October Dividend Portfolio Update 2024 🔥 🚀

All Time Highs EVERYWHERE! 📊

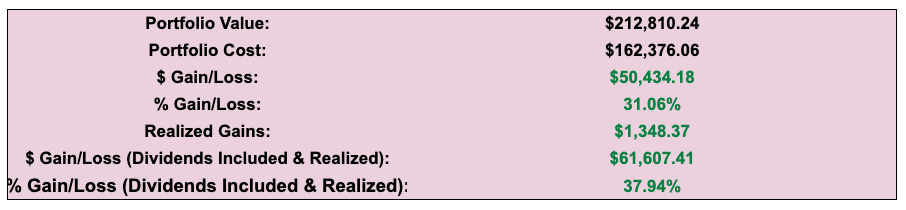

My portfolio has soared in the past month, and just hit a new all time high of almost $213,000.

The past 3 months have been the lowest amount of contributions I’ve made to my portfolio in quite some time.

Despite this, my portfolio has continued to climb at a fast rate.

In fact, the market just had its best day in two years earlier this week following the election.

And the day after, we saw Jerome Powell cut interest rates by another 0.25%.

What does this mean?

Stocks become more attractive… especially dividend stocks.

Take it from Warren Buffett:

Why is this?

Just a few months ago, interest rates were higher. You could find high yield savings accounts with yields of around 5%.

Investors who are very risk averse and looking for immediate yield obviously turned to these instruments, instead of higher yielding dividend stocks.

But as we see interest rates go lower, savings accounts start yielding less, making dividend stocks (and other assets) more attractive.

With rates going lower, stocks are going higher.

My average monthly dividend payments is sitting at $518.

With the market literally at all time highs, one of the most common questions I see is “Should I keep investing at all time highs?”

While the market being at all time highs does impact the way we invest and many stocks are on the upper end of their valuation… History tells us this:

Keep investing.

The red dots on the image below are every time the market hits a new all time high.

Imagine if you would’ve stopped investing years ago when the market was at all time highs.

You would’ve missed out on massive gains.

While contributions to my portfolio have been lower over the past few months, I continue to dollar cost average into my core positions, like SCHD.

While there is no way to know how this will do in the short term, history tells us that this will pay off.

I’ll continue making contributions, reinvesting over $500 a month back into my portfolio, and letting my holdings increase their dividend payouts.

This will help me achieve my long term goal of living off dividends, which it looks like I am only 14 years away from hitting!

Living off dividends is the goal, and I’m not stopping until I get there.

Get the snowball rolling, and then it keeps rolling and growing on its own.

Tweet of the Week:

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News…

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Can you mention us with %CAGR so we would know performance on annual basis

Nice update. Thanks.