September Dividend Portfolio Update 2024 🔥 🚀

$500 a Month in Dividends! 🧱

I hit a massive portfolio milestone this month.

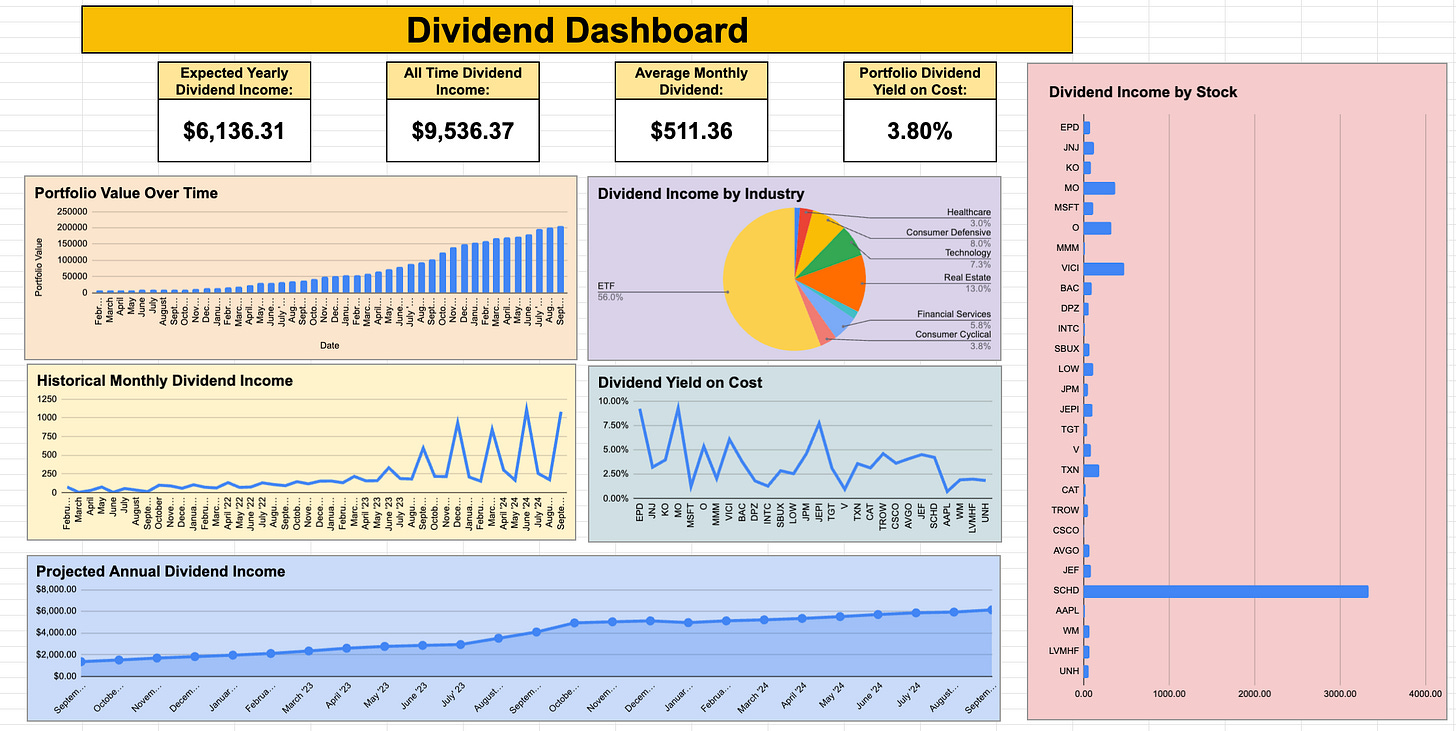

My average monthly dividend income is now over $500.

This is obviously a huge milestone for many reasons, but perhaps the biggest reason is this:

The Snowball Effect.

This now means that regardless of how much capital I contribute to my portfolio on a monthly basis, I’ll still have $500 on average every month being reinvested right back into my portfolio.

What’s interesting about this milestone, is I actually haven’t contributed much capital to my portfolio over the last 1 to 2 months.

The jump up in average monthly dividends came from some key dividend hikes in my portfolio:

For example, here are just a few of the recent dividend hikes I’ve benefitted from:

$SCHD - SCHD announced a $0.7545/share quarterly dividend, 15.28% increase from the 2023 Q3 dividend

$O - Realty Income declares $0.2635/share monthly dividend, 0.2% increase from prior dividend of $0.2630.

$VICI - VICI Properties declares $0.4325/share quarterly dividend, 4.2% increase from prior dividend of $0.4150.

$MSFT - Microsoft declares $0.83/share quarterly dividend, 10.7% increase from prior dividend of $0.75.

$JPM - JPMorgan declares $1.25/share quarterly dividend, 8.7% increase from prior dividend of $1.15. (2nd hike this year)

(Note: I get news of dividend hikes, earnings reports, and 52 week lows emailed to me once a week via The Dividend Report newsletter)

These dividend hikes played a major role in pushing my monthly dividend income higher.

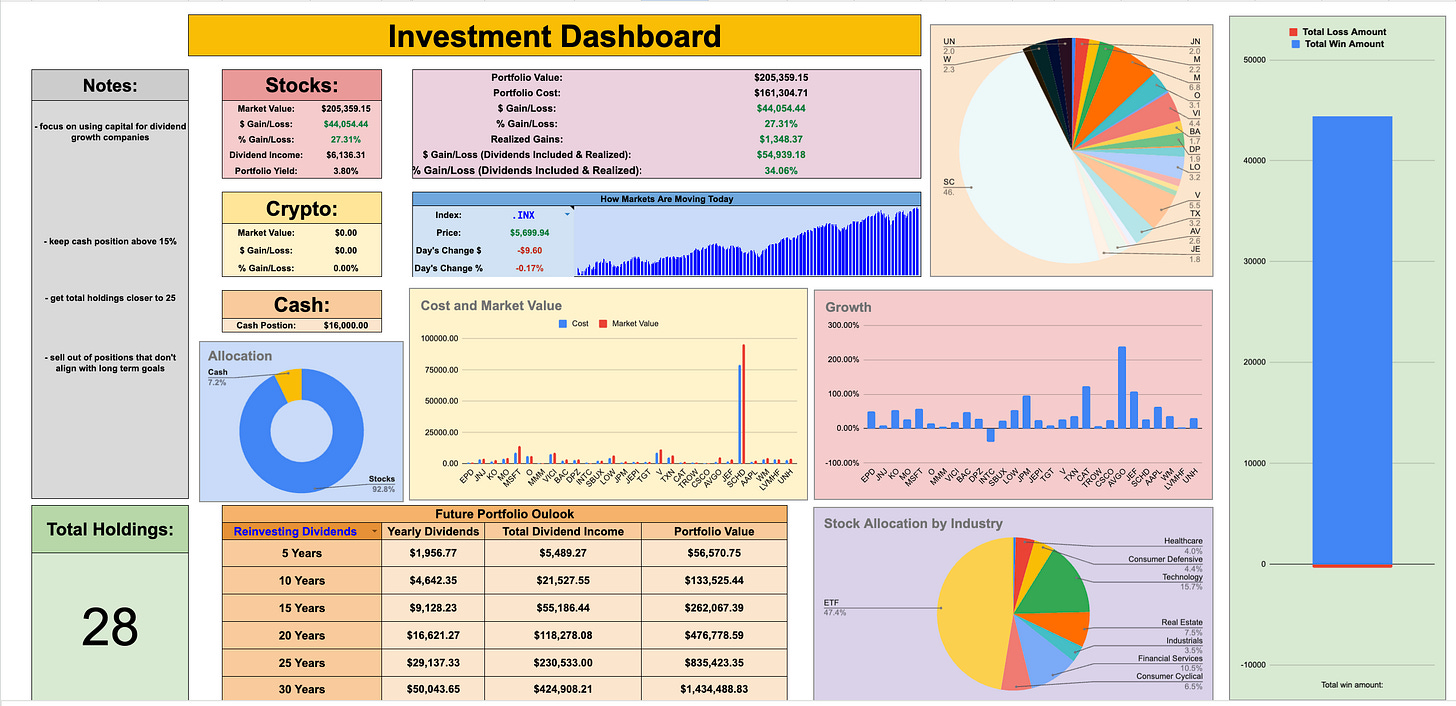

Not to mention, my portfolio has really been benefiting from the 2024 bull market.

The down side of this, is many companies appear to be trading at or above fair value, making it difficult to find great opportunities.

It’s an important reminder that much of the money or gains I’m seeing now, are a result of buying companies a good valuations months or even years ago.

Sometimes you just have to be willing to sit back and hold your quality companies.

You don't have to buy at the bottom and sell at the top to be a great investor.

Just buy quality companies at good valuations, and hold long term.

I think that you'll really like the results.

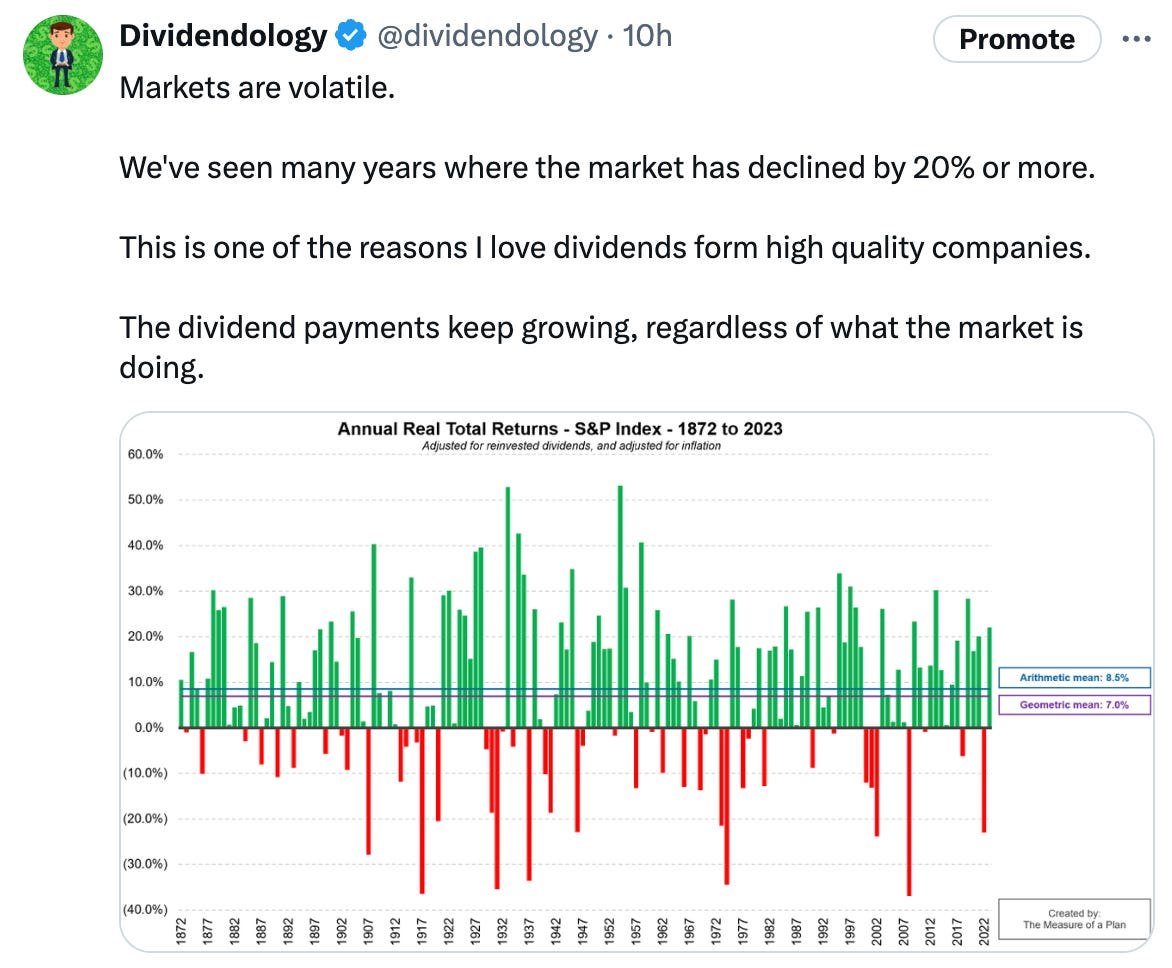

Tweet of the Week:

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News…

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Congratulations! This is a big deal. (From a 60+ year old retired investor living on dividends)