Show Me The Dividends! 🔥

Capital Allocation Masterclass

The best businesses in the world pay dividends.

Think of companies like Meta, Apple, Microsoft, Google, and Visa.

These are considered some of the highest-quality and largest companies globally.

Yet, there’s a lot of misunderstanding about dividend-paying stocks.

Some people argue that no healthy, growing company should ever pay a dividend—that paying dividends is a sign that a company has run out of growth opportunities.

At first glance, this seems like a valid point. If we look at the return on invested capital (ROIC) for these companies, they achieve very high returns.

This means the projects they reinvest their earnings into are typically highly profitable, allowing them to generate market-beating returns over time.

So why would a company that achieves such high returns on reinvestment choose to pay a dividend?

To answer that, we need to understand the primary responsibility of management:

Capital allocation.

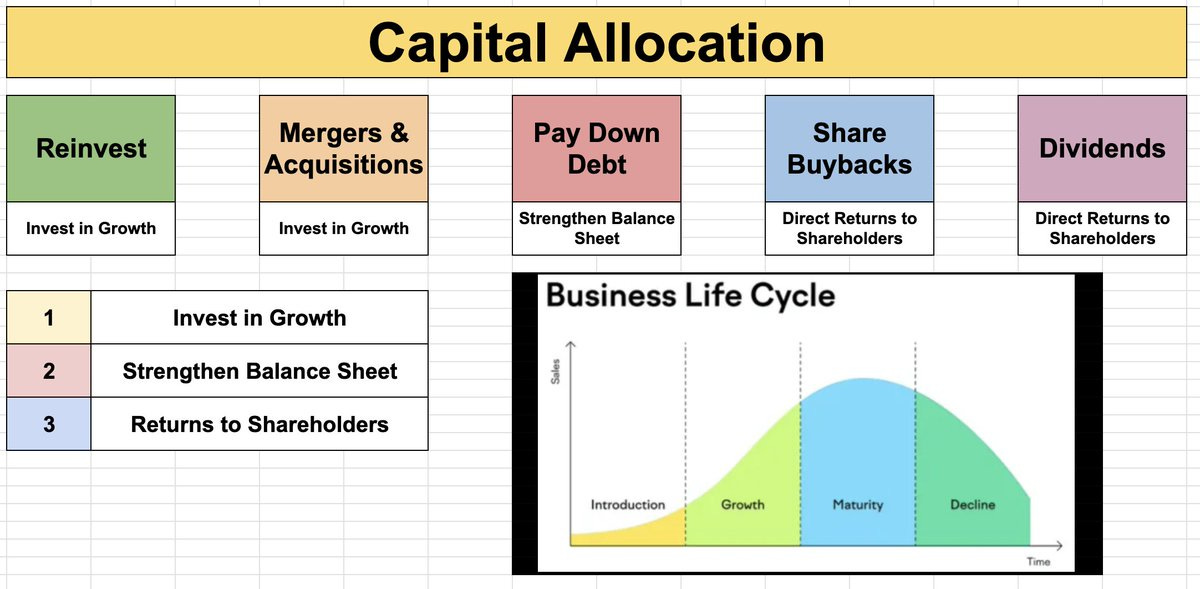

What Is Capital Allocation?

Capital allocation refers to how a company decides to deploy the free cash flow it generates.

Management teams have five main options:

1. Reinvest back into the business

2. Pursue mergers and acquisitions

3. Pay down debt

4. Share Buybacks

5. Pay dividends

Each of these options serves a different purpose, and the right choice depends on various factors, including business life cycle.

The Business Life Cycle

Take a company in the early stages of its life cycle, like Palantir, which went public in 2020.

These companies are laser-focused on growth and typically reinvest all their earnings—or even issue more shares—to fund expansion.

Dividends aren’t even on the radar because every dollar is needed to fuel growth.

But the best businesses in the world are different.

They’ve already passed the introduction phase and established themselves as leaders in their industries.

Companies like Meta, Apple, and Microsoft are still in their growth phase but generate so much free cash flow that they can no longer reinvest it all efficiently.

A Real-World Example: META

Let’s look at Meta.

Earlier this year, Meta announced plans to start paying dividends.

If we examine their financials, we see a company with exceptional profitability.

Over the past decade, Meta has grown its revenue at an impressive rate, with a five-year compound annual growth rate (CAGR) of 19.3%.

Their balance sheet is just as strong, with over $91 billion in current assets and minimal debt.

Yet, despite their financial strength, Meta faced a unique problem: they had too much cash.

Over the past four years, Meta burned through $45 billion trying to build Reality Labs, their metaverse division, which turned out to be unprofitable.

This illustrates a critical point: even the best companies can misallocate capital if they reinvest too much without high returns.

By choosing to pay dividends now, Meta acknowledges they’ve reached a stage where it’s better to return cash to shareholders than continue over investing in low-return projects.

Why High-Quality Companies Pay Dividends

The decision to pay dividends often comes down to efficiency.

Companies like Microsoft, Apple, and Google generate so much cash that, after funding high-return projects, there’s still excess.

At this point, paying dividends becomes the most efficient use of capital.

But here’s what makes these companies unique: they can pay dividends without sacrificing growth.

For example, Microsoft has been paying dividends since 2003. In 2013, they paid out $7.5 billion in dividends while generating $24.5 billion in free cash flow.

A decade later, their free cash flow nearly tripled to $60 billion, and their dividend payments grew to $18 billion annually.

Despite paying out dividends, Microsoft continued to grow at an exceptional rate.

Why the Best Businesses Choose Dividends Over Other Forms of Capital Return

Some investors argue that share buybacks—another common form of returning capital to shareholders—are a better option.

And, indeed, buybacks can reduce the total number of shares outstanding, increasing the value of each remaining share.

In the right instance, share buybacks can be more effective than any other capital allocation option

However, there are issues with buybacks.

1. Some studies indicate that buybacks can harm value when tied to short-term incentives.

2. Share buybacks are counter intuitive if done at an over valuation

3. Share buybacks are not nearly as reliable or predictable as dividends.

A great example of #3 is $ADM. (See pic below)

They have reliably grown dividends every year, but the same is definitely not true for buybacks.

In contrast, dividends offer a steady, predictable return to investors without relying on market conditions or price fluctuations.

When you receive a dividend, it’s real cash in your pocket, not just a paper gain.

This is especially important for long-term investors who value stability and income.

Why Dividends Create Investor Loyalty

Finally, dividend payments foster a sense of loyalty and trust between companies and their shareholders.

For this reason, dividend-paying stocks often attract long-term, loyal shareholders who believe in the business and are less likely to sell during market downturns.

This stability in the shareholder base can lead to a less volatile stock price, which further contributes to the company’s reputation as a safe, high-quality investment.

But dividends are just one piece of the puzzle.

Effective capital allocation requires balancing all five options.

Too much reinvestment, as we saw with Meta’s metaverse project, can waste capital.

At the same time, paying out too much in dividends can hinder a company’s ability to fund growth.

The best management teams strike the perfect balance, maximizing total returns for shareholders.

As someone with a long-term investing horizon, I’ve learned that the highest-quality businesses in the world don’t just pay dividends—they pay growing dividends while continuing to grow their free cash flow and earnings.

These are companies with high gross profit margins, exceptional ROIC, and a proven ability to allocate capital wisely.

So whether you love dividends or are skeptical of them...

When used correctly, they can help the best businesses in the world maximize their total return for shareholders.

Check out these resources:

Tickerdata 🚀 (BLACK FRIDAY SALE)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (BLACK FRIDAY SALE)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Hi there , I traded in my PPE and tools and now I'm new to Substack. I write about markets, risk, and the stories we tell ourselves to stay comfortable. After the Close focuses on process over prediction, discipline over drama, and thinking clearly when the screens go dark. Appreciate a review of my process. Good or bad I can handle it. - Andrew