🔥 Super Investors Bought These Dividend Stocks

Free Spreadsheet Inside! 🚀

Have you heard of Mohnish Pabrai?

His funds delivered compound returns of over 28% annually from 1999 to 2006.

His secret?

Being a shameless Buffett copycat.

“I’m a shameless copycat. Everything in my life is cloned…..I have no original ideas.” -Mohnish Pabrai

I’m in the same boat as Pabrai.

One of my favorite ways to find investment ideas?

Stealing from Super Investors.

Super investors are investors with over $100M in assets under management.

Every 3 months, they are required by law to reveal all of the moves they’ve been making in their portfolio.

So every quarter, I research and compile data on the 50 most frequently bought dividend stocks by Super Investors.

This not only reveals some interesting moves they’ve been making, but at times can also reveal some underlying trends where the big money is moving.

📊 Where the Money is Moving

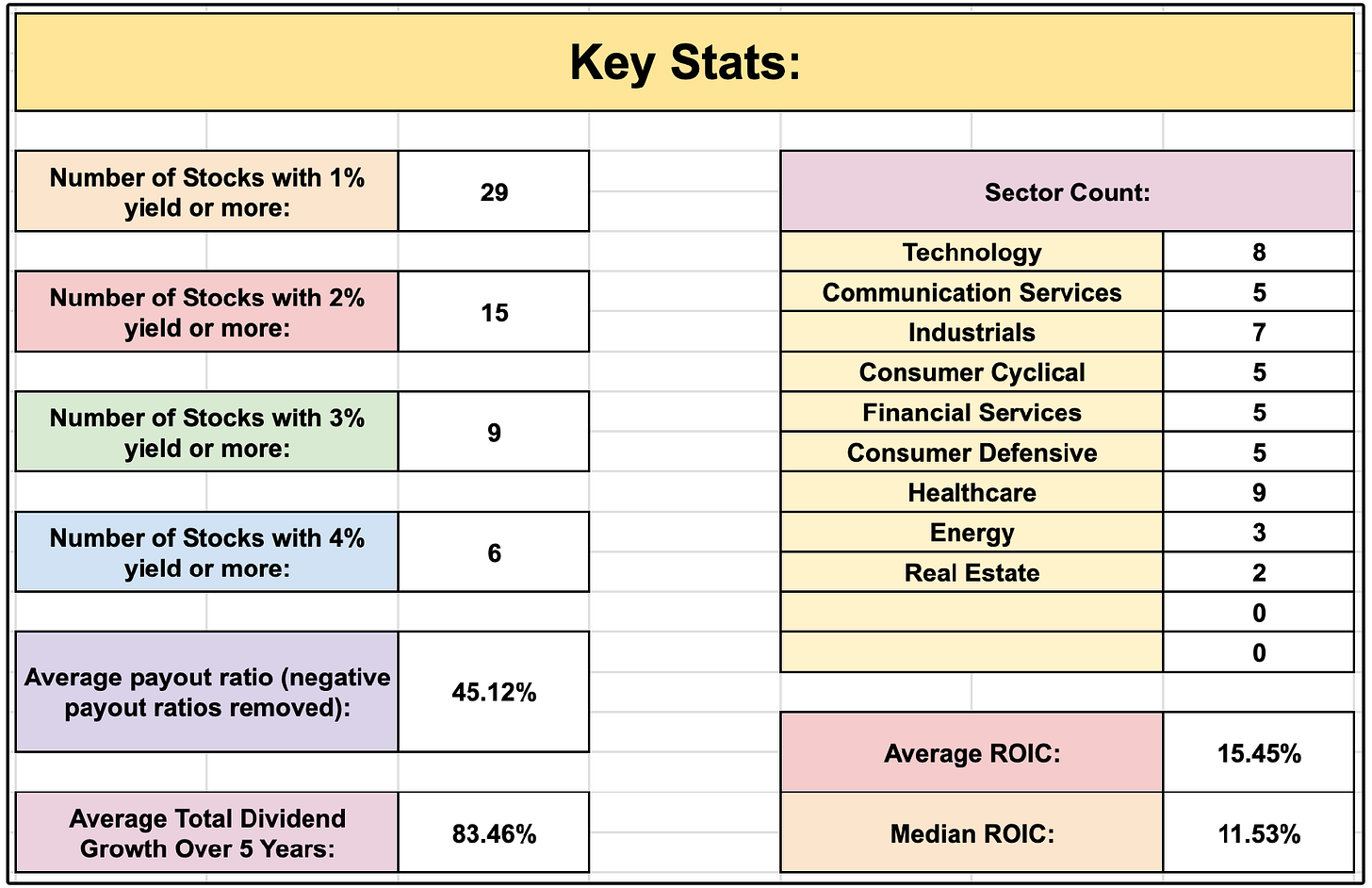

I compiled insights on the top 50 most bought dividend stocks by Super Investors.

This revealed 2 takeaways:

Super Investors have a bias towards high-quality dividend growth stocks

Super Investors are heavily buying Healthcare stocks

The first shouldn’t come as a surprise.

Super Investors love high-quality dividend growth stocks for the same reasons I do:

High Returns on Invested Capital

Low Payout Ratios (Leaving ample room to reinvest back into the business)

Consistent Free Cash Flow Growth

Strong Dividend Growth

Durable Competitive Advantages

These are the exact type of stocks that have historically outperformed.

Buying Healthcare? 🏥

The most frequently bought sector by Super Investors was healthcare.

This is somewhat rare, as Super Investors are typically tech focused.

This marks the second straight quarter of increased healthcare buying.

Why might this be the case?

The Vanguard Healthcare ETF (VHT) is down ~8.97% over the past year.

The S&P 500 is up ~9.04% in the same timeframe.

Healthcare’s forward P/E sits at ~16.9, near 5-year lows.

Meanwhile, the S&P 500’s P/E is near all-time highs.

When markets get uncertain, investors often shift toward sectors like healthcare, which is considered more recession-resilient.

Super Investors Top 10 Buys 💰

These were the top 10 most bought dividend stocks by Super Investors in the most recent quarter:

MSFT – Microsoft Corporation 💻

META – Meta Platforms, Inc. 📱

TSM – Taiwan Semiconductor Manufacturing Company 🧠

GOOGL – Alphabet Inc. (Class A) 🔍

WCC – WESCO International, Inc. 🔌

TXN – Texas Instruments Incorporated 📟

LEN – Lennar Corporation 🏠

COF – Capital One Financial Corporation 💳

DG – Dollar General Corporation 🛒

GOOG – Alphabet Inc. (Class C) 🌐

There are 4 stocks on this list that I think are particularly interesting.

NOTE: The full top 50 list is below :)

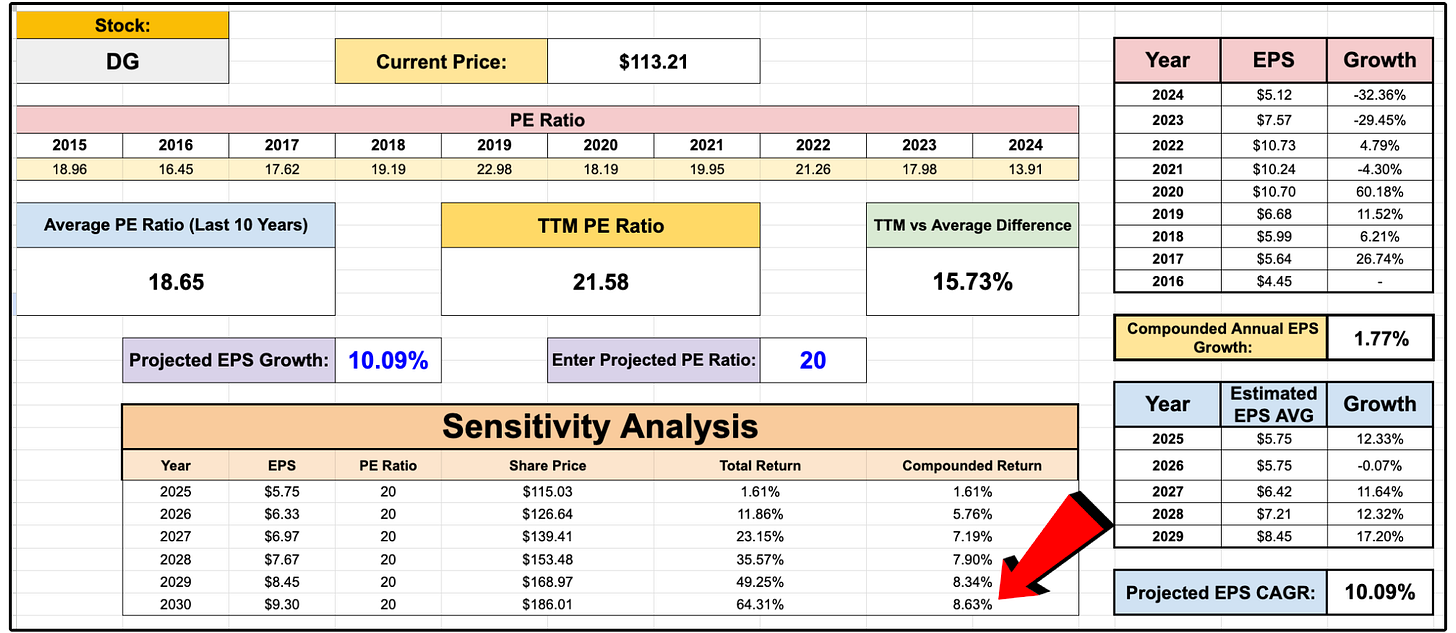

1. DG – Dollar General Corporation 🟡

Super Investor Rank: 9

YTD Performance: +49%

A name many might be surprised to see, but it’s delivered a stellar 49% return year-to-date.

This was a stock I highlighted as an undervalued opportunity in January this year.

The stock dropped from ~$125 in mid-2024 to as low as $66 in early 2025… then soared on improving financials.

📈 What Changed?

EPS outlook for 2025 was upgraded: $5.20–$5.80

Gross profit margin improved: Q1 came in at 31% vs. last year’s 29.6%

Free cash flow finally covered the dividend again (30.8% payout ratio in 2024)

💡 Dividend Track Record:

10-year CAGR: 10%+

Yield: 2.05%

Quarterly dividend: flat at $0.59/share since 2022

🎯 Total Return Outlook (via Tickerdata):

Assuming 10% EPS growth (the average analyst estimate) & 20x forward P/E → ~8.63% CAGR through 2030

There’s not nearly as much upside potential at current prices, but it's still worth watching.

2. TXN - Texas Instruments 📟

Super Investor Rank: 6

YTD Performance: +9.59%

Texas Instruments is a historic dividend growth machine with one major issue lately: free cash flow collapse.

From $6B in 2022 → $1.3B in 2023 → $1.5B in 2024, resulting in a 320% FCF payout ratio (yikes).

But context matters.

The numbers don’t tell the whole story.

Texas Instruments is nearing the end of a 6-year, capex-heavy reinvestment cycle to build out 300mm chip capacity.

While this has lowered free cash flow in the short term, management says this will:

Cut chip costs by ~40%

Boost gross margins

Set up long-term FCF growth starting in 2026+

Texas Instruments has been sacrificing near-term profits to set itself up for long-term cost advantages and higher cash flow long term.

The fact that Texas Instruments made the Super Investors Top Buys list suggests they believe this capex-heavy period is about to pay off, just as management claims.

3. GOOG / GOOGL - Google 🌐

Super Investor Rank: 4 & 10

YTD Return: -11.79%

The big fear most have for Google is that AI is eating into Google’s search MOAT.

However, this doesn’t seem to be the case yet.

Search revenue in Q1: +10% YoY

Google is a major player in the AI race. Gemini 2.5 Pro leads in reasoning, adaptive thinking, and overall performance in benchmark tests.

EPS CAGR (2024–2029): 14.36% average analyst estimate

🎯 Total Return Outlook (via Tickerdata):

Assuming 14.36% EPS growth (the average analyst estimate)

20x forward P/E

You would get a 14.22% CAGR through 2030 and an over 122% total return.

It’s no surprise to see Google as one of the most frequently bought stocks by Super Investors.

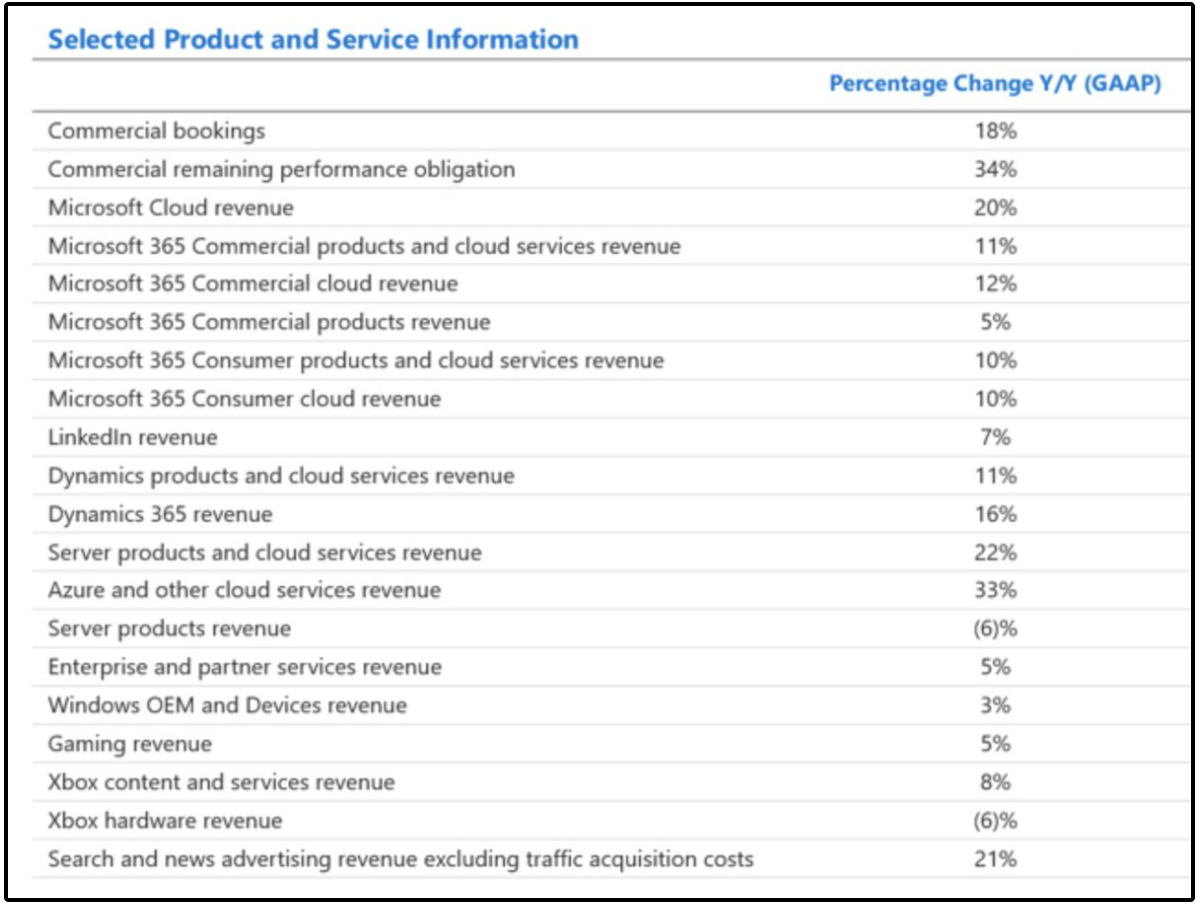

4. MSFT - Microsoft 💻

Super Investor Rank: 1

YTD Performance: +16.29%

A favorite of Super Investors (And the largest individual holding in my portfolio).

Why?

ROIC: 20%+ for 4 straight years

Gross margin: 69.8%, up from 10-year average

Dividend CAGR: ~10%

FCF payout ratio: declining, even as dividends grow

What’s interesting is that I’ve been tracking Super Investor buys for years, and MSFT consistently ranks near the top.

In fact, here is Microsoft’s ranking on the list over the last 4 quarters:

Q1 2025: 1st

Q4 2024: 1st

Q3 2024: 1st

Q2 2024: 2nd

I’ve been through a Master’s degree program in data science, but I don’t think one would be necessary to spot a trend there.

Buying Microsoft is essentially buying a tech ETF.

They currently have 20 business segments, with the majority of them growing at a double digit rate.

Microsoft is now trading at an all time high, and will likely remain the largest holding in my portfolio for the foreseeable future.

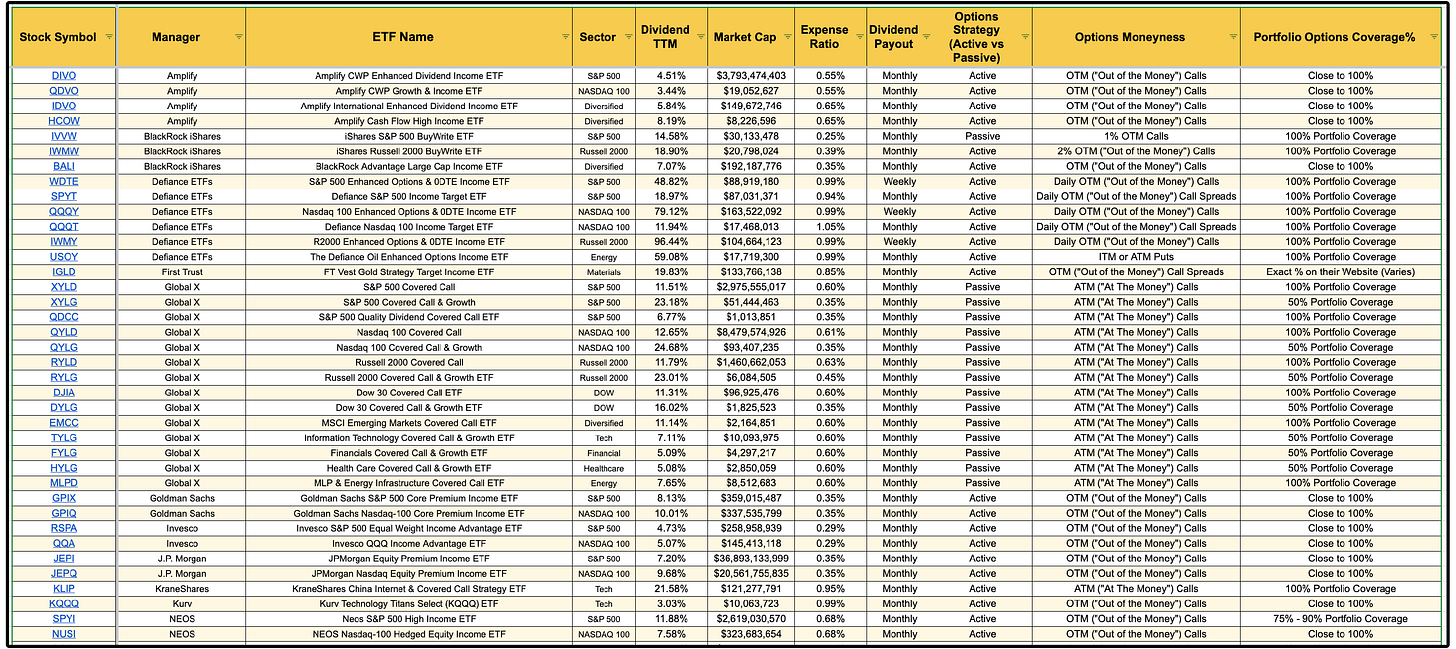

The Full List 📝

Below is the full list of the 50 Most Bought Dividend Stocks by Super Investors:

You can download the above spreadsheet for free here:

Reminder: You should never blindly copy someone’s trades.

Everyone has different goals, risk tolerance, time horizon, etc.

With that being said, we should be like Mohnish Pabrai and steal some ideas from super investors.

🛠️ P.S. – Something BIG is Coming…

Dividendology will soon be turning into a full-scale investment platform. 🚀

Over the years, I’ve gotten two questions more than almost any other:

“How would you invest right now if you were starting from scratch?”

And…

“What would you buy if you were building a high-yield portfolio today?”

These are actually great questions, because if your goal is to live off dividends, the way you should invest completely depends on what stage you are in.

So I’ve decided to show you, not just tell you.

I’ll be launching two real-money portfolios on Dividendology.com:

💰 The Starter Portfolio – Built from $0, showing exactly how I’d invest if I were starting my dividend journey today

🧾 The High-Yield Portfolio – Focused on maximizing immediate dividend income without seeing NAV decay (Think 8% yield+)

These are not mock portfolios. I’ll be putting real money into both, tracking every move, every dividend, and every update with full transparency, just like I always have with my personal portfolio.

And these portfolios are just the beginning.

Behind the scenes, I’ve been pouring immense time and capital (a lot of capital) into what will soon become the Dividendology Database, a game-changing tool for dividend investors.

You’ve already seen a glimpse with the Covered Call ETF database (featuring option moneyness, portfolio coverage, and more soon).

But the full platform will include in-depth data on:

🧠 Owner-Operator Dividend Growth Stocks

🥇 Super Investor Buying History

💼 BDC Research

🏢 REITs

💸 Covered Call ETFs

💰 Preferred Shares Breakdown

📊 High-Yield Opportunities

… and a lot more.

Most investors don’t realize how many quality dividend options are out there (as I showed you here), or how to properly evaluate them.

This platform is being built to change that.

Stay tuned, I’m working hard behind the scenes and will give more information soon.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($60 off!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Buffett doesn’t mind!