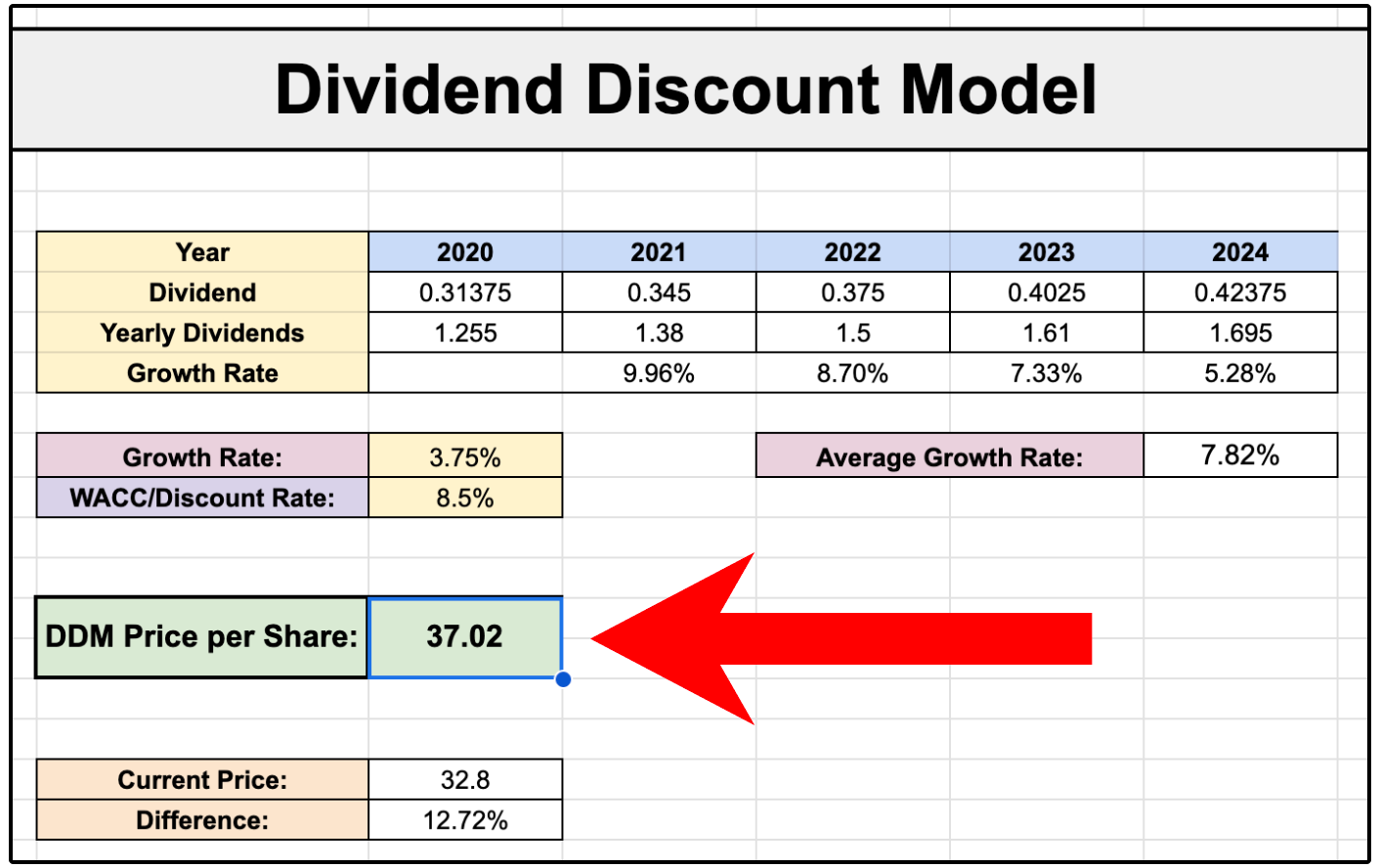

As for the valuation, if we run VICI through a dividend discount model assuming 3.75% dividend growth, we come to a fair value of $37.02.

This gives VICI 13% upside.

2. Canadian National Railway Company (CNI)

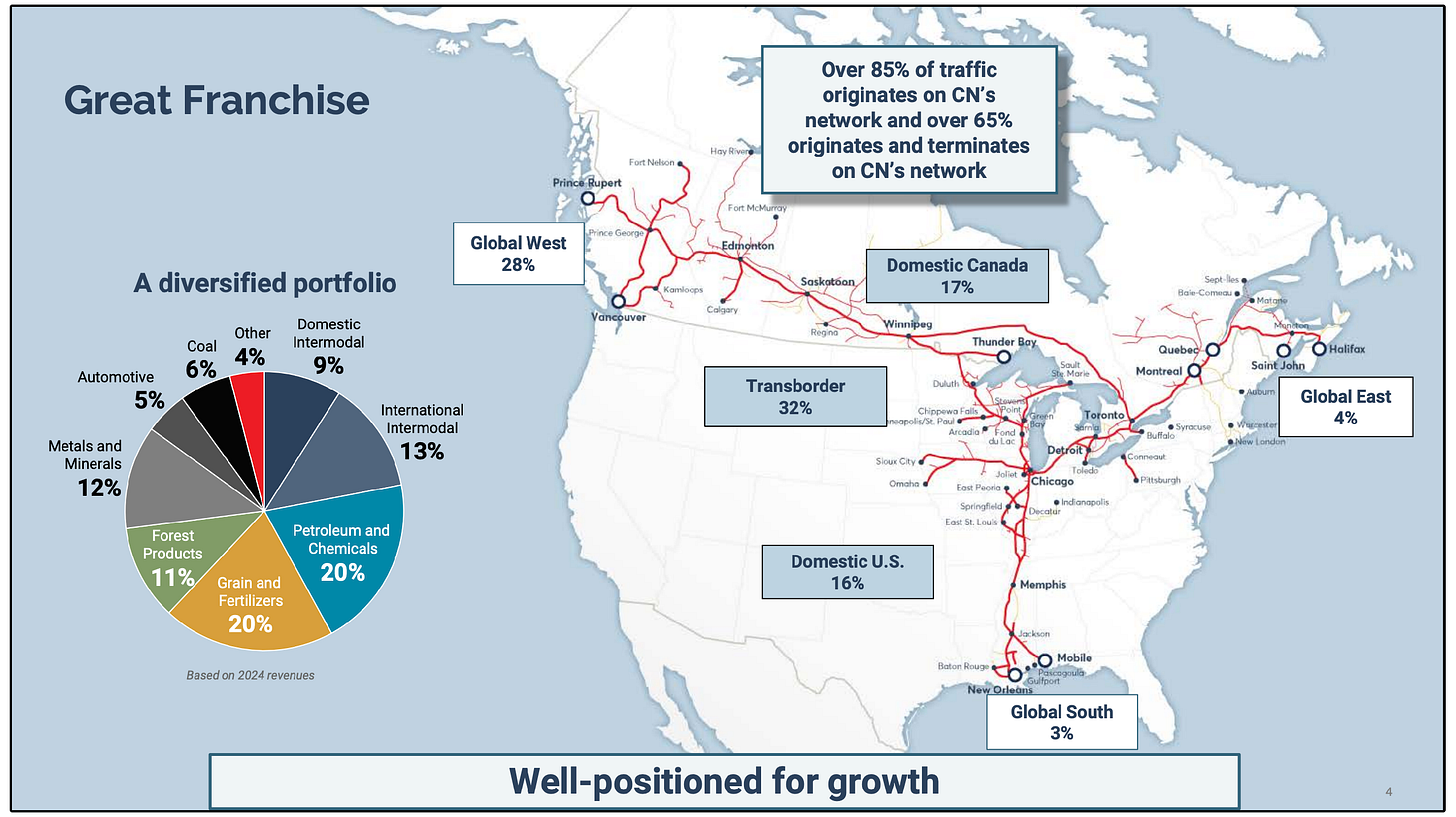

CNI is in the freight transportation business, and it generates revenue from moving goods across its 20,000+ mile rail network in Canada and the U.S.

Railroads are economically sensitive, but CNI’s business model has some clear advantages:

Operates 20,000+ miles of track across Canada and the U.S.

Only railroad with coast-to-coast reach in North America

Diversified revenue base across intermodal, grain, forest products, petroleum, automotive, and chemicals

This diversification helps CNI weather downturns better than most industrial names.

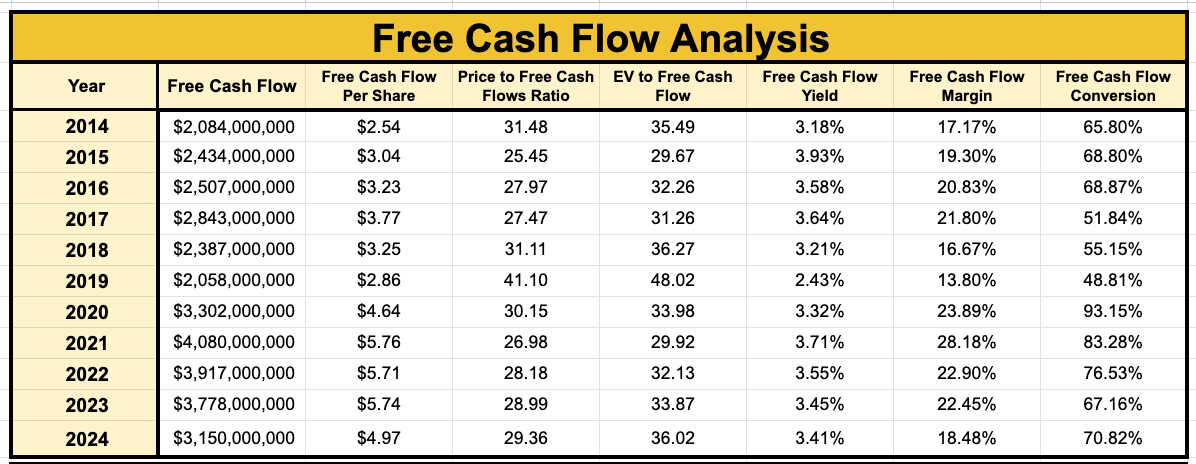

Railroads are capital-intensive, but CNI’s scale and efficiency generate healthy free cash flow.

This has helped their FCF margin consistently hover around 20%

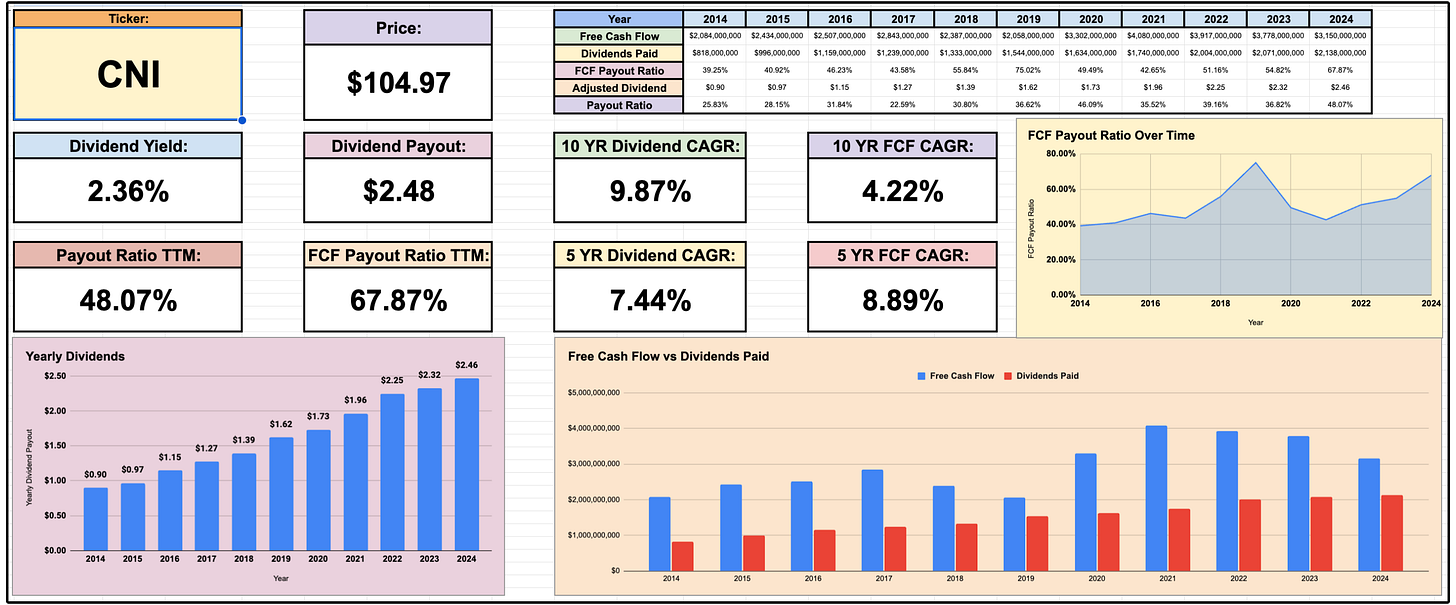

The company also has a rich history of growing their dividend.

The starting yield is around 2.4%, with a 10 year dividend compounded annual growth rate of 10%.

The reason CNI has been able to reliably grow its dividend for so long, is its MOAT.

“A good business is like a strong castle with a deep moat around it. I want sharks in the moat to keep away those who would encroach on the castle.” - Warren Buffett

CNI benefits from several key moats:

Network effect — It would be nearly impossible to replicate their rail infrastructure

Cost advantage — Rail is ~4x more fuel efficient than trucks per ton-mile

High barriers to entry — Between land use restrictions, capital costs, environmental approvals, and tight logistics, it's nearly impossible for a new competitor to start a national railway today.

With few real competitors and massive barriers to entry, CNI enjoys steady pricing power and operating leverage over time.

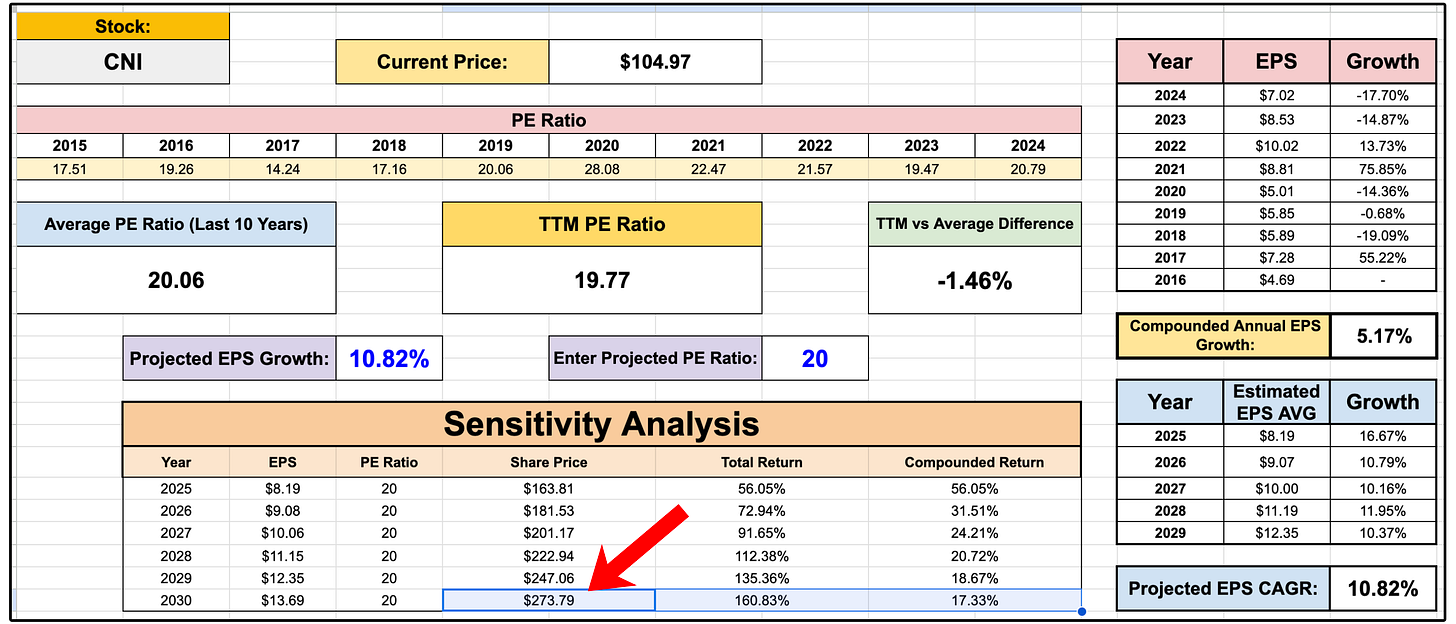

The valuation for CNI makes it appear to be an under-the-radar pick to beat the market over the next 5 years, while providing a growing stream of income.

Based on the average analyst EPS estimates, and assuming the PE ratio stays where it is now (slightly below its 10 year average)-

You would get a 2030 price target of $273.79.

This would be a 17.33% compounded annual return, or 160.83% total return (not including dividends).

3. UnitedHealth Group (UNH)

No doubt, one of the most controversial stocks out there right now.

But UnitedHealth Group has long been one of the most dominant and consistently growing healthcare companies in the U.S.

2024 and 2025 brought a wave of negative headlines that triggered a dramatic 36% stock decline in just a few months.

This has led UNH to become a higher risk/high reward play.

And recent news has been good for those who are taking advantage of this sell off:

DOJ Shifts Focus Away From Monopolization

New reports show the DOJ is pivoting the investigation toward UNH’s pharmacy benefit manager (PBM) business. This shift weakens the original antitrust case, which is a huge positive for UNH.

Medicaid Tax Provision Rejected

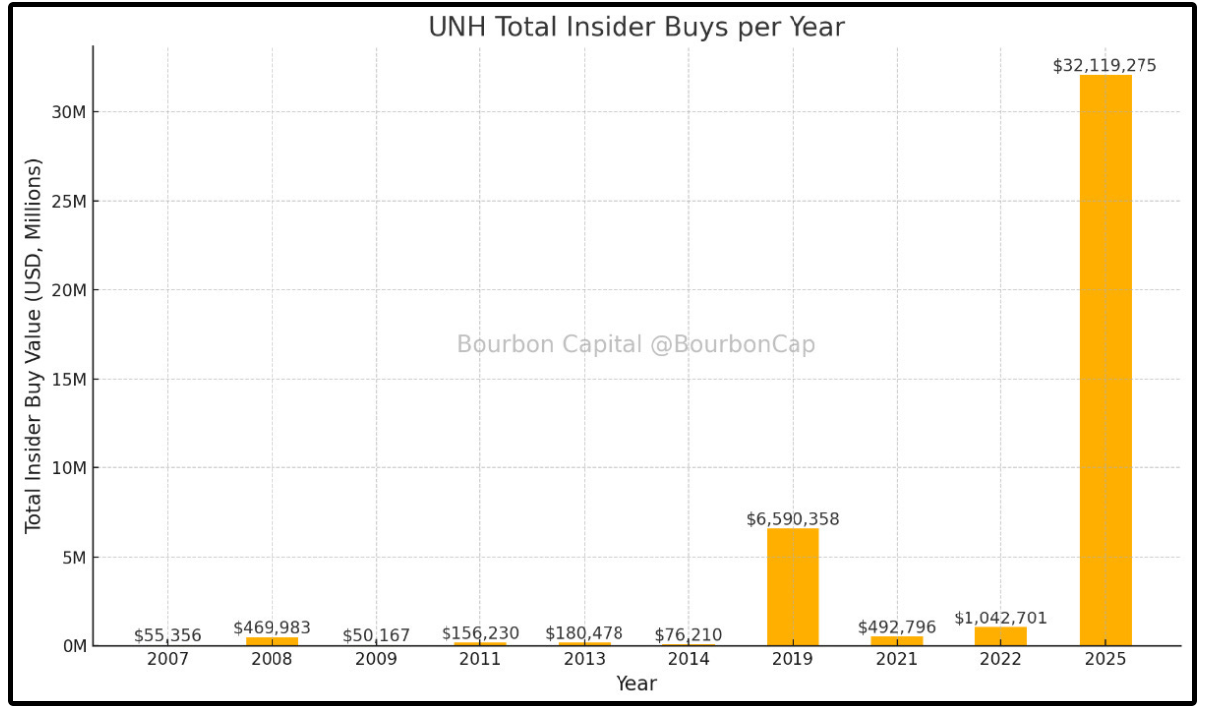

A new Senate ruling blocks cuts to Medicaid provider tax, a move that helps protect a significant revenue stream for UNH.Insider Buying Surges

Insiders — including the CEO and CFO — have already bought $32M+ of stock in 2025. Compare that to < $1M in most prior years.

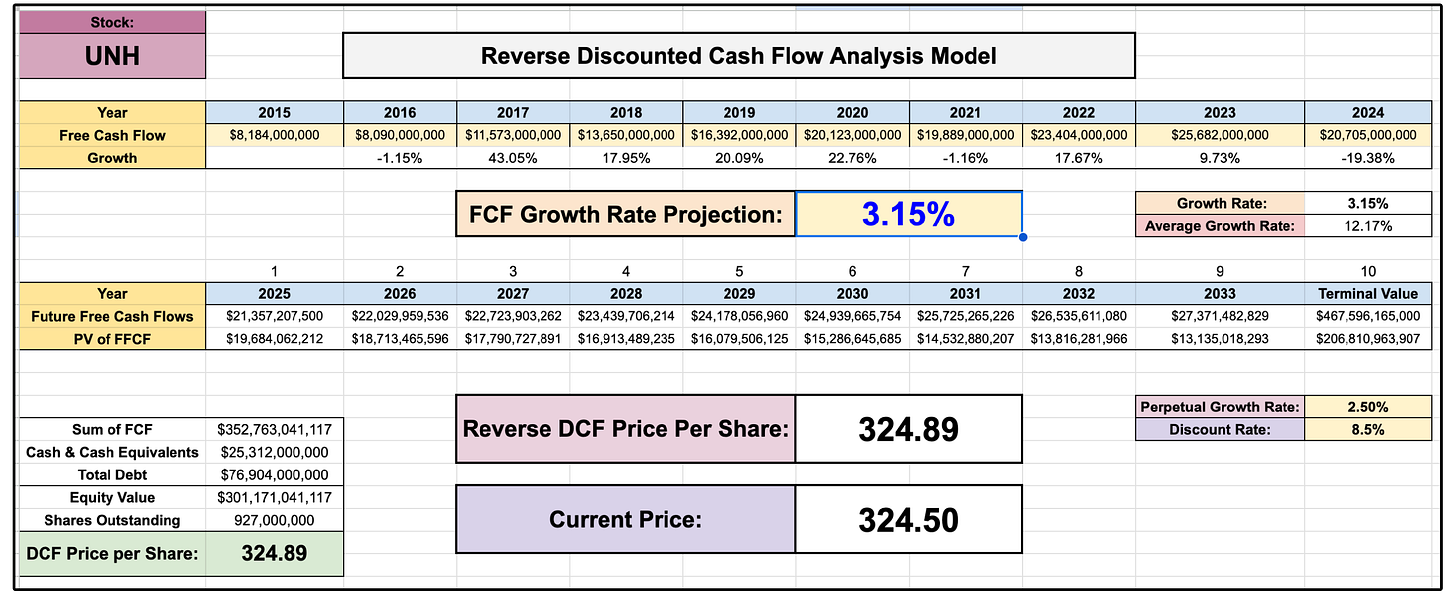

If we look at UNH’s valuation with a reverse DCF model, the results are quite shocking.

The market is only pricing in 3.15% annual free cash flow growth into UNH over the next decade.

From a fundamental standpoint, there is no doubt UNH is dramatically undervalued.

But the reason is some investors have concerns over the legitimacy of the lawsuits.

Higher risk/higher reward play.

Now, let’s jump into this month’s full list below. 👇