🔎 The Hidden Winner of Rate Cuts!

🔥 $7 Trillion in Cash Is Waiting to Move — Here’s Where It’s Headed

Jerome Powell and the Federal Reserve kicked off their rate-cutting cycle just a month ago, which was the first cut in over a year.

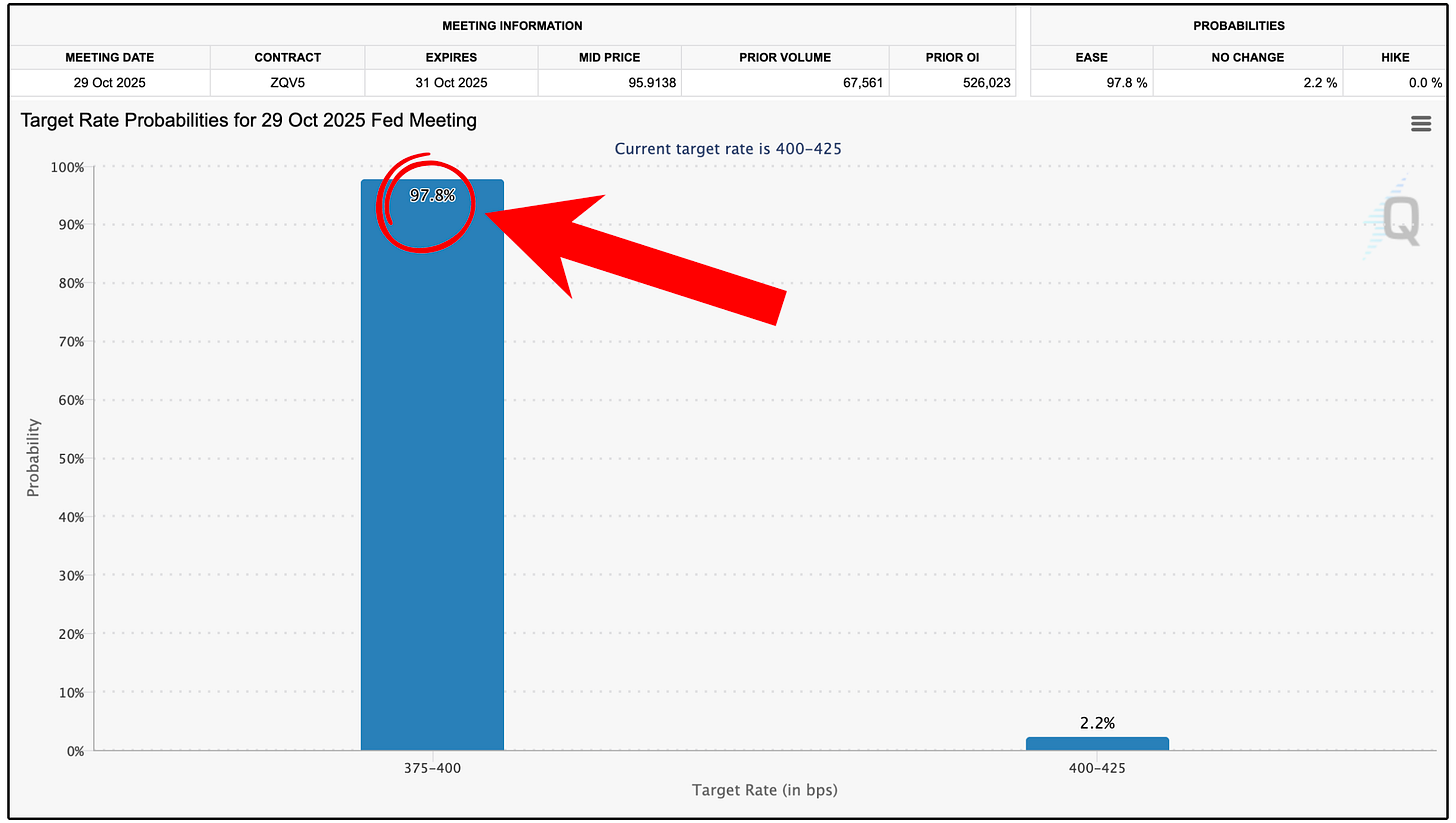

Markets are now pricing in a 97.8% chance of another cut tomorrow, October 29th.

Let’s look at two ways to take advantage of this shift in the market-

And look at one massive mistake to avoid.

🎯 The Fed’s Dual Mandate

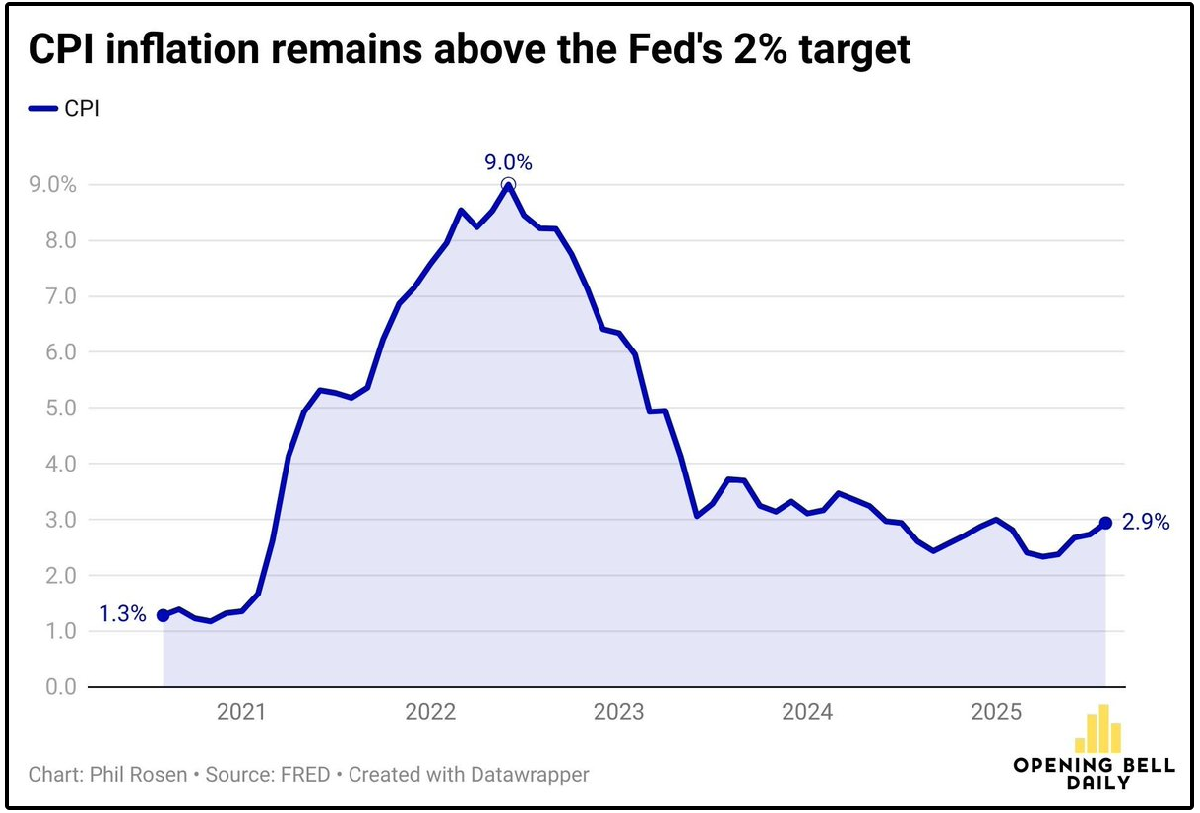

Inflation is currently sitting at 2.9%.

The Fed’s target inflation rate is 2%.

So why is the Federal Reserve lowering rates?

The Federal Reserve has two goals:

Keep inflation tame

Support the job market

Lowering interest rates will likely cause an increase in inflation.

But it also can provide a boost to the job market.

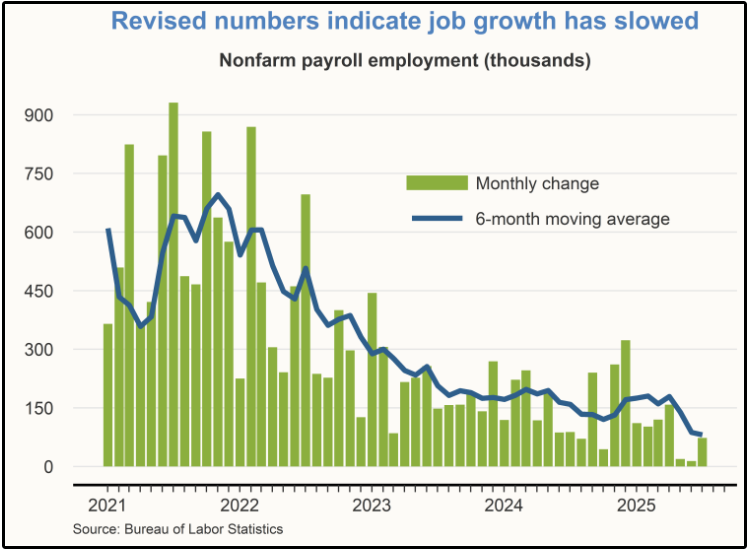

“In this less dynamic and somewhat softer labor market, the downside risks to employment appear to have risen” - Jerome Powell

According to Powell, the major threat to the economy right now is not inflation, it’s the job market.

And fortunately for us, this is very bullish for stocks in general, but especially dividend paying stocks.

💰 Bullish for Dividend Stocks

In general, there are two primary ways that dividend paying stocks get impacted by rate cuts.

They can be impacted by:

A fundamental perspective

An opportunity cost perspective

Let’s look at a brief example of each.

1. JP Morgan (Fundamental perspective)

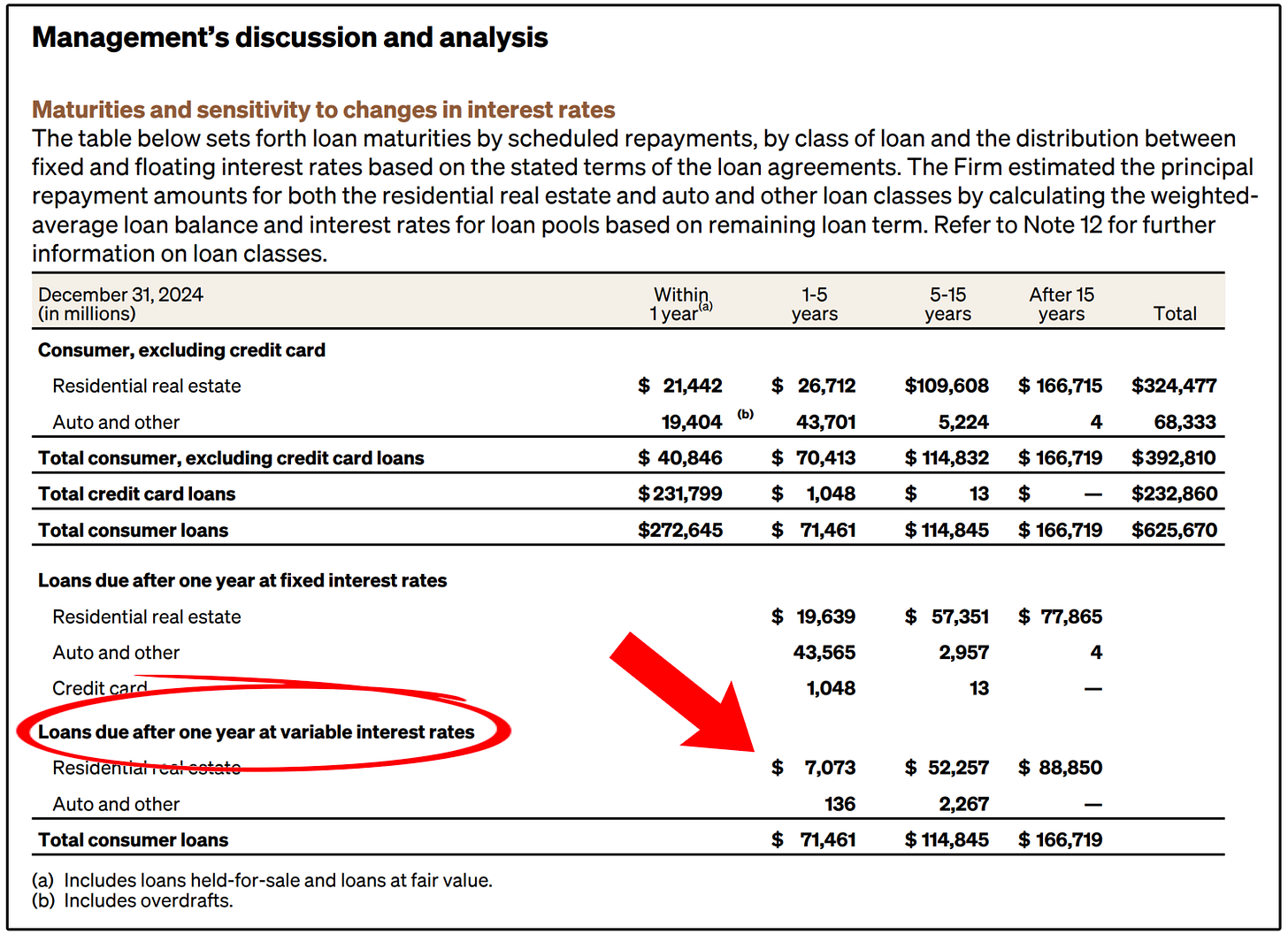

JP Morgan is an example of a company that benefits from rate cuts from a fundamental standpoint.

As we can see below, a portion of the loans that JP Morgan issues are variable rate loans.

If rates go down, the interest JP Morgan collects from these loans goes down.

However, as noted in their form 10-k, this lower rates can benefit JP Morgan long term.

“Higher interest rates can also negatively affect the payment performance on loans within JPMorganChase’s consumer and wholesale loan portfolios that are linked to variable interest rates. If borrowers of variable rate loans are unable to afford higher interest payments, those borrowers may reduce or stop making payments, thereby causing JPMorganChase to incur losses and increased operational costs related to servicing a higher volume of delinquent loans.” - JP Morgan 10k

2. Agree Realty Corporation (Opportunity Cost perspective)

Agree Realty (and most REITs in general) greatly benefit from rate cuts from an opportunity cost perspective.

Every investment must be looked at through the lens of opportunity cost.

For the risk averse investor seeking yield, treasury rates play a massive role in shaping behavior.

When the Federal Reserve cuts rates, treasury yields typically fall, which means investors earning 4–5% on “risk-free” bonds suddenly face reinvestment risk.

As those safe yields decline, investors have to turn to other assets to find yield.

That’s where REITs like Agree Realty come in.

Agree Realty currently yields 4.2%, but that yield becomes far more attractive as ‘risk free assets’ like savings account begin to yield far less.

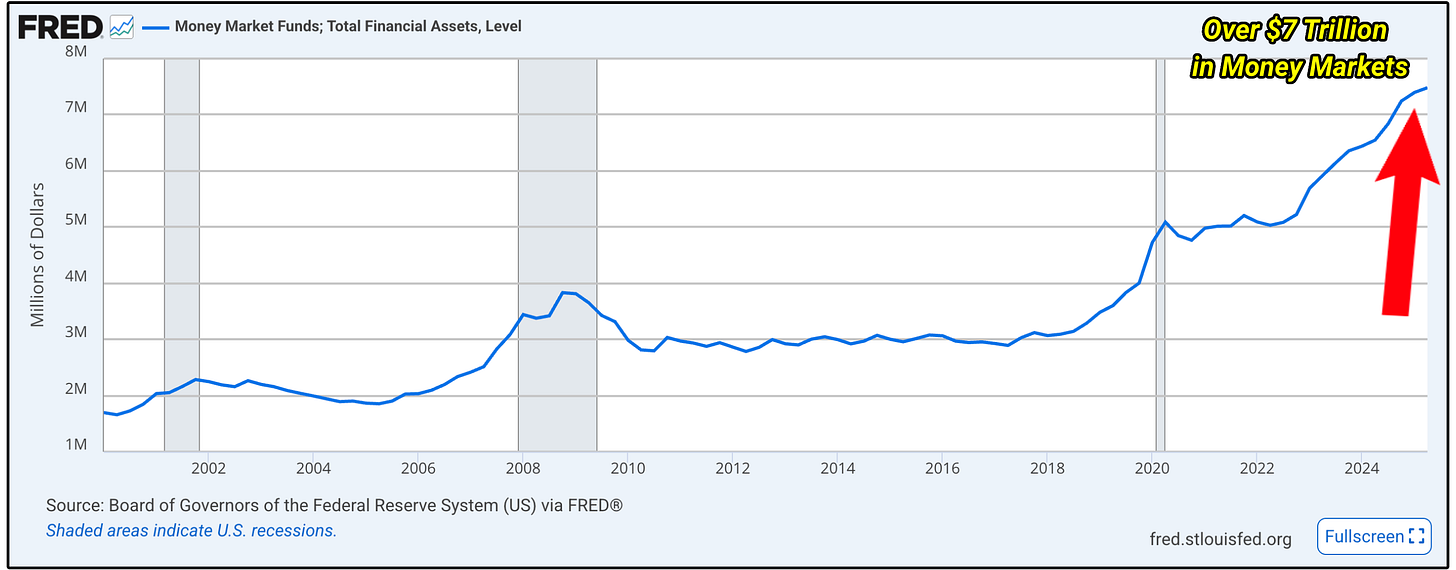

Right now, there is currently a record level of capital in money market funds (over $7 trillion!) that is simply waiting to be deployed in the markets.

As rates fall and opportunity costs shift, even a small rotation of that cash into income-generating equities could create a powerful tailwind for dividend stocks and REITs alike.

Let’s look at two dividend stocks set to benefit from declining rates:

1.⚡ NextEra Energy (NEE)

YTD Return: +16.66% | Yield: 2.63%

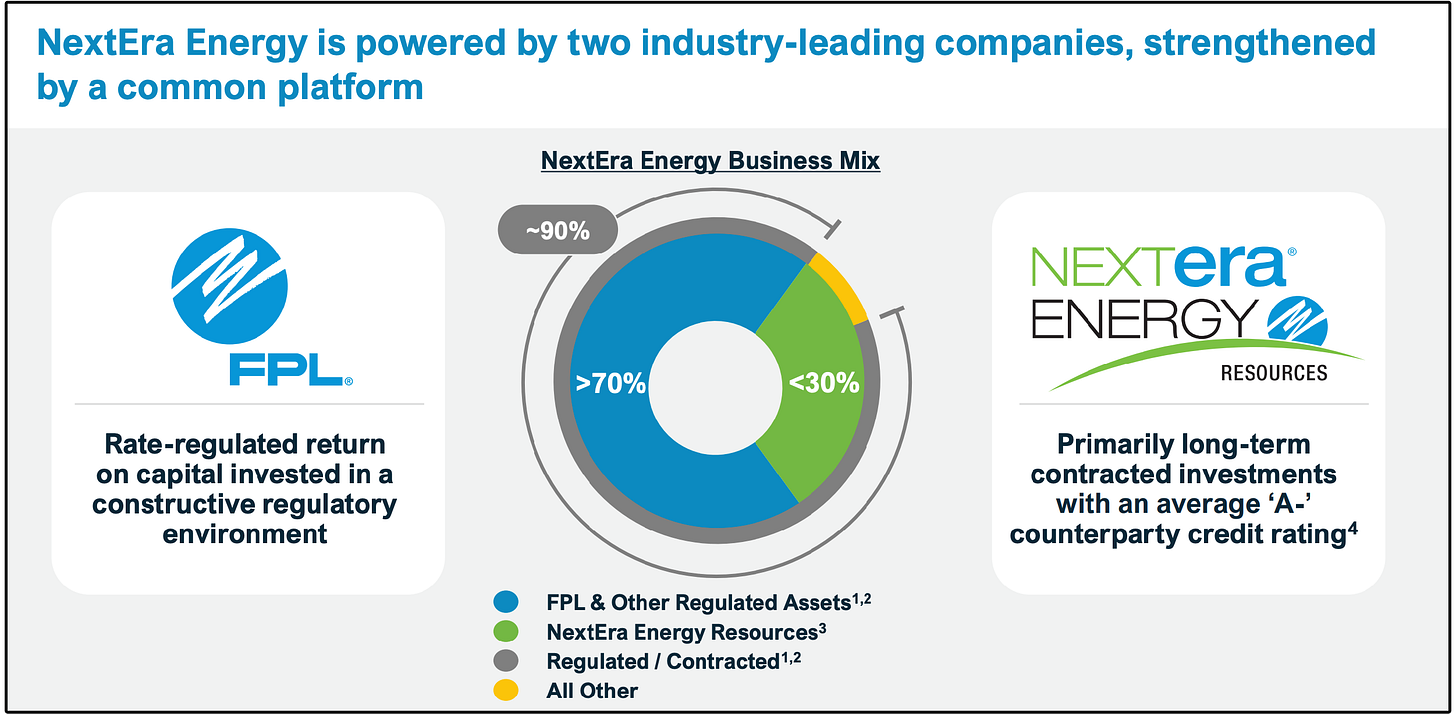

NextEra operates through two core segments:

Florida Power & Light (≈70%) – A regulated utility serving millions of customers in Florida.

NextEra Energy Resources (≈30%) – One of the largest renewable energy generators in the world.

Over the past two decades, NextEra has posted:

Earnings per share CAGR: ~9%

Dividend CAGR: ~10%

Operating cash flow CAGR: ~8%

This level of consistency not only outpaces most peers in the utilities sector but has even beaten the S&P 500 on total shareholder return over long timeframes.

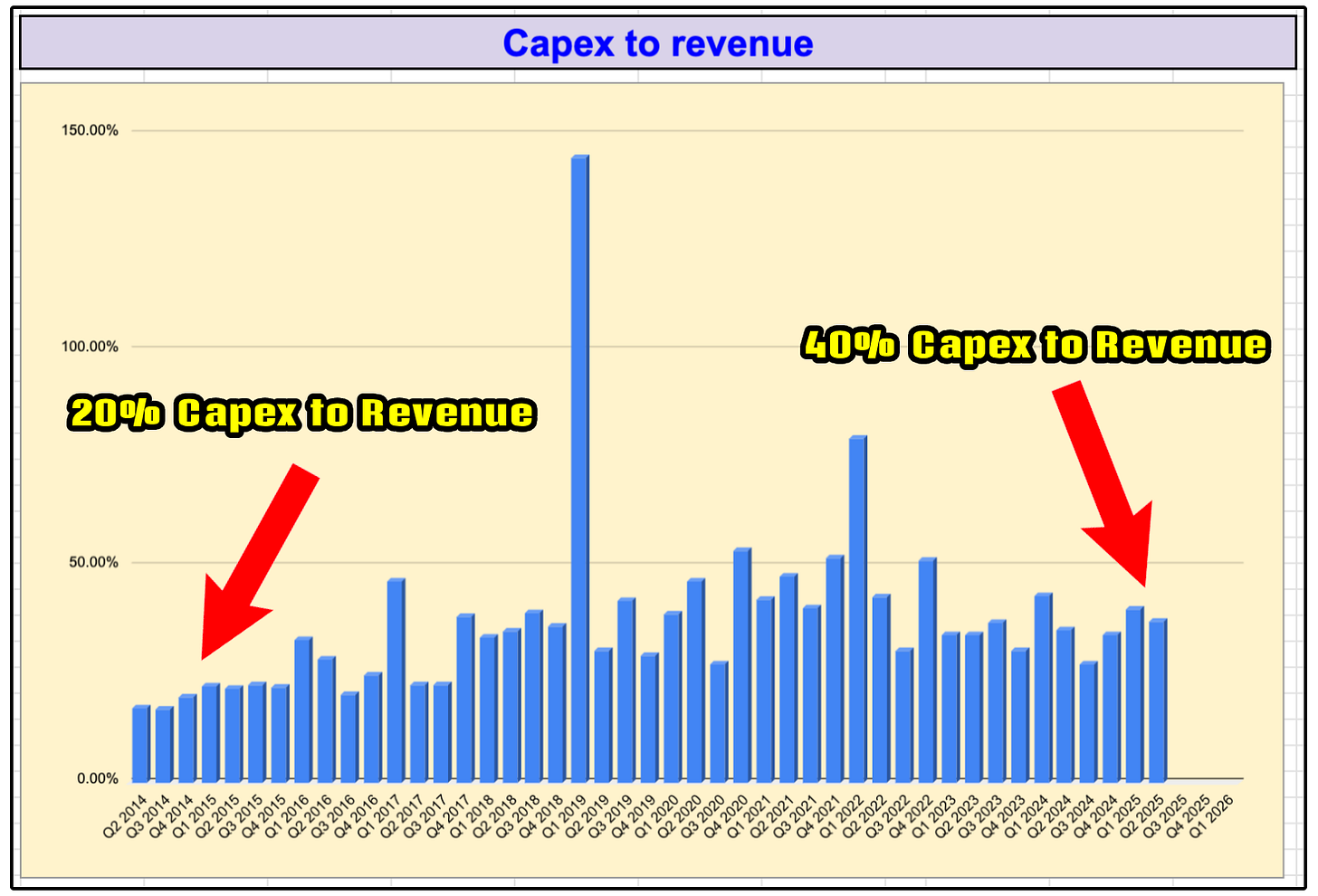

As a capital-intensive company, NextEra’s growth is heavily influenced by borrowing costs.

Their capital expenditures-to-revenue ratio has nearly doubled over the last decade, rising from about 20% to roughly 40% in recent quarters.

Higher capex typically means more debt, which makes the cost of that debt a critical factor.

That’s where rate cuts come in.

Lower interest rates reduce NextEra’s cost of borrowing, directly improving its interest coverage ratio, which measures how many times the company can cover its interest payments with operating earnings.

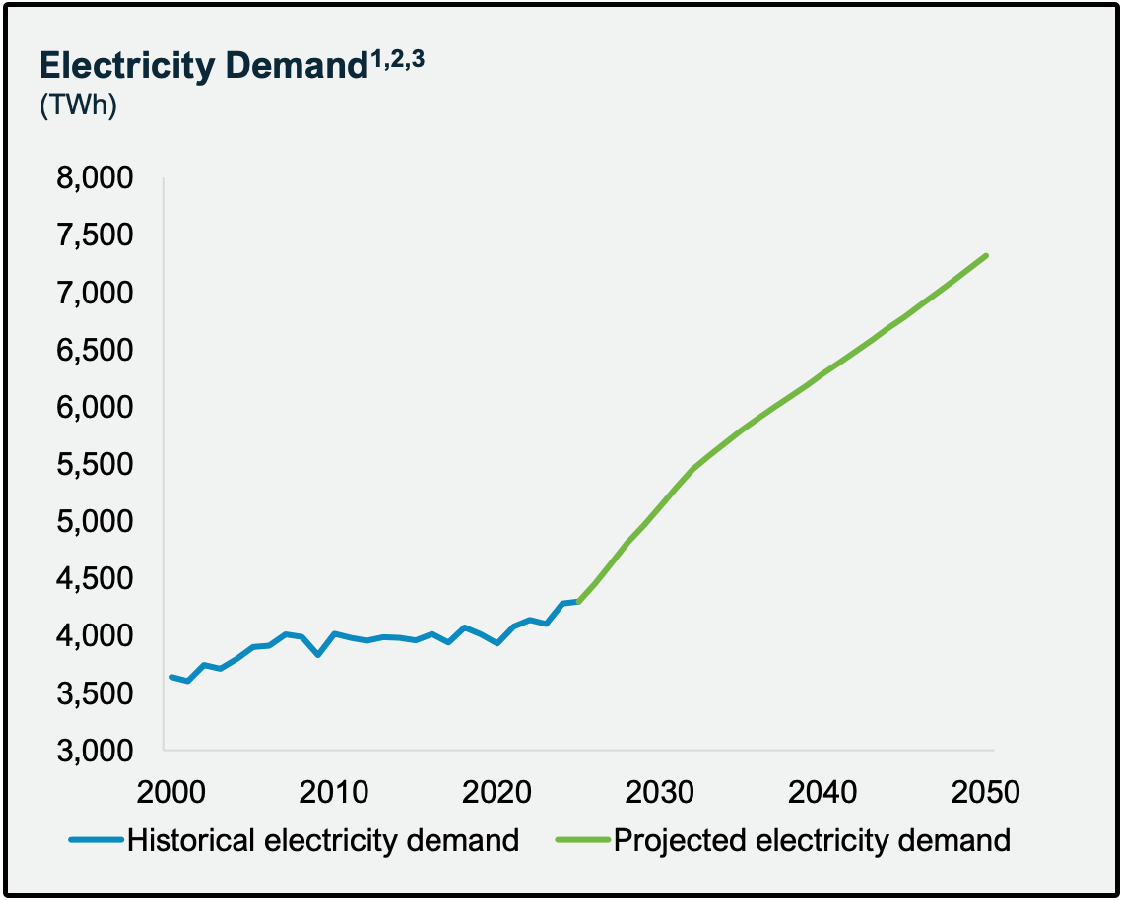

NextEra’s management also recently noted that the global demand for electricity is expected to grow more over the next decade than it has over the past three decades combined.

As companies like OpenAI, Meta, and Amazon build massive data infrastructure, the power demand surge directly benefits utilities like NextEra that are expanding renewable generation capacity.

Rate cuts are coming at the absolute optimal time for NextEra.

2.🏭 Realty Income (O)

YTD Return: +11.44% | Yield: 5.35%

Could this pick get any more boring?

But it’s true, Realty Income is one of the easiest and safest ways to position yourself to take advantage of rate cuts.

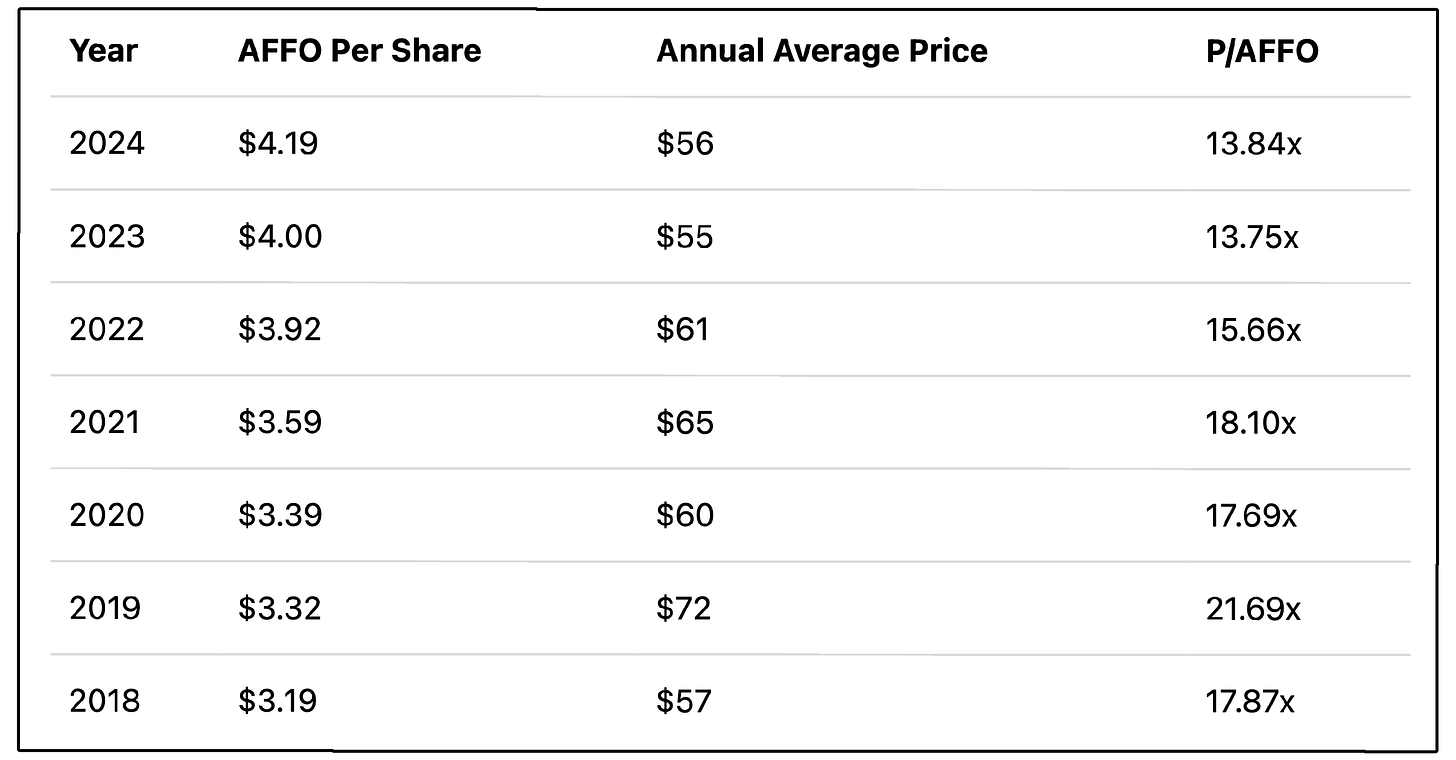

As I’ve pointed out time and time again, REITs are trading at some of their lowest valuations in decades.

Realty Income is no exception.

The company has continued to pay out and grow their large dividends and grow AFFO per share every year.

In other words, intrinsic value is growing.

Yet the share price has not followed.

This is entirely due to multiple contraction, which is what makes them much more attractive from a valuation stand point.

Few REITs stand to benefit from lower rates more than Realty Income.

When interest rates fall, two things happen:

Cost of capital declines.

Realty Income can finance new property acquisitions at cheaper rates, boosting spreads between their cap rates and borrowing costs, directly improving profitability.

Investor opportunity cost declines.

An over 5% yield becomes far more attractive when Treasury yields fall from 5% to 3%.

This combination not only drives valuation expansion but also improves acquisition growth, since lower financing costs open the door to more accretive deals.

In short, Realty Income is built to thrive in a falling-rate environment.

⚠️ Avoid This

Not every “High Yield” asset is set to benefit from declining interest rates.

To be straight to the point, it is quite a dangerous time to buy BDCs.

While BDCs have high yields, (10%+ in many cases), these companies generate these yields by issuing loans.

The vast majority of these loans are variable interest rate loans.

The average BDC in the Dividendology Database has around 88.5% of their loans at variable rates.

This means as rates drop, the net interest income they generate lowers, meaning their dividend coverage lowers.

Out of the 42 BDCs in the Dividendology Database, only 20 currently have above 100% base dividend coverage-

And only 11 have above 110% base dividend coverage.

This is exactly why I built the Dividendology Database-

To provide the data and information needed to avoid dangerous high yield investments and take advantage of safer high yield opportunities.

Members of Dividendology can go to Dividendology.com to review the BDC, REIT, and Covered Call ETF database at any time.

If you’d like to get access to the Dividendology Database and all the features below, you can do so here:

📊 Full Access to the Dividendology Database

Built with over $10,000 invested in tools and research, this powerful database tracks dividend stocks and alternative income assets like Covered Call ETFs, REITs, and BDCs.📈 The Dividend Growth Portfolio

A real-money portfolio built from scratch, focused on long-term wealth creation and building a rapidly growing stream of dividend income💸 The High Yield Portfolio

A real-money portfolio, designed to generate massive sustainable income with an average yield of 8%+📉 Running List of Undervalued Dividend Stocks

Updated regularly — stay ahead with a curated list of the most attractively valued dividend opportunities in the market🧠 In-Depth Research & Reports

Deep dives into dividend stocks and income strategies you won’t find on mainstream platforms

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 ($30 off! + 7 day free trial)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

There are some very good BDC. Yet almost noone provides analysis on them.