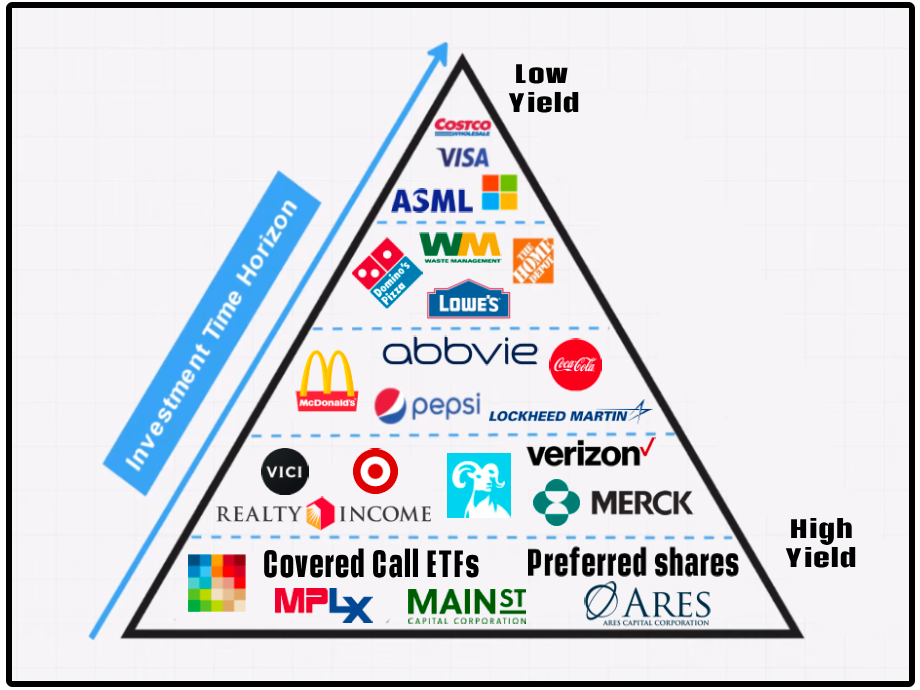

🔺 The Dividend Growth Pyramid

This will tell you how to live off dividends! 💵

The most common mistakes I see dividend investors make?

Not knowing where they are on the dividend growth pyramid.

📝 How You Should Invest

The end goal for most interested in dividends, is to be able to one day live off dividends.

However, the path to achieving that goal looks different for everyone.

Fortunately, the dividend growth pyramid tells you exactly:

How to invest

When to invest

Where to invest

This is the key concept:

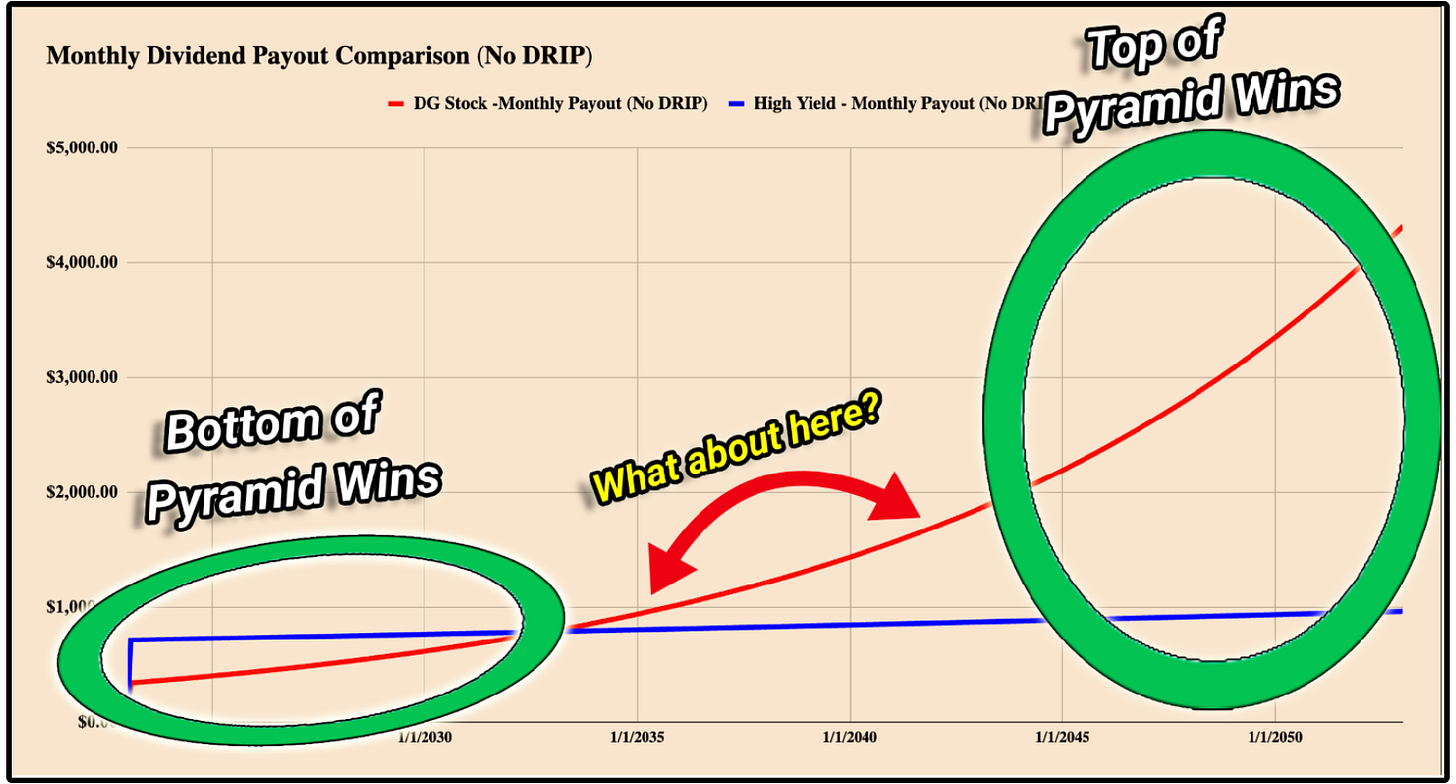

The longer your time horizon, the more you should focus on dividend growth.

The shorter your time horizon, the more you should focus on yield.

This concept is best understood when visualized.

📊 My High Yielders

I often discuss how powerful a dividend growth strategy can be over long periods of time, particularly when it comes to living off dividends.

And as you probably already know, dividend growth stocks have historically outperformed.

I have a long time horizon, which is why the bulk of my investments are dividend growth.

However, high yielding investments have the potential to be incredibly powerful when done correctly.

In fact, I currently have 2 high yielding stocks in my personal portfolio:

EDP - Enterprise Products Partners (my yield on cost: 9.39%)

MO - Altria Group (my yield on cost: 9.27%)

Not only is my yield on cost for both of these positions well above 9%, but I’ve seen phenomenal gains from these positions:

EDP +63.65%

MO +70.67%

While there are certainly plenty of risky high yield investments, the belief that high yield always equals bad investment could not be further from the truth. (You can read more about this here)

Along with this, these stocks increase their dividend payouts every single year.

🏦 High Yield vs Dividend Growth

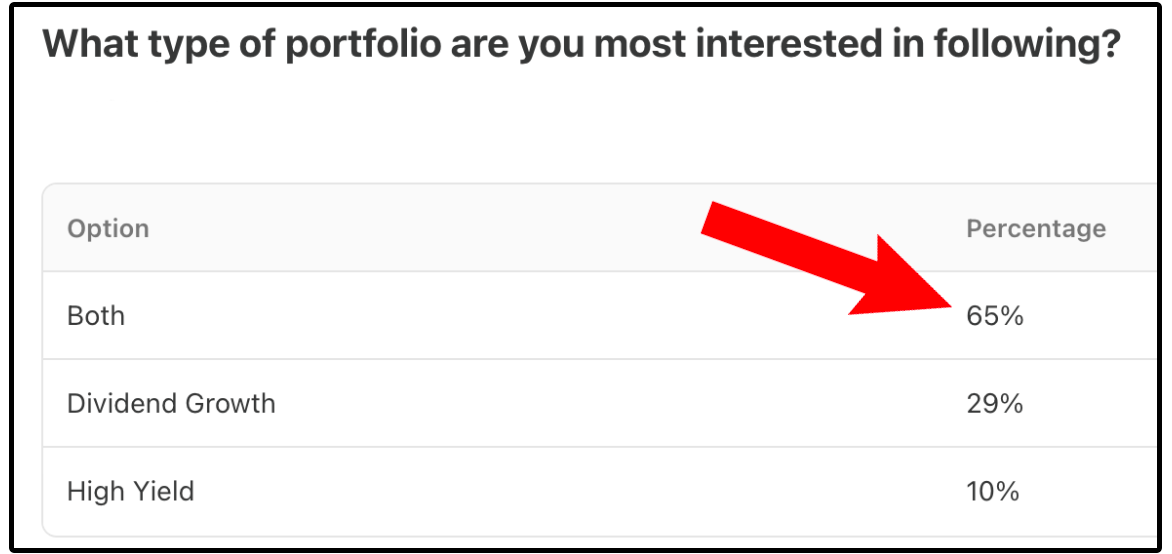

We are only a few weeks away from the start of building our two real-money model portfolios, the high yield portfolio and the dividend growth portfolio.

I sent out a survey to many of you to see which portfolio you were most interested in.

Here’s the results: 👇

The vast majority of you are interested in both!

There results don’t surprise me at all, because if your goal is to one day live off dividends, there is a high likelihood you’ll be utilizing both strategies at some point-

Which is exactly why the dividend growth pyramid exists, to help you maximize the income coming into your portfolio over different periods of time.

Big News 🎉

I’ve been publicly sharing my portfolio for years.

But there’s a problem.

Not everyone gains as much value in following my portfolio anymore, because it's grown larger, built over many years, and tailored to my specific financial situation.

And over the years, two questions have come up more than almost any others:

“How would you invest right now if you were starting from scratch?”

“What would you buy if you were building a high-yield portfolio today?”

How you invest completely depends on where you are on the dividend pyramid.

I’ll be launching two real-money portfolios on Dividendology.com:

💰 The Dividend Growth Portfolio – Built from $0, showing exactly how I’d begin investing today if I were starting from scratch

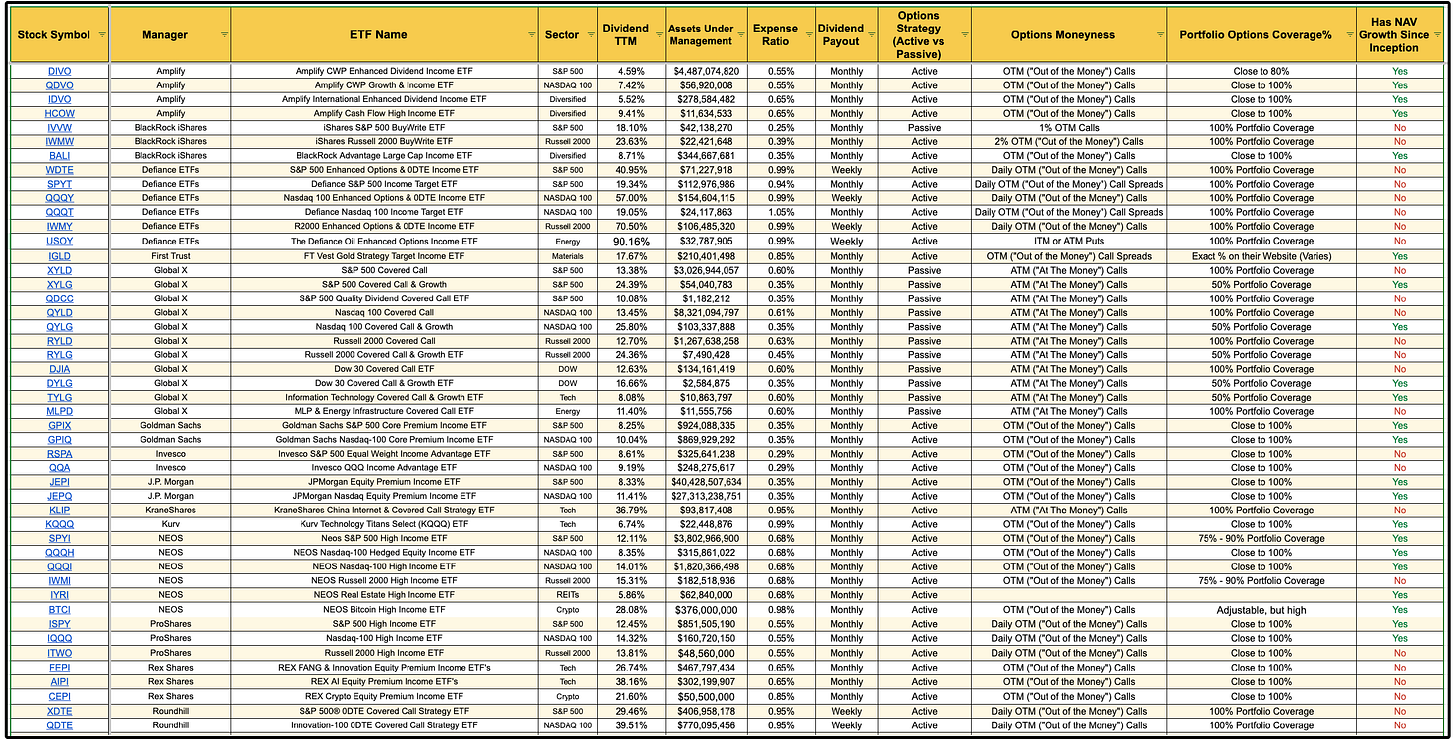

🧾 The High-Yield Portfolio – Designed to maximize immediate dividend income (think 8%+ yields) without sacrificing capital

These aren’t mock portfolios.

I’ll be investing real money, tracking every move, every dividend, and every update with full transparency, just like I always have.

And behind the scenes, I’ve been pouring in countless hours (and a lot of capital) into what will soon become the Dividendology Database.

This will be a game-changing platform for income investors.

The full launch for both is in just a few weeks!

Stay tuned.

Here’s everything you’ll get as a paid Dividendology member 👇

📊 Full Access to the Dividendology Database

Built with now over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

The full launch is almost here!

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (Now currently running their Summer sale ($30 off! + 7day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

That’s all for now!

See you next week!

Dividendology 🚀

Always top-notch information, Dividendology. When to seek Dividend Growth v. When to focus on Dividend Yields . Good stuff. Thanks. — Charlie Whooph

Great breakdown, I struggle balancing the two but also hold mostly dividend growth in my taxable brokerage.

Excited for the dividend growth and high yield portfolio build out!