Super Investors Are Buying Dividend Stocks 👀 💰

They Just Bought These Dividend Stocks 🔥

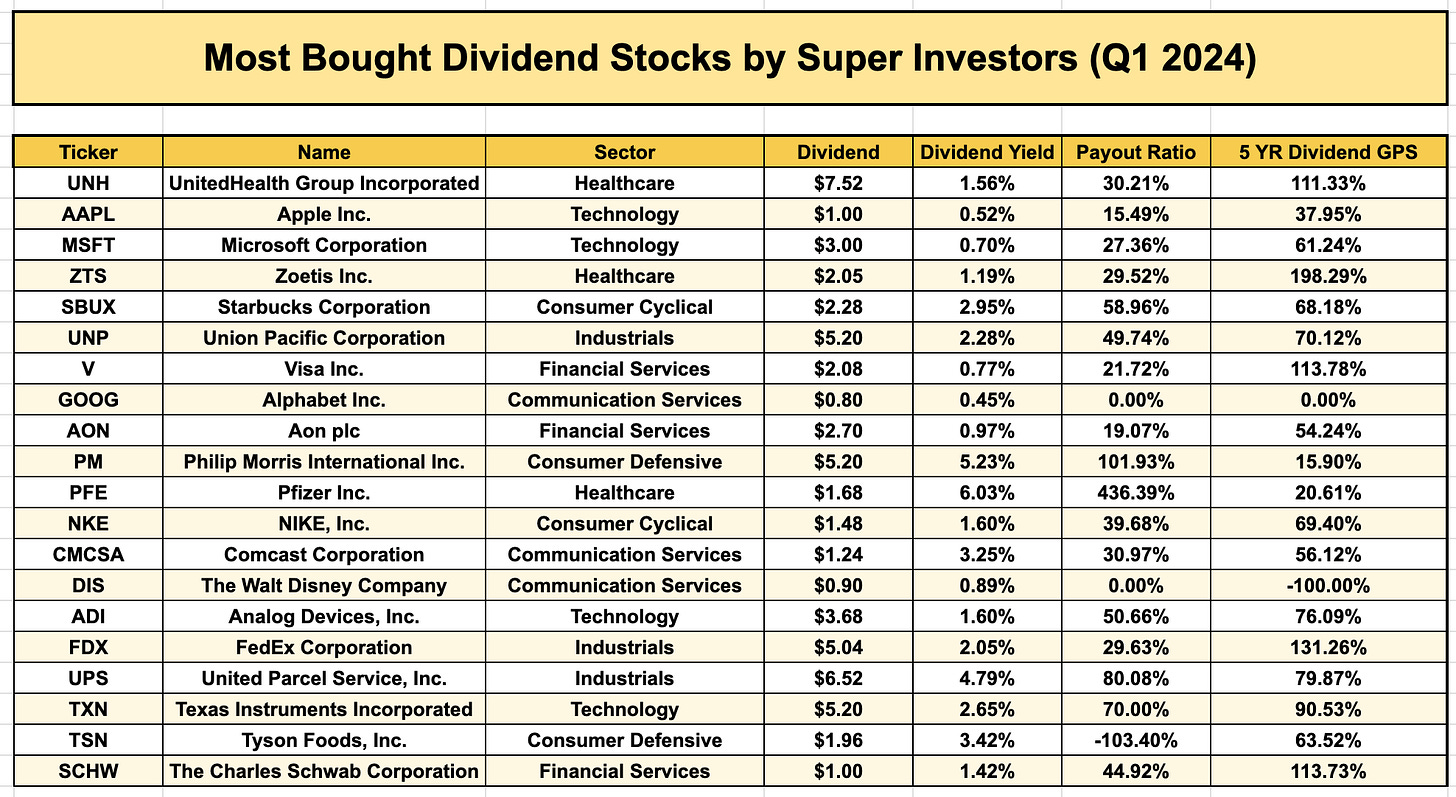

In the first quarter of 2024, Super Investors (who are investors with over $100 million in assets under management) loaded up on dividend paying stocks.

I discussed 10 of these companies in this video, but I want to give you the full list of the top 20 most frequently bought dividend stocks by super investors.

You can get the full spreadsheet clicking below:

You can also see the full list pictured below:

Now, let’s look at a few key takeaways.

1. Super Investors Like My Recent Purchase

The most frequently bought dividend stock by super investors was UnitedHealth Group (UNH).

I was very excited to see this as number one on the list, because this was actually a stock I added to my portfolio recently.

The company has been growing their dividend payments at a rapid rate over the past decade- (and thanks to Tickerdata, we can easily see this below).

From a dividend perspective, this company is everything I look for in a dividend stock!

2. Super Investors Prioritize Dividend Growth

Out of the 20 most frequently bought dividend stocks by super investors, 15 of the stocks increased their dividend payouts over the last 5 years by at least 50%.

That is rapid dividend growth.

The stocks that grew their dividends the fastest over the last 5 years were:

ZTS (Zoetis Inc) - 198.29%

FDX (FedEx) - 131.26%

V (Visa) - 113.78%

SCHW (Charles Schwab Corp) - 113.73%

UNH (UnitedHealth Group) - 111.33%

All 5 of these companies more than doubled their dividend payouts over the last 5 years!

So don’t be scared away by the lower starting yield for some of these companies, because they are growing those dividends at an astounding rate. 🚀

3. Super Investors Buying… High Yielders?

I wasn’t surprised to see super investors focusing on dividend growth stocks.

But I was surprised to see a few higher yielding stocks by super investors.

Here are some of the higher yielding stocks bought by super investors:

PFE (Pfizer) - 6.03%

PM (Philip Morris) - 5.23%

UPS (United Parcel Service) - 4.79%

4. Will Starbucks Rebound?

The past year has been brutal for Starbucks, with the company down over 21%.

And while most of the market has been scared away from the stock, it seems super investors have taken an interest in it, with it being the 5th most frequently bought dividend stock by super investors.

I myself added a few shares when the company was trading in the low $70s.

Let me know if you have any thoughts on the recent moves by super investors by replying to this email!

Check out these resources as well:

Other News…

At the end of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

This sheet was received by nearly 200 dividend investors last month. (Wow!)

If you’d like to receive this sheet at the end of this month, you can sign up here:

I plan on sending out this month’s edition in the next couple of days, so sign up soon if you want to receive it.

That’s all for now!

See you next week!

Dividendology