Share Buybacks: A Case Study of What NOT To Do ❌

I like Buybacks... But Here's the Problem 💭

Share buybacks can have massive benefits.

Most realize buybacks give shareholders a larger stake in the company.

But buybacks also make every 'per share' metric look much better.

Think of the different metrics that become much healthier when companies buy back shares:

Revenue per share

Free cash flow per share

Earnings per share

Dividends per share

But here's what's often ironic about share buybacks…

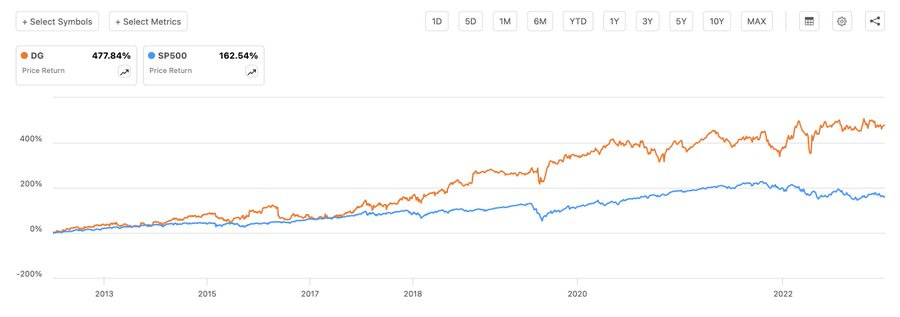

From 2013 to 2023, Dollar General went from 322M shares outstanding, to 219M shares outstanding.

(Chart from Tickerdata)

During this time, $DG saw market beating returns.

But here's where things get interesting.

Buybacks only create value for a company when their intrinsic value is higher than their current price.

For the majority of the past decade, Dollar General was buying back shares when the company had a P/E ratio ranging from 17 to 26.

This is a good thing-

As long as the companies intrinsic value was higher than the price they bought shares back at.

But here's where things get really interesting.

The share price for Dollar General has recently dropped dramatically.

The company is at a 52 week low, is down 34% in the last year, and is now trading close to its lowest P/E ratio in over a decade, at a 14.5 forward looking P/E ratio.

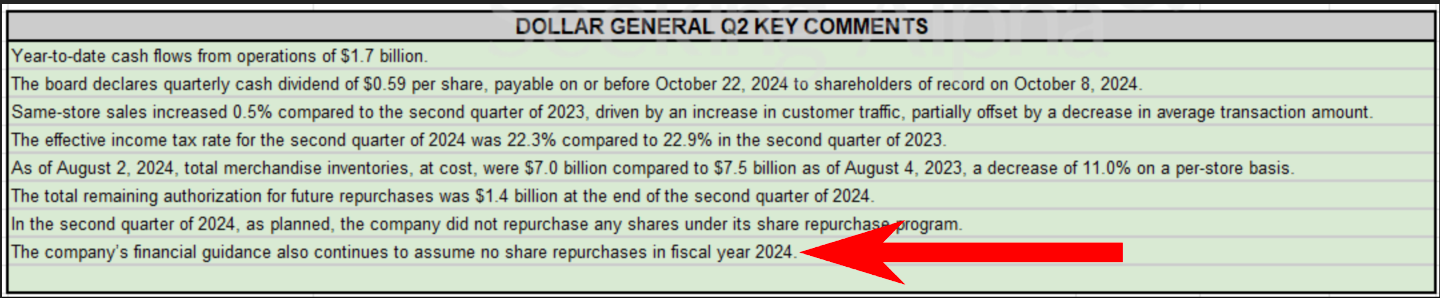

But guess what the company announced in their recent earnings report?

They stated they would not be buying any shares for the rest of fiscal 2024.

The irony of share buybacks, is companies often don't perform them when the company is trading at lower prices, due to the fact the company is in a more difficult financial situation.

Company’s are great at buying back shares when the company is drowning in cash and the stock price is at an all time high-

But they aren't typically great at buying back shares when the stock price is at a 52 week low and the company is undervalued. (Which would be the best time to buyback stock)

This is the trap that Dollar General fell into.

Now would be a great time to be buying back shares.

But unfortunately, the best time to buyback shares, is often when company’s don't have the cash on hand to do so.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

In Other News…

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

That was the part that always bugged me about it, buyback when the price is ridiculously high.