💰Our High Yield Portfolio is Yielding 8.5%!

Sustainable and Growing High Yields! 💸

We are currently in the beginning stages of building out our two real money portfolios:

The Dividend Growth Portfolio

The High Yield Portfolio

Last week, we reviewed the dividend growth portfolio.

Today, we will be reviewing the High Yield Portfolio.

🧱The Goal

As a reminder, the goal of the High Yield Portfolio is simple:

Deliver a sustainable dividend yield of around 8%

Preserve capital (no long-term value erosion)

Provide predictable cash flow

It’s important we make note as to why this is our goal.

Based on the 4% rule that is commonly touted, you would need a $1 million portfolio to generate $40,000 a year.

But what if we could achieve our goal of building a portfolio that yields 8%, with no capital erosion?

All of a sudden, the amount of capital we need to generate $40,000 is cut in half.

With a portfolio that has a dividend yield of 8%, you would only need $500k to generate that same $40,000 a year.

And of course, as I’ve mentioned many times, it protects us from the dreaded sequence risk (which is very often overlooked by most investors):

The sequence of returns you get plays a major role in the potential longevity of your portfolio-

But living off dividends solves this problem.

So naturally, our three goals for our portfolio make complete sense:

Deliver a sustainable dividend yield of around 8% (reduce the capital needed to live off dividends)

Preserve capital (we need capital to generate income)

Provide predictable cash flow (we need to be able to sleep well at night!)

Simply achieving any single one of the goals is not hard.

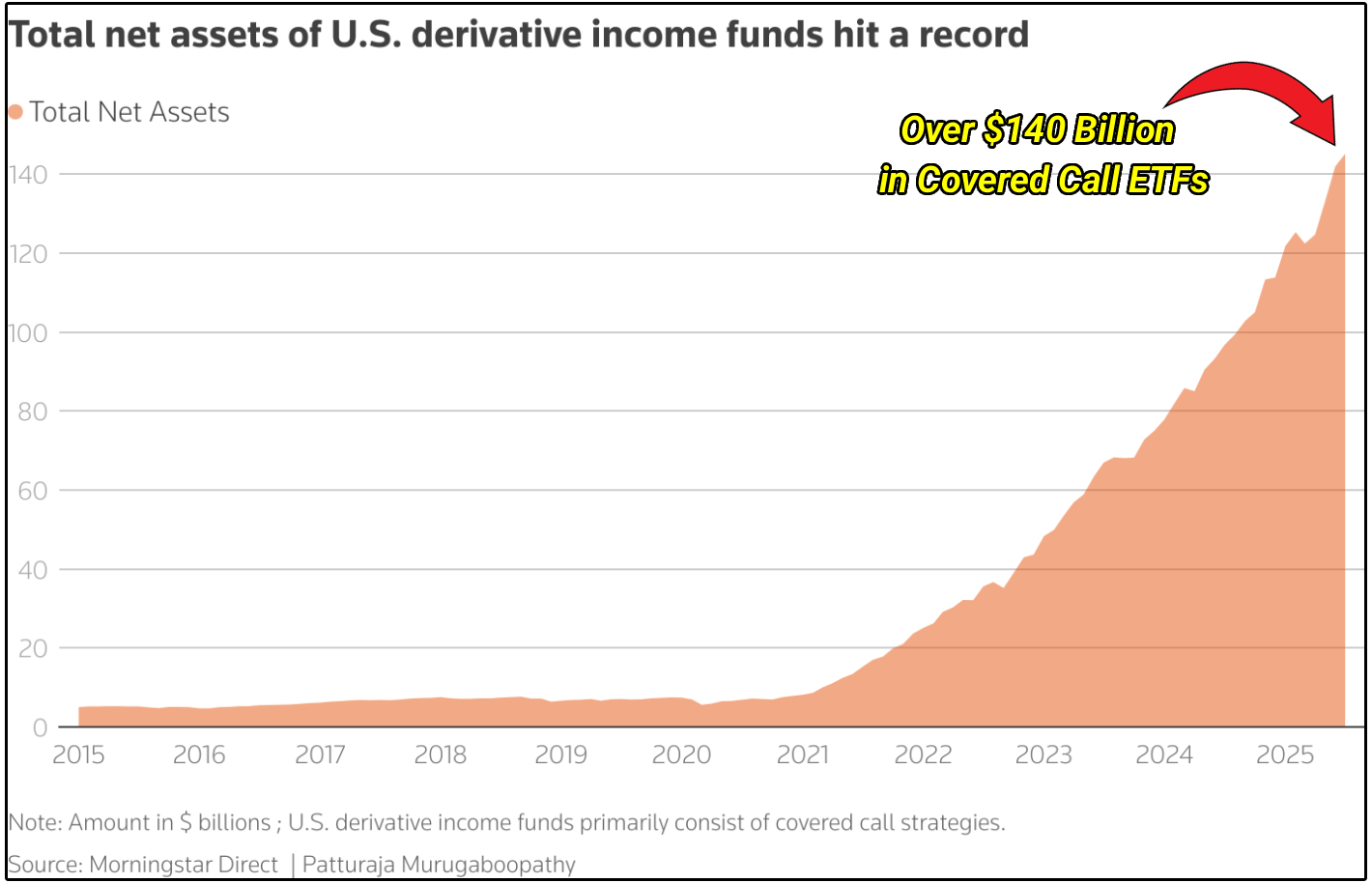

There are now plenty of Covered Call ETFs yielding well over 8%, and this asset class has surged in popularity.

However, this asset class does not always:

Preserve capital

Provide predictable cash flow

This is just a simple example of how achieving all three of our stated portfolio goals is much more difficult than the average investor would realize.

So while our goal is certainly not to try and outperform the market by any means, there is a hidden advantage to high yield investing.

Because there is very limited analyst coverage and limited data, there is increased market inefficiencies in the high yield space.

This means that there can be extended periods of time where the share price does not follow the evolution of the intrinsic value of a company.

So to take advantage of this, we must be able to do three things:

Identify high yield opportunities

Acquire the proper data to analyze them (NOTE: We do this for most asset classes through the Dividendology Database, which is available to members and updated monthly)

Be willing and able to endure prolonged periods of time where the share price is disconnected from reality

This is certainly not easy, but that is exactly why there is at times massive opportunities in the high yield space.

⚡The Performance

So as we judge the performance of our High Yield Portfolio, we must judge it based on our three critical criteria.

Let’s start with our first criteria:

“Deliver a sustainable dividend yield of around 8%”

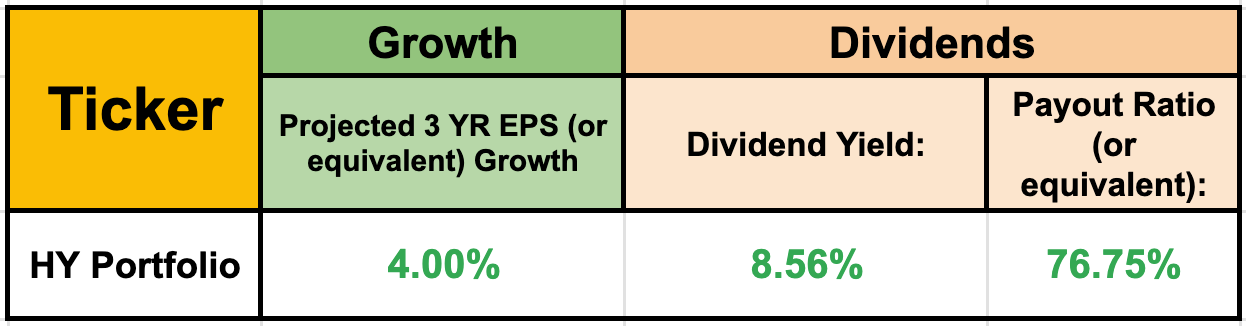

As of right now, the average yield of our portfolio is sitting comfortably above this goal, with a yield of 8.56%.

We meet our first criteria.

“Preserve capital”

As of right now, the value of our portfolio is down by around 1%.

Does this concern me any?

No, not at all.

The portfolio has existed for slightly over 3 months.

The quality of the stocks and funds in our portfolio are already far superior to most high yield investments, with the projected earnings/AFFO per share/distributable cash flow per share growth looking attractive moving into 2026.

Over the long term, the market will reflect this.

“Provide predictable cash flow”

Our portfolio has excelled at this, and is positioned to do this well into the future.

We currently own one fund in our portfolio.

The fund yields over 9%, and the fund manager informed me when we met two weeks ago that there will likely be a dividend hike in 2026!

The other holdings in our portfolio when averaged out are currently projected to grow their dividends at around 6%.

This is where our portfolio excels.

Most high yield portfolios see drastic swings in their dividend income month over month.

Our portfolio is structured to continue to grow their dividends sustainably (which is another reason I believe our holdings will have share price appreciation over the long term).

Here is how our portfolio looks as it stands today:

Note that in reality, our payout ratio is even healthier due to the fund we own in our portfolio.

Now, let’s look at a brief update on the current holdings: