May Dividend Portfolio Update 2024 🔥 ✅

Collect Dividends While You Wait.

There are a multitude of qualities an investor needs to be successful, but at times, none is more important than this:

Patience.

Not every month will be a month where you add an exciting new position to your portfolio.

Not every month will be a month where you find great companies trading below their fair value.

But here’s the beautiful part about dividend investing:

You can sit there and collect dividends while you wait.

Whether the market goes up or goes down-

When you buy quality dividends stocks, those dividend payments keep rolling in.

Every month my dividend income increases, even if I don’t contribute new capital.

This is due to:

Companies increasing dividend payments

Reinvesting my dividends

I find that this makes dividend investing extremely motivating, and it also makes it quite easy to be patient to wait for the right opportunities.

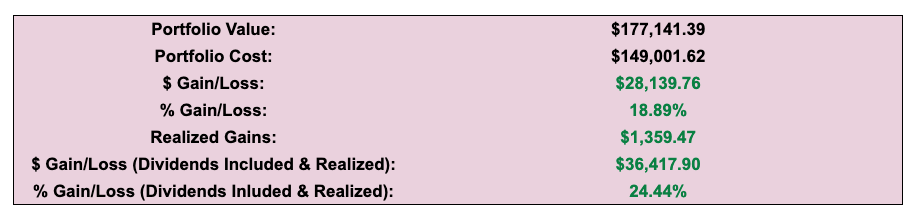

As of writing this, my portfolio is currently sitting at about $177,141.39, and I’ve seen over $36,000 in gains.

I didn’t buy any new positions to my portfolio this month, but I did add some capital to:

SCHD

V

UNH

SBUX

Over the past month, SBUX is up over 11%, so it looks like buying the dip has paid off so far.

The growth from many of my other positions has been quite nice as we can see below.

I’ll continue to make sure the holdings in my portfolio align with my long term goals. And in fact, I may consider selling a few of these I don’t believe align with my goals.

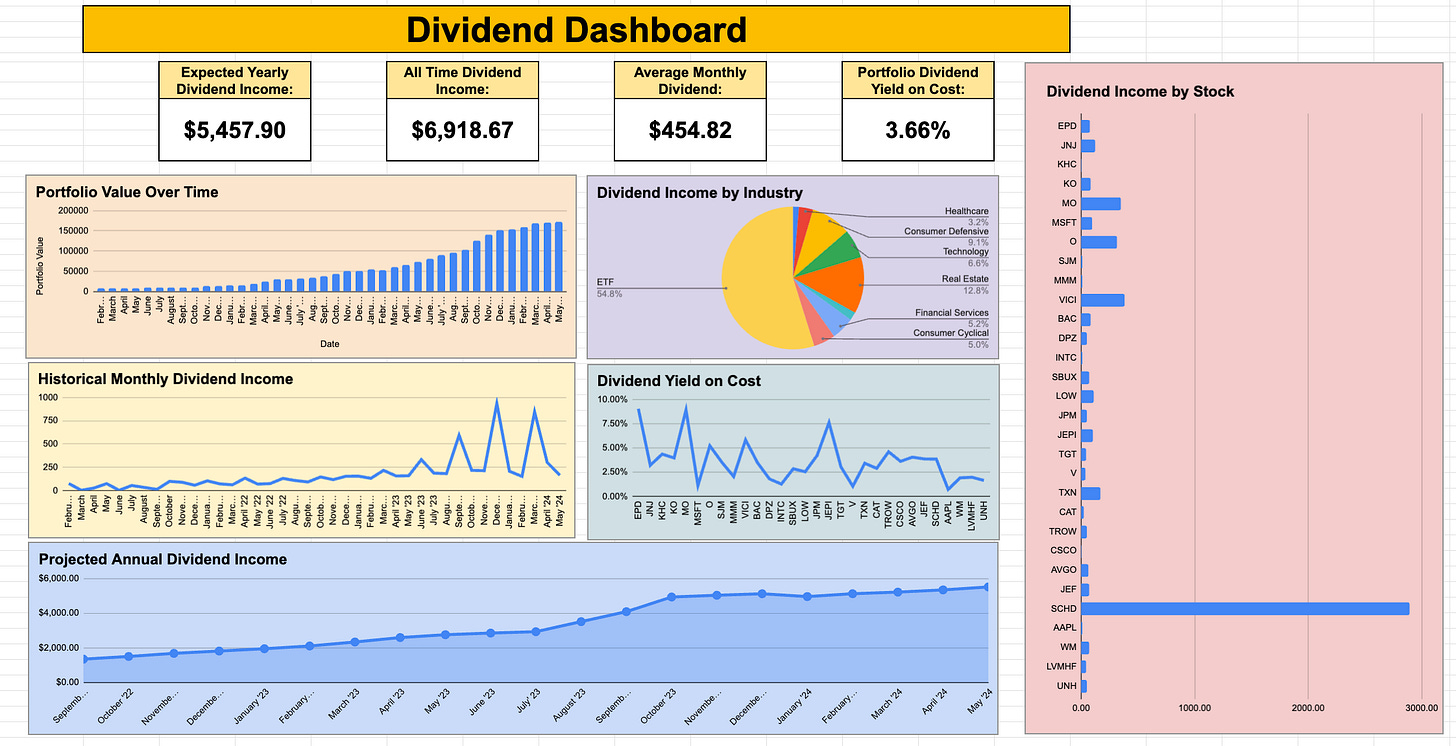

My average monthly dividend income just hit a milestone, being over $450! This puts my expected yearly dividend income at $5,457.

That’s $450 being reinvested back into my portfolio, regardless of market conditions or how much I personally contribute to my portfolio.

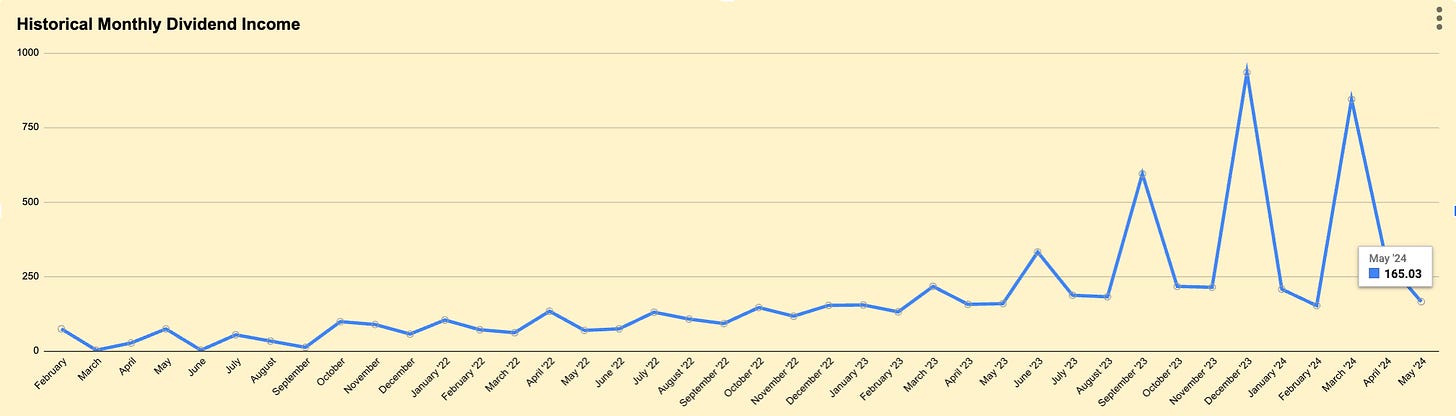

And while my dividend income in the month of May was lower at about $165, next month is shaping up to be my largest month of dividends ever at potentially over $1,000 (depending on how much SCHD pays out).

The amount of time it will be until I can achieve my long term goal of living off dividends continues to decline over time. In 10 years from now, I could easily be making over $35,000 a year in dividends.

And in 15 years, this jumps all the way up to $65,808.

It will be here before you know it.

The key is staying consistent, and like I mentioned earlier, patience.

I’ll continue to sit back and collect dividends while I wait.

And my dividend income will continue to increase every month.

Tweet of the Week:

If you missed it..

I recently launched Tickerdata!

Tickerdata is a spreadsheet integration tool that gives you the ability to automatically pull in live stock data for over 70,000 different stocks, 30+ years of historical financial statement data, other key financial metrics, and it can pull in data from over 70+ stock exchanges all across the world, straight into your spreadsheet.

This is the tool I use to track my portfolio and analyze stocks.

You can access Tickerdata and download my spreadsheets here.

You can also subscribe to the Tickerdata YouTube here, where I post tutorials and even more stock analysis!

Check out these resources:

Lastly…

Every month, I send out a Newsletter to my paid newsletter subscribers that lists out the dividend stocks I believe to currently be undervalued.

I plan on sending out this months edition in the next day or two, so if you’d like to receive it and even gain access to last months, the you can become a paid member below. 👇

That’s all for now! Feel free to respond to this email and let me know of any thoughts you have!

See you next week!

Dividendology

You re the best. Hands down