May Dividend Portfolio Update 2025 🔥 🚀

The Snowball Keeps Rolling 💰

Portfolio Update 📊

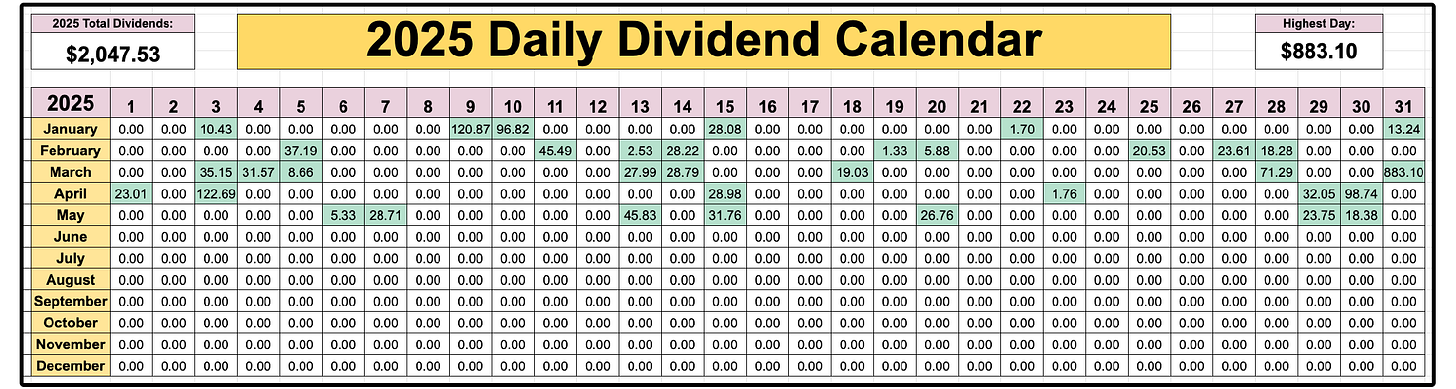

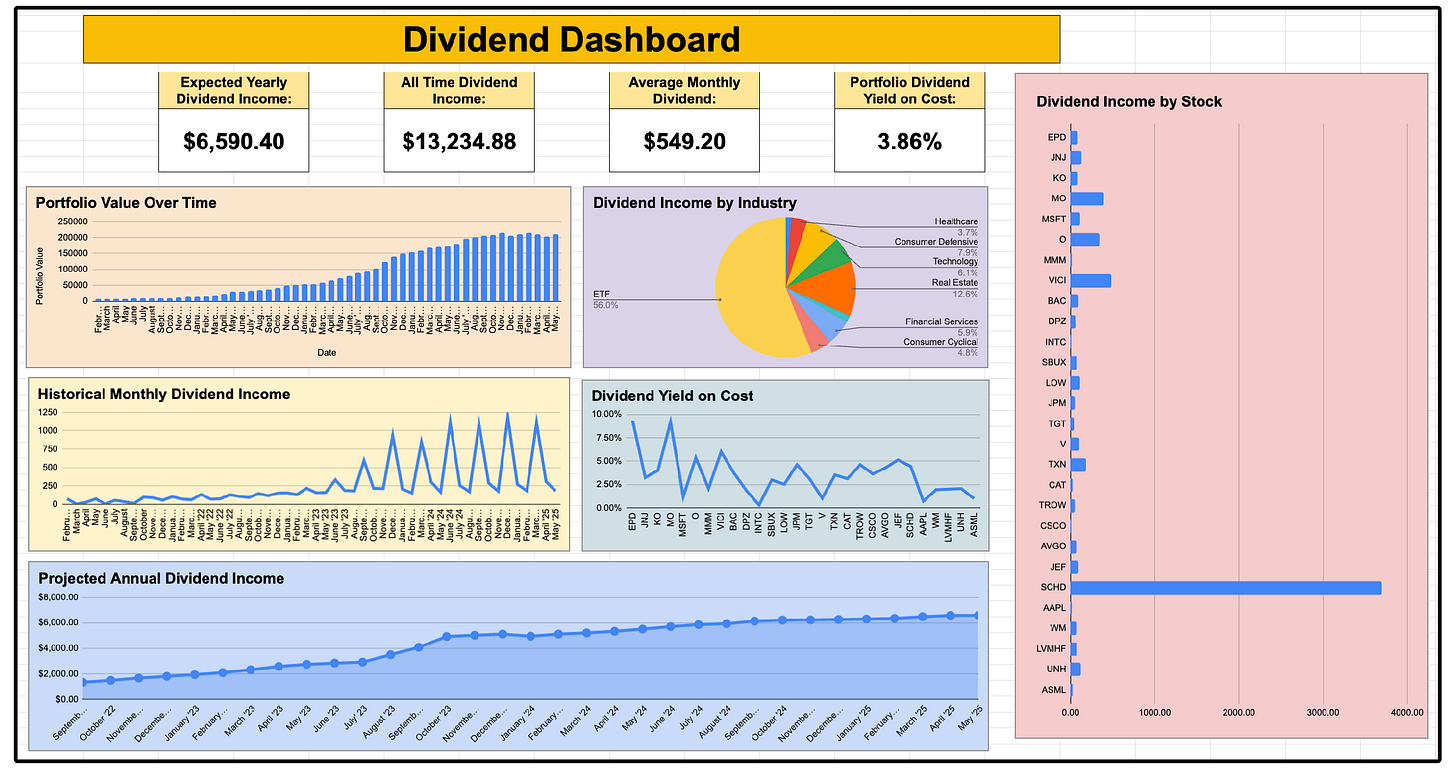

We are now 5 months through 2025, and my portfolio has generated $2,047.53 in dividends.

And on top of this, my average monthly dividend income is now around $550.

It’s important to note that the focus of my portfolio is to maximize dividend income over the long term.

Why is this important?

Maximizing Dividends Long Term 🎯

If my portfolio were currently focused on high yield (think 9%)-

I would be making $18,900 in dividends a year, or $1,575 a month.

That’s nearly 3x more than I currently earn.

For people who are looking to utilize dividends as supplemental income right now, it would certainly make sense to focus on higher yielding investments.

The day will come when I shift to a higher yielding strategy.

But for now, the main focus is predominantly dividend growth.

Over the long term, stocks that grow dividends at a high rate pay out more than high-yielding stocks, even if dividends are reinvested.

This is why the focus for now is dividend growth.

The strategy is to buy high-quality stocks that grow free cash flow rapidly, enabling strong dividend growth.

Along with this, stocks that grow their dividends over time tend to outperform the market.

Note: You can read more about the above study here.

My Dividends 💰

Here is every dividend payment I received in the month of May:

🧠 ASML – $5.33

🛠️ LOW (Lowe’s) – $28.71

🔌 TXN (Texas Instruments) – $45.83

🏢 O (Realty Income) – $29.12

🍏 AAPL (Apple) – $2.64

🛢️ EPD (Enterprise Products) – $20.86

🚜 CAT (Caterpillar) – $5.90

💼 JEF (Jefferies Financial) – $23.75

☕ SBUX (Starbucks) – $18.38

The total amount of dividends received was $180.52.

This was an expected lower month, but next month is projected to be over $1,000.

My Purchases 🚀

This past month was much lighter in terms of stock buys.

The only stock purchase was UNH with an average buy price in the low $300s.

Keep in mind, I now consider UNH a high risk/high reward play.

You can learn more about where they currently stand in this video.

Living Off Dividends 💭

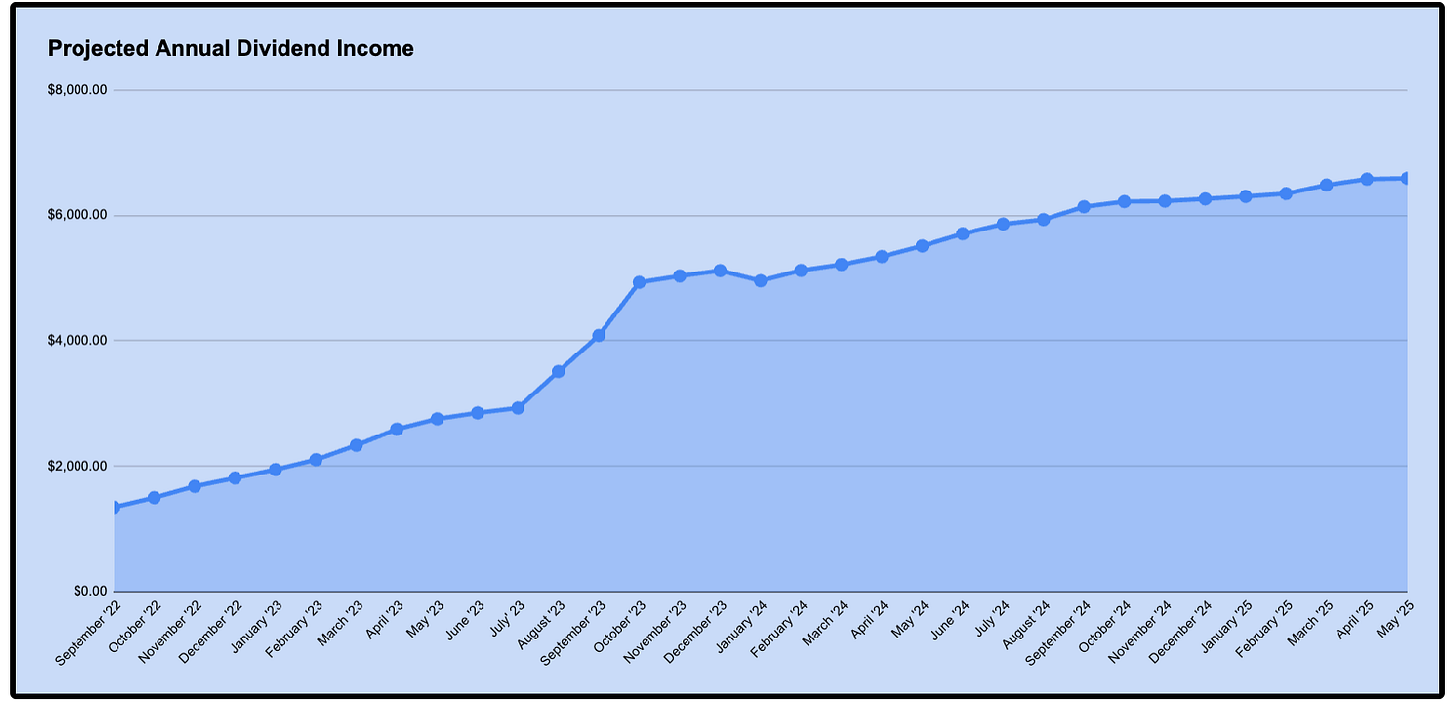

What’s beautiful about dividend growth investing, is my projected annual dividend income climbs every single month, even with minimal activity in my portfolio.

My projected annual dividend income keeps rising month after month, thanks to the 3 key drivers behind the snowball effect:

💰 New contributions

🔁 Reinvested dividends

📈 Stocks growing dividend payouts

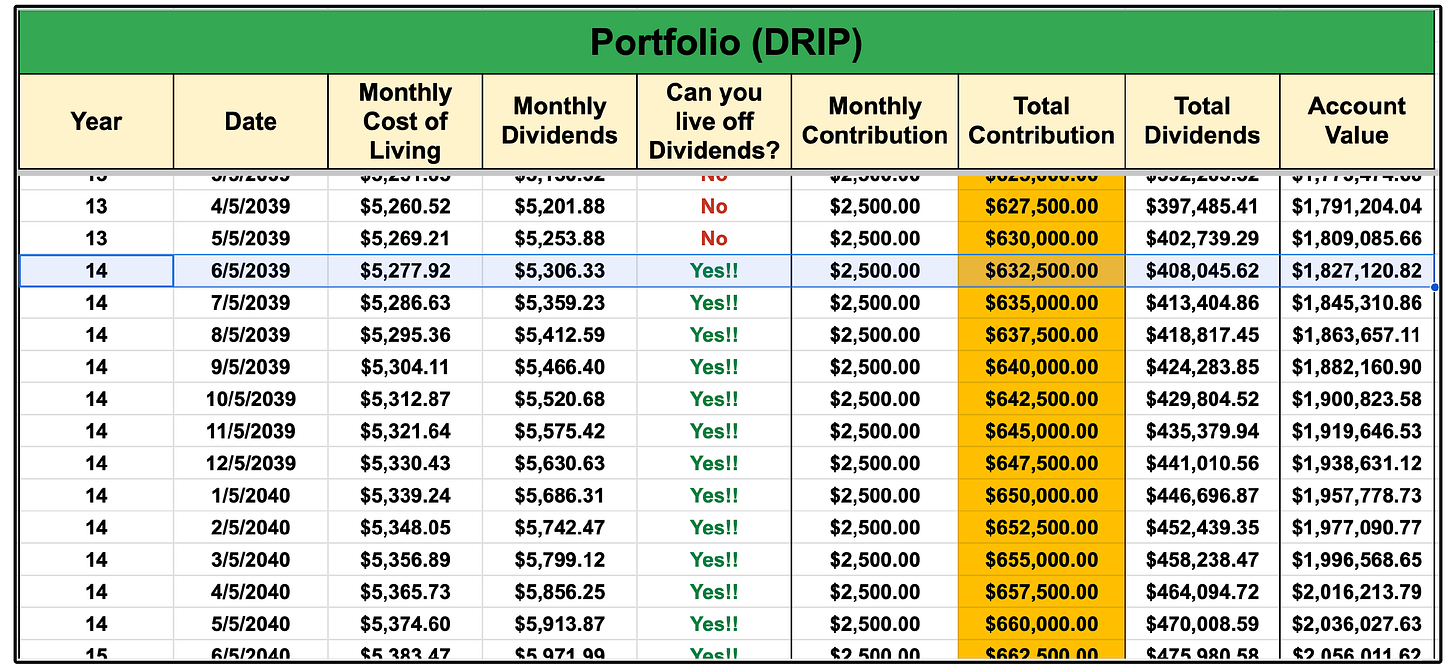

This snowball effect is my plan for financial freedom.

Eventually, the snowball will grow so big, that it will completely cover my cost of living.

Whether you are currently looking to maximize immediate dividend income with a high yield strategy, or are looking to grow dividends with a dividend growth strategy-

Keep feeding the snowball.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform + Spring Sale!!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

If I missed your portfolio, would you mind sharing

Hi! I'm pretty new to this field and still learning the basics.

Really great content, I found it super interesting!

Quick question: how do you figure out which stocks actually grow their dividends at a high rate? Do you use any specific tools for that, or is there some kind of metric that shows this objectively? Or is it more about doing your own analysis?

Thanks in advance.