🔥 Super Investors Bought These Dividend Stocks

Free Spreadsheet Inside! 🚀

One of the biggest winners in my portfolio?

A stock many have never heard of.

Jefferies Financial.

I’m up over 124%, with a yield on cost of over 5.10%.

The reason I discovered this stock?

Stealing ideas from Super Investors.

Super Investors are investors with over $100M in assets under management.

Every 3 months, they are required by law to reveal all of the moves they’ve been making in their portfolio.

This most recent quarter, they made some shocking moves.

🔍 Dividendology Database

Early this month, we launched the Dividendology Database.

While we primarily use this database for alternative income asset classes like-

REITs

BDCs

Covered Call ETFs

One of the things we also track in this database is the buying history of dividend stocks for Super Investors.

This not only gives insight into what Super Investors have been buying lately-

But also reveals the underlying trends of where the smart money has been moving over time.

📊 Grow The Dividends

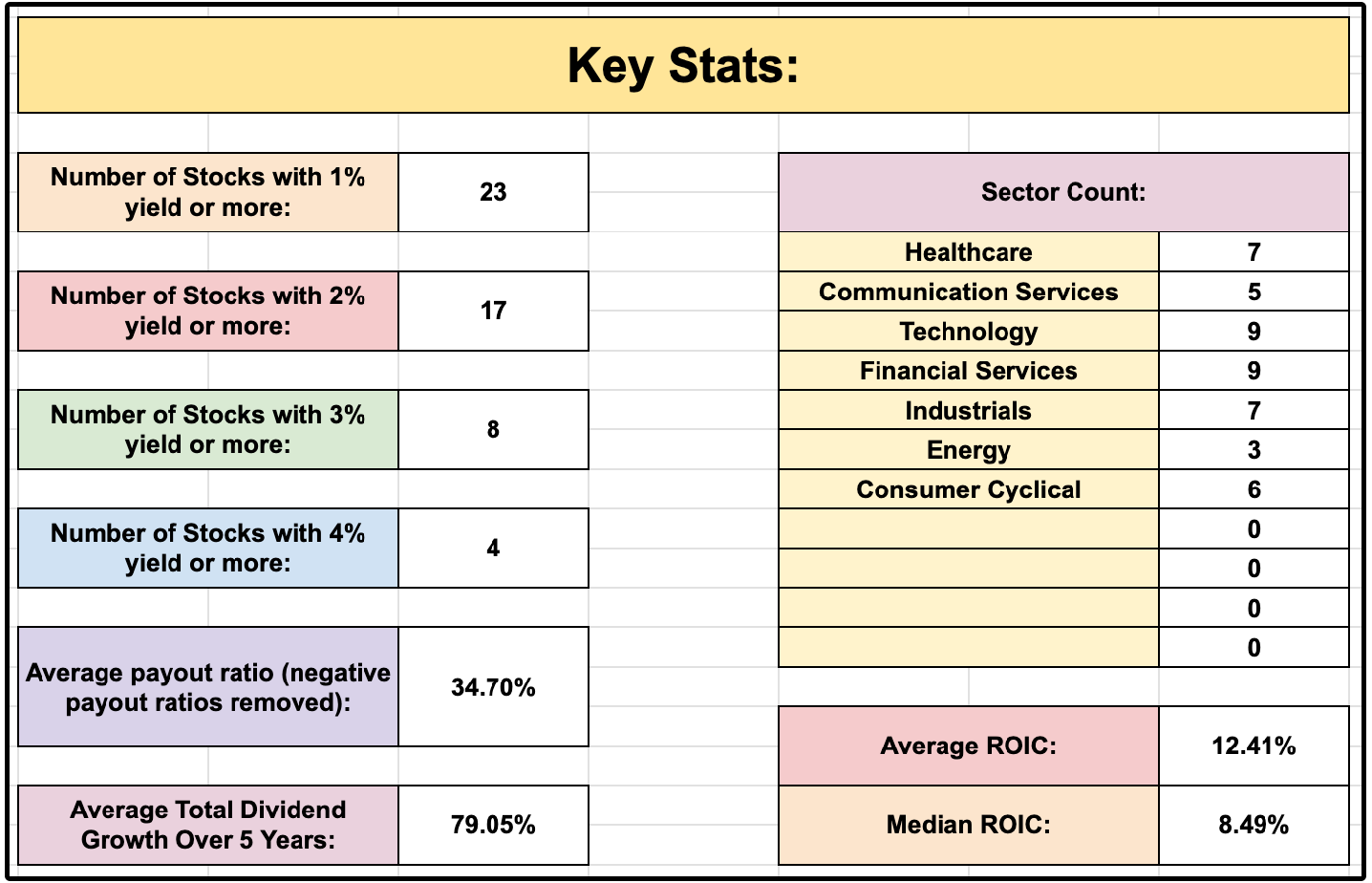

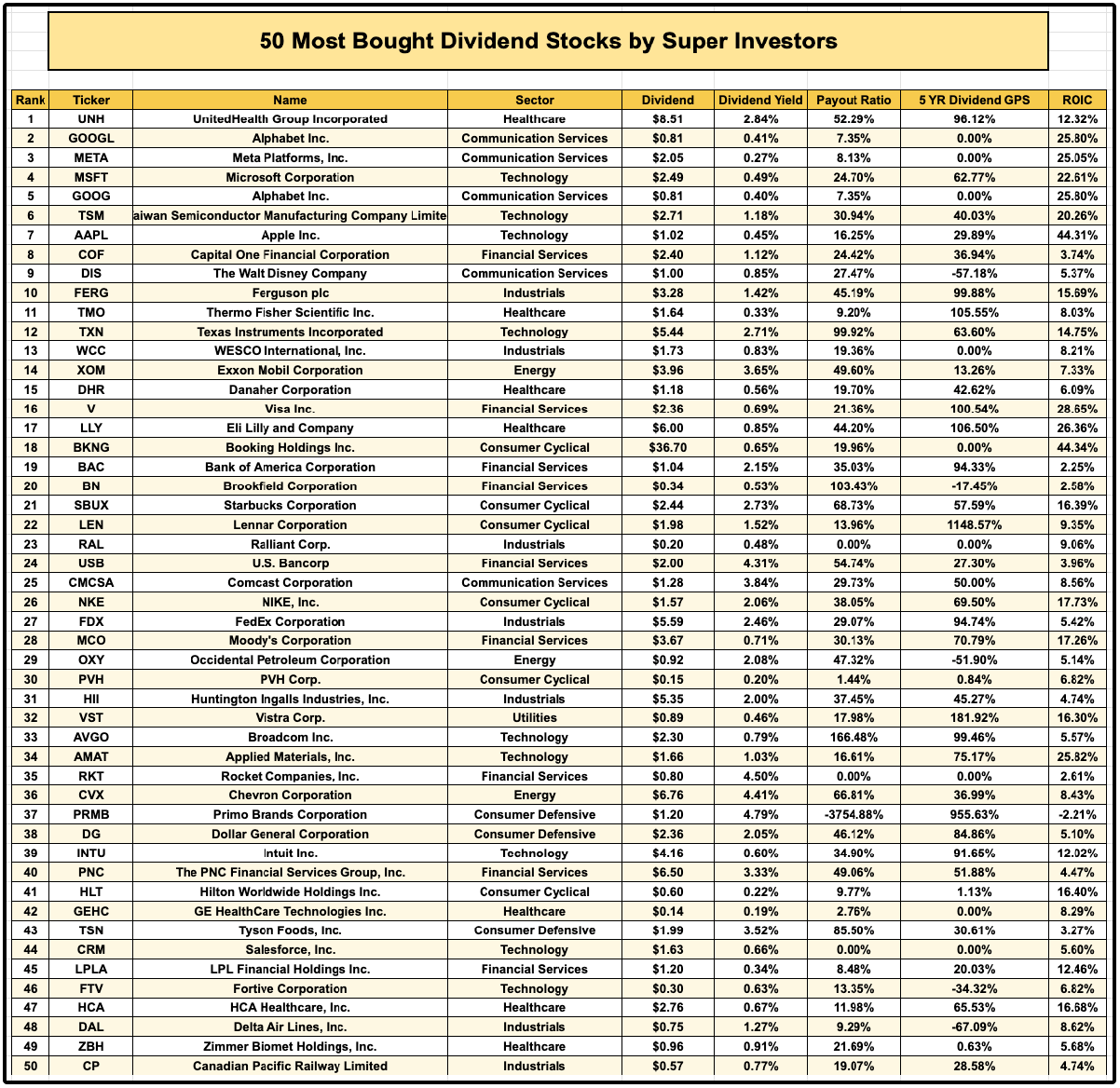

I compiled insights on the top 50 most bought dividend stocks by Super Investors.

The trend we see every quarter?

Super Investors have a bias towards dividend growth stocks.

Stocks that grow free cash flow at a high rate, and as a result, grow dividends at a high rate.

The average total dividend growth over the last 5 years from these stocks was almost 80%.

🩺 Healthcare

Technology and finance were the most frequently purchased sectors.

That’s somewhat typical for Super Investors.

But over the last 2 quarters?

Healthcare has been the most frequently purchased sector.

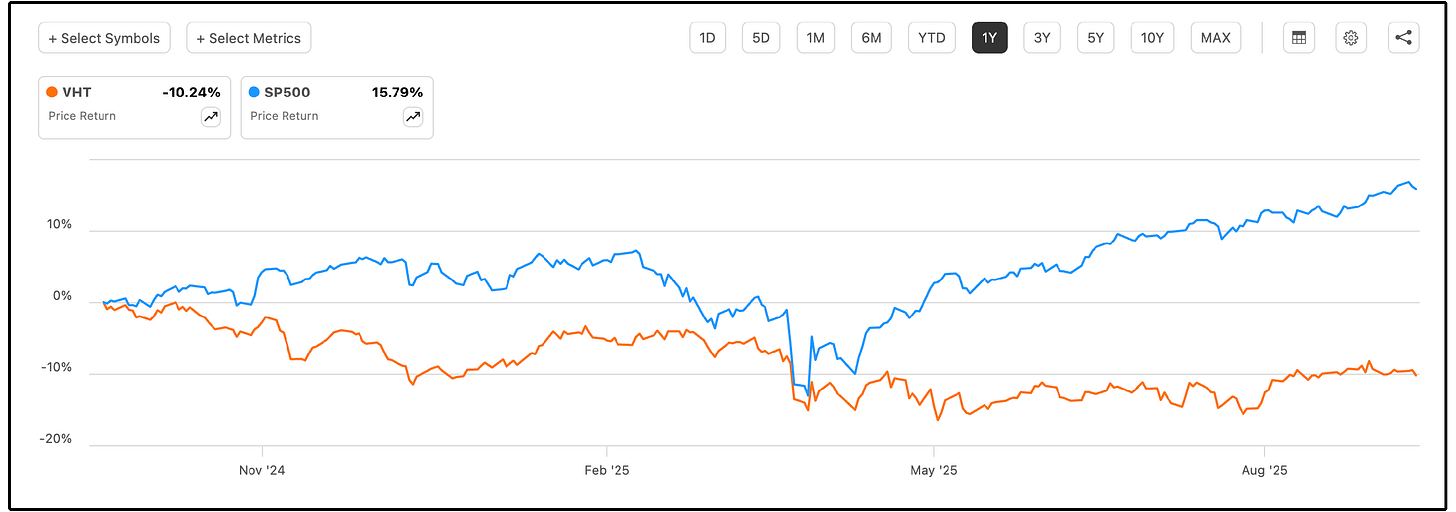

In the past year, the healthcare sector has lagged the market by a remarkable margin.

S&P 500 performance: +15.79%

Vanguard Healthcare Index: -10.24%

But the real deviation isn’t just price performance.

It’s the valuation.

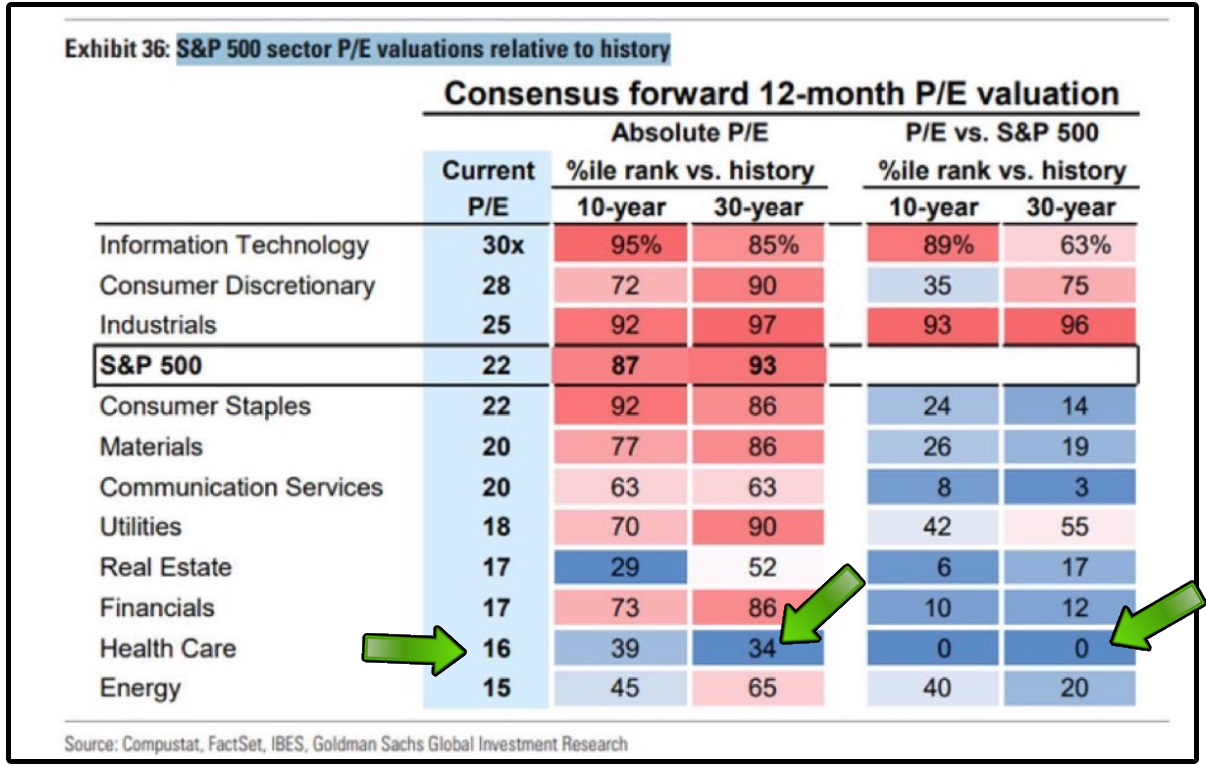

This chart from Goldman Sachs shows current forward P/E ratios across S&P 500 sectors, compared against both their own history and the S&P 500 as a whole.

Nearly every sector is trading at a premium compared to their historical valuations.

Here’s what stands out for healthcare:

Current P/E: 16x — well below the S&P 500 average of 22x.

Historical Valuation: Healthcare valuations are in the 34th percentile versus the past 30 years. That means they’ve been cheaper 66% of the time.

Relative Valuation: Compared to the S&P 500, healthcare sits at the 0th percentile over both 10 and 30 years. In other words, relative to the market, healthcare has never been this cheap in modern history.

And ironically enough, the number one most frequently bought stock was a healthcare stock.

💰 Super Investors Top 10 Buys

🏥 UNH — UnitedHealth Group

🔎 GOOGL — Alphabet (Class A)

📱 META — Meta Platforms

💻 MSFT — Microsoft

🌐 GOOG — Alphabet (Class C)

🖥️ TSM — Taiwan Semiconductor

🍏 AAPL — Apple

💳 COF — Capital One Financial

🎬 DIS — Walt Disney

🛠️ FERG — Ferguson plc

The full top 50 list is below:

If you want to download this spreadsheet, you can do so here.

I’ve identified one of the stocks in the above list as a potential opportunity to add to our real money Dividend Growth Portfolio.

Earlier this week, we added our first position to our High Yield Portfolio.

The position:

Yields over 9%

Pays monthly dividends

Grows its dividend annually

Does NOT utilize options to generate income

If you want to get access to the portfolios and all features mentioned below, you can join Dividendology here:

Here’s everything you’ll get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($30 off! + 7 day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Would you consider a third model portfolio consisting of dividend stocks chosen by super investors?

And the company is?