November Dividend Portfolio Update 2023 ✅ 🔥

New All Time High!! 😎

Throughout your dividend investing journey, hitting new all time highs with your portfolio should be a somewhat frequent event.

Early on in your investing career, this most commonly happens due to contributing capital.

But as your portfolio grows, it more commonly occurs due to the dividend payments you receive, and capital gains.

The latter is the reason I hit a new all time high with my portfolio this month.

After contributing the most capital to my portfolio I ever had in a single month in October, my cash position was sitting at only 4.3%.

So this month, my focus was increasing my cash position, which now sits at 8.9%.

The higher cash position will put me in healthier position to make more moves in the market when the opportunity comes.

So although I contributed very little to my portfolio this month, my portfolio value is sitting higher than ever before at $143,483.17.

If we take a look at my growth chart, we can see the vast majority of my positions are currently in the green.

As of right now, my 3 winningest positions are AVGO (up 84.72%), JPM (up 46.15%), and MSFT (up 42.93%).

While it’s fun to see some amazing gains from the positions in my portfolio as well as new all time highs, it’s important to remember the end goal for my portfolio.

Living off dividends.

So while the short term gains are fun, I need to make sure my portfolio is designed to compound for the long term utilizing dividend growth companies.

My yearly dividend income now sits at $5,032.

That’s $419.35 a month!

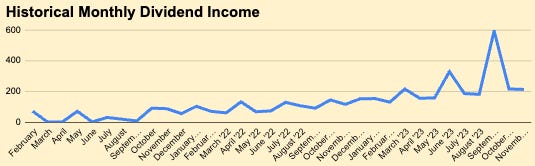

Looking at my historical monthly dividend income, it’s easy to tell that my monthly income is trending upward rapidly.

It’s also clear that next month is shaping up to be my highest in dividend income ever. I’m also expecting to receive my highest dividend payment ever next month from my favorite dividend ETF, SCHD.

SCHD was actually the only position I added capital to over this past month. But again, this was a very small add.

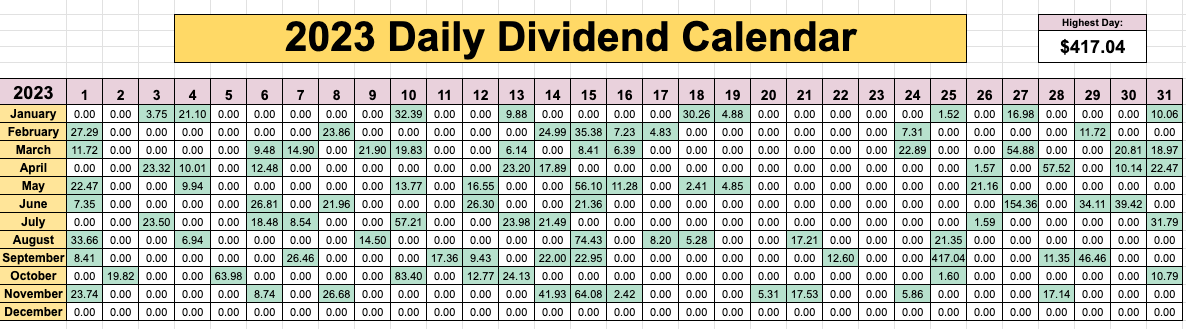

Looking at my daily dividend calendar, you can see that my previous highest day in 2023 was $417.04, which came in September.

While I’m still a long way off from being able to live off dividends, it’s clear that my portfolio is being set up for the snowball effect to take over.

In about 16 years (as we can see from the chart above), I should be able to live off dividends.

5 years from now, I’m projected to be making around $14,884 a year in dividend income.

And 30 years from now?

If I choose to reinvest dividends over that entire time period, I could be making over $316,000 a year in dividends.

The snowball effect is absolutely insane.

And that is exactly why it’s so important to focus on getting your snowball rolling as soon as possible.

When I first started investing, I was only contributing $50 a month.

But it was a mindset shift.

I knew every dollar I contributed now, could be worth 10x, 20x or possibly even 30x in the future.

Now matter where you’re at, get started-

And do not stop.

Dividendology

Real Quick:

Seeking Alpha is still running their Black Friday Sale! Get a huge discount here: https://seekingalpha.me/Dividendology

Link to download my spreadsheets: https://www.patreon.com/dividendology