🚀 Outperforming the Market with Dividend Growth

The Engines of Outperformance Can Double Returns 📊

Dividend Growth investing is simply amazing.

You can make a one-time investment, and get paid a growing stream of income for the rest of your life.

And on top of this?

Dividend growers have historically outperformed.

Today, we will be looking at the characteristics we need our dividend growth portfolio holdings to have in order for us to outperform over the long term.

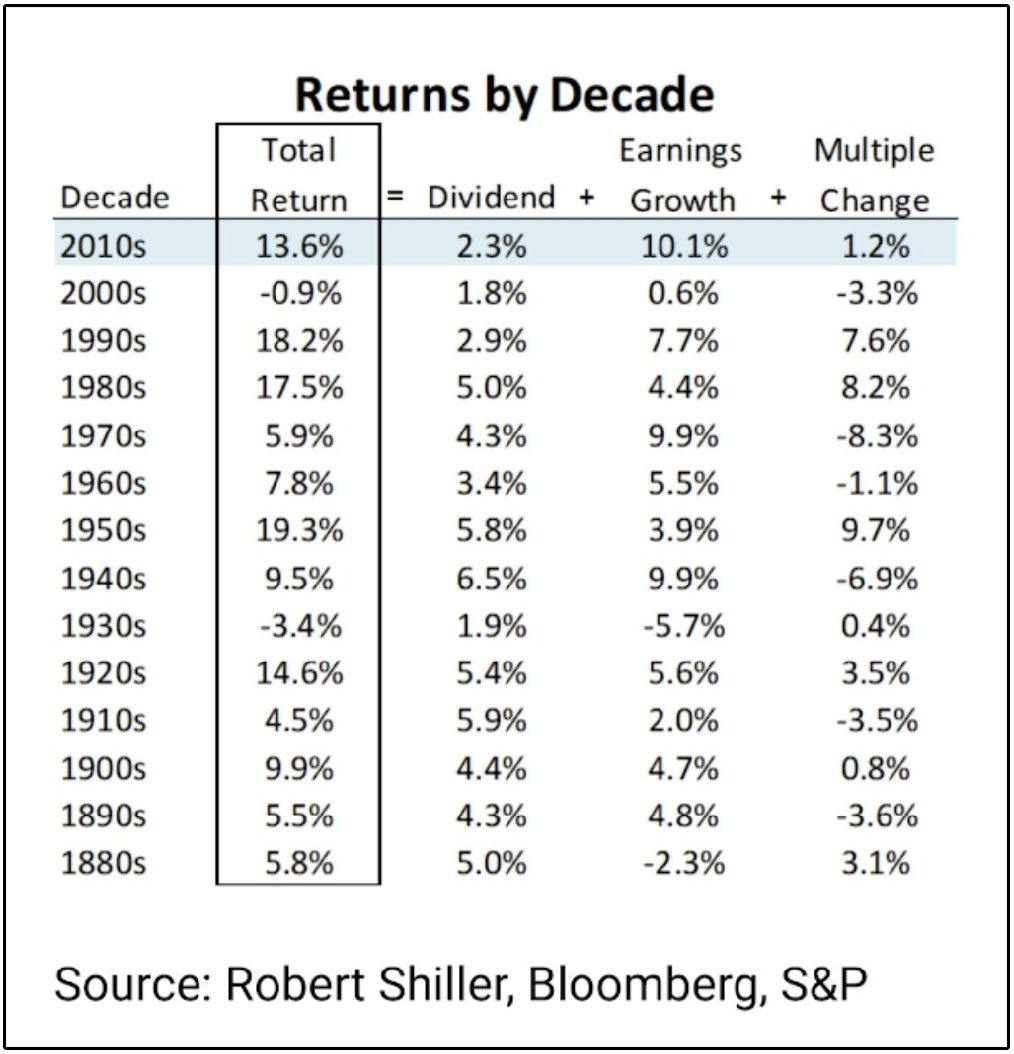

🧮 Sources of Returns

It’s always important to review the 3 potential sources of returns:

Earnings per share growth

Multiple expansion/contraction (Price to earnings ratio growing/shrinking)

Dividends

For example, here is what the sources of returns look like for the S&P each decade:

Some decades (like the 2010s), earnings growth was the main driver of returns.

Some decades (like the 1980s), multiple expansion was the ultimate driver of returns.

And some decades, when market performance was particularly poor-

Dividends were the main driver of returns, and sometimes the only positive source of returns.

We must note that over the long run, share price follows earnings growth.

📈 Outperforming the Market

Many of the decades (not all) where the S&P 500 had above average returns were primarily driven by:

Earnings growth

Multiple expansion

These are the ultimate engines of market outperformance over the long term.

The math behind this is simple.

Let’s say we have a stock that grows earnings per share at 15% per year.

At a 15% annual growth rate, earnings would double in about 4.8 years

Assuming that:

The stock doesn’t pay dividends

The P/E multiple stays the same

This means that the share price of the stock over the 4.8 year time period would double as well.

A 100% gain in just 4.8 years!

But let’s run this scenario one more time…

This time we will assume the stock is trading at a price to earnings multiple of 15.

Like above the stock continues to grow earnings per share at a rate of 15%.

But at the end of the 4.8 year period, the company is trading at a P/E multiple of 25.

To review:

EPS grows at 15%

The P/E multiple expands from 15 to 25

This means the stock would provide a total return of 234% in just 4.8 years!

🧩 The Unique Role of Dividends

Dividends play a unique role in the sources of returns, and provide some major advantages to investors.

Since 1960, a staggering 85% of the S&P 500’s cumulative return has come from reinvested dividends and the power of compounding.

$10,000 invested in the S&P 500 in 1960 without reinvesting dividends?

Turned into $982,072.

$10,000 invested in the S&P 500 in 1960 while reinvesting dividends?

Turned into $6,399,429.

The longer you receive and reinvest dividends, the more powerful they become.

However, dividends also provide advantages when we have decades like the 2000s.

For the investor looking to retire off the 4% rule, the 2000s were devastating.

However, for the investor living off of dividend growth stocks, the 2000s were of no concern.

The reason (as I’ve discussed many times before) is sequence risk.

In the above example, both investors started with $100,000, and had an average annual return of 4% over a 15 year time period.

But here is what each finished with:

Investor 1: $105,944

Investor 2: $35,889

Why such a difference?

Because the sequence of returns you get plays a major role in the potential longevity of your portfolio.

Dividend growth solves this problem.

With dividend growth, your payments grow larger every year, despite the fluctuations in the market.

The 4% rule killed many investors ability to retire in 2020, 2022, and essentially for the entire decade of the 2000s.

But those with a dividend growth strategy continued to collect their growing payments.

On top of this, those reinvesting their dividends continued to accumulate more shares at discounted prices-

Setting them up to benefit from the major bull run we’ve seen over the last 15 years.

Essentially, dividends radically diminish our risk over time, while compounding our returns over time-

Not to mention the major psychological benefits.

🏅Microsoft Case Study

I recently touted that the easiest investment I ever made was when I made Microsoft my largest position back in 2022.

I got push back from some online, stating this was ‘hindsight bias’-

But the reasons I had such high conviction on this investment, was because I was looking at Microsoft through the lens of what my potential ‘Sources of Returns’ were.

Let’s look at the history of MSFT.

From January of 2000 to 2010, MSFT stock declined by -47.7%.

However, during this time period, EPS grew from $0.89 to $2.13.

That means EPS grew at a compounded annual growth rate of 9.1%!

MSFT also started paying dividends in 2003, with an initial yield of 0.55%-

And grew the dividend at a 7.1% CAGR through 2010.

What does this mean?

Microsoft was providing double digit operational returns (Dividend Yield + Earnings Growth).

But the entire decade of returns was destroyed by multiple contraction.

The P/E multiple for MSFT was well over 50 at multiple points in the year 2000.

Buying stocks at an overvaluation can destroy decades of returns.

Compare this to my investment in MSFT over the last 3 years.

During this time, MSFT has grown EPS at a compounded annual growth rate of 12.7%.

The yield was above 1%, and grew at a near double digit rate.

They were providing a double-digit operational return annually.

But here’s what really made the difference.

MSFT was trading at its lowest PE multiple in over 5 years, at below 25.

Even if the PE multiple for MSFT remained unchanged-

I would still have gotten:

12.7% returns from EPS growth

Over 1% returns from dividends (plus dividend growth!)

Near 14% returns annually.

But the market realized it’s mispricing of MSFT, and the PE multiple has climbed significantly.

This led to total returns of well over 100% in just a 3 year time period.

🎯 Valuation Multiples

Keep in mind, valuation multiples are often correlated with EPS growth.

Stocks that grow EPS quickly, warrant higher P/E multiples.

Stocks that are projected to grow EPS quickly in the future, warrant higher EPS multiples.

The other feature that makes investors willing to pay a premium P/E multiple?

Cash flow predictability.

Think of stocks like:

Microsoft

S&P Global

Costco

These companies trade at premiums because investors feel confident in the future cash flows of the business.

With that being said, let’s make sure we don’t buy stocks with valuation multiples like the companies during the ‘dot com’ bubble. (Imagine paying a 623 P/E multiple for Yahoo)

⚡Our Dividend Growth Portfolio

On Tuesday, we will be adding our first position to our Dividend Growth Portfolio.

The goal?

Buy stocks that allow us to benefit from all 3 of the sources of returns.

If you want to be a part of the process of building this portfolio and also get access to everything mentioned below, you can join here:

Here’s everything you’ll get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 ($30 off! + 7 day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Why do I get the feeling that this is the foundation of successful investing over time. In the short term, 0-3 years, there are ALL KINDS of influences that affect stock prices, mostly emotional or herd mentality. But am I correct in seeing that over the long haul, 5-10-20-30 years, dividend growth and EPS growth rule the day? Does ROIC match to dividend/EPS growth?

General thought and may I just missed something obvious. Understanding it varies wildly depending on the vehicle with which you buy the compelling dividend equities, what about taxes? Certainly with REITs.

Appreciated.