🔥 Super Investors Are Buying These Stocks!

Free Spreadsheet Inside! 🚀

One of the things I love about investing?

It’s an open-book test.

Every quarter, Super Investors are legally required to show us exactly what they’re buying, selling, trimming, and holding.

It’s all public. It’s all transparent. And it’s updated every 90 days.

Today, we will look into where the smart money is moving.

🔍 Dividendology Database

The Dividendology Database is primarily used for alternative income asset classes like-

REITs

BDCs

Covered Call ETFs

But one of the things I compile data on every quarter is the buying history of dividend stocks for Super Investors.

This not only gives insight into what Super Investors have been buying lately-

But also reveals the underlying trends of where the smart money has been moving over time.

📊 Trends

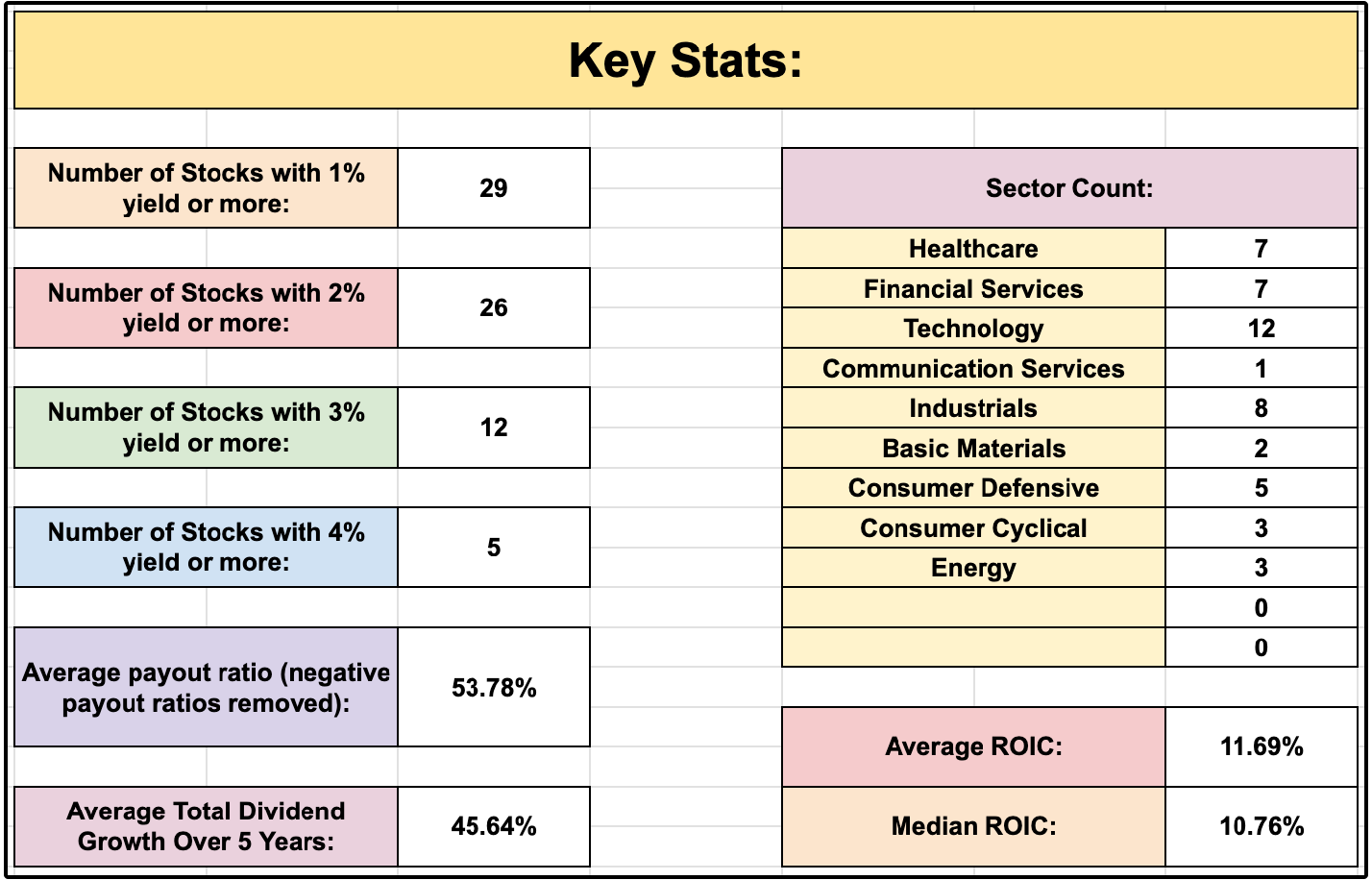

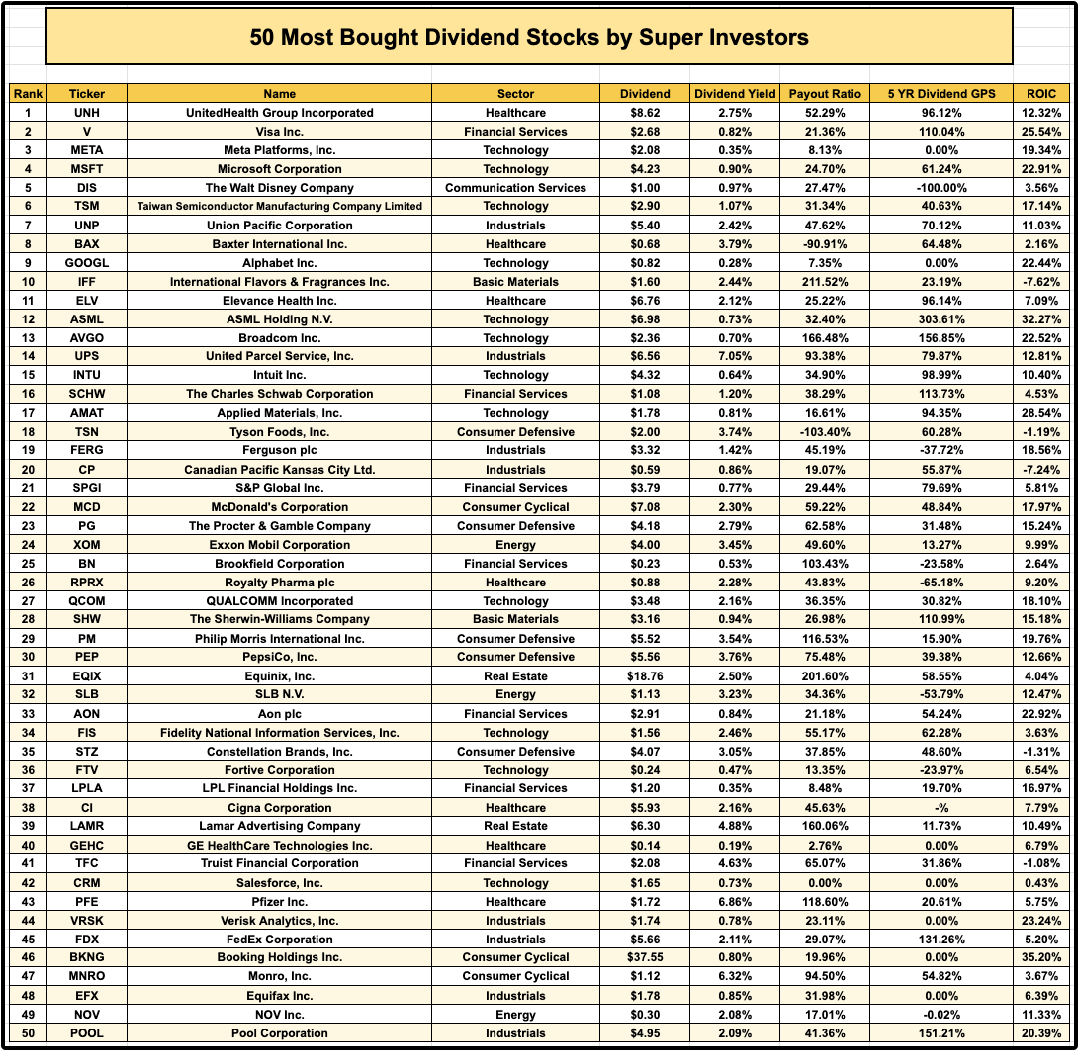

I compiled insights on the top 50 most bought dividend stocks by Super Investors.

The trend we see every quarter?

Super Investors have a major bias towards tech stocks.

Why?

These companies often:

Are capital-light

Generate high returns on invested capital

Scale revenue without scaling costs

Benefit from recurring, high-margin business models

Benefit from network effects

These are the exact same qualities that have allowed dividend growth stocks to outperform over time.

💵 The High Yield Buys

In the most recent quarter, there were 5 stocks in the 50 most bought with yields of 4% or more:

UPS - United Parcel Service (14th most bought, 7.2% yield)

LAMR - Lamar Advertising (39th most bought, 4.9% yield)

TFC - Truist Financial Corporation (41st most bought, 4.7% yield)

PFE - Pfizer Inc (43rd most bought, 7.1% yield)

MNRO - Monro Inc (47th most bought, 6.4% yield)

Most of these companies are what one would consider a turnaround play-

Especially Pfizer and UPS.

My greatest concern for both of these companies is capital allocation.

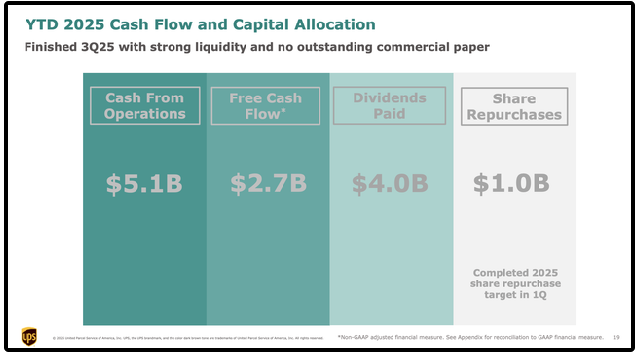

For example, UPS has generated $2.7 billion in free cash flow year to date.

The problem?

They’ve paid out $4 billion in dividends and bought back $1 billion in shares outstanding.

They’ve already used more than double their free cash flow, before reinvesting back into the business.

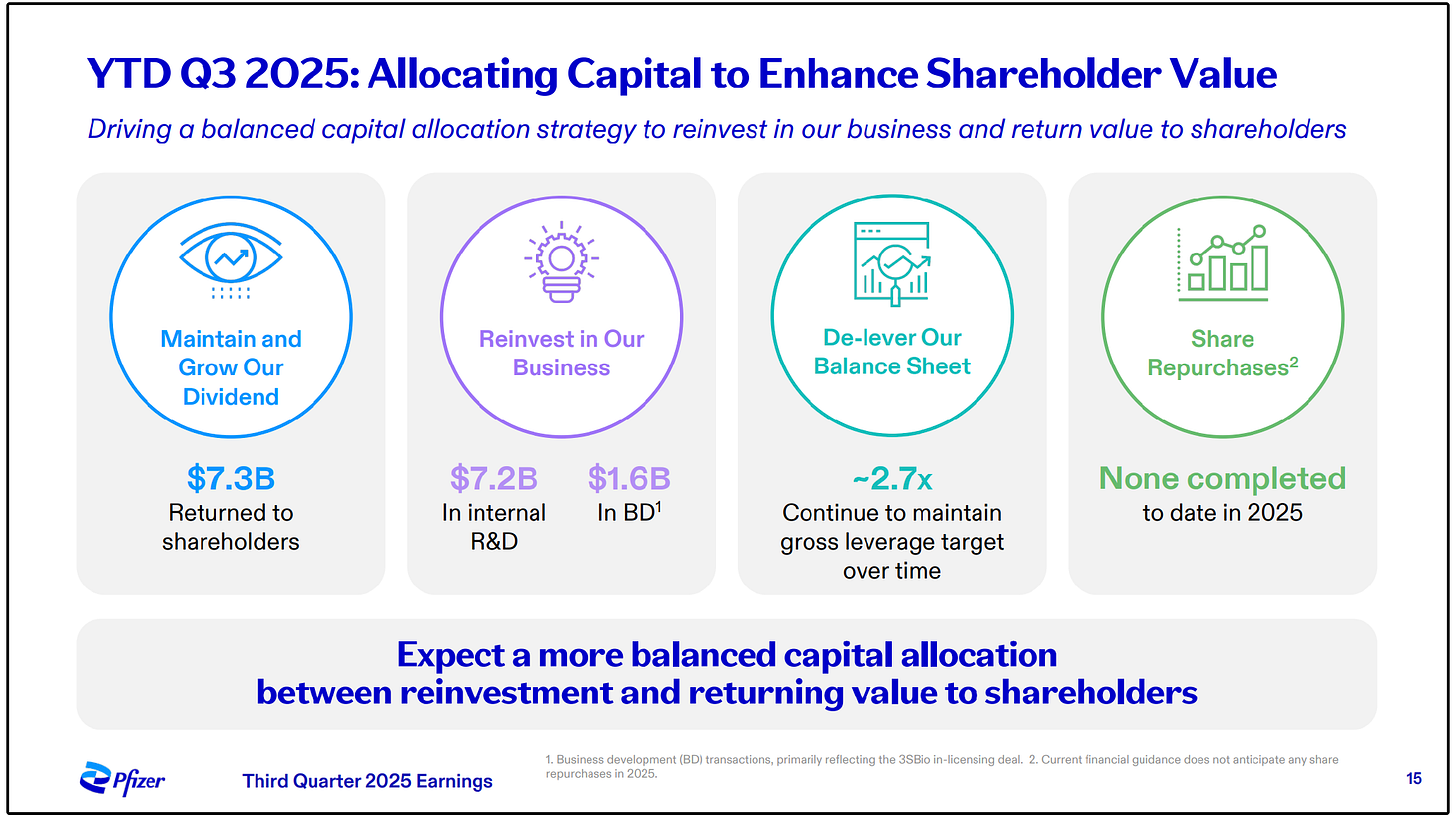

This is an issue for Pfizer as well.

Pfizer has generated $4.57B in free cash flow year to date, but has already distributed $7.3B in free cash flow.

On top of that, the company claims they are currently trying to ‘de-lever’ their balance sheet-

Which is essentially impossible to do if you are paying out more in dividends than you are generating in free cash flow.

I believe this makes it clear that these high yielders are not being bought for the high yield, but rather the turnaround play potential.

Let’s look at the key moves from just a few of the top Super Investors:

💎 1. Warren Buffett

This recent quarter was one of the last before Warren Buffett retires.

You can read a full analysis of Buffett’s moves here.

The most notable move was undoubtedly his purchase of Google.

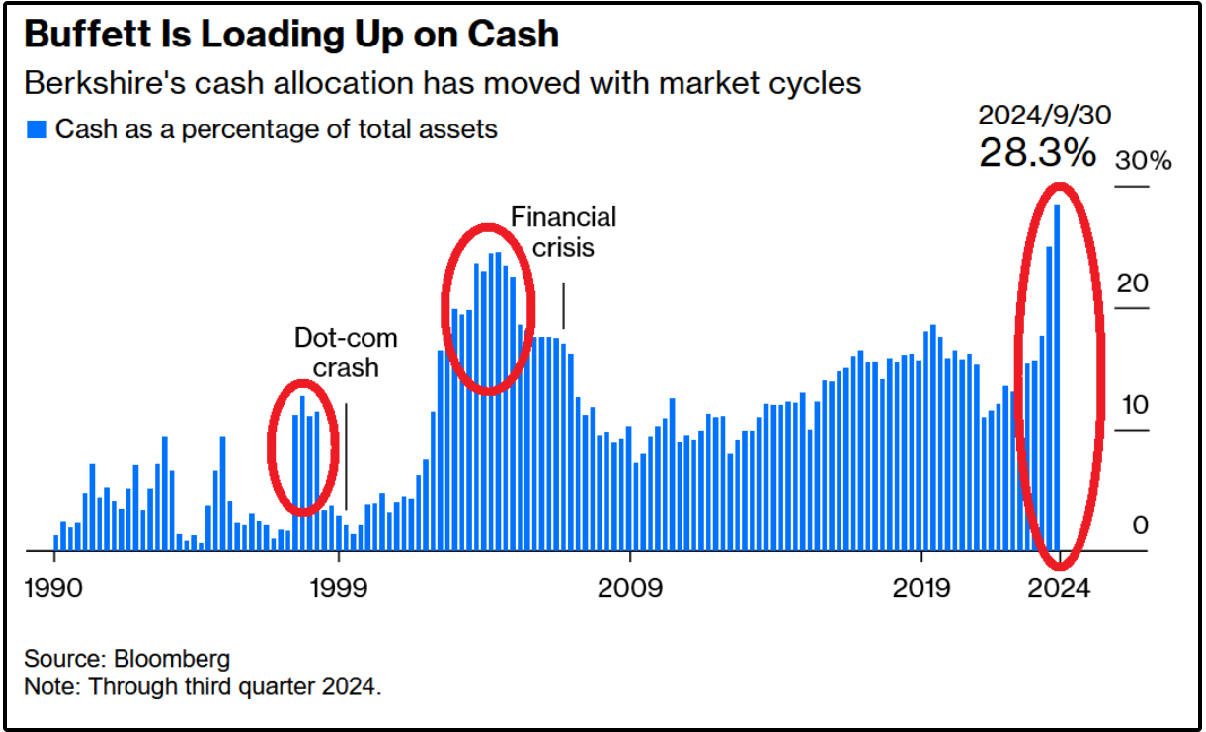

But the underlying trend we’ve seen happening over the last few years?

His growing cash position.

Buffett has built up a large cash position two other times in the last 30 years-

Right before the dot com crash and the financial crisis.

🧮 2. Bill Gates

Something I haven’t seen covered by traditional media in the last week?

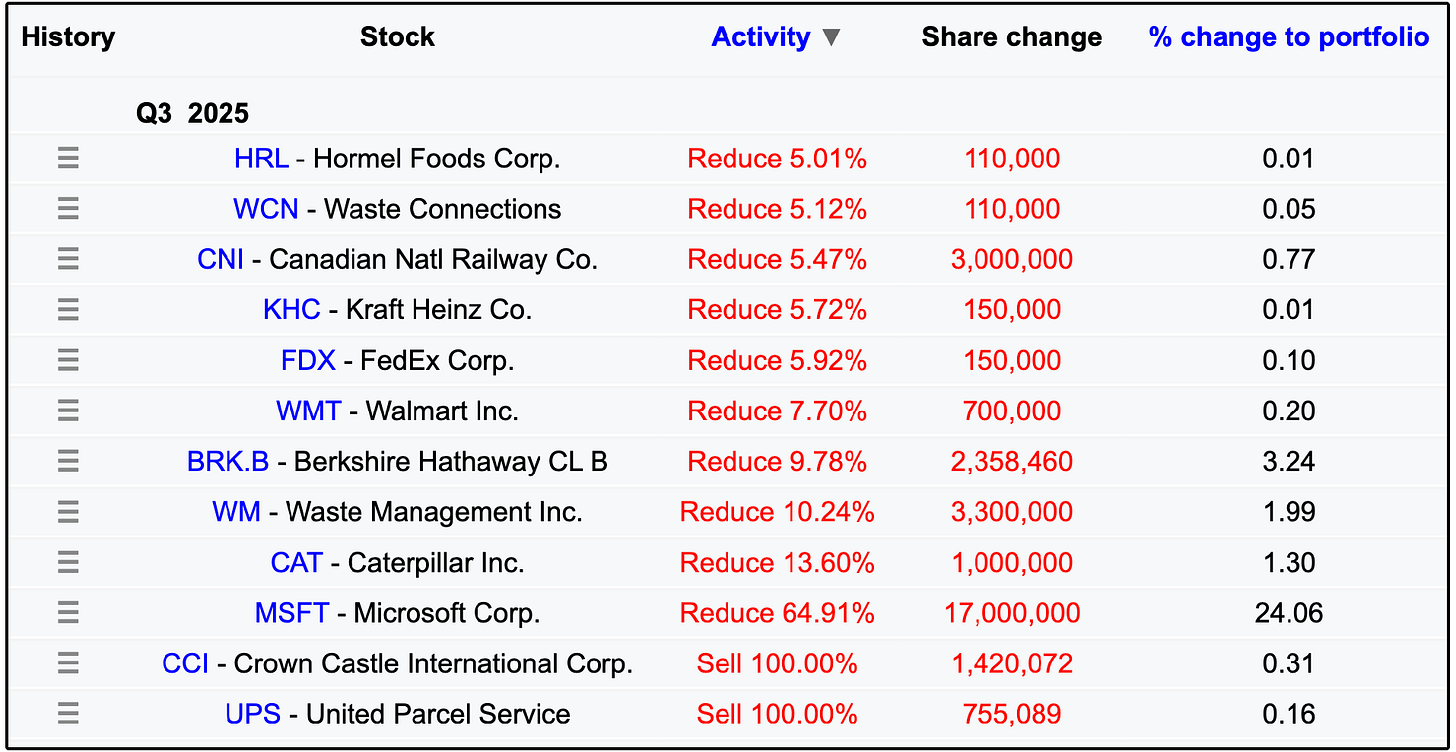

The massive sell off of Bill Gates’ portfolio.

Most notably, he sold off nearly 65% of his Microsoft position.

A sell off of this degree is certainly due to macroeconomic concerns.

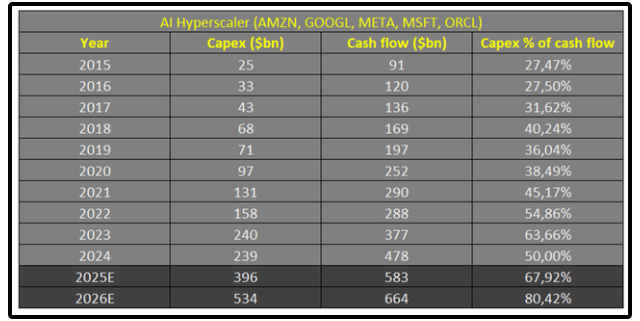

And the greatest threat to the future of the economy is the heavy capex spending from big tech companies not paying off.

Tech stocks are historically quite capital light businesses-

But that has quietly changed dramatically in the last couple of years, and is projected to continue to change.

In 2025, Capex was only about 27.47% of ‘AI hyperscalers’ free cash flow.

By the end of 2026, it is projected to be 80.42%.

To put it simply, if this capex spending doesn’t generate significant returns on investment, we will likely see a significant pullback in the market as a whole.

Keep in mind, the top ten holdings in United States (along with the rest of the world) currently make up a significant portion of the total market.

🧠 3. Pat Dorsey

Pat Dorsey is most famous for defining and teaching the four major types of economic moats:

Intangible Assets (brands, patents, licenses)

Switching Costs

Network Effects

Cost Advantages

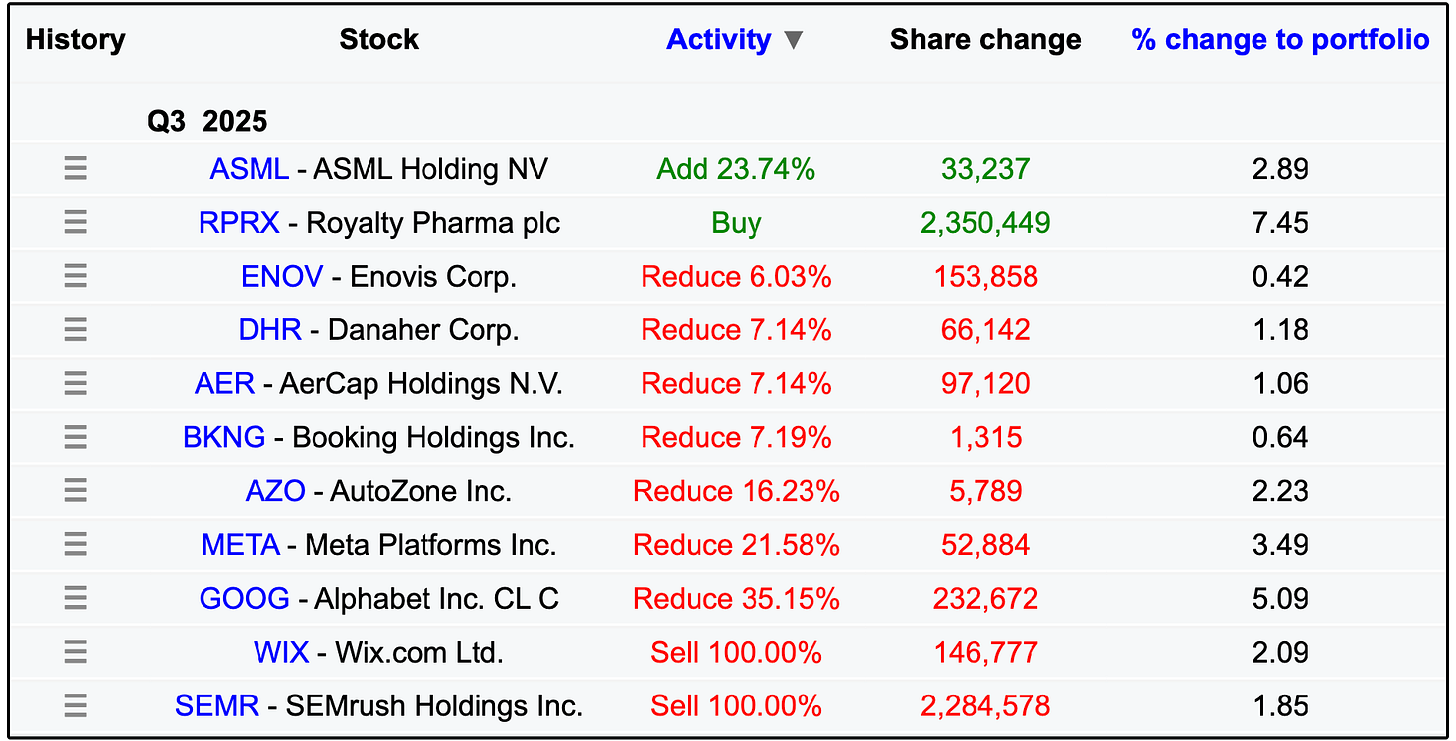

His emphasis on MOATs perfectly explains his two purchases in the recent quarter.

ASML and Royalty Pharma were his two big purchases.

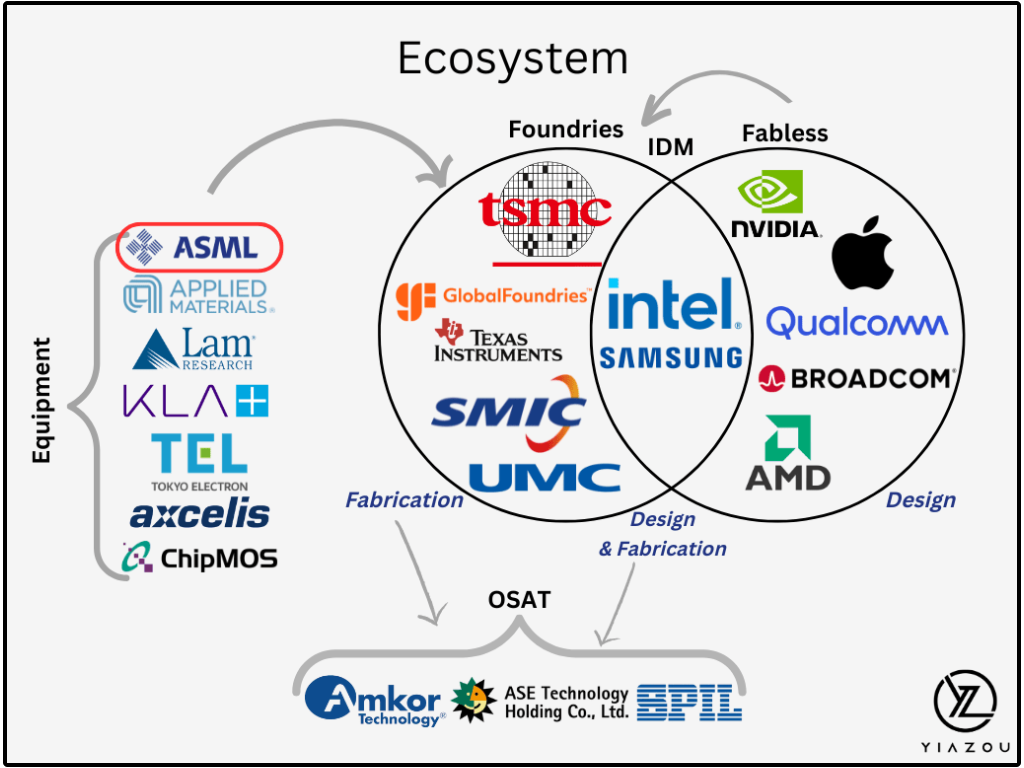

The best way to understand the importance of ASML, is to understand the AI semiconductor value chain.

ASML is the sole manufacturer of extreme ultraviolet (EUV) lithography machines, which are critical for producing the world’s most advanced computer chips.

These are the machines used to etch the smallest, fastest, most advanced semiconductor chips in the world.

An ASML EUV machine has:

100,000+ parts

2 km of wiring

Over 40 companies contributing subsystems

This investment makes complete sense due to Pat Dorsey’s emphasis on MOATs.

Royalty Pharma falls into this category as well.

Royalty Pharma does not do drug development.

Instead, they buy drug royalties from other pharma companies or research labs.

This means RPRX doesn’t have to spend billions on trials like other pharma companies.

This produces:

Very high returns on capital

Predictable cash flows

No exposure to clinical trial failures

Dorsey loves businesses where capital intensity is low and returns are high.

💰 Super Investors Top 10 Buys

These were the top 10 most bought dividend stocks by Super Investors in the most recent quarter:

UNH — UnitedHealth Group Incorporated 🏥

V — Visa Inc. 💳

META — Meta Platforms, Inc. 📱

MSFT — Microsoft Corporation 💻

DIS — The Walt Disney Company 🎬

TSM — Taiwan Semiconductor Manufacturing Co. 🖥️

UNP — Union Pacific Corporation 🚂

BAX — Baxter International Inc. 🧪

GOOGL — Alphabet Inc. 🔍

IFF — International Flavors & Fragrances Inc. 🌸

📝 The Full List

Below is the full list of the 50 Most Bought Dividend Stocks by Super Investors:

You can download the above spreadsheet for free here:

Don’t ever blindly copy someone’s trades.

But stealing from Super Investors is a great place to start stealing investment ideas.

🎉 Exciting News…

I’ve had many of you become a Dividendology member in the last few months in order to get access to the features below.

📊 Full Access to the Dividendology Database

Built with now over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

Next week, I’ll be adding a brand new feature that Dividendology Members will be receiving every month.

Be on the lookout from an update from me next week!

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (BLACK FRIDAY SALE)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

So is RPRX similar to FNV in that they both buy royalty participations that are already in play?

Who are the “Super Investors”? Perhaps they are listed on another list or your website? Thank you.